Instacart has been treading water for the past six months, recording a small loss of 3.3% while holding steady at $44.40. The stock also fell short of the S&P 500’s 14.3% gain during that period.

Is now the time to buy CART? Find out in our full research report, it’s free for active Edge members.

Why Is CART a Good Business?

Powering more than one billion grocery orders since its founding, Instacart (NASDAQ: CART) is an online grocery shopping and delivery platform that partners with retailers to help customers shop from local stores through its app or website.

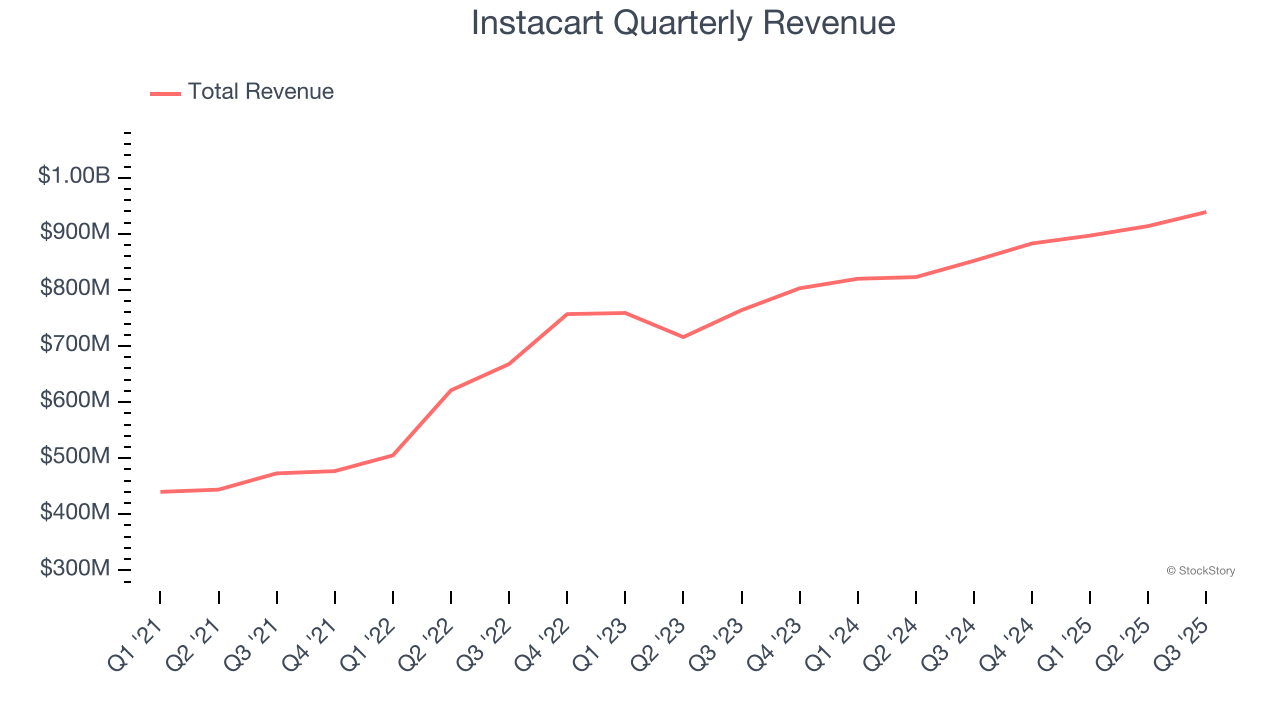

1. Long-Term Revenue Growth Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Instacart’s sales grew at a solid 17% compounded annual growth rate over the last three years. Its growth beat the average consumer internet company and shows its offerings resonate with customers.

