The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Peloton (NASDAQ: PTON) and the rest of the consumer discretionary stocks fared in Q3.

This sector includes everything from cable TV services to hotel stays to gym memberships. While diverse, the way people buy and experience these products is being upended by the internet and digitization. Consumer discretionary companies are working to adapt to secular trends such as streaming video, online marketplaces for lodging accommodations, and connected fitness. That discretionary purchases are, by definition, something consumers can give up makes it even more imperative for companies in the space to adapt.

The consumer discretionary stocks we track reported a satisfactory Q3. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Luckily, consumer discretionary stocks have performed well with share prices up 25.2% on average since the latest earnings results.

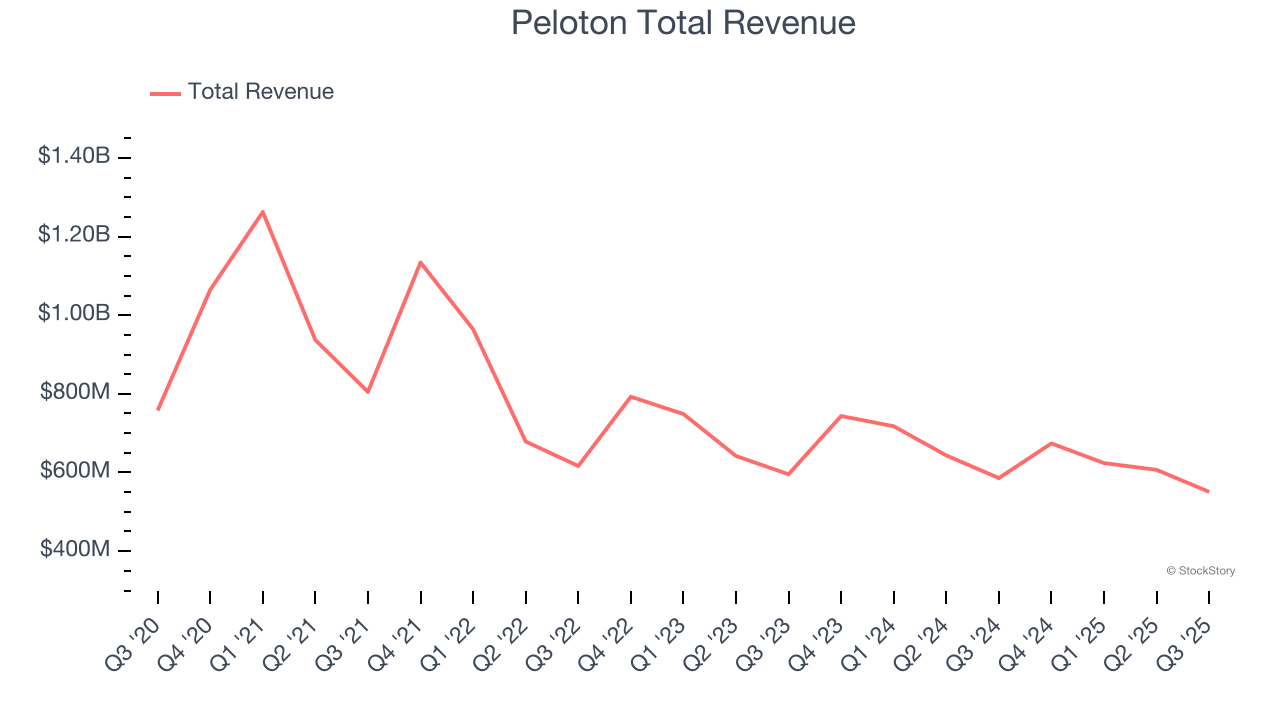

Peloton (NASDAQ: PTON)

Started as a Kickstarter campaign, Peloton (NASDAQ: PTON) is a fitness technology company known for its at-home exercise equipment and interactive online workout classes.

Peloton reported revenues of $550.8 million, down 6% year on year. This print exceeded analysts’ expectations by 2.1%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

"In this quarter leading up to the launch of our new equipment lineup and Peloton IQ, our team once again demonstrated the power of disciplined execution and focus," said Peloton CEO Peter Stern.

Peloton delivered the weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 2% since reporting and currently trades at $6.25.

Is now the time to buy Peloton? Access our full analysis of the earnings results here, it’s free for active Edge members.

