Slot machine and terminal operator Accel Entertainment (NYSE: ACEL) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 9.1% year on year to $329.7 million. Its GAAP profit of $0.16 per share was 15.6% above analysts’ consensus estimates.

Is now the time to buy Accel Entertainment? Find out by accessing our full research report, it’s free for active Edge members.

Accel Entertainment (ACEL) Q3 CY2025 Highlights:

- Revenue: $329.7 million vs analyst estimates of $328 million (9.1% year-on-year growth, 0.5% beat)

- EPS (GAAP): $0.16 vs analyst estimates of $0.14 (15.6% beat)

- Adjusted EBITDA: $51.17 million vs analyst estimates of $50.51 million (15.5% margin, 1.3% beat)

- Operating Margin: 7.7%, in line with the same quarter last year

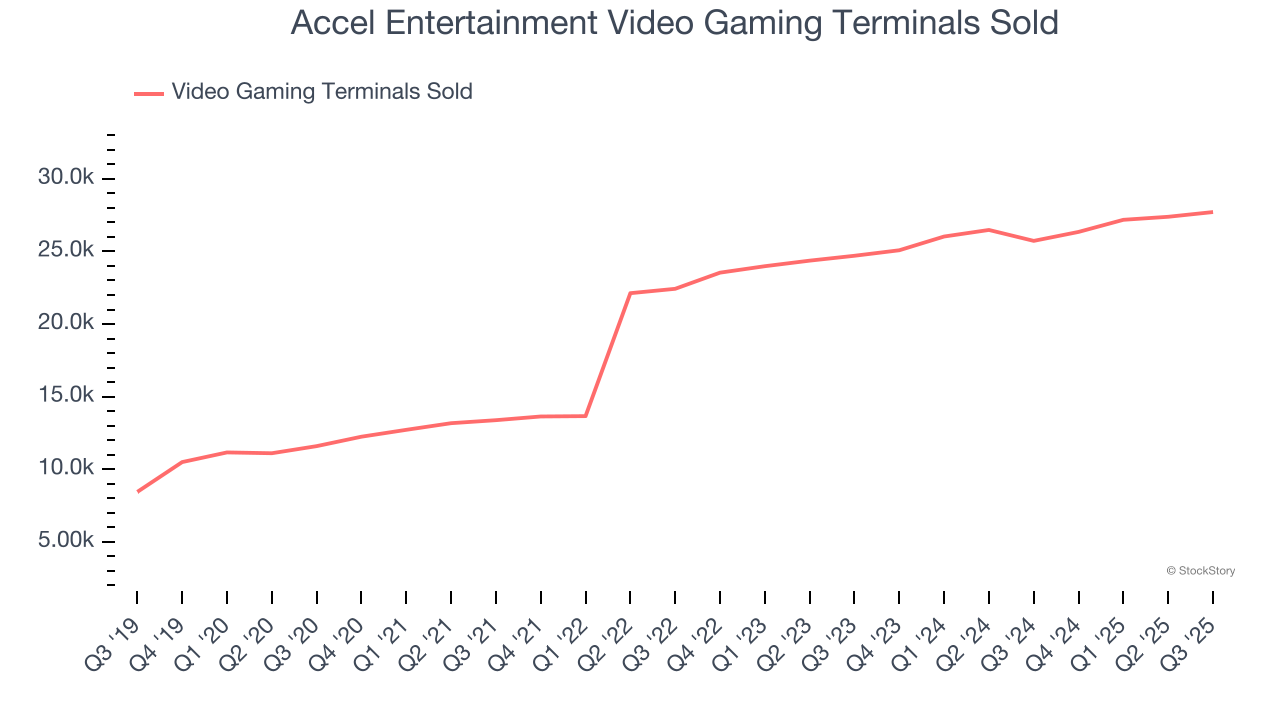

- Video Gaming Terminals Sold: 27,714, up 1,985 year on year

- Market Capitalization: $837 million

CHICAGO--(BUSINESS WIRE)--Accel Entertainment, Inc. (NYSE: ACEL) (“Accel” or the “Company”), a leading locals-focused gaming operator partnering with small businesses, local communities, and state governments to provide entertaining, convenient, and safe gaming experiences nationwide, announced today that Brett Summerer has been named Chief Financial Officer, effective September 22, 2025.

