Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at CME Group (NASDAQ: CME) and the best and worst performers in the financial exchanges & data industry.

Financial exchanges and data providers operate trading platforms and sell market information. They enjoy relatively stable revenue from trading fees and subscriptions, increasing demand for data analytics, and expansion opportunities in emerging markets. Challenges include regulatory oversight of market structure, competition from alternative trading venues, and substantial technology investments needed to maintain low-latency trading infrastructure and data security.

The 9 financial exchanges & data stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1%.

While some financial exchanges & data stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.5% since the latest earnings results.

CME Group (NASDAQ: CME)

Born from the Chicago Mercantile Exchange founded in 1898 as a butter and egg trading venue, CME Group (NASDAQ: CME) operates the world's largest derivatives marketplace where traders can buy and sell futures and options contracts across interest rates, equities, currencies, commodities, and more.

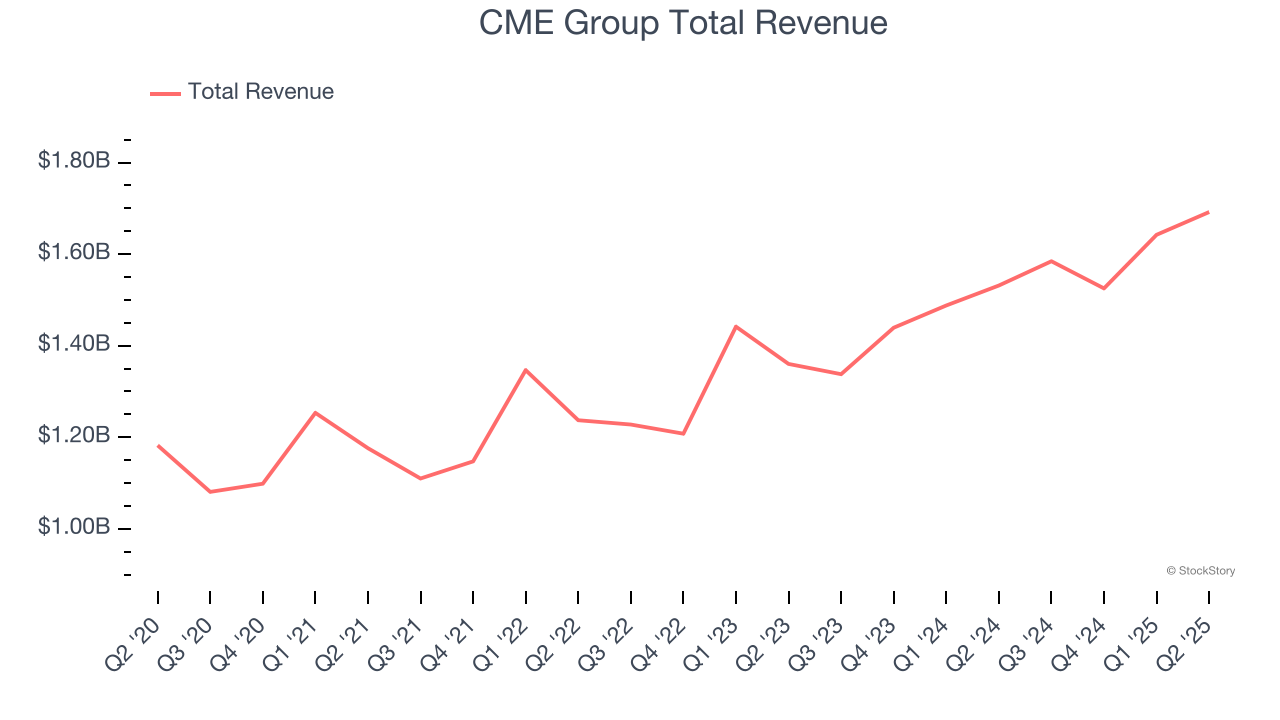

CME Group reported revenues of $1.69 billion, up 10.5% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with sales inline with expectations.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $272.39.

Is now the time to buy CME Group? Access our full analysis of the earnings results here, it’s free.

Best Q2: Moody's (NYSE: MCO)

Founded in 1900 during America's railroad boom when investors needed reliable information on bond risks, Moody's (NYSE: MCO) provides credit ratings, risk assessment tools, and analytical solutions that help organizations evaluate financial risks and make informed investment decisions.

