TPG has had an impressive run over the past six months as its shares have beaten the S&P 500 by 9.7%. The stock now trades at $65.73, marking a 21.2% gain. This run-up might have investors contemplating their next move.

Following the strength, is TPG a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Is TPG a Good Business?

Founded in 1992 and managing over 300 active portfolio companies across more than 30 countries, TPG (NASDAQ: TPG) is a global alternative asset management firm that invests across private equity, credit, real estate, and public market strategies.

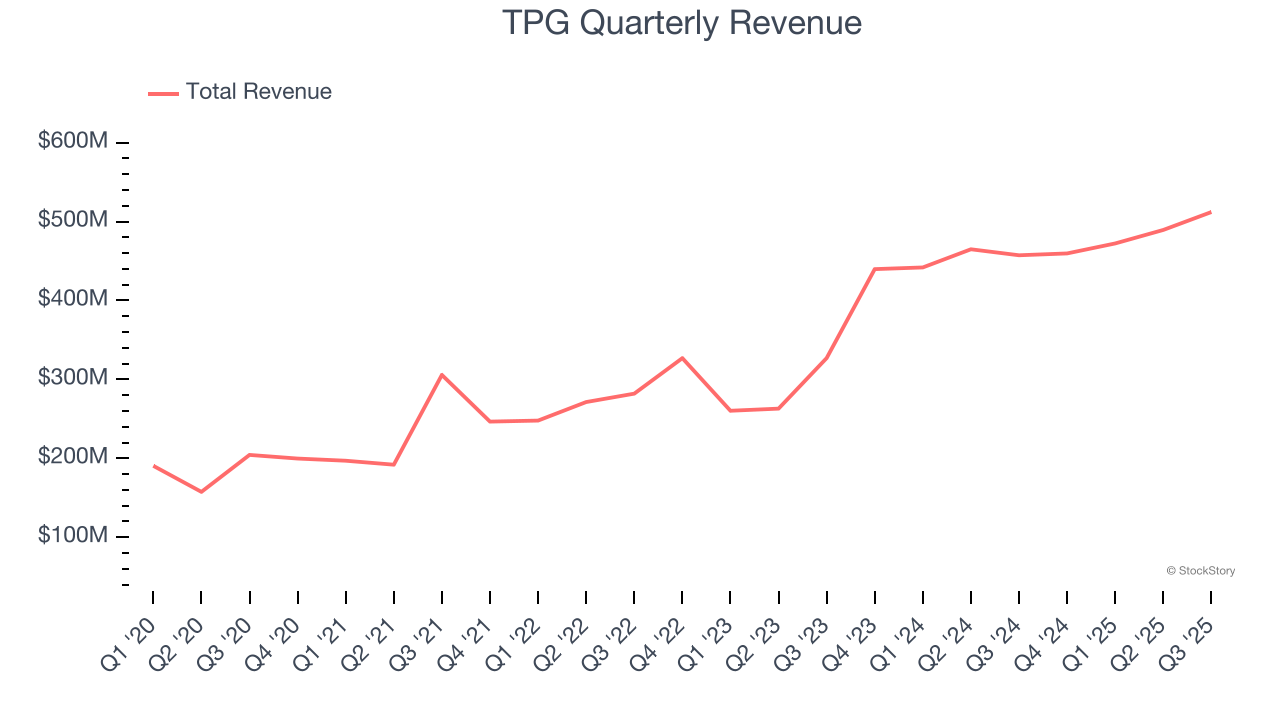

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Thankfully, TPG’s 21.7% annualized revenue growth over the last five years was exceptional. Its growth beat the average financials company and shows its offerings resonate with customers.

