Mueller Water Products has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 9.3% to $26.85 per share while the index has gained 8.1%.

Is now a good time to buy MWA? Find out in our full research report, it’s free.

Why Does Mueller Water Products Spark Debate?

As one of the oldest companies in the water infrastructure industry, Mueller (NYSE: MWA) is a provider of water infrastructure products and flow control systems for various sectors.

Two Things to Like:

1. Operating Margin Rising, Profits Up

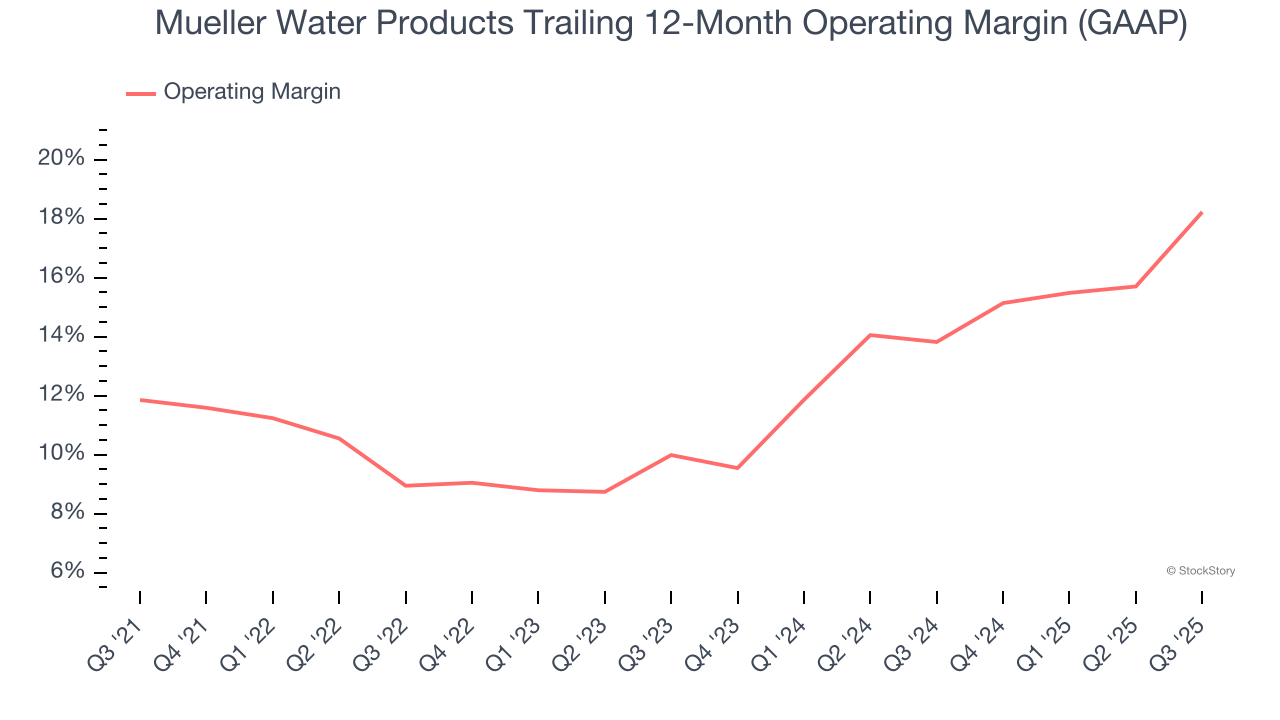

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, Mueller Water Products’s operating margin rose by 6.4 percentage points over the last five years, as its sales growth gave it immense operating leverage. Its operating margin for the trailing 12 months was 18.2%.

