Financial technology provider Jack Henry & Associates (NASDAQ: JKHY) announced better-than-expected revenue in Q3 CY2025, with sales up 7.3% year on year to $644.7 million. The company expects the full year’s revenue to be around $2.5 billion, close to analysts’ estimates. Its GAAP profit of $1.97 per share was 15.2% above analysts’ consensus estimates.

Is now the time to buy Jack Henry? Find out by accessing our full research report, it’s free for active Edge members.

Jack Henry (JKHY) Q3 CY2025 Highlights:

Company Overview

Founded in 1976 by two entrepreneurs who saw the need for specialized banking software in the early days of financial computing, Jack Henry & Associates (NASDAQ: JKHY) provides technology solutions that help banks and credit unions innovate, differentiate, and compete while serving the evolving needs of their accountholders.

Revenue Growth

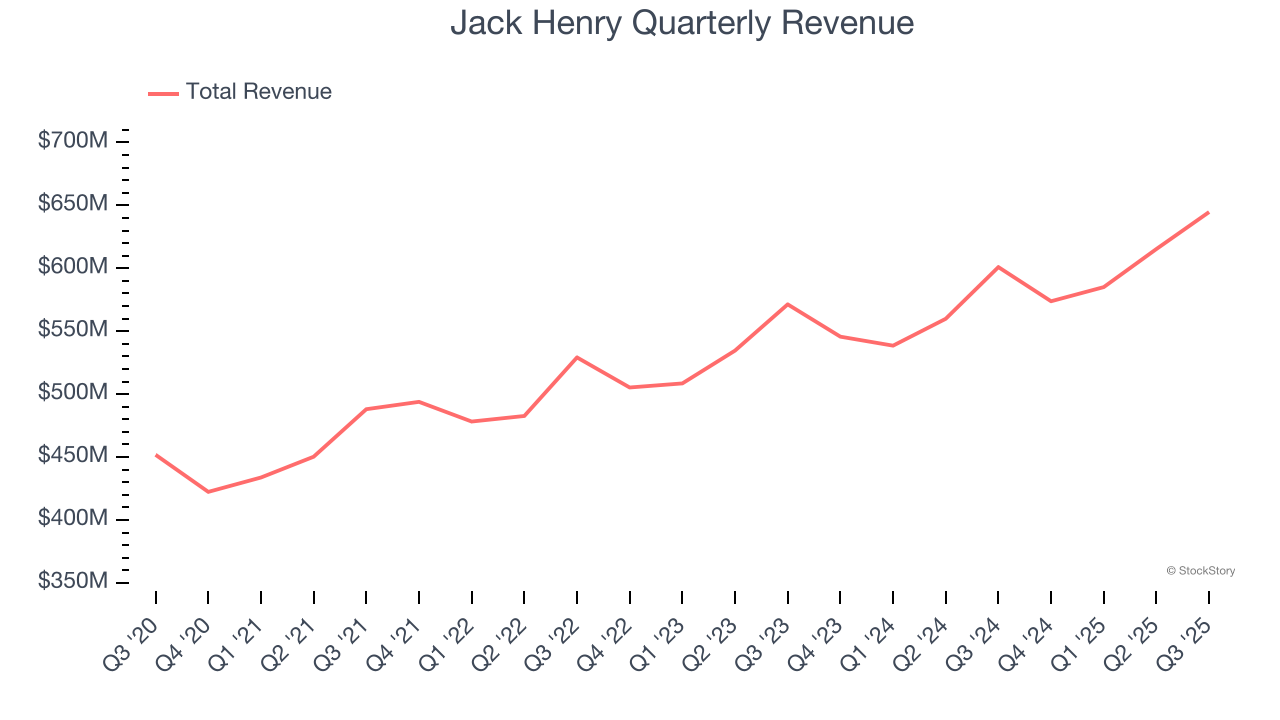

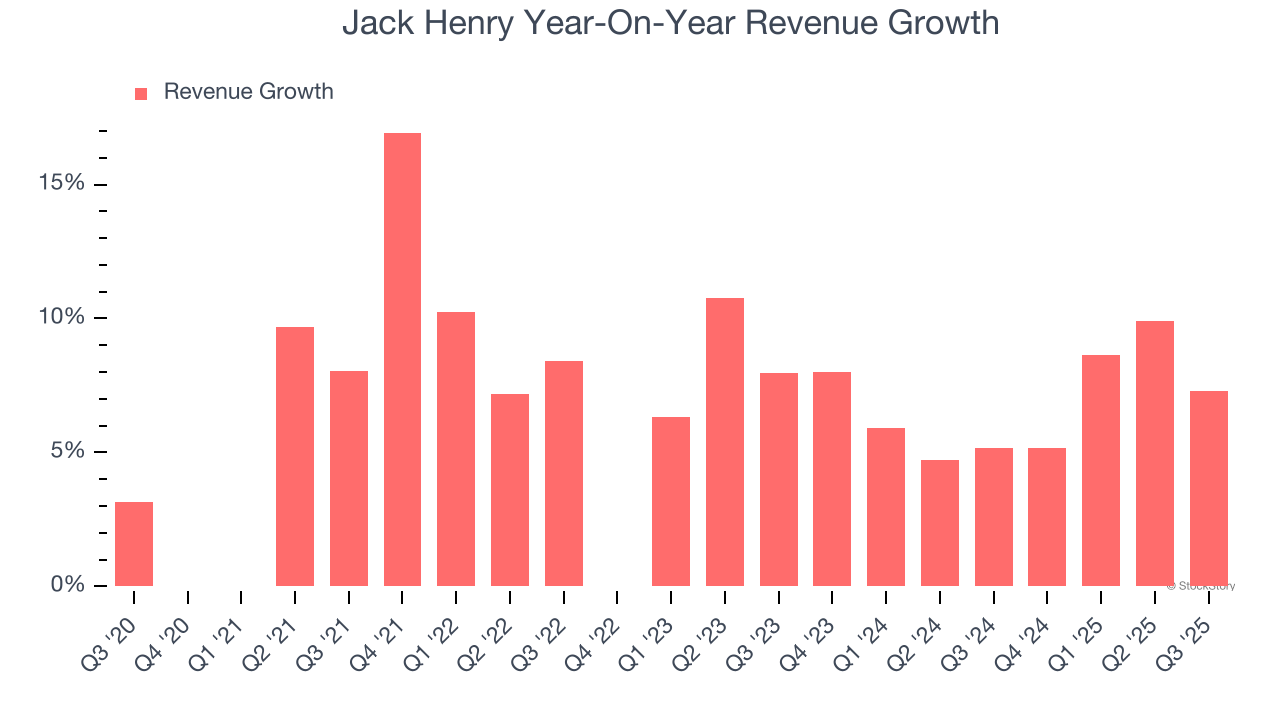

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Jack Henry’s 7.2% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about Jack Henry.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Jack Henry’s annualized revenue growth of 6.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

