What a fantastic six months it’s been for Globus Medical. Shares of the company have skyrocketed 62.5%, hitting $87.15. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy GMED? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does GMED Stock Spark Debate?

With operations spanning 64 countries and a portfolio of over 10 new products launched in 2023 alone, Globus Medical (NYSE: GMED) develops and sells implantable devices, surgical instruments, and technology solutions for spine, orthopedic, and neurosurgical procedures.

Two Positive Attributes:

1. Constant Currency Revenue Propels Growth

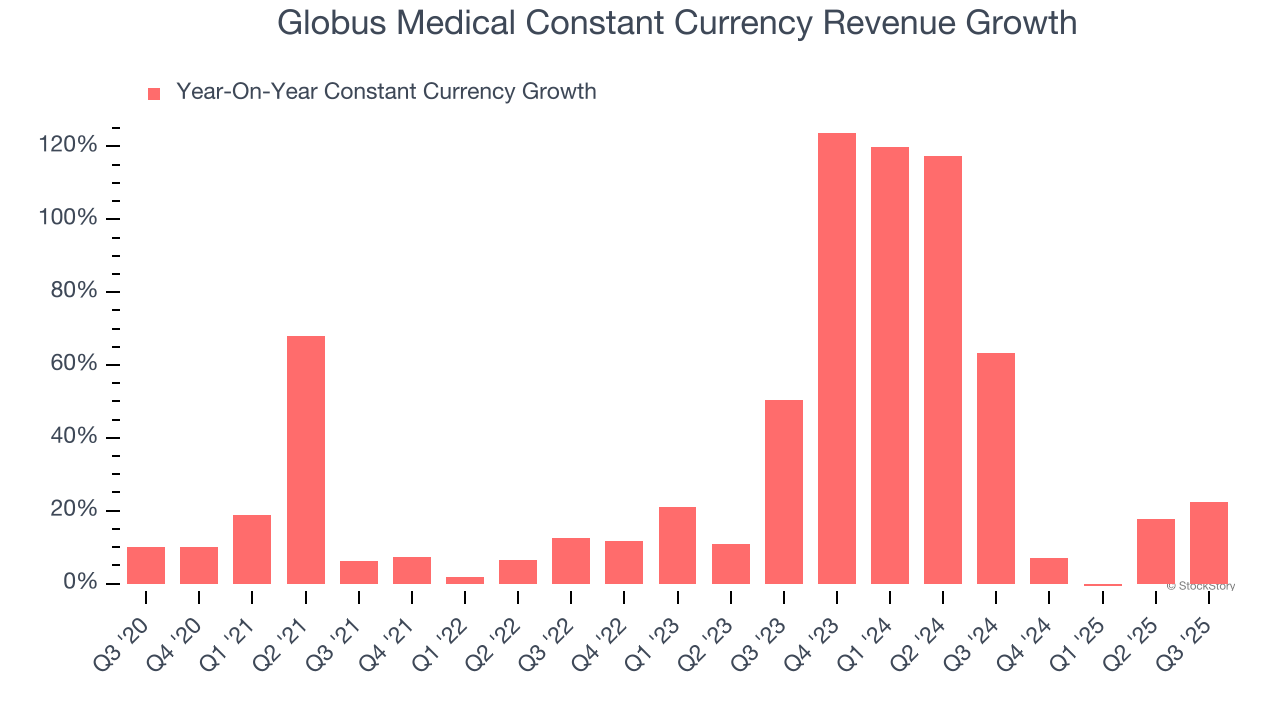

In addition to reported revenue, constant currency revenue is a useful data point for analyzing Medical Devices & Supplies - Specialty companies. This metric excludes currency movements, which are outside of Globus Medical’s control and are not indicative of underlying demand.

Over the last two years, Globus Medical’s constant currency revenue averaged 58.8% year-on-year growth. This performance was fantastic and shows it can expand quickly on a global scale regardless of the macroeconomic environment.