2. Outstanding Long-Term EPS Growth

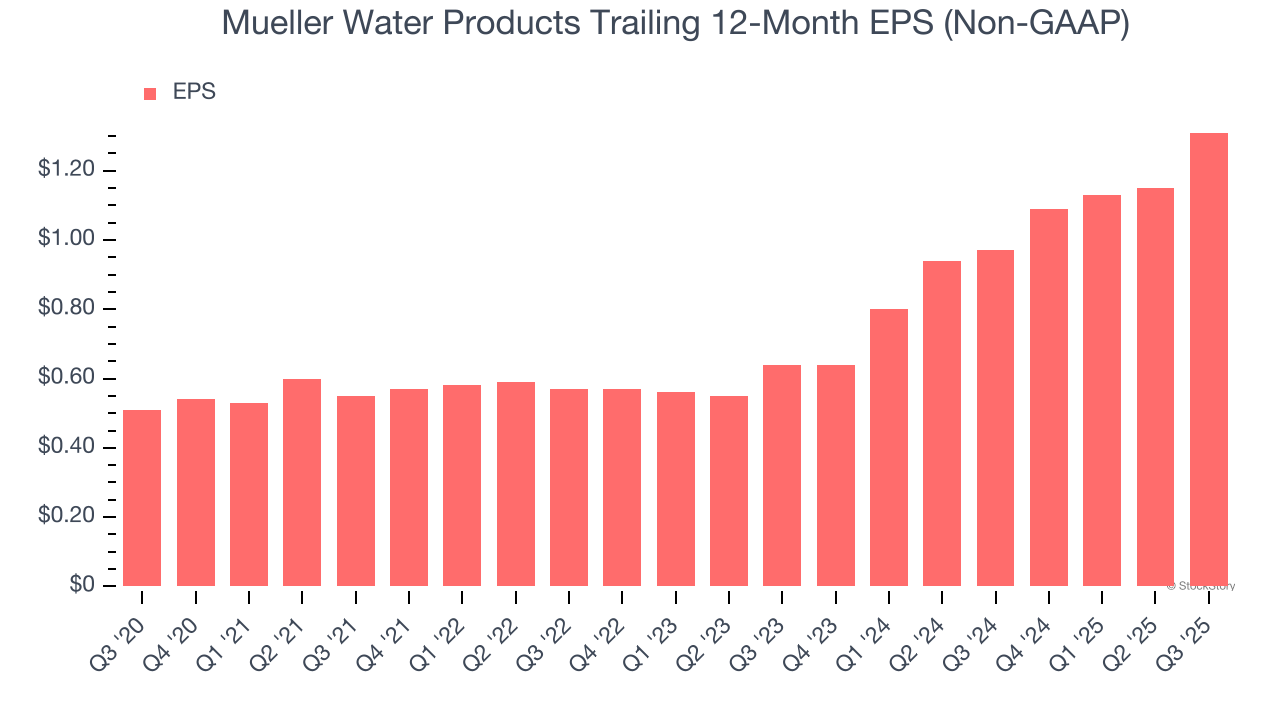

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Mueller Water Products’s EPS grew at an astounding 20.8% compounded annual growth rate over the last five years, higher than its 8.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Slow Organic Growth Suggests Waning Demand In Core Business

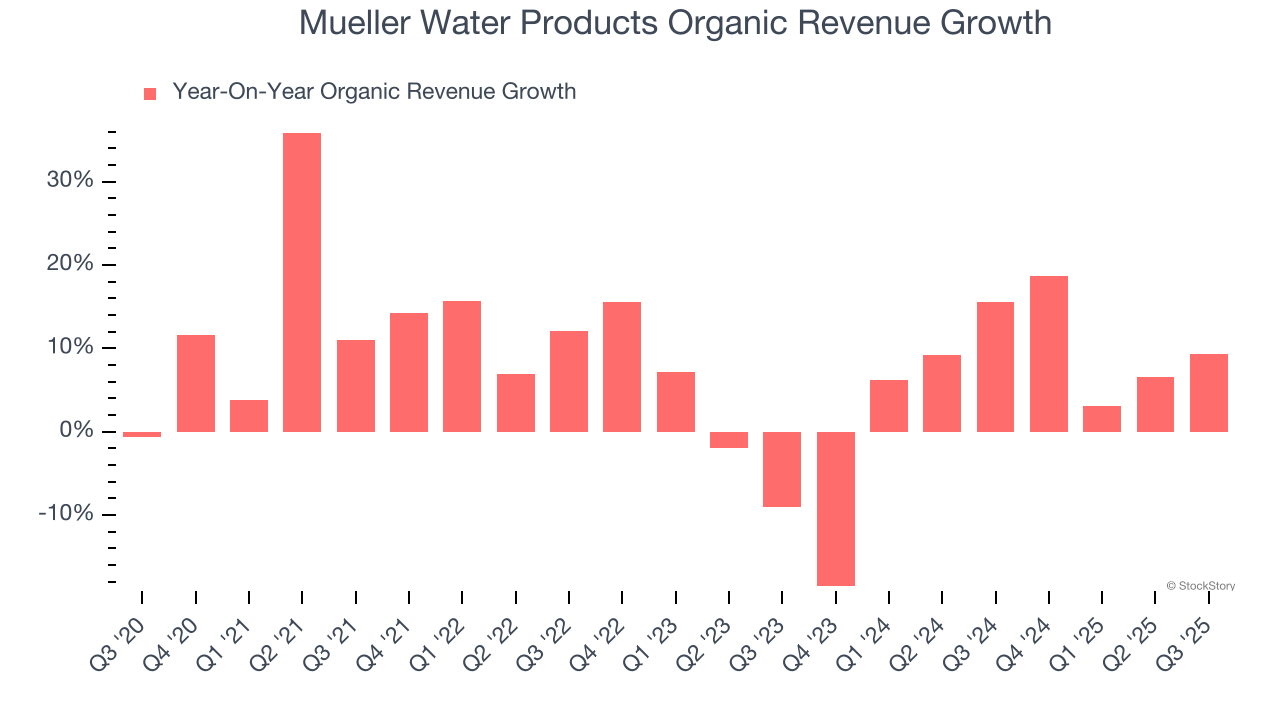

Investors interested in Water Infrastructure companies should track organic revenue in addition to reported revenue. This metric gives visibility into Mueller Water Products’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Mueller Water Products’s organic revenue averaged 6.3% year-on-year growth. This performance slightly lagged the sector and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

Mueller Water Products’s positive characteristics outweigh the negatives, but at $26.85 per share (or 19× forward P/E), is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.