Over the past six months, Brighthouse Financial has been a great trade, beating the S&P 500 by 6%. Its stock price has climbed to $53.34, representing a healthy 11% increase. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Brighthouse Financial, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Brighthouse Financial Will Underperform?

Despite the momentum, we're sitting this one out for now. Here are three reasons why BHF doesn't excite us and a stock we'd rather own.

1. Declining Net Premiums Earned Reflects Weakness

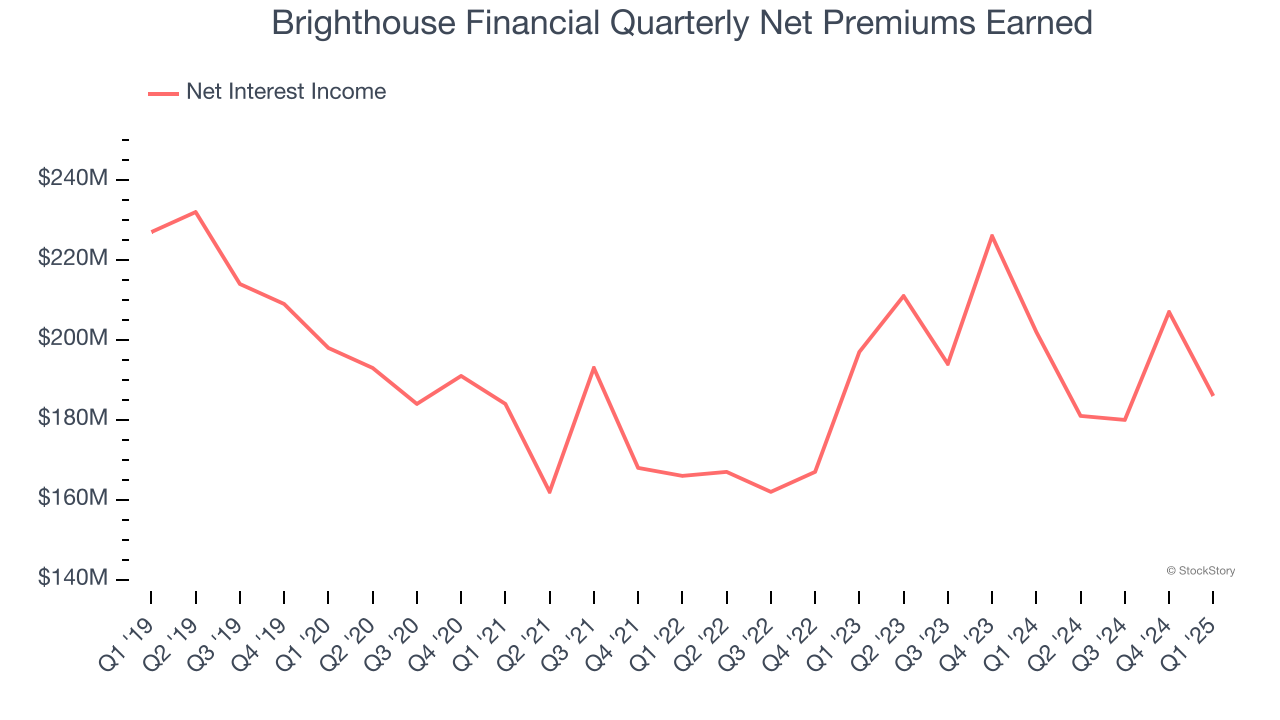

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

Brighthouse Financial’s net premiums earned has declined by 2.4% annually over the last five years, much worse than the broader insurance industry. This shows that policy underwriting underperformed its other business lines.