2. Outstanding Long-Term EPS Growth

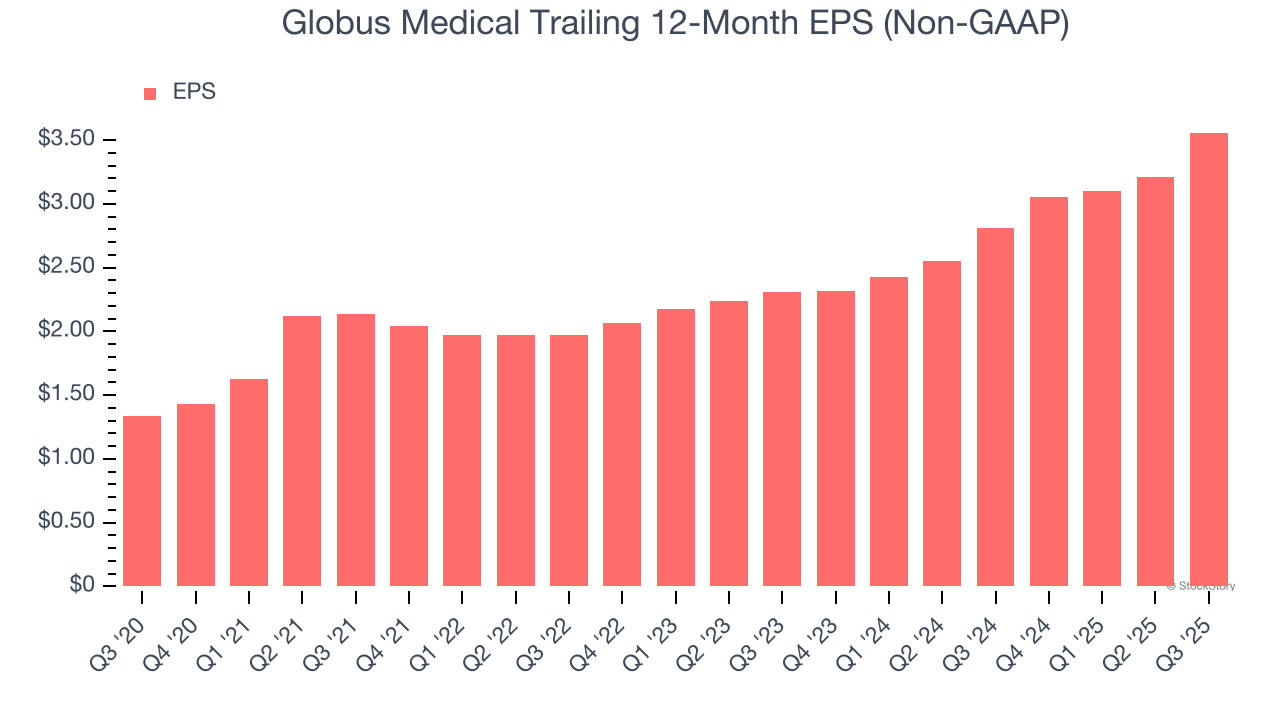

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Globus Medical’s EPS grew at an astounding 21.6% compounded annual growth rate over the last five years. This performance was better than most healthcare businesses.

One Reason to be Careful:

New Investments Fail to Bear Fruit as ROIC Declines

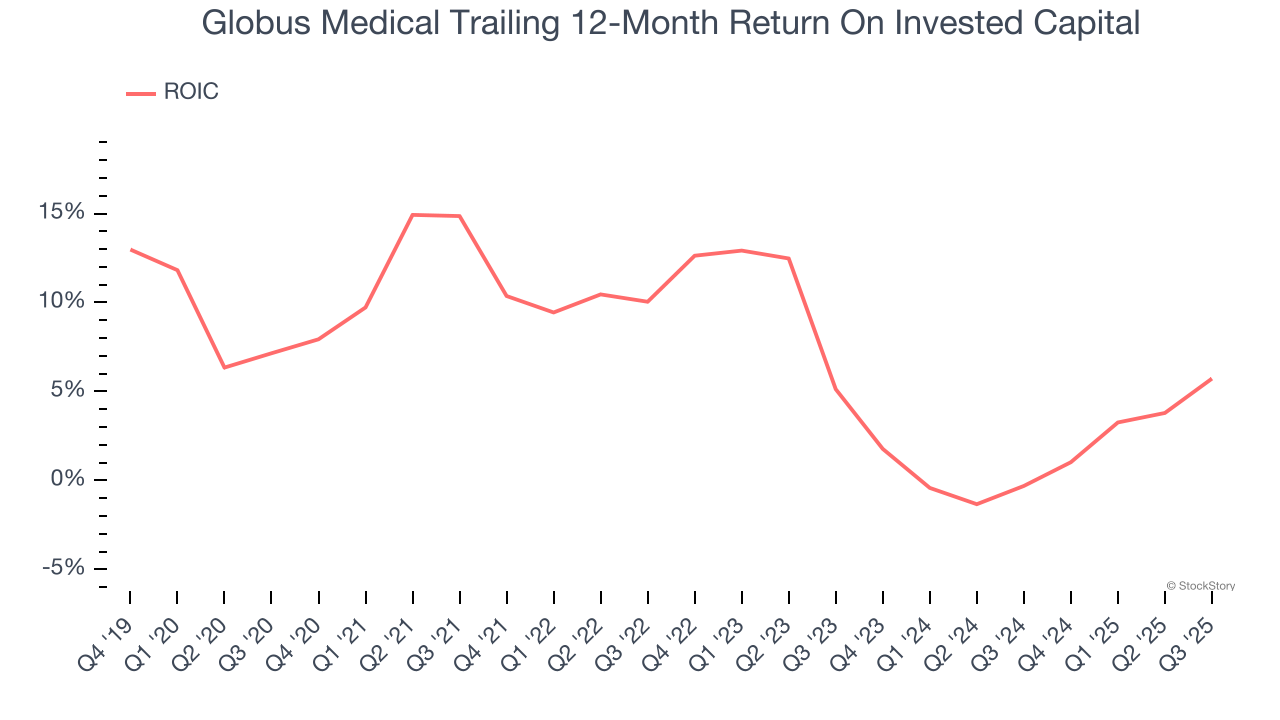

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Globus Medical’s ROIC has decreased over the last few years. If its returns keep falling, it could suggest its profitable growth opportunities are drying up. We’ll keep a close eye.

Final Judgment

Globus Medical has huge potential even though it has some open questions, and with the recent rally, the stock trades at 20.9× forward P/E (or $87.15 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Globus Medical

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.