Company Overview

Established in Illinois, Accel Entertainment (NYSE: ACEL) is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

Revenue Growth

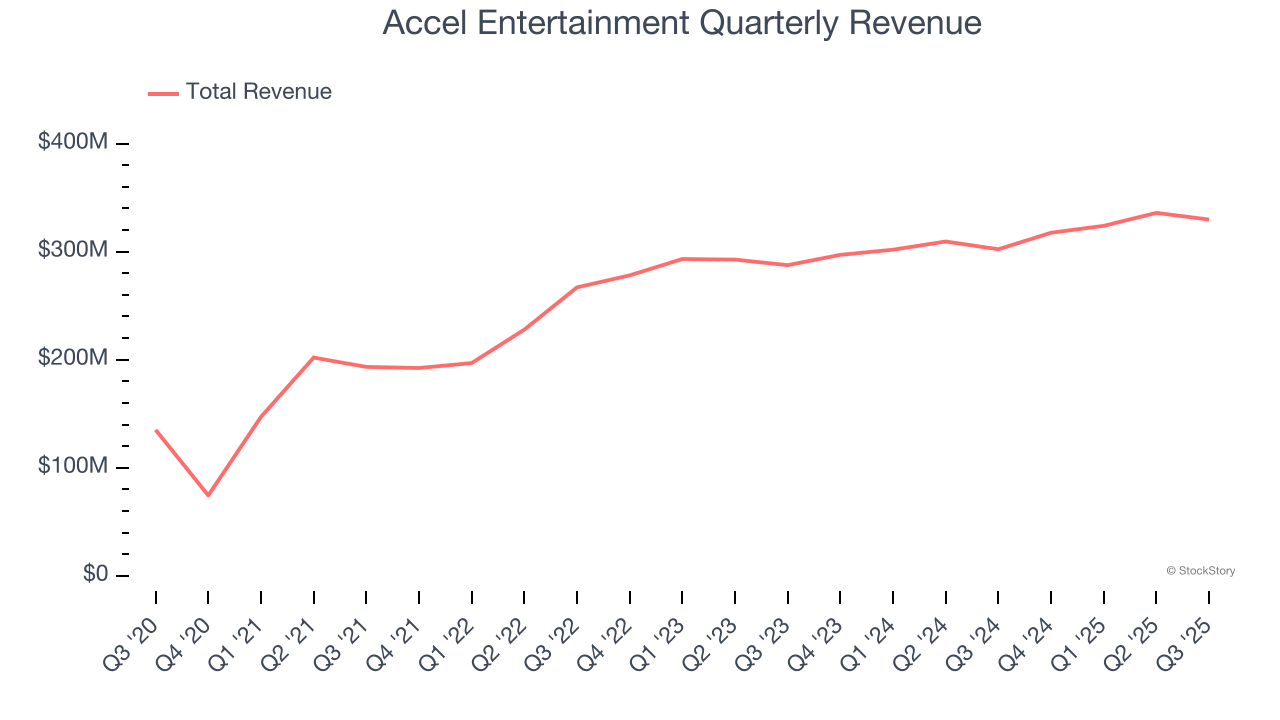

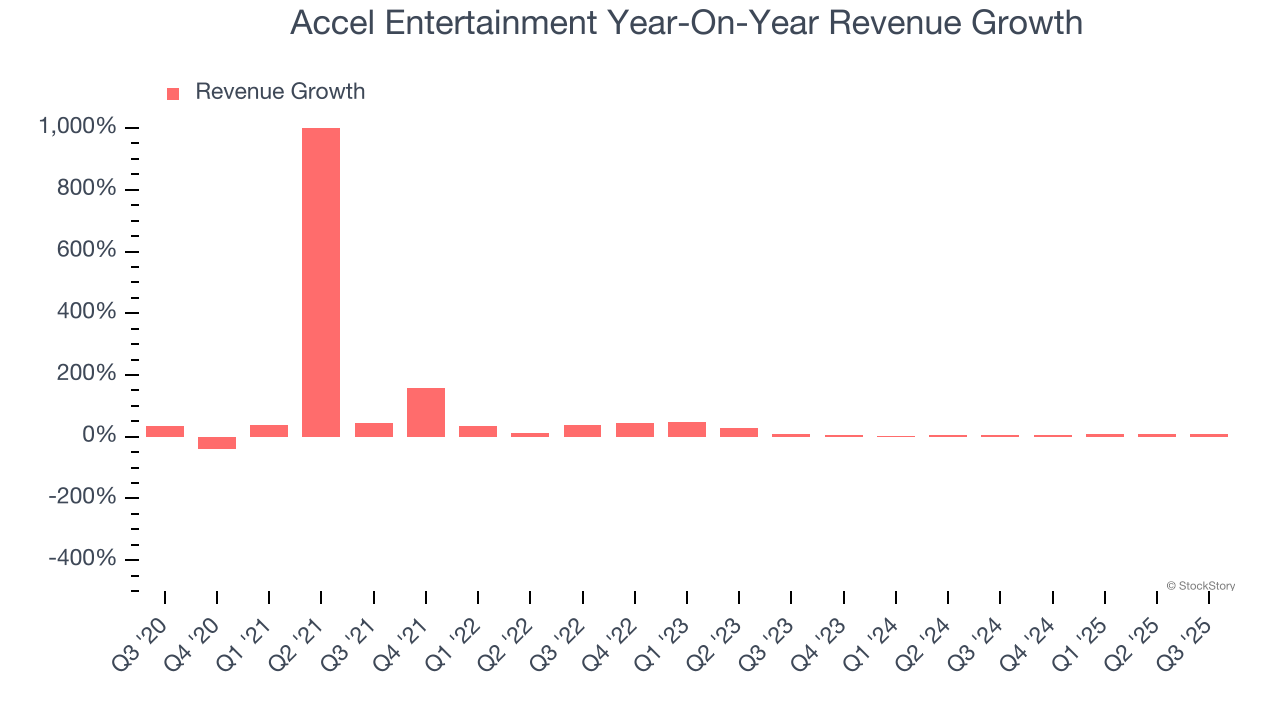

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Accel Entertainment’s sales grew at an exceptional 29.1% compounded annual growth rate over the last five years. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Accel Entertainment’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 6.5% over the last two years was well below its five-year trend.

Accel Entertainment also discloses its number of video gaming terminals sold, which reached 27,714 in the latest quarter. Over the last two years, Accel Entertainment’s video gaming terminals sold averaged 6.1% year-on-year growth. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, Accel Entertainment reported year-on-year revenue growth of 9.1%, and its $329.7 million of revenue exceeded Wall Street’s estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

