Over the past six months, Old Dominion Freight Line’s shares (currently trading at $171.03) have posted a disappointing 6.4% loss, well below the S&P 500’s 5% gain. This might have investors contemplating their next move.

Is now the time to buy Old Dominion Freight Line, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Old Dominion Freight Line Not Exciting?

Despite the more favorable entry price, we don't have much confidence in Old Dominion Freight Line. Here are three reasons why you should be careful with ODFL and a stock we'd rather own.

1. Demand Slipping as Sales Volumes Decline

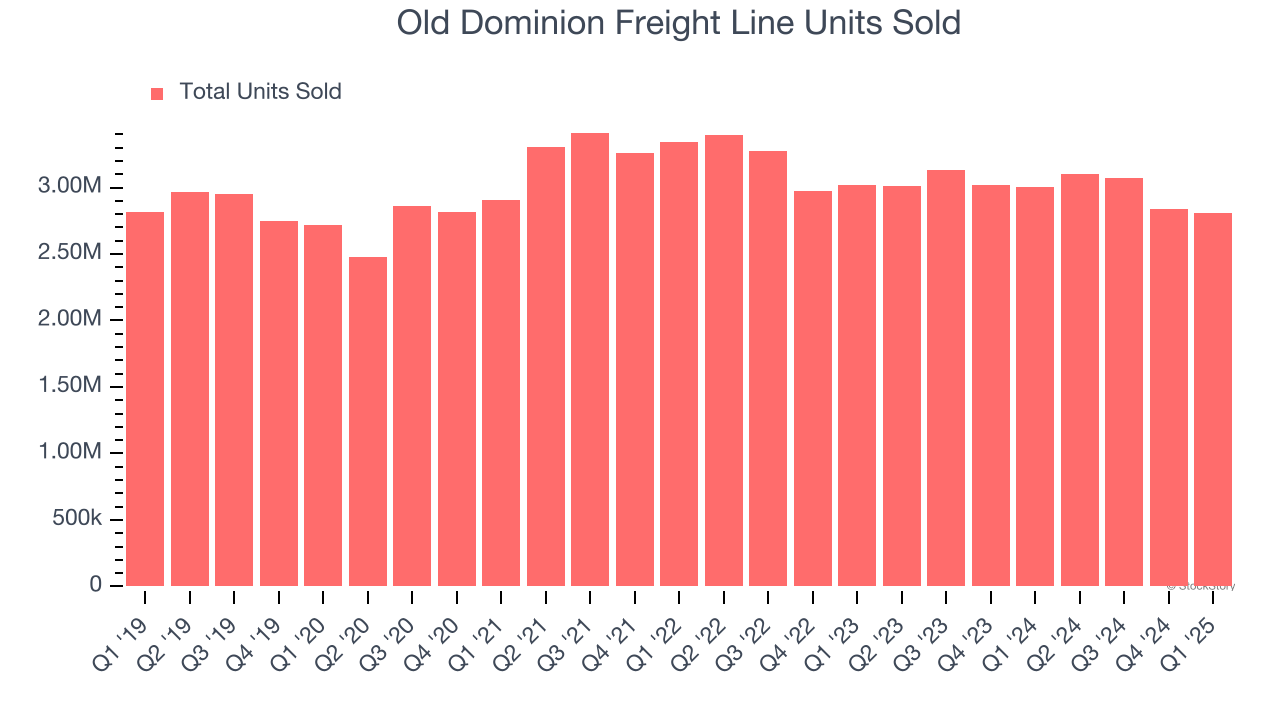

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Ground Transportation company because there’s a ceiling to what customers will pay.

Old Dominion Freight Line’s units sold came in at 2.81 million in the latest quarter, and they averaged 3.3% year-on-year declines over the last two years. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Old Dominion Freight Line might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. EPS Took a Dip Over the Last Two Years