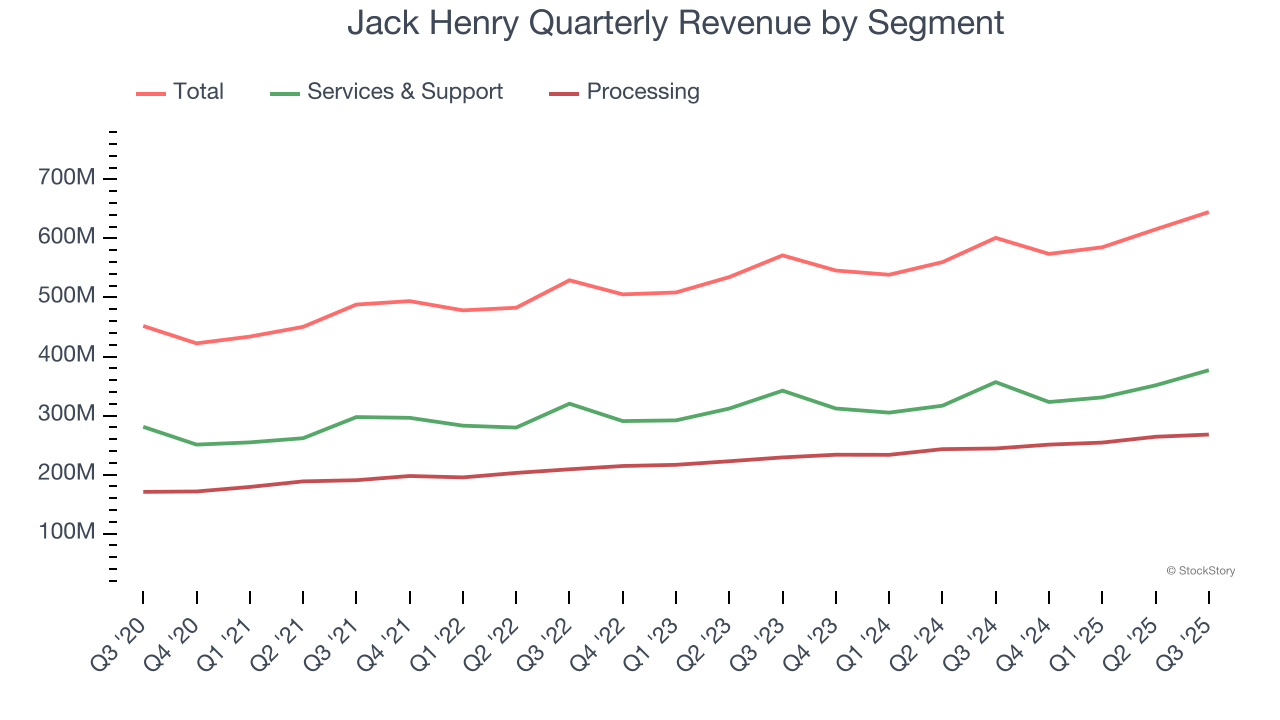

We can better understand the company’s revenue dynamics by analyzing its most important segments, Services & Support and Processing, which are 58.5% and 41.5% of total revenue. Services & Support revenue grew by 5.6% and 5.7% annually over the past five and two years, respectively. At the same time, Processing revenue increased by 9.6% and 8.4% per year over the past five and two years, respectively. These results outperformed its total revenue.

This quarter, Jack Henry reported year-on-year revenue growth of 7.3%, and its $644.7 million of revenue exceeded Wall Street’s estimates by 1.3%.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Key Takeaways from Jack Henry’s Q3 Results

We were impressed by how significantly Jack Henry blew past analysts’ Processing segment expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 4.2% to $158.95 immediately following the results.

Jack Henry may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.