Olaplex has been treading water for the past six months, recording a small loss of 3.8% while holding steady at $1.55. The stock also fell short of the S&P 500’s 3.8% gain during that period.

Is there a buying opportunity in Olaplex, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

We don't have much confidence in Olaplex. Here are three reasons why we avoid OLPX and a stock we'd rather own.

Why Is Olaplex Not Exciting?

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ: OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

1. Revenue Spiraling Downwards

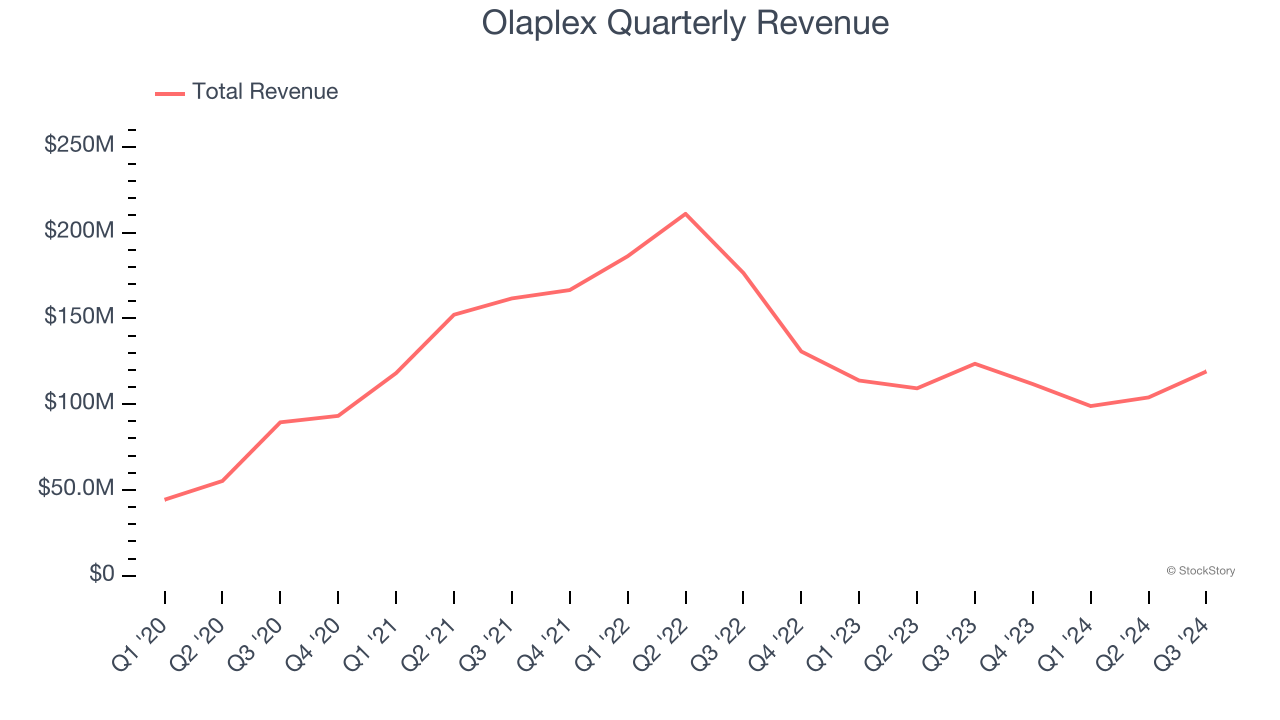

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Olaplex struggled to consistently generate demand over the last three years as its sales dropped at a 6.2% annual rate. This fell short of our benchmarks and is a sign of lacking business quality.

