What a brutal six months it’s been for Gray Television. The stock has dropped 34.1% and now trades at $3.37, rattling many shareholders. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Gray Television, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why you should be careful with GTN and a stock we'd rather own.

Why Is Gray Television Not Exciting?

Specializing in local media coverage, Gray Television (NYSE: GTN) is a broadcast company supplying digital media to various markets in the United States.

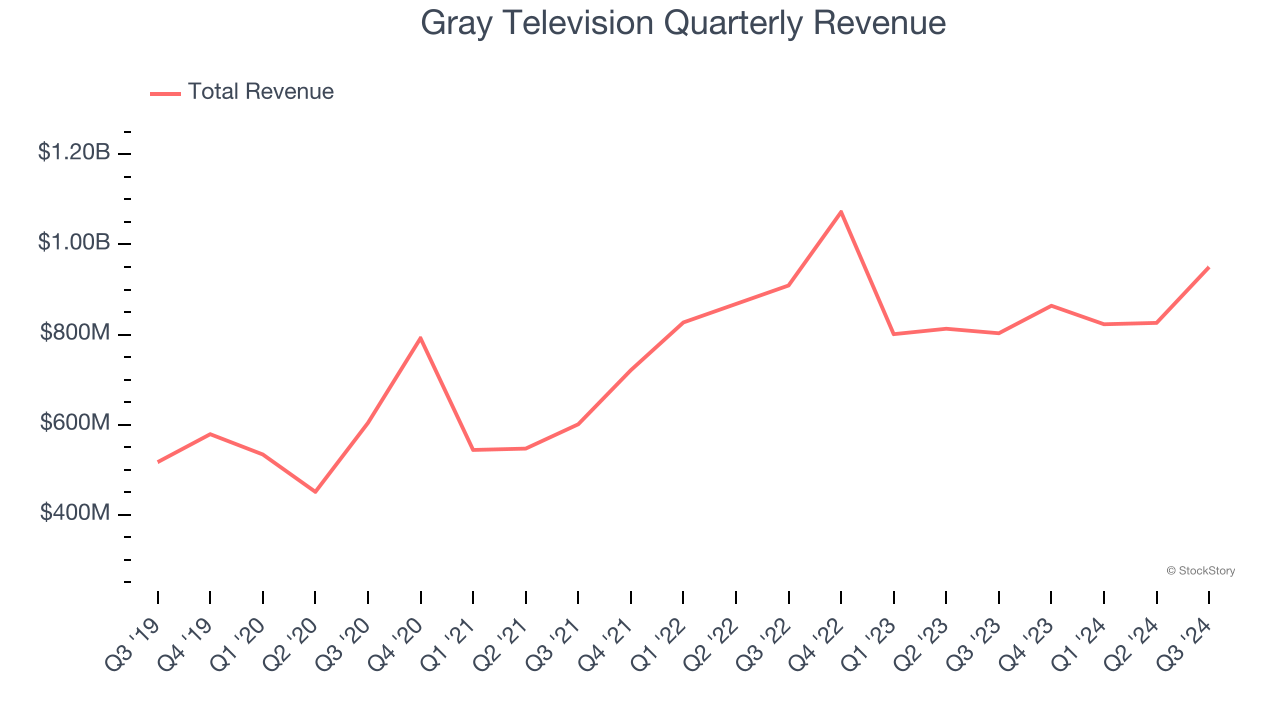

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Gray Television grew its sales at a 13.1% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our benchmark for the consumer discretionary sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Gray Television’s revenue to rise by 3%, close to its 2.1% annualized growth for the past two years. This projection doesn't excite us and indicates its newer products and services will not lead to better top-line performance yet.

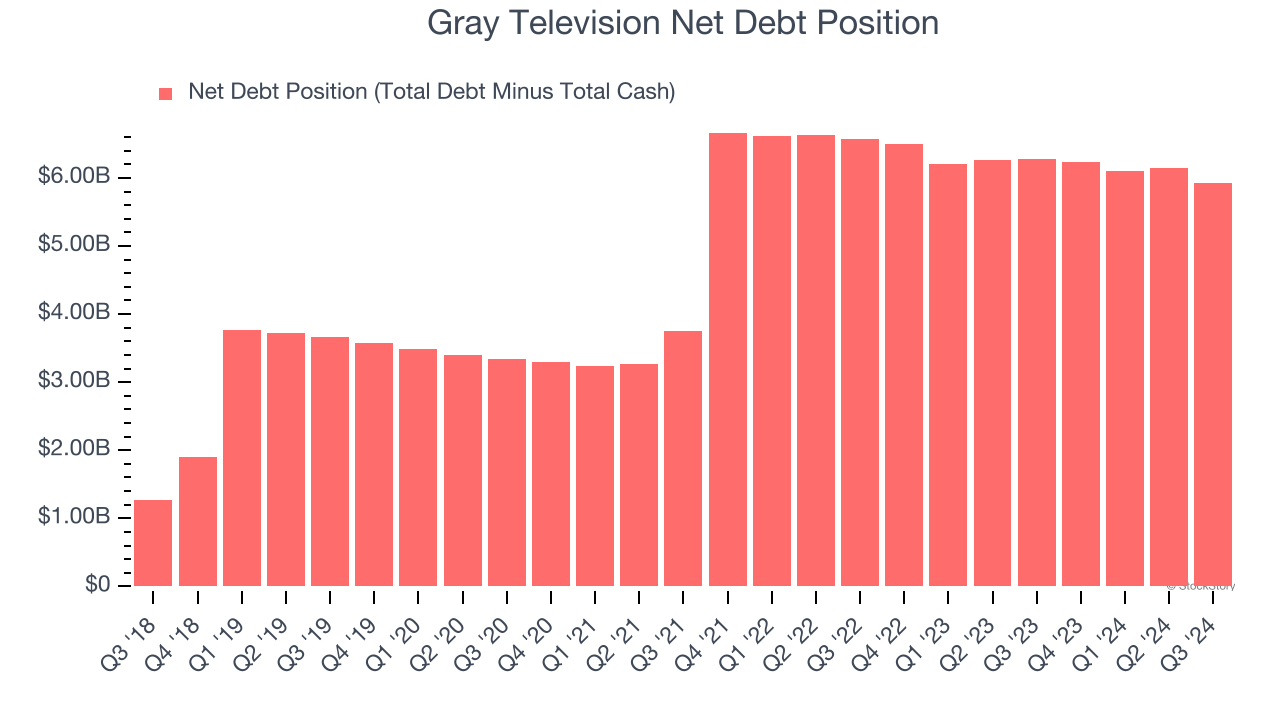

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Gray Television’s $5.99 billion of debt exceeds the $69 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $943 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Gray Television could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Gray Television can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Gray Television isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 2.1× forward price-to-earnings (or $3.37 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. We’d suggest looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Gray Television

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.