Principal Financial Group has been treading water for the past six months, recording a small loss of 2.2% while holding steady at $79.90. The stock also fell short of the S&P 500’s 4.5% gain during that period.

Is there a buying opportunity in Principal Financial Group, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Principal Financial Group Will Underperform?

We're cautious about Principal Financial Group. Here are three reasons why PFG doesn't excite us and a stock we'd rather own.

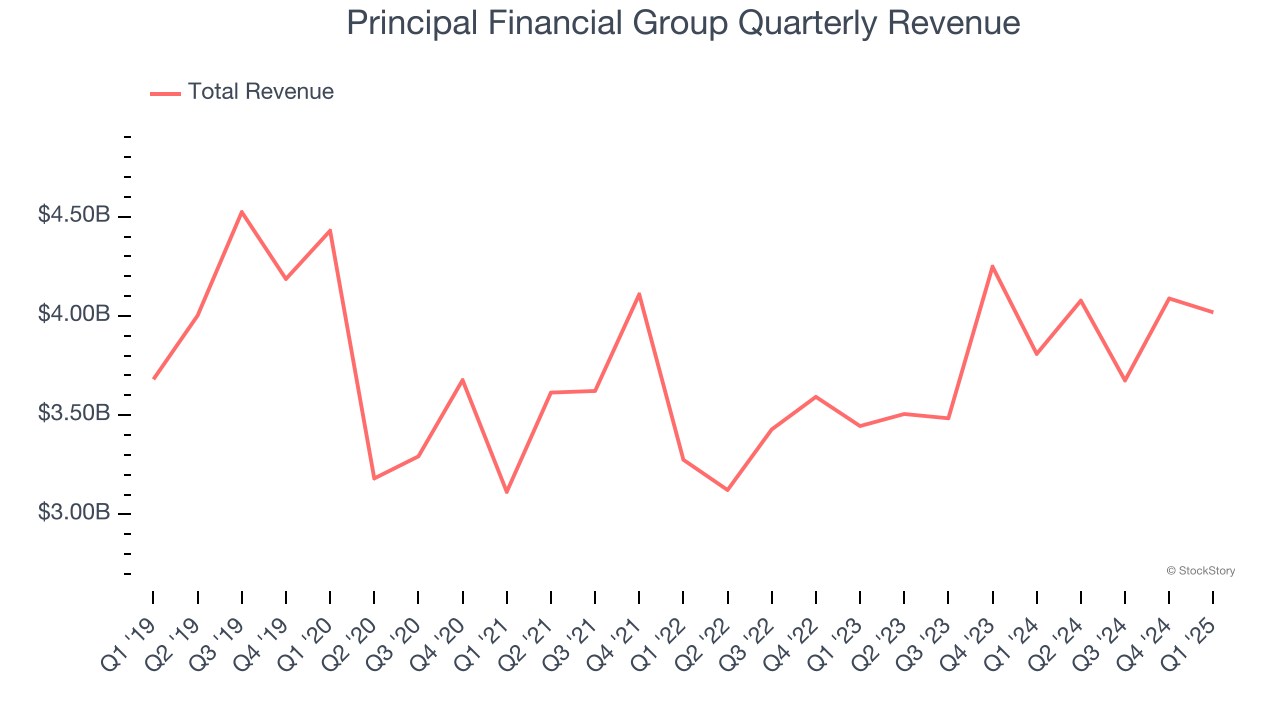

1. Revenue Spiraling Downwards

Insurance companies earn revenue from three primary sources:

- The core insurance business itself, often called underwriting and represented in the income statement as premiums

- Income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities

- Fees from various sources such as policy administration, annuities, or other value-added services

Over the last five years, Principal Financial Group’s demand was weak and its revenue declined by 1.5% per year. This was below our standards and is a sign of poor business quality.

