Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Centene (NYSE: CNC) and its peers.

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

The 11 health insurance providers stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.4% since the latest earnings results.

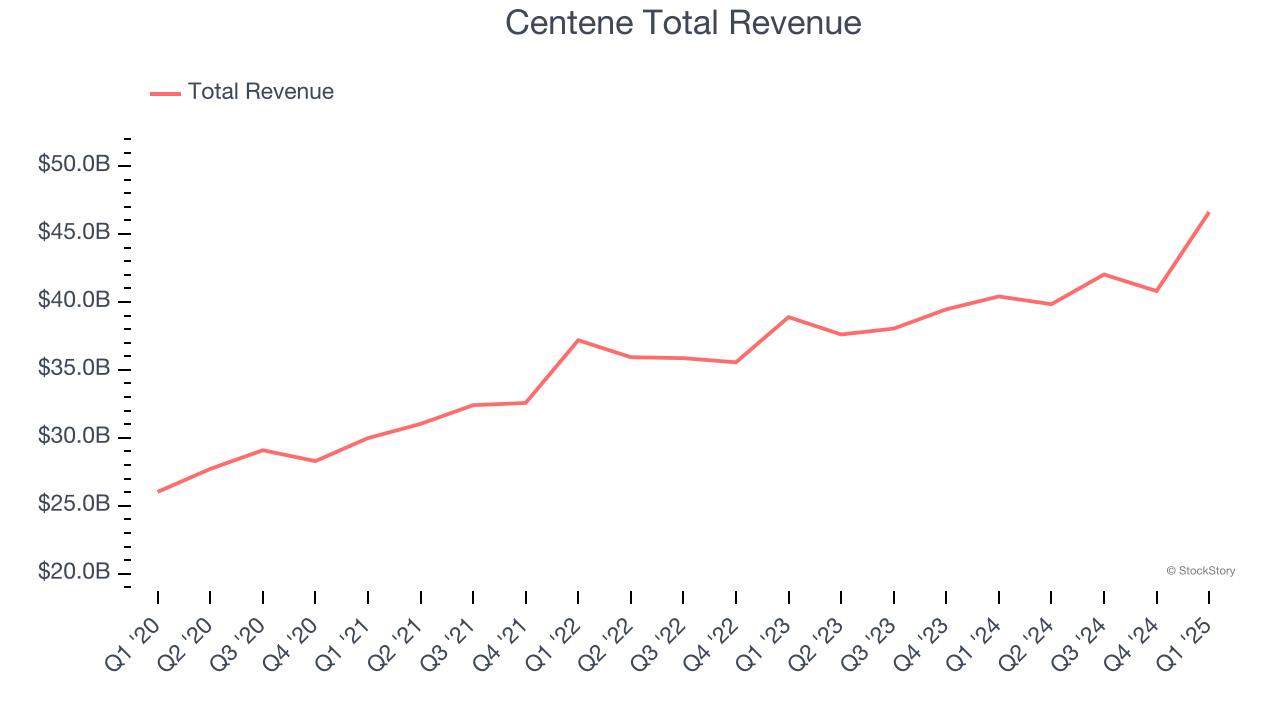

Centene (NYSE: CNC)

Serving nearly 1 in 15 Americans through its government healthcare programs, Centene (NYSE: CNC) is a healthcare company that manages government-sponsored health insurance programs like Medicaid and Medicare for low-income and complex-needs populations.

Centene reported revenues of $46.62 billion, up 15.4% year on year. This print exceeded analysts’ expectations by 8.3%. Overall, it was a strong quarter for the company with full-year revenue guidance exceeding analysts’ expectations and a solid beat of analysts’ EPS estimates.

"Our first quarter results demonstrate the resiliency of Centene's platform and the progress we are making as an organization while navigating a dynamic policy landscape," said Chief Executive Officer of Centene, Sarah M. London.

Centene achieved the highest full-year guidance raise of the whole group. The company lost 656,600 customers and ended up with a total of 27.94 million. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $61.

Is now the time to buy Centene? Access our full analysis of the earnings results here, it’s free.