2. EPS Trending Down

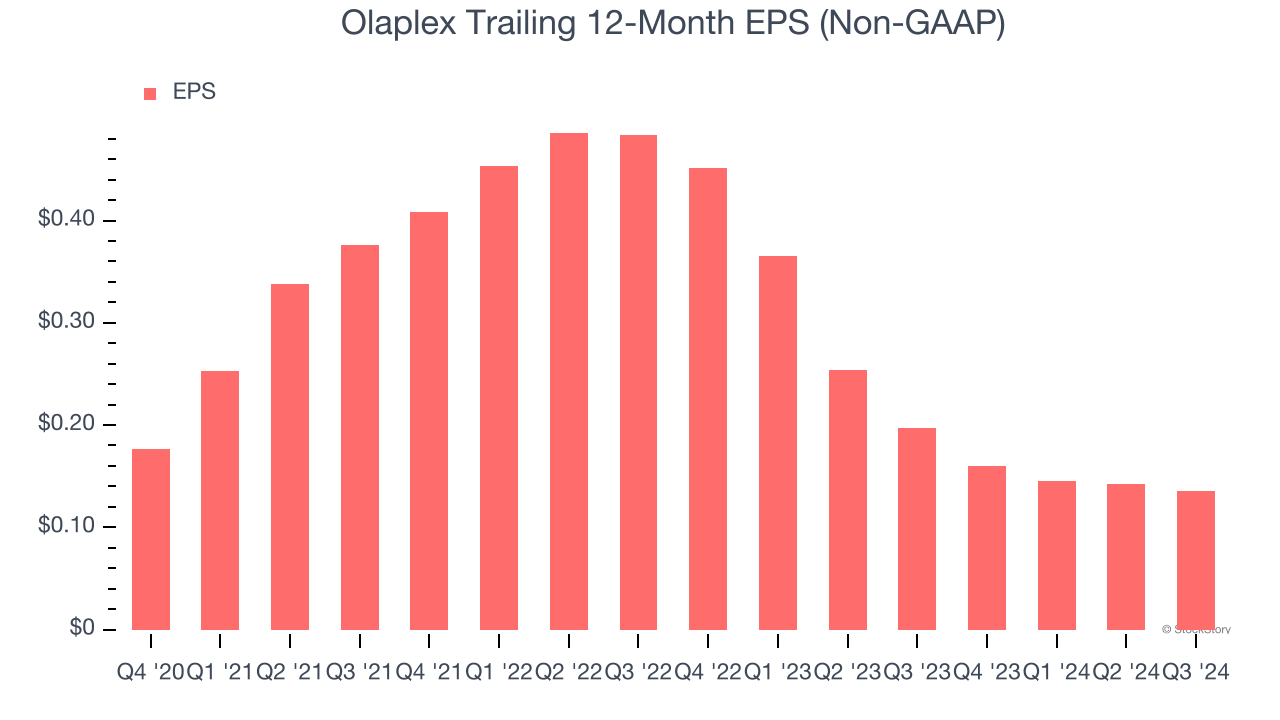

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Olaplex, its EPS declined by more than its revenue over the last three years, dropping 28.8% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

3. Free Cash Flow Margin Dropping

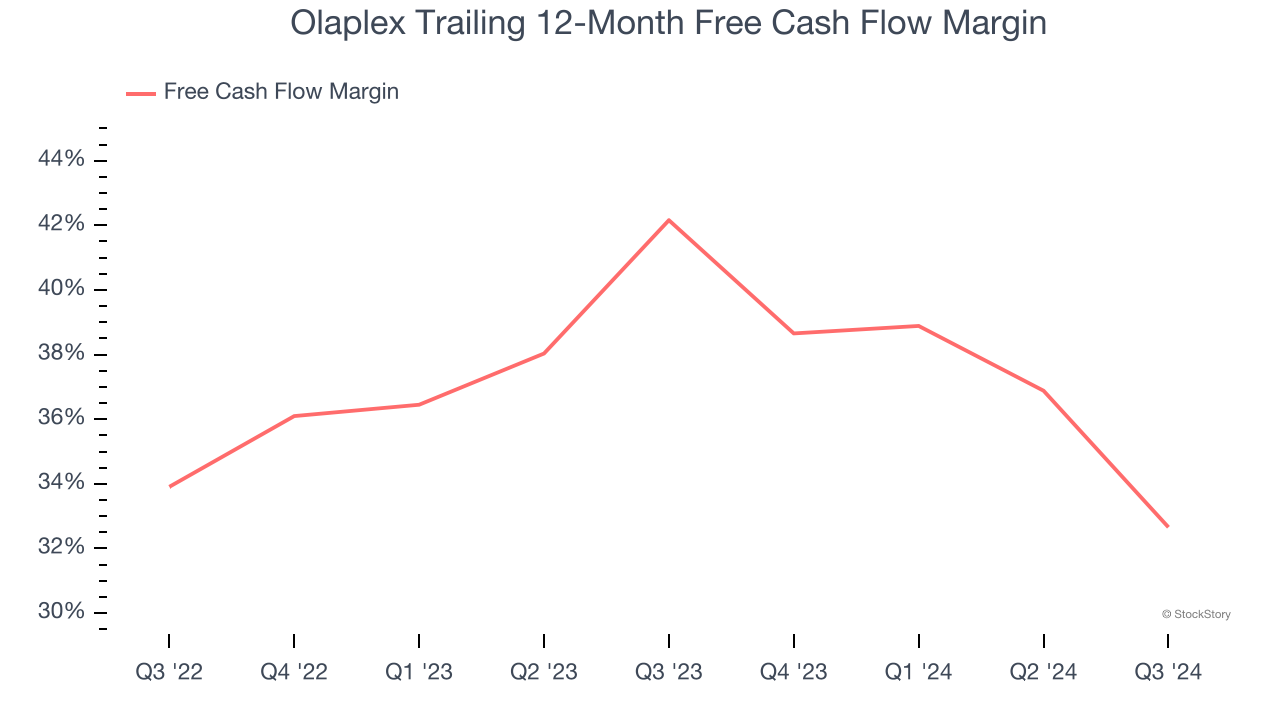

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Olaplex’s margin dropped by 9.5 percentage points over the last year. Continued declines could signal it is in the middle of an investment cycle. Olaplex’s free cash flow margin for the trailing 12 months was 32.7%.

Final Judgment

Olaplex isn’t a terrible business, but it doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 9.4× forward price-to-earnings (or $1.55 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at Chipotle, which surprisingly still has a long runway for growth.

Stocks We Would Buy Instead of Olaplex

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.