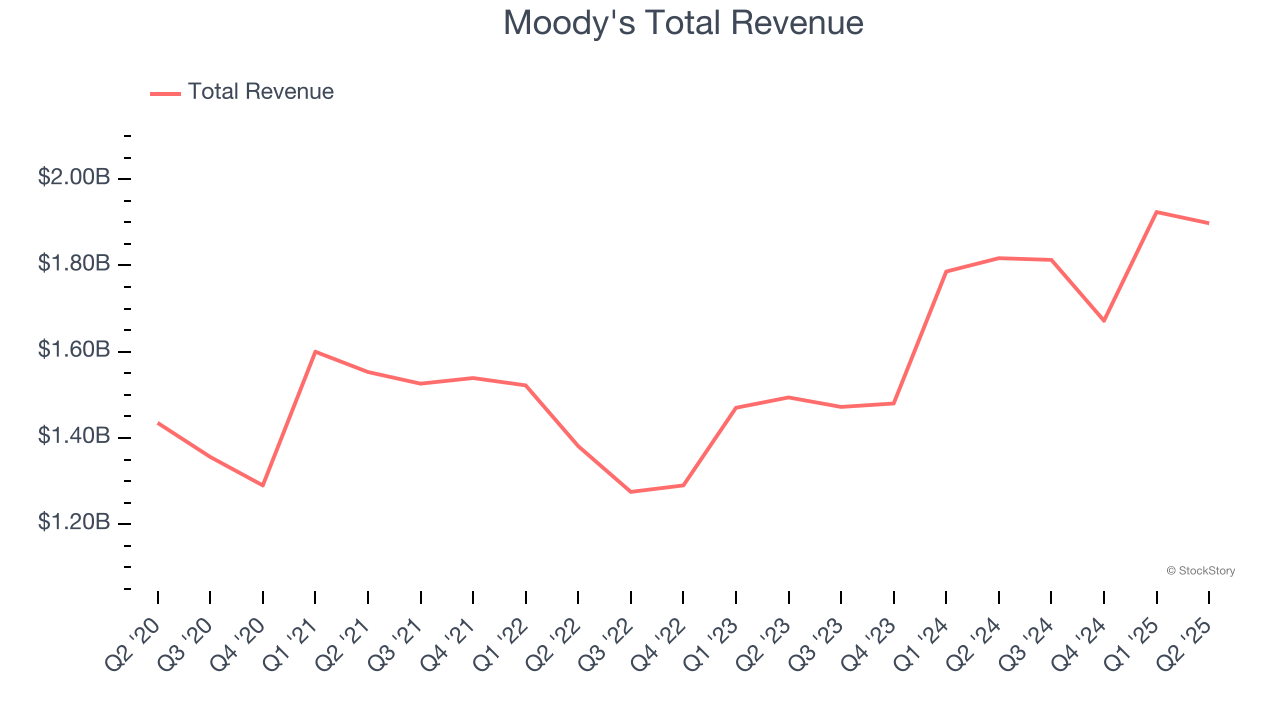

Moody's reported revenues of $1.90 billion, up 4.5% year on year, outperforming analysts’ expectations by 2.9%. The business had a strong quarter with sales and earnings exceeding expectations.

Moody's pulled off the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 2.2% since reporting. It currently trades at $510.

Is now the time to buy Moody's? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Tradeweb Markets (NASDAQ: TW)

Founded in 1996 as one of the pioneers in electronic bond trading, Tradeweb Markets (NASDAQ: TW) builds and operates electronic marketplaces that connect financial institutions for trading across rates, credit, equities, and money markets.

Tradeweb Markets reported revenues of $513 million, up 26.7% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 8.6% since the results and currently trades at $126.36.

Read our full analysis of Tradeweb Markets’s results here.

Morningstar (NASDAQ: MORN)

Founded in 1984 by Joe Mansueto with just $80,000 in personal savings, Morningstar (NASDAQ: MORN) provides independent investment data, research, and analysis tools that help investors, advisors, and institutions make informed financial decisions.

Morningstar reported revenues of $605.1 million, up 5.8% year on year. This number beat analysts’ expectations by 1.4%. Overall, it was a strong quarter.

The stock is down 8.3% since reporting and currently trades at $261.29.

Read our full, actionable report on Morningstar here, it’s free.

Nasdaq (NASDAQ: NDAQ)

Originally founded in 1971 as the world's first electronic stock market, Nasdaq (NASDAQ: NDAQ) operates global exchanges and provides technology, data, and corporate services that help companies, investors, and financial institutions navigate capital markets.

Nasdaq reported revenues of $1.31 billion, up 12.7% year on year. This print surpassed analysts’ expectations by 2.1%. It was a strong quarter.

The stock is up 6.8% since reporting and currently trades at $94.32.

Read our full, actionable report on Nasdaq here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.