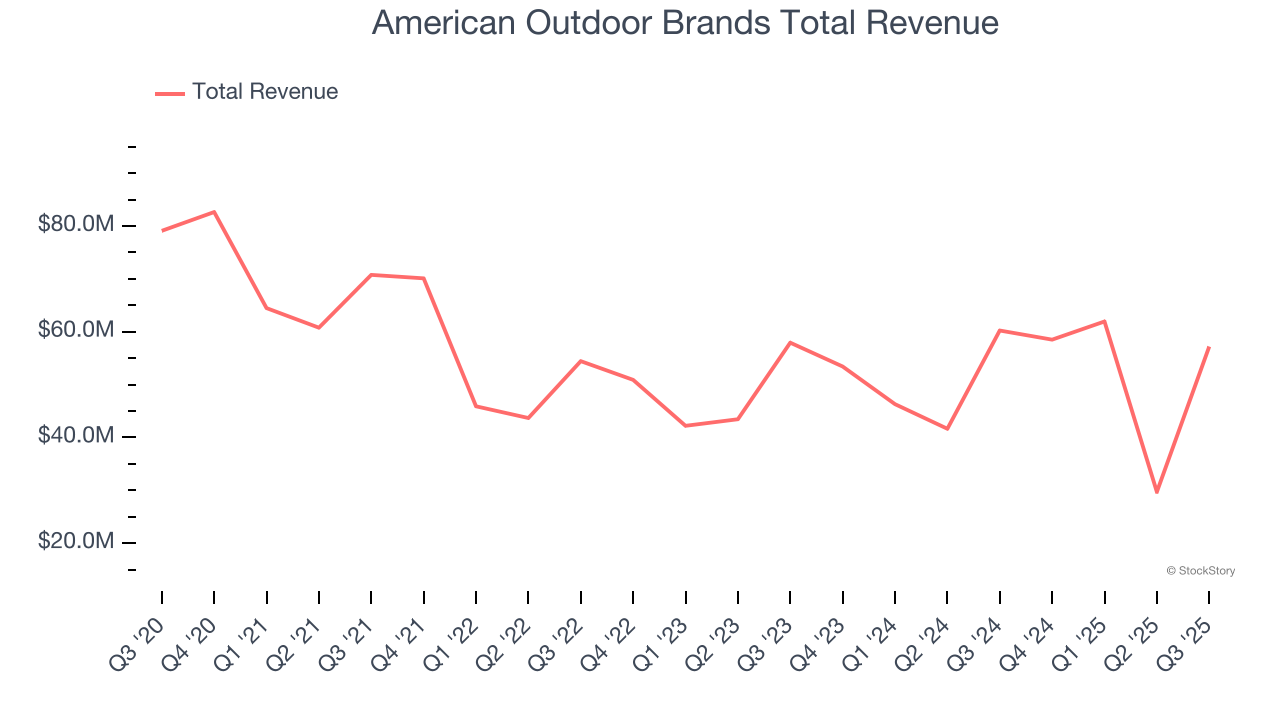

Best Q3: American Outdoor Brands (NASDAQ: AOUT)

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ: AOUT) is an outdoor and recreational products company that offers outdoor and shooting sports products but does not sell firearms themselves.

American Outdoor Brands reported revenues of $57.2 million, down 5% year on year, outperforming analysts’ expectations by 12.3%. The business had an incredible quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 8.1% since reporting. It currently trades at $8.35.

Is now the time to buy American Outdoor Brands? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: PlayStudios (NASDAQ: MYPS)

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ: MYPS) offers free-to-play digital casino games.

PlayStudios reported revenues of $57.65 million, down 19.1% year on year, falling short of analysts’ expectations by 3%. It was a disappointing quarter as it posted a miss of analysts’ daily active users estimates and a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 23.4% since the results and currently trades at $0.70.

Read our full analysis of PlayStudios’s results here.

G-III (NASDAQ: GIII)

Founded as a small leather goods business, G-III (NASDAQ: GIII) is a fashion and apparel conglomerate with a diverse portfolio of brands.

G-III reported revenues of $988.6 million, down 9% year on year. This print missed analysts’ expectations by 2.3%. Zooming out, it was a mixed quarter as it also produced a beat of analysts’ EPS estimates but a miss of analysts’ Wholesale revenue estimates.

The stock is up 6.5% since reporting and currently trades at $31.59.

Read our full, actionable report on G-III here, it’s free for active Edge members.

fuboTV (NYSE: FUBO)

Originally launched as a soccer streaming platform, fuboTV (NYSE: FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

fuboTV reported revenues of $377.2 million, down 2.3% year on year. This number topped analysts’ expectations by 4.9%. It was a stunning quarter as it also logged a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is down 30.6% since reporting and currently trades at $2.63.

Read our full, actionable report on fuboTV here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.