2. Deteriorating Pre-tax Profit Margin

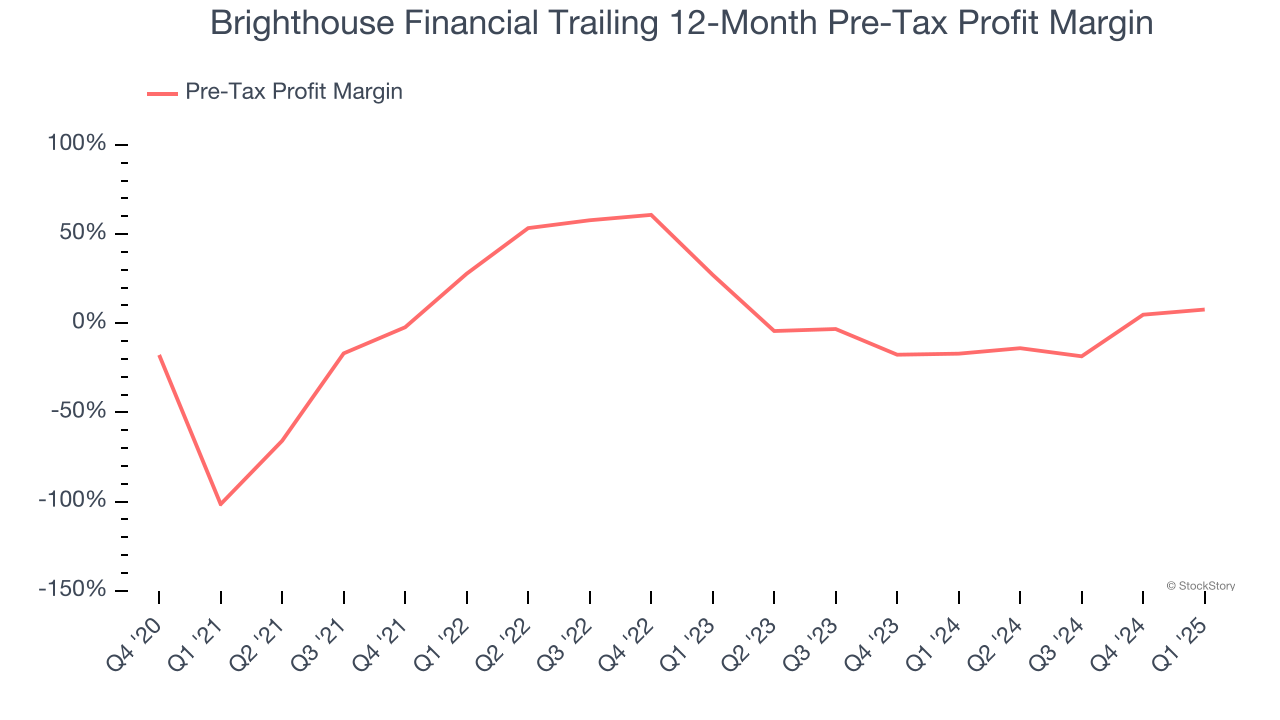

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because insurers are balance sheet businesses, where assets and liabilities define the core economics. This means that interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company’s control - should not.

Over the last four years, Brighthouse Financial’s pre-tax profit margin has risen by 109.1 percentage points, clocking in at 7.7% for the past 12 months. Said differently, the company’s expenses have grown at a slower rate than revenue, which is always a positive sign.

3. Substandard BVPS Growth Indicates Limited Asset Expansion

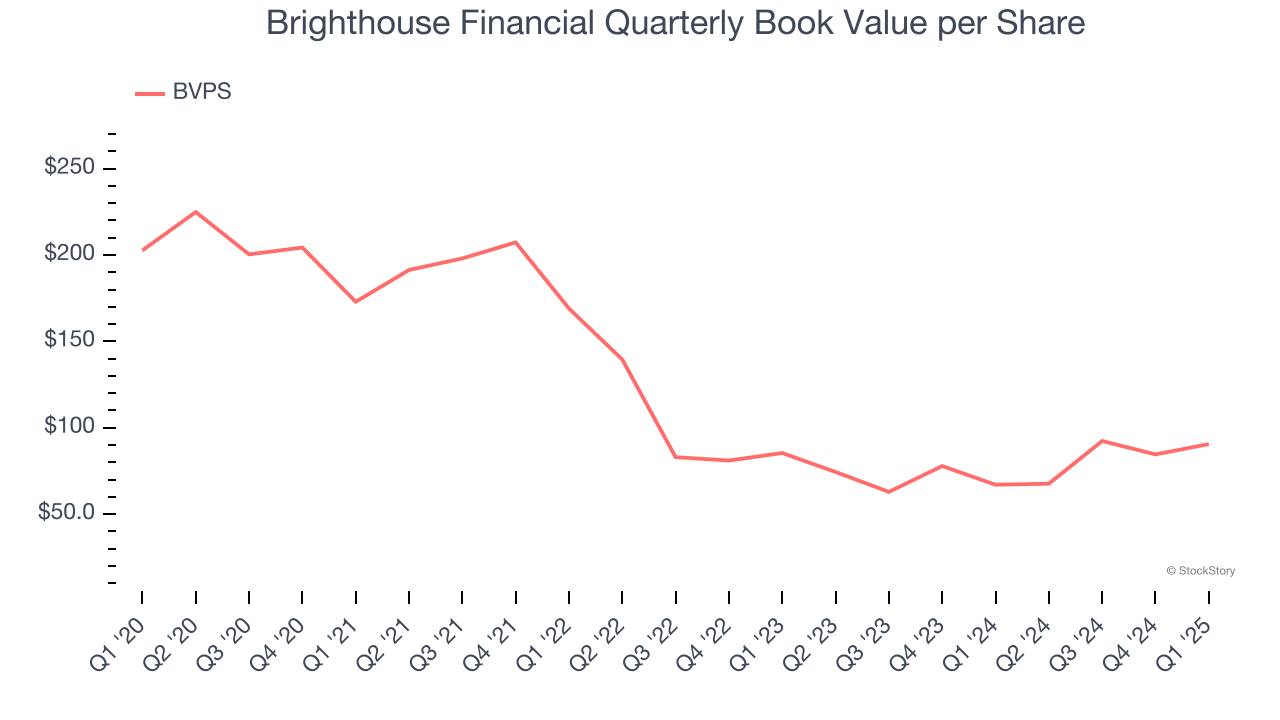

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

Disappointingly for investors, Brighthouse Financial’s BVPS grew at a sluggish 3% annual clip over the last two years.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Brighthouse Financial, we’ll be cheering from the sidelines. With its shares outperforming the market lately, the stock trades at 0.8× forward P/B (or $53.34 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.