Array’s stock price has taken a beating over the past six months, shedding 39.4% of its value and falling to $6.75 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Array, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why you should be careful with ARRY and a stock we'd rather own.

Why Do We Think Array Will Underperform?

Going public in October 2020, Array (NASDAQ: ARRY) is a global manufacturer of ground-mounting tracking systems for utility and distributed generation solar energy projects.

1. Demand Slipping as Sales Volumes Decline

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Renewable Energy company because there’s a ceiling to what customers will pay.

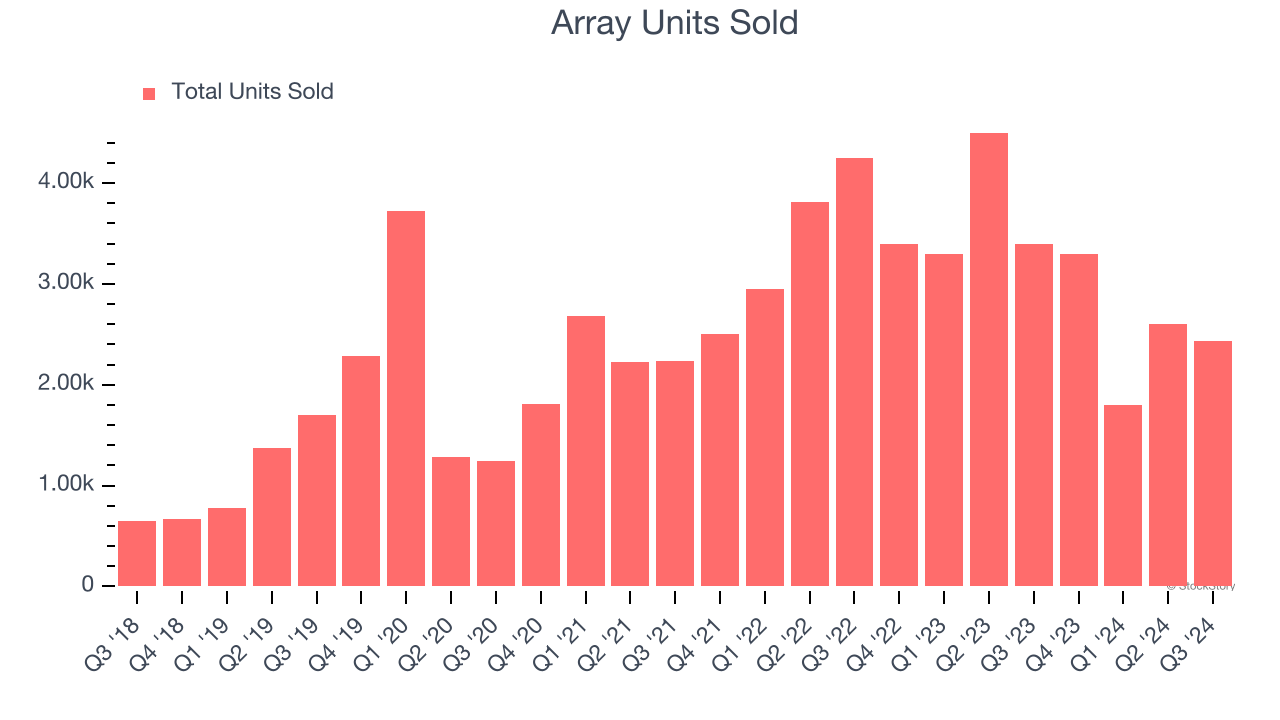

Array’s units sold came in at 2,431 in the latest quarter, and they averaged 9.2% year-on-year declines over the last two years. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Array might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. EPS Trending Down

