Over the past six months, Kirby’