Over the last six months, Bloom Energy’s shares have sunk to $21.48, producing a disappointing 8.4% loss - a stark contrast to the S&P 500’s 1.7% gain. This might have investors contemplating their next move.

Following the pullback, is this a buying opportunity for BE? Find out in our full research report, it’s free.

Why Are We Positive On Bloom Energy?

Working in stealth mode for eight years, Bloom Energy (NYSE: BE) designs, manufactures, and markets solid oxide fuel cell systems for on-site power generation.

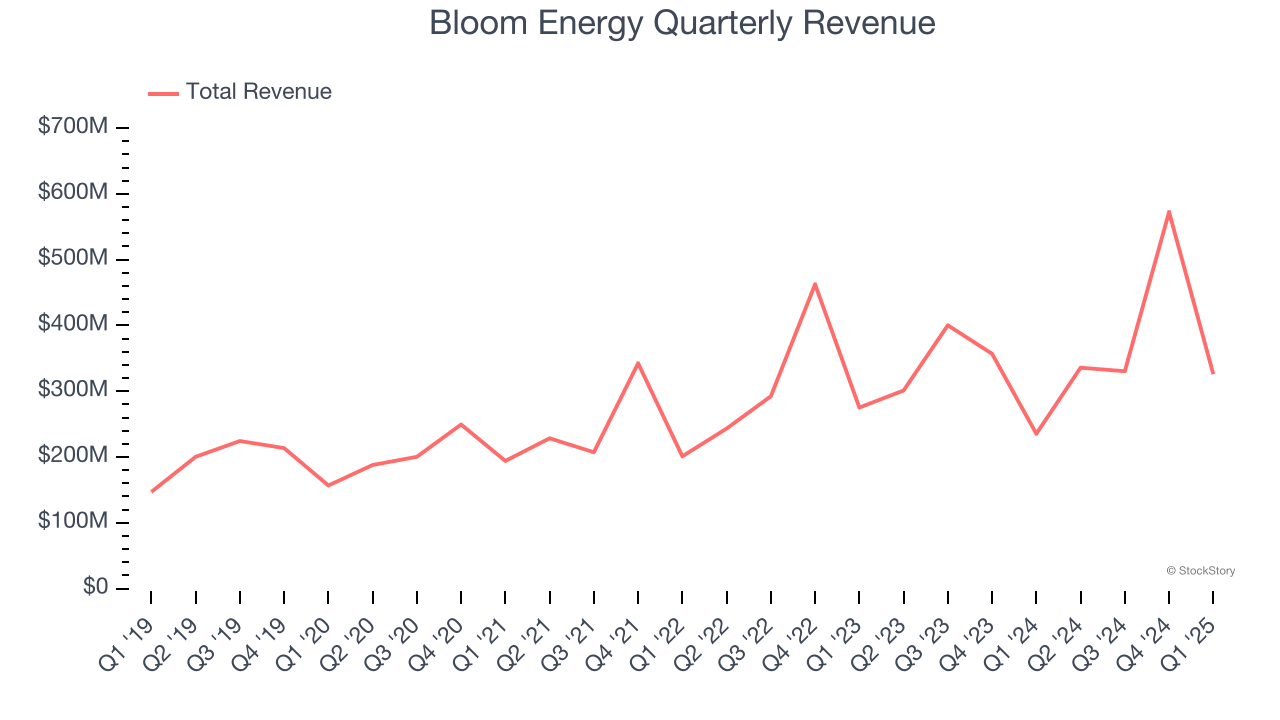

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Bloom Energy’s 14.5% annualized revenue growth over the last five years was exceptional. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

