Equitable Holdings has been treading water for the past six months, holding steady at $51.72.

Is there a buying opportunity in Equitable Holdings, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Equitable Holdings Will Underperform?

We're swiping left on Equitable Holdings for now. Here are three reasons why EQH doesn't excite us and a stock we'd rather own.

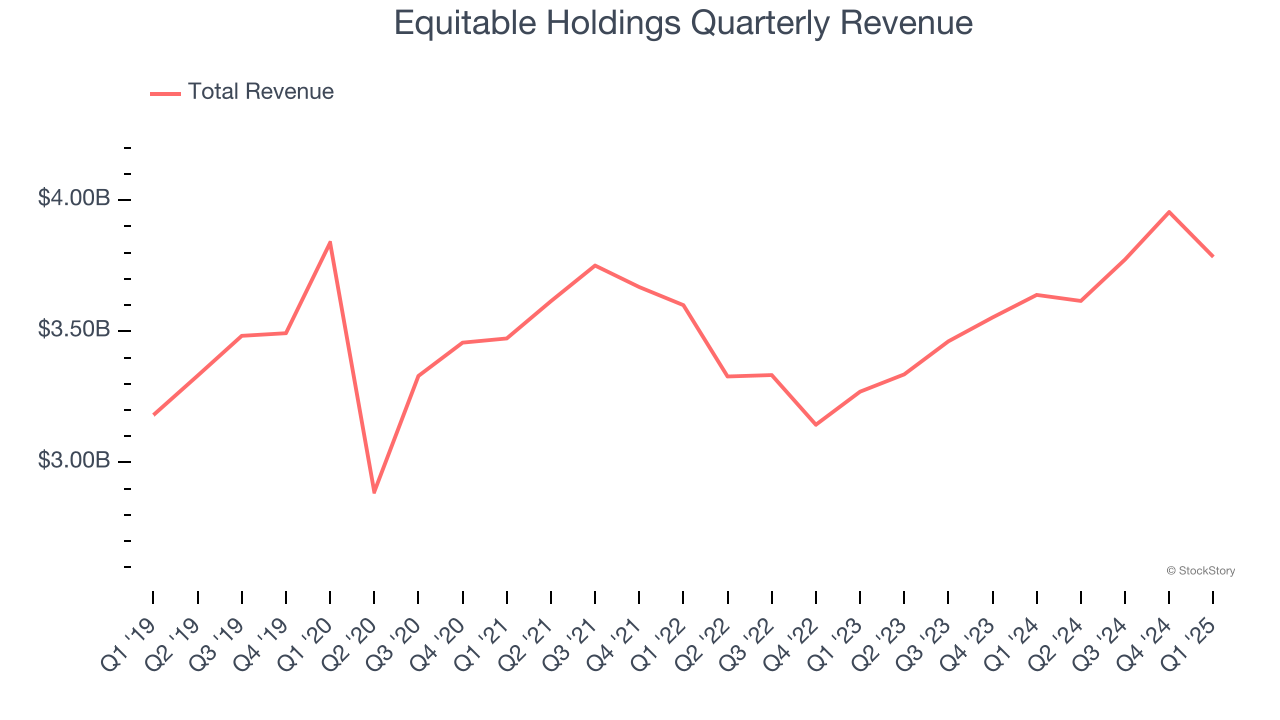

1. Long-Term Revenue Growth Disappoints

Insurance companies earn revenue from three primary sources:

- The core insurance business itself, often called underwriting and represented in the income statement as premiums

- Income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities

- Fees from various sources such as policy administration, annuities, or other value-added services

Unfortunately, Equitable Holdings’s 1.4% annualized revenue growth over the last five years was weak. This was below our standards.

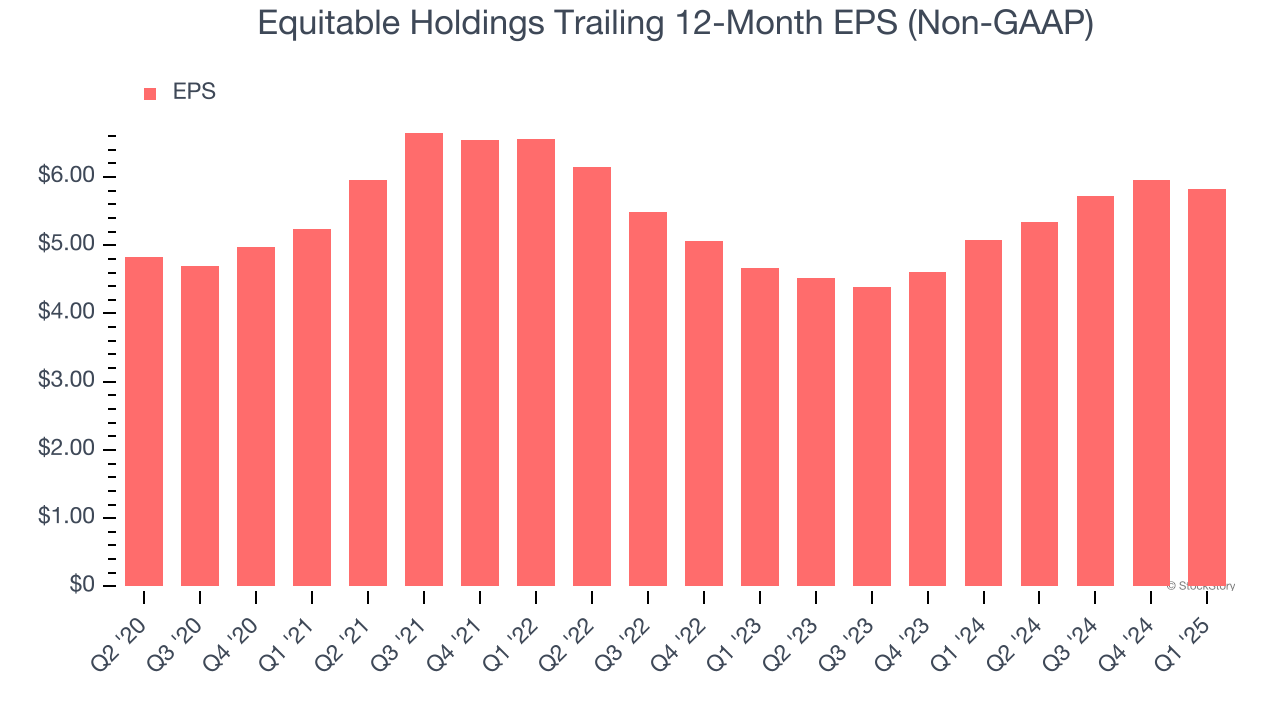

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Equitable Holdings’s weak 2.8% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

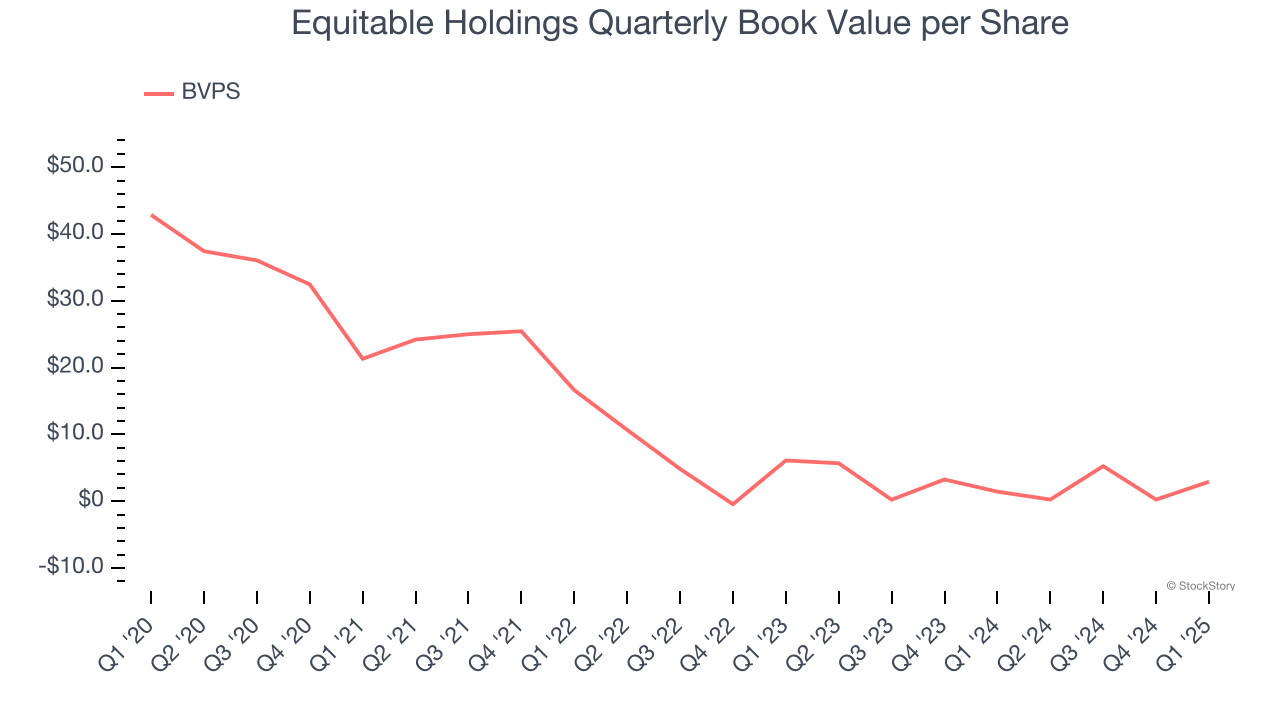

3. Declining BVPS Reflects Erosion of Asset Value

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

To the detriment of investors, Equitable Holdings’s BVPS declined at a 30.9% annual clip over the last two years.

Final Judgment

We see the value of companies helping consumers, but in the case of Equitable Holdings, we’re out. That said, the stock currently trades at 12.9× forward P/B (or $51.72 per share). This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment. Let us point you toward our favorite semiconductor picks and shovels play.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.