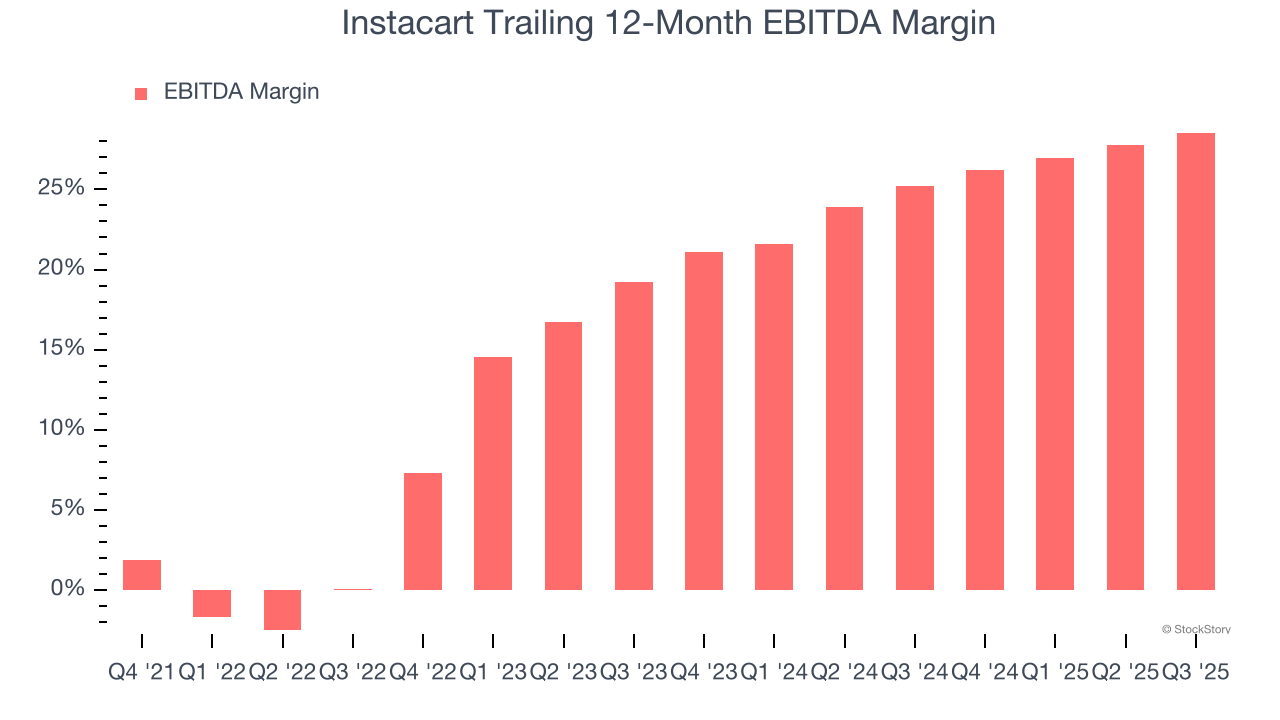

2. EBITDA Margin Reveals a Well-Run Organization

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Instacart has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 27%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

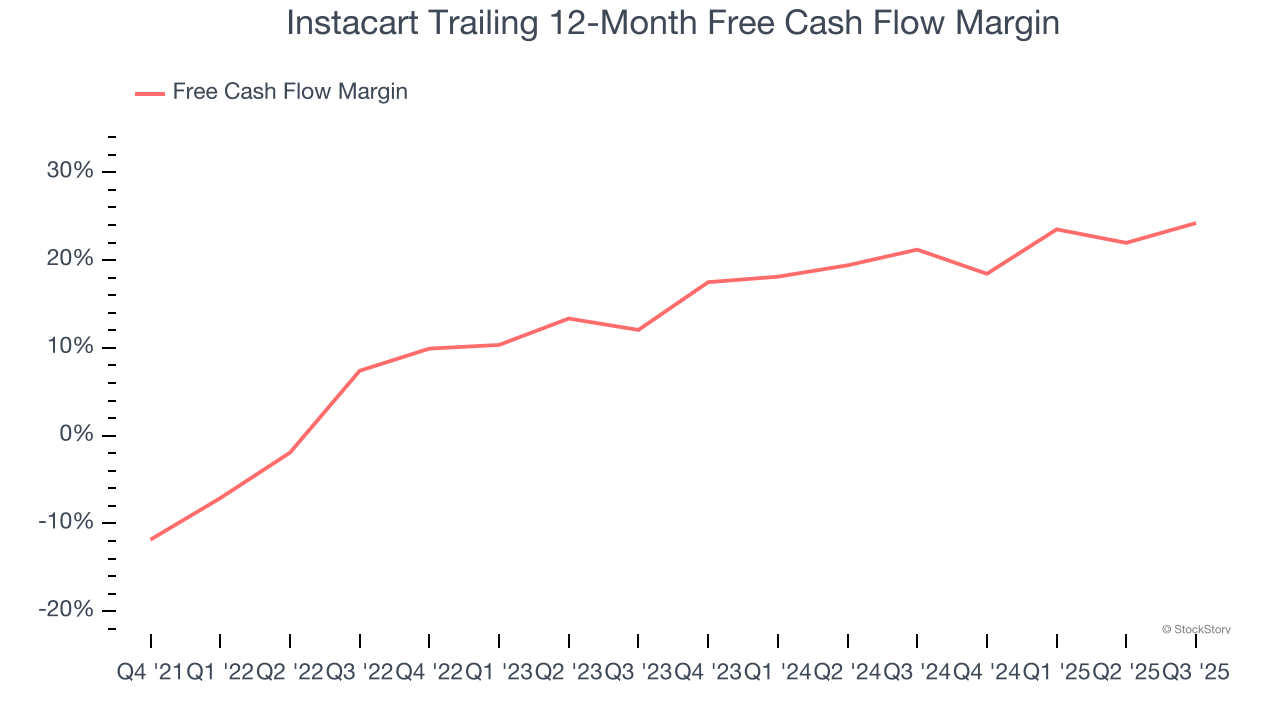

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Instacart’s margin expanded by 16.8 percentage points over the last few years. This is encouraging because it gives the company more optionality. Instacart’s free cash flow margin for the trailing 12 months was 24.2%.

Final Judgment

These are just a few reasons why Instacart ranks highly on our list. With its shares underperforming the market lately, the stock trades at 10.6× forward EV/EBITDA (or $44.40 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Instacart

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.