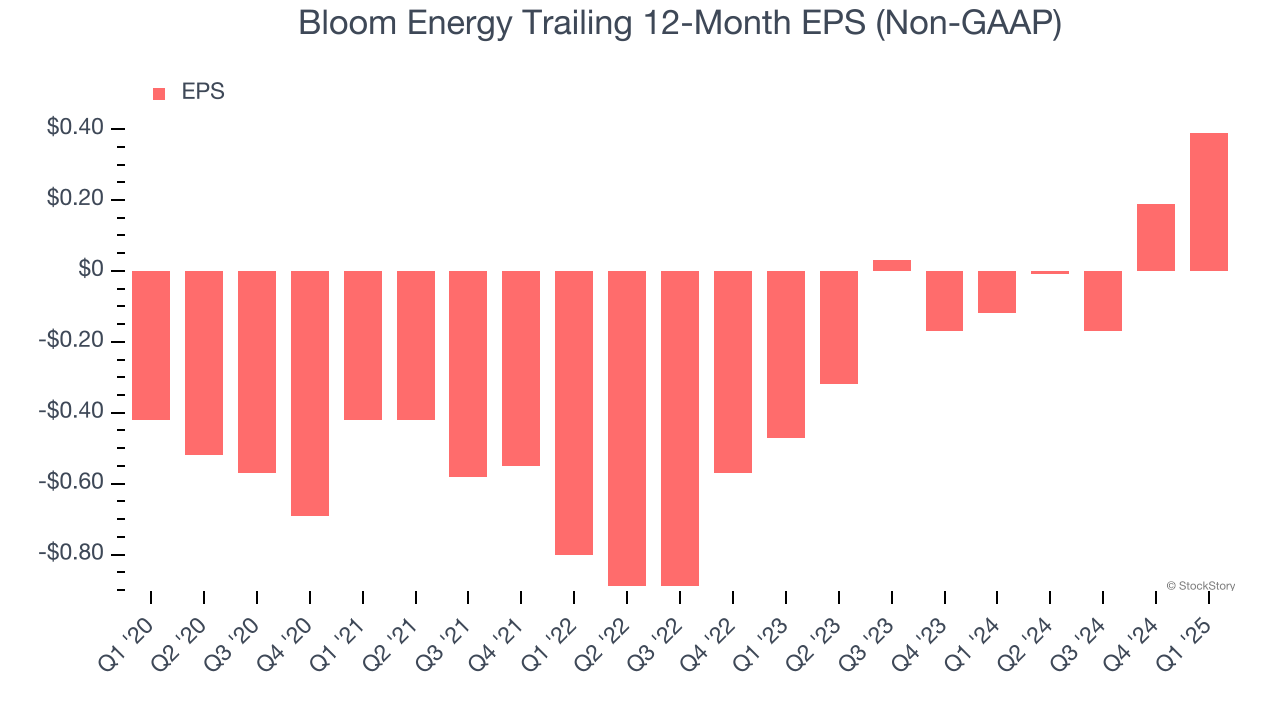

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Bloom Energy’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

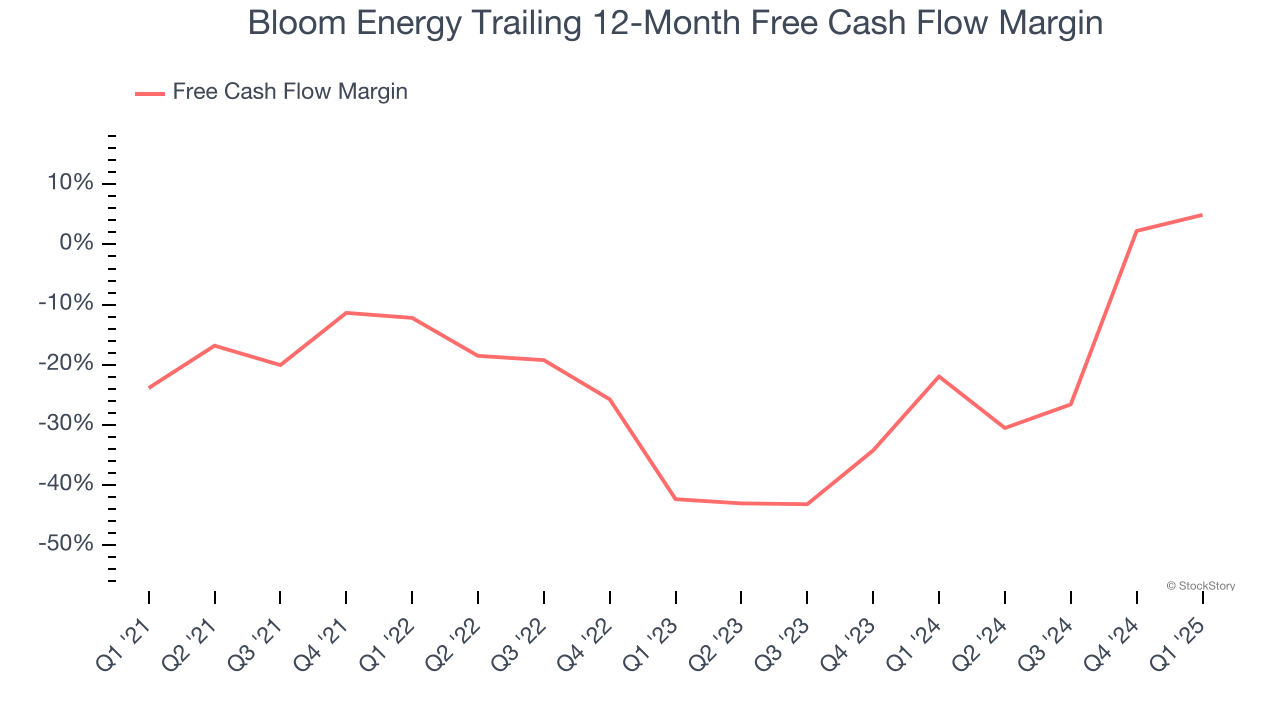

3. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Bloom Energy’s margin expanded by 28.8 percentage points over the last five years. Bloom Energy’s free cash flow margin for the trailing 12 months was 4.9%.

Final Judgment

These are just a few reasons why Bloom Energy ranks highly on our list. With the recent decline, the stock trades at 47.6× forward P/E (or $21.48 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Bloom Energy

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.