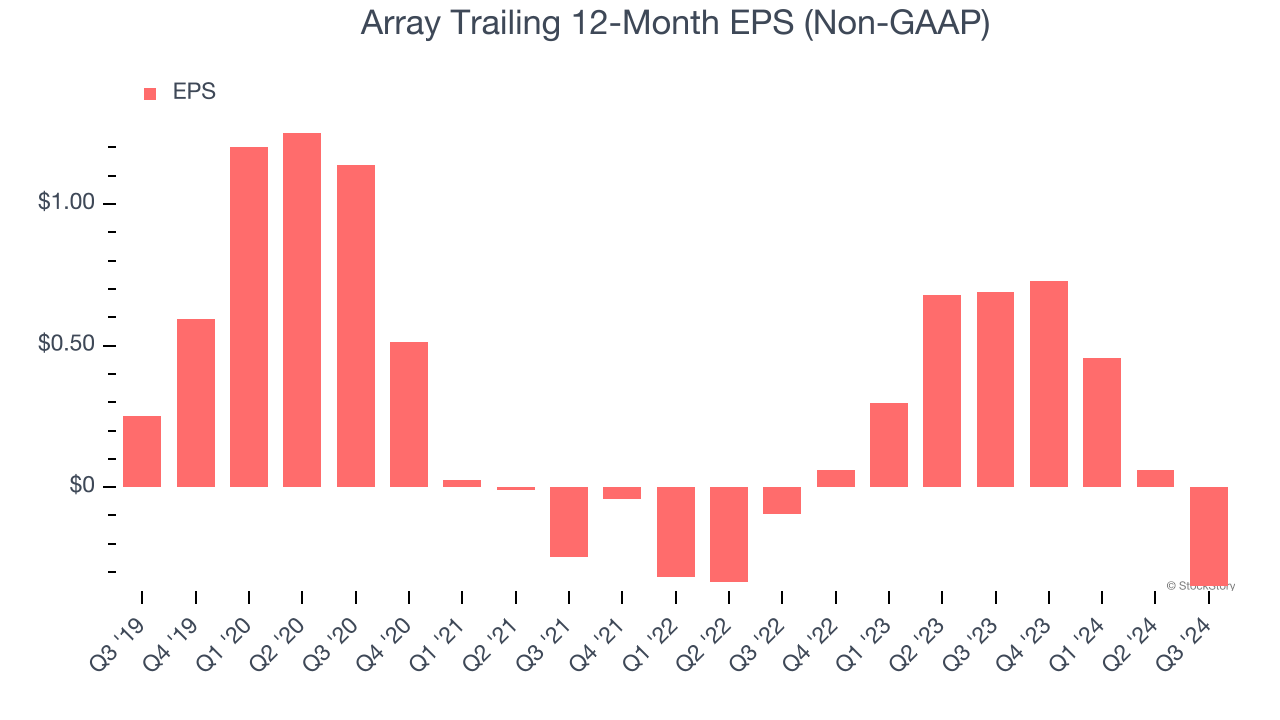

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Array, its EPS declined by 27.8% annually over the last five years while its revenue grew by 14.6%. This tells us the company became less profitable on a per-share basis as it expanded.

3. New Investments Fail to Bear Fruit as ROIC Declines

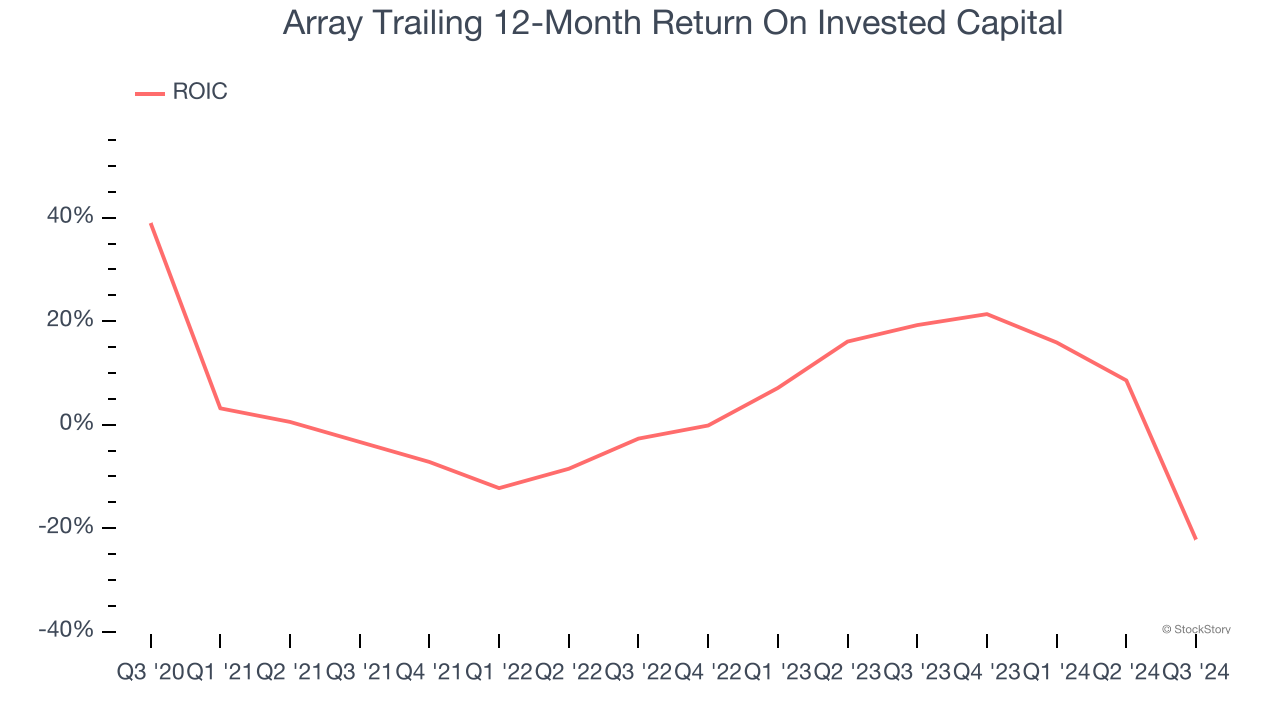

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Array’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We see the value of companies helping their customers, but in the case of Array, we’re out. After the recent drawdown, the stock trades at 8× forward price-to-earnings (or $6.75 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d recommend looking at Microsoft, the most dominant software business in the world.

Stocks We Would Buy Instead of Array

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.