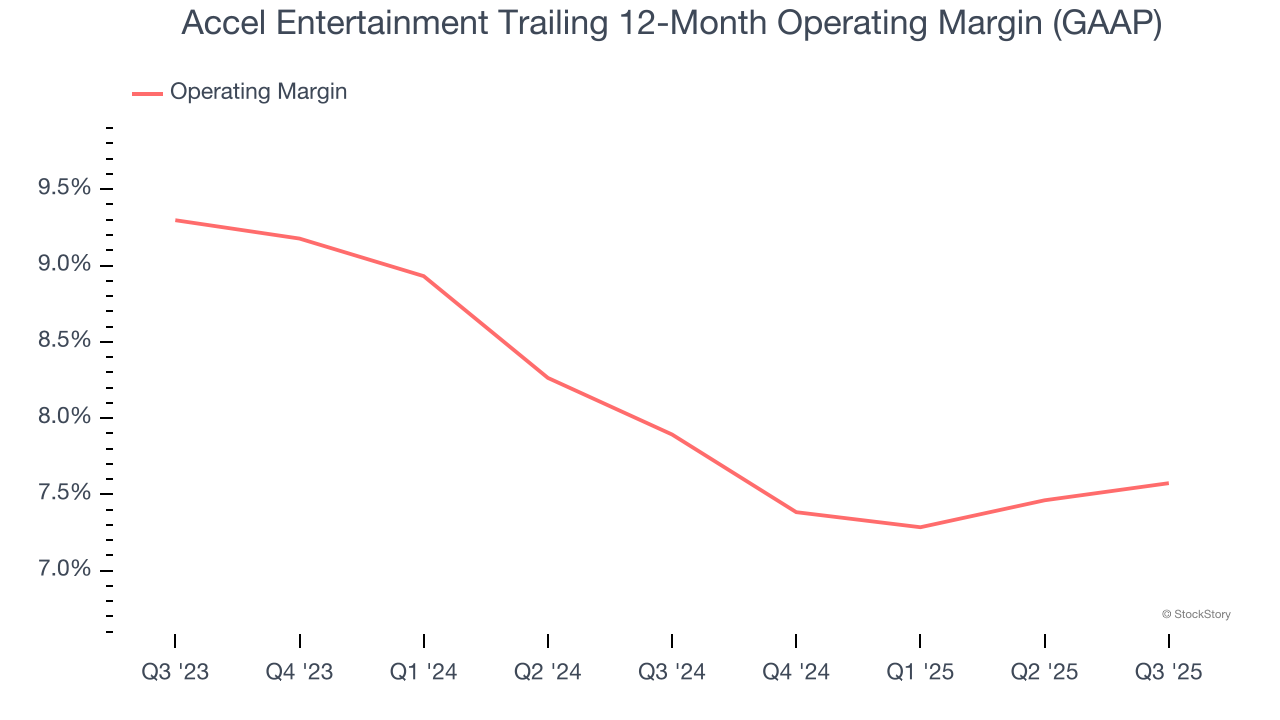

Accel Entertainment’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 7.7% over the last two years. This profitability was paltry for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Accel Entertainment generated an operating margin profit margin of 7.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

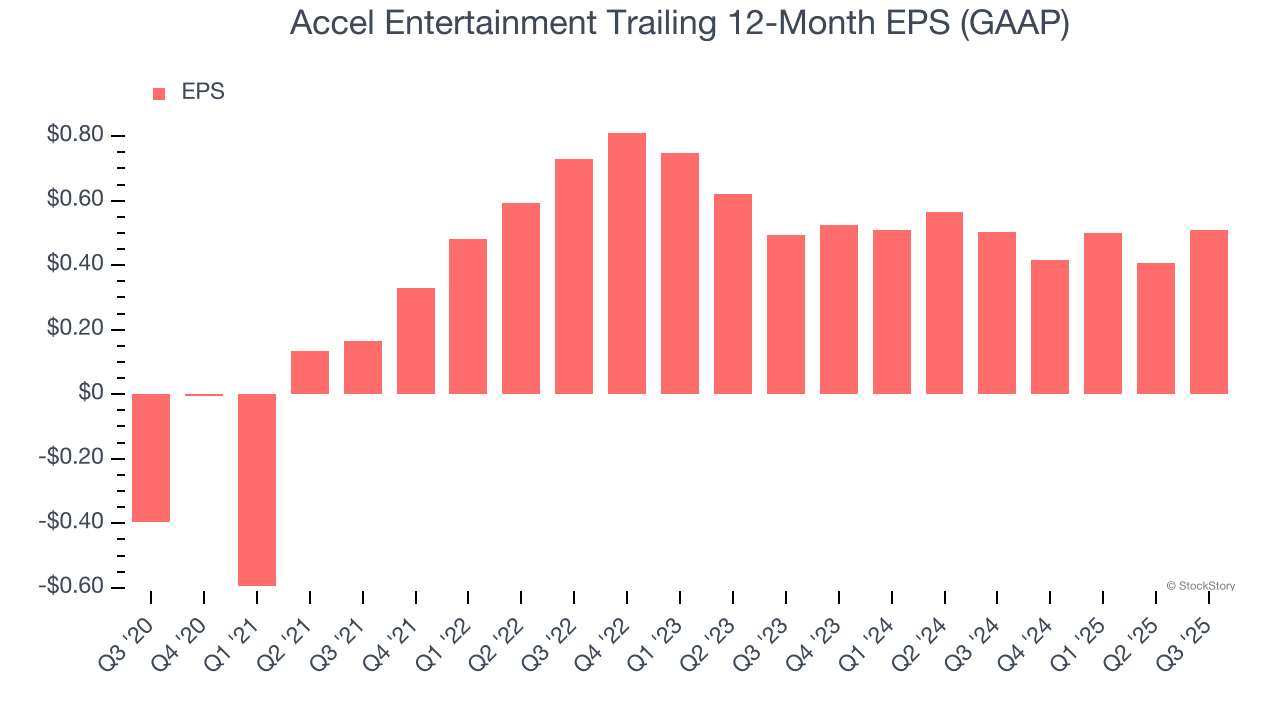

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Accel Entertainment’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Accel Entertainment reported EPS of $0.16, up from $0.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Accel Entertainment’s Q3 Results

It was good to see Accel Entertainment beat analysts’ EPS expectations this quarter. We were also glad its number of video gaming terminals sold outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 2.4% to $10.16 immediately after reporting.

Accel Entertainment may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.