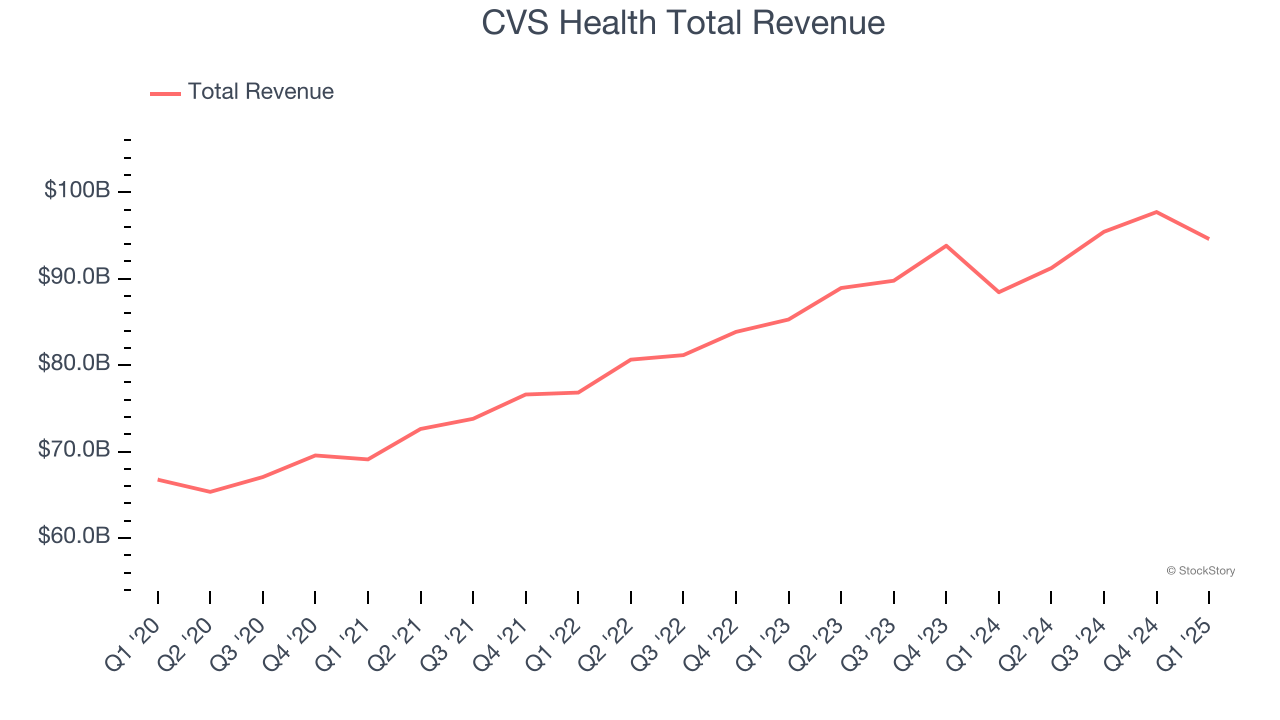

Best Q1: CVS Health (NYSE: CVS)

With over 9,000 retail pharmacy locations serving as neighborhood health destinations across America, CVS Health (NYSE: CVS) operates retail pharmacies, provides pharmacy benefit management services, and offers health insurance through its Aetna subsidiary.

CVS Health reported revenues of $94.59 billion, up 7% year on year, outperforming analysts’ expectations by 1.5%. The business had an exceptional quarter with a solid beat of analysts’ same-store sales estimates and an impressive beat of analysts’ EPS estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 6.5% since reporting. It currently trades at $62.36.

Is now the time to buy CVS Health? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: UnitedHealth (NYSE: UNH)

With over 100 million people served across its various businesses and a workforce of more than 400,000, UnitedHealth Group (NYSE: UNH) operates a health insurance business and Optum, a healthcare services division that provides everything from pharmacy benefits to primary care.

UnitedHealth reported revenues of $109.6 billion, up 9.8% year on year, falling short of analysts’ expectations by 1.7%. It was a softer quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

UnitedHealth delivered the weakest performance against analyst estimates in the group. The company added 395,000 customers to reach a total of 54.12 million. As expected, the stock is down 50.9% since the results and currently trades at $287.66.

Read our full analysis of UnitedHealth’s results here.

Molina Healthcare (NYSE: MOH)

Founded in 1980 as a provider for underserved communities in Southern California, Molina Healthcare (NYSE: MOH) provides managed healthcare services primarily to low-income individuals through Medicaid, Medicare, and Marketplace insurance programs across 21 states.

Molina Healthcare reported revenues of $11.15 billion, up 12.2% year on year. This result surpassed analysts’ expectations by 2.6%. More broadly, it was a satisfactory quarter as it also logged a decent beat of analysts’ EPS estimates but customer base in line with analysts’ estimates.

The company added 217,000 customers to reach a total of 5.75 million. The stock is down 1.9% since reporting and currently trades at $325.34.

Read our full, actionable report on Molina Healthcare here, it’s free.

Alignment Healthcare (NASDAQ: ALHC)

Founded in 2013 with a mission to transform healthcare for seniors, Alignment Healthcare (NASDAQ: ALHC) provides Medicare Advantage health plans for seniors with features like concierge services, transportation benefits, and technology-driven care coordination.

Alignment Healthcare reported revenues of $926.9 million, up 47.5% year on year. This number beat analysts’ expectations by 4.4%. It was a very strong quarter as it also recorded an impressive beat of analysts’ EPS estimates.

Alignment Healthcare pulled off the fastest revenue growth among its peers. The company added 28,400 customers to reach a total of 217,500. The stock is down 10.2% since reporting and currently trades at $15.00.

Read our full, actionable report on Alignment Healthcare here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.