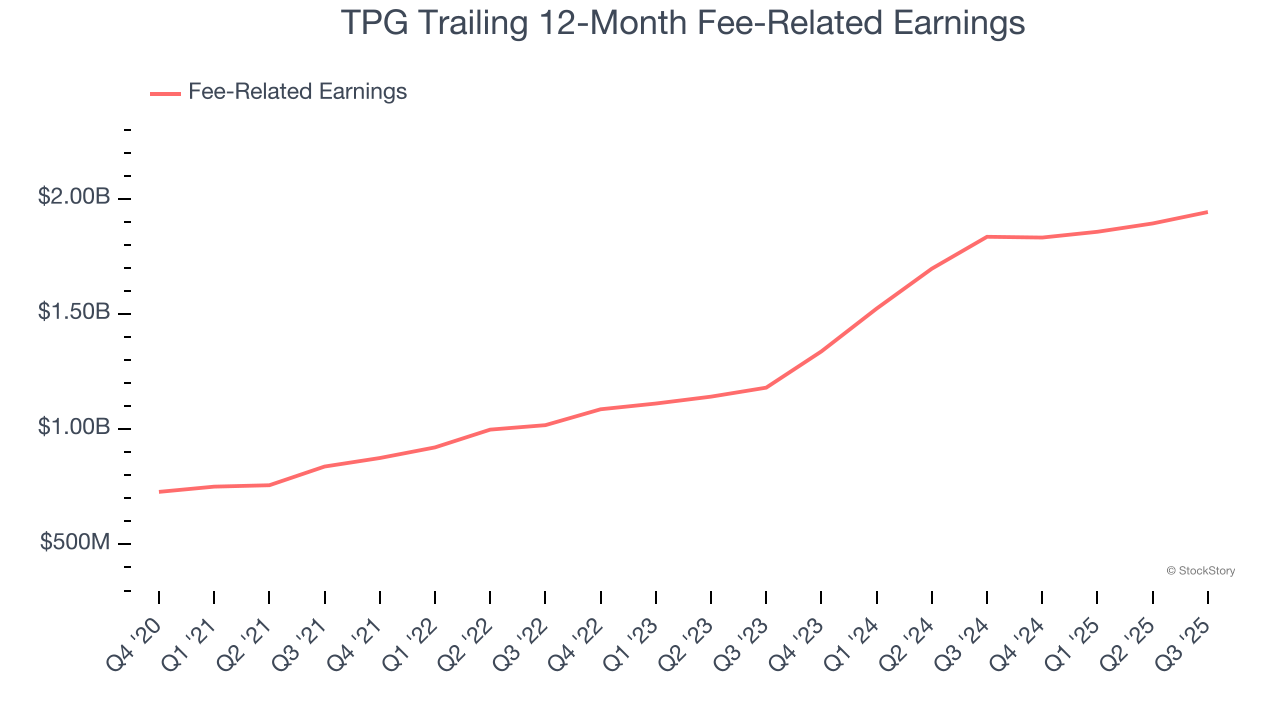

2. Fee-Related Earnings Jumped Higher

Topline performance tells part of the story, but sustainable profitability is the real measure of success. In the asset management space, fee-related earnings isolate the consistent profits from ongoing fee-based operations, filtering out the volatility of performance fees and investment income. This gives us a clear view of the company’s recurring earnings potential.

TPG’s annual fee-related earnings growth over the last four years was 23.4%, a top-notch result.

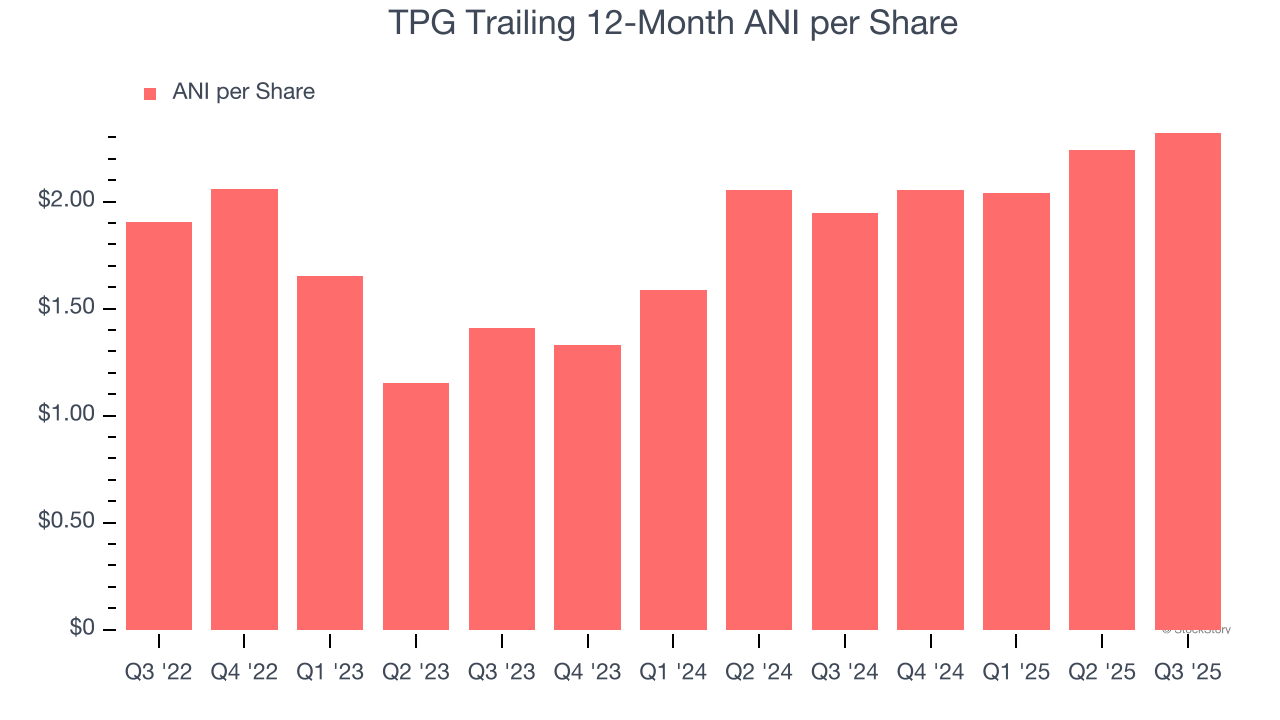

3. EPS Surges Higher Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

TPG’s astounding 28.3% annual EPS growth over the last two years aligns with its revenue trend. This tells us it maintained its per-share profitability as it expanded.

Final Judgment

These are just a few reasons why we think TPG is a high-quality business, and with its shares outperforming the market lately, the stock trades at 23.5× forward P/E (or $65.73 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than TPG

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.