The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Wiley (NYSE: WLY) and the rest of the traditional media & publishing stocks fared in Q1.

The sector faces structural headwinds from declining linear TV viewership, shifts in advertising spend toward digital platforms, and ongoing challenges in monetizing print and broadcast content. However, for companies that invest wisely, tailwinds can include AI, the power of which can result in more personalized content creation and more detailed audience analysis. These can create a flywheel of success where one feeds into the other. Still there are outstanding questions around AI-generated content oversight, and the regulatory framework around this could evolve in unseen ways over the next few years.

The 4 traditional media & publishing stocks we track reported a very strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 8.4% on average since the latest earnings results.

Wiley (NYSE: WLY)

With roots dating back to 1807 when Charles Wiley opened a small printing shop in Manhattan, John Wiley & Sons (NYSE: WLY) is a global academic publisher that provides scientific journals, books, digital courseware, and knowledge solutions for researchers, students, and professionals.

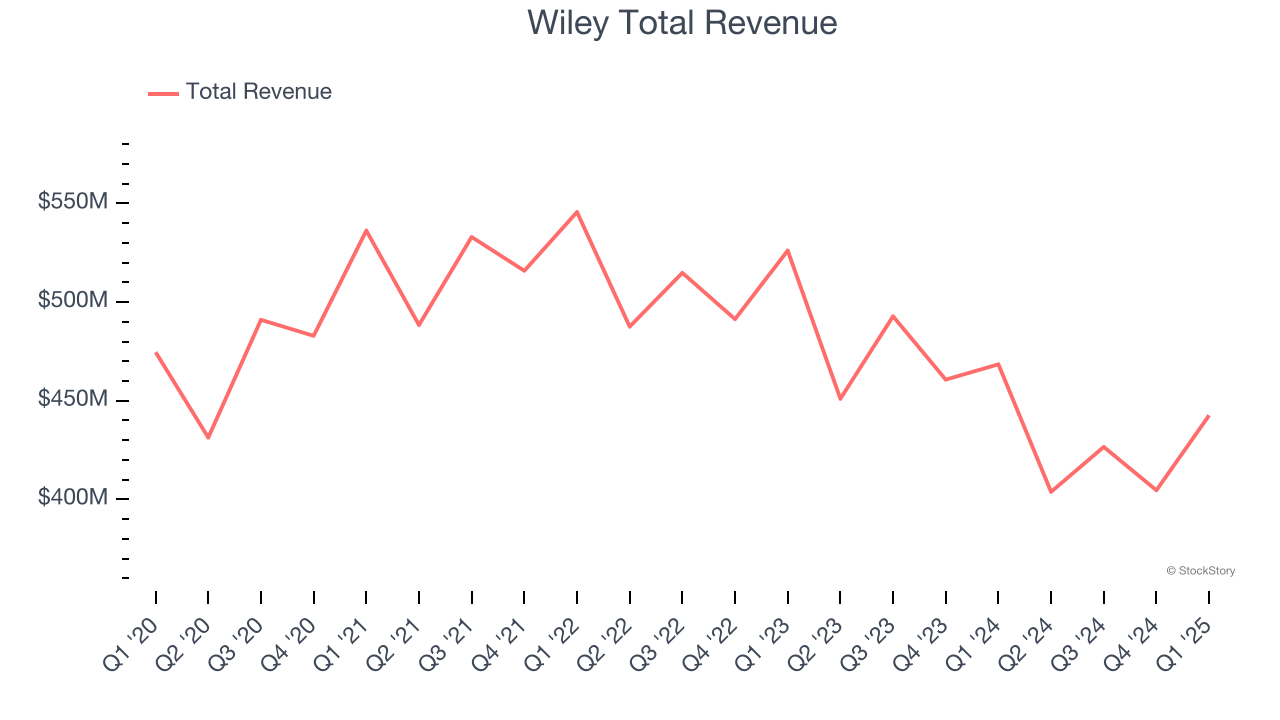

Wiley reported revenues of $442.6 million, down 5.5% year on year. This print exceeded analysts’ expectations by 1.7%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EPS estimates.

“We delivered another strong year of execution as we met or exceeded our financial commitments, drove profitable growth in our core, expanded margins and free cash flow, and extended further into the corporate market through AI licensing and partnership, science analytics, and knowledge services,” said Matthew Kissner, President and CEO.

Wiley delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 6.5% since reporting and currently trades at $43.40.

Is now the time to buy Wiley? Access our full analysis of the earnings results here, it’s free.

Best Q1: IMAX (NYSE: IMAX)

Originally developed for World Expo '67 in Montreal as an innovative projection system, IMAX (NYSE: IMAX) provides proprietary large-format cinema technology and systems that deliver immersive movie experiences with enhanced image quality and sound.

IMAX reported revenues of $86.67 million, up 9.5% year on year, outperforming analysts’ expectations by 2.9%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates.

IMAX delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 12.8% since reporting. It currently trades at $27.14.

Is now the time to buy IMAX? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Sinclair (NASDAQ: SBGI)

With over 2,400 hours of local news produced weekly and 640 broadcast channels reaching millions of American homes, Sinclair (NASDAQ: SBGI) operates a network of 185 local television stations across 86 U.S. markets, producing news programming and distributing content from major networks.

Sinclair reported revenues of $776 million, down 2.8% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted full-year revenue guidance exceeding analysts’ expectations but a significant miss of analysts’ EPS estimates.

As expected, the stock is down 7.3% since the results and currently trades at $14.55.

Read our full analysis of Sinclair’s results here.

EchoStar (NASDAQ: SATS)

Following its 2023 acquisition of DISH Network, EchoStar (NASDAQ: SATS) provides satellite communications, pay-TV services, wireless networks, and broadband solutions across consumer and enterprise markets.

EchoStar reported revenues of $3.87 billion, down 3.6% year on year. This result met analysts’ expectations. Overall, it was a very strong quarter as it also logged a solid beat of analysts’ EPS estimates.

EchoStar had the weakest performance against analyst estimates among its peers. The stock is up 21.6% since reporting and currently trades at $29.01.

Read our full, actionable report on EchoStar here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.