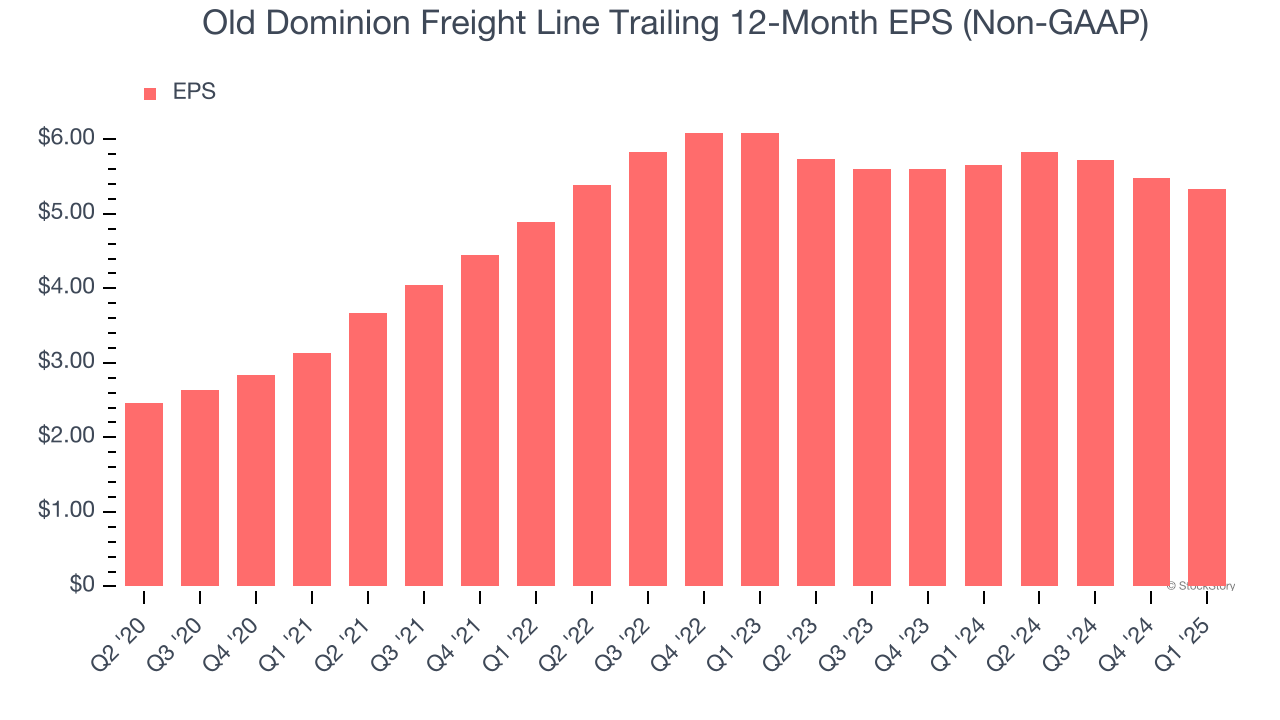

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Old Dominion Freight Line, its EPS declined by more than its revenue over the last two years, dropping 6.4%. This tells us the company struggled to adjust to shrinking demand.

3. Free Cash Flow Margin Dropping

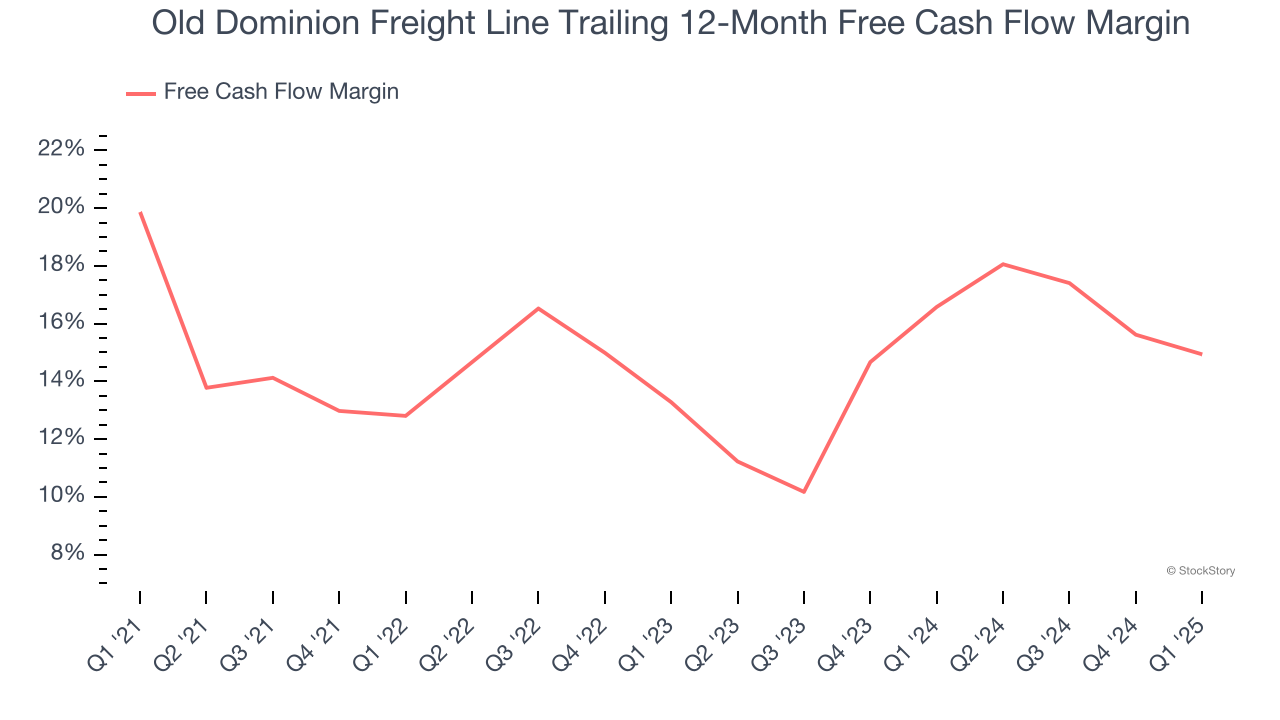

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Old Dominion Freight Line’s margin dropped by 4.9 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Old Dominion Freight Line’s free cash flow margin for the trailing 12 months was 14.9%.

Final Judgment

Old Dominion Freight Line isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 30.3× forward P/E (or $171.03 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think other companies feature superior fundamentals at the moment. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.