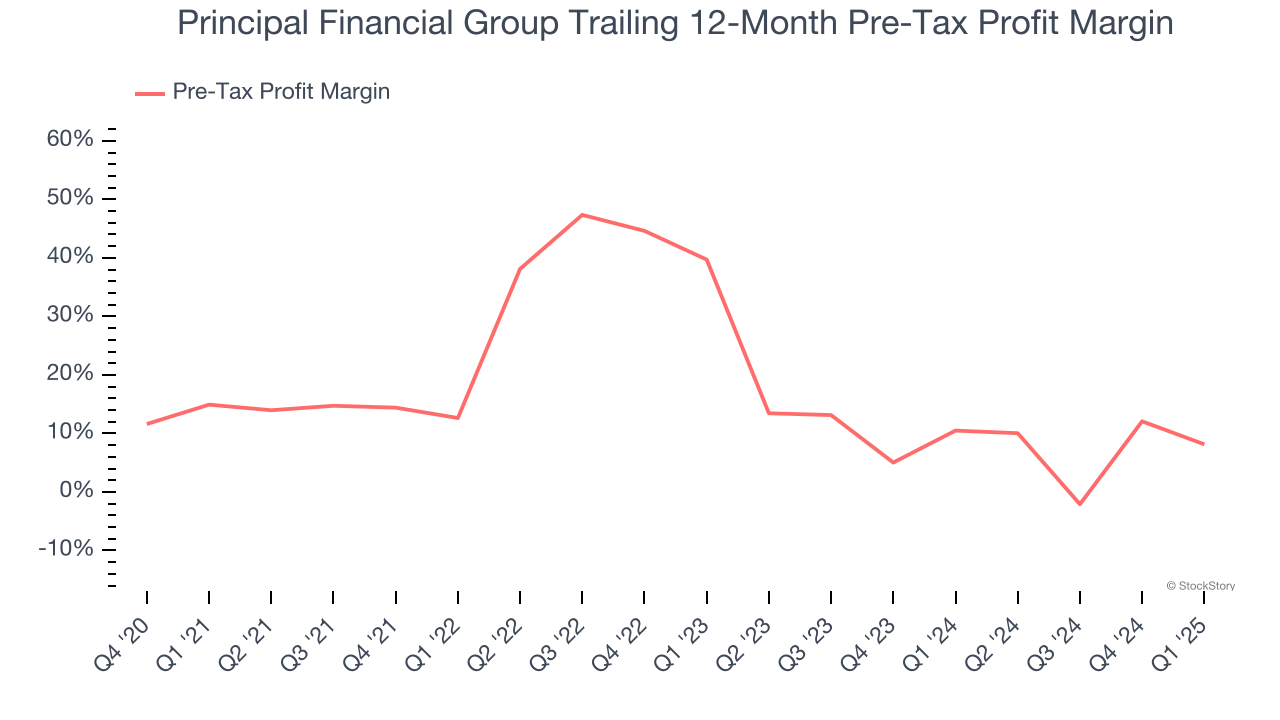

2. Deteriorating Pre-tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Insurance companies are balance sheet businesses, where assets and liabilities define the economics. Interest income and expense should therefore be factored into the definition of profit but taxes - which are largely out of a company’s control - should not. This is pre-tax profit by definition.

Over the last four years, Principal Financial Group’s pre-tax profit margin has fallen by 6.8 percentage points, hitting 8.1% for the past 12 months. Said differently, the company’s expenses have increased at a faster rate than revenue, which is usually raises questions in mature industries (the exception is a high-growth company that reinvests its profits in attractive ventures).

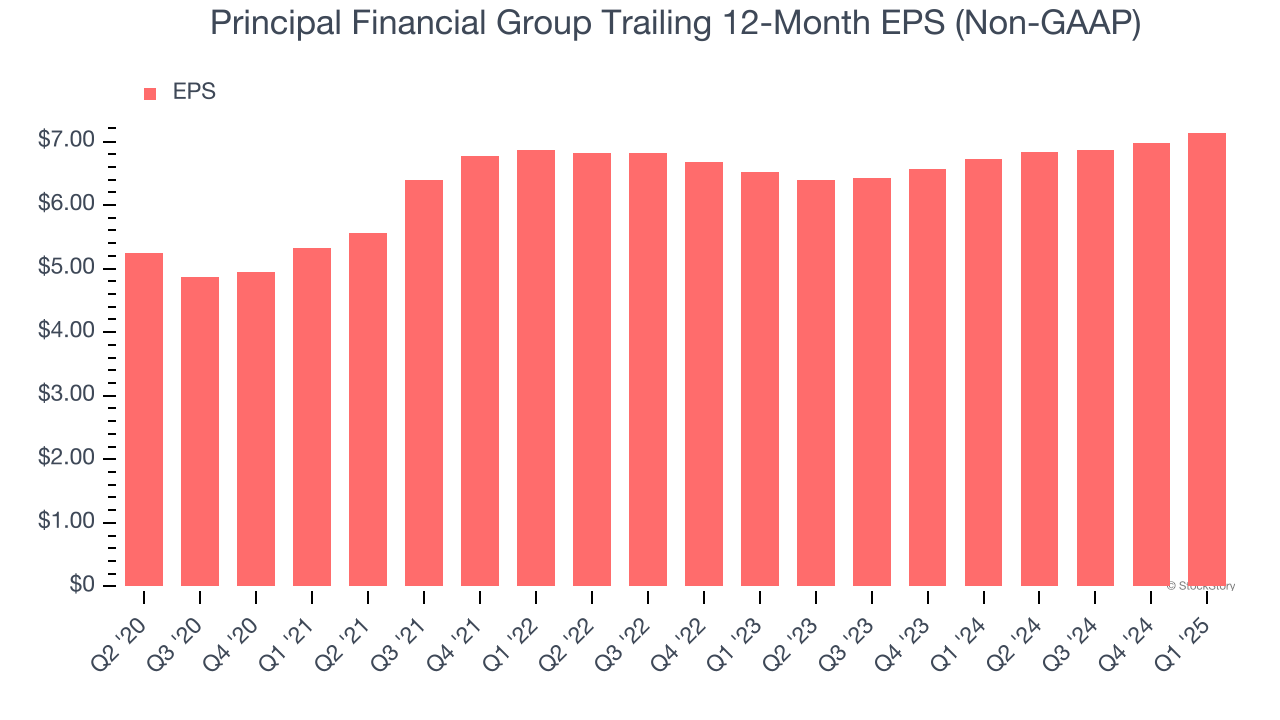

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Principal Financial Group’s EPS grew at an unimpressive 7.8% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.5% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Principal Financial Group, we’ll be cheering from the sidelines. With its shares underperforming the market lately, the stock trades at 1.5× forward P/B (or $79.90 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Principal Financial Group

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.