What a time it’s been for MicroStrategy. In the past six months alone, the company’s stock price has increased by a massive 114%, reaching $344.69 per share. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in MicroStrategy, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

We’re glad investors have benefited from the price increase, but we're swiping left on MicroStrategy for now. Here are three reasons why there are better opportunities than MSTR and a stock we'd rather own.

Why Do We Think MicroStrategy Will Underperform?

Founded in 1989 with an initial contract with DuPoint, MicroStrategy (NASDAQ: MSTR) started as a data mining and business intelligence software platform, but in 2020, the company made waves by investing heavily in Bitcoin.

1. Declining Billings Reflect Product and Sales Weakness

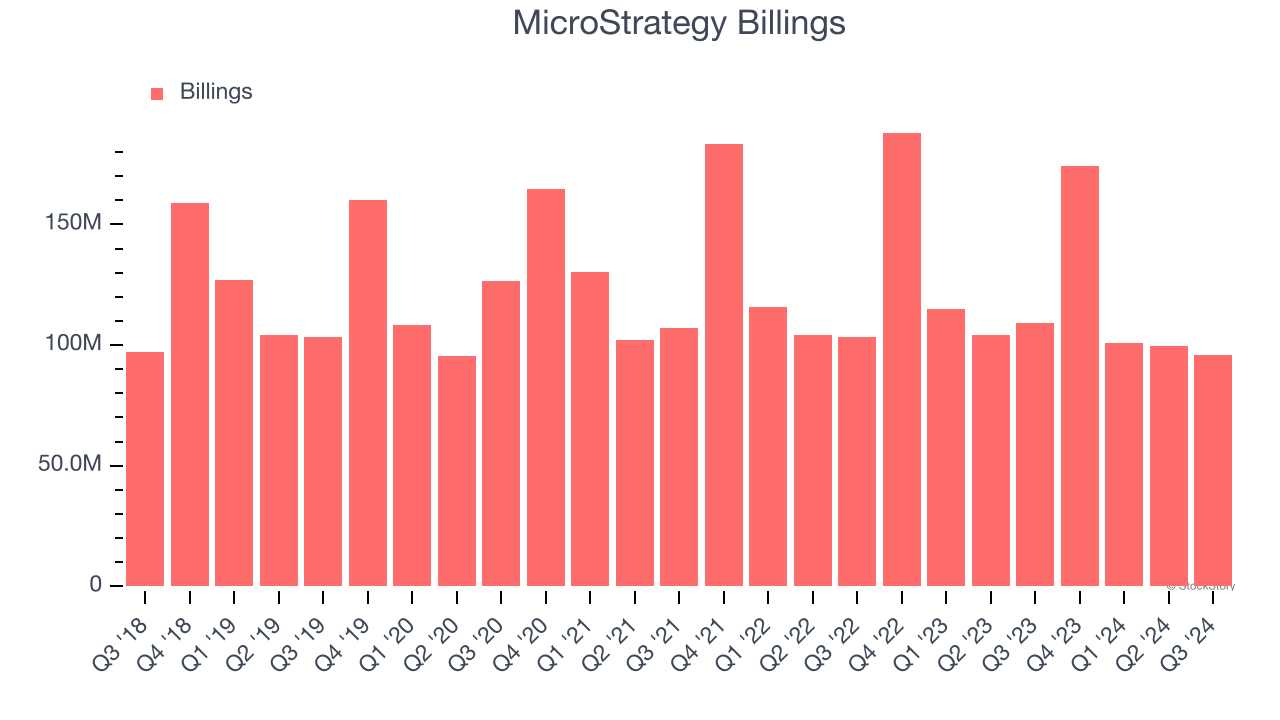

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

MicroStrategy’s billings came in at $96.02 million in Q3, and it averaged 8.9% year-on-year declines over the last four quarters. This performance was underwhelming and shows the company faced challenges in acquiring and retaining customers. It also suggests there may be increasing competition or market saturation.

2. Forecasted Operating Margin Shows Stronger Profits Ahead

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Looking ahead, Wall Street expects MicroStrategy to shrink its losses but remain unprofitable. Analysts are expecting the company’s trailing 12-month operating margin of negative 188% to rise to negative 12% in the coming year.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

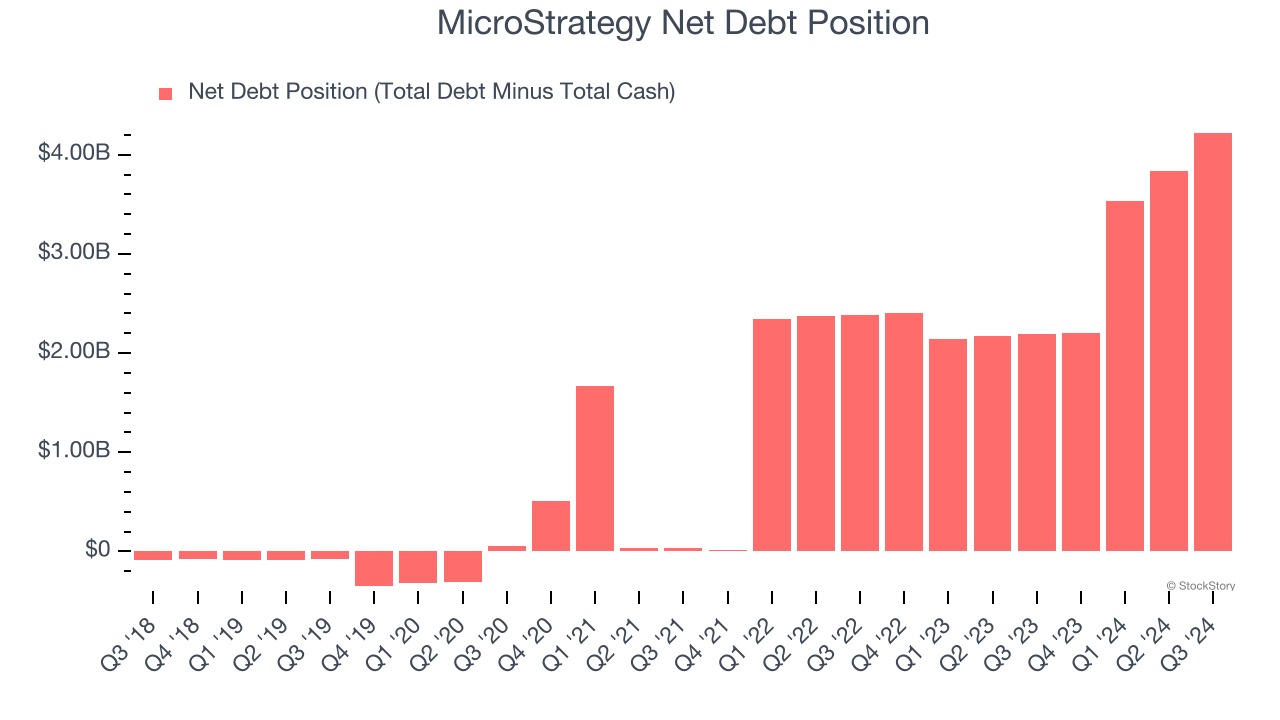

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

MicroStrategy burned through $37.57 million of cash over the last year, and its $4.27 billion of debt exceeds the $46.34 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the MicroStrategy’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of MicroStrategy until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

We see the value of companies addressing major business pain points, but in the case of MicroStrategy, we’re out. Following the recent surge, the stock trades at 143.1× forward price-to-sales (or $344.69 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. Let us point you toward Costco, one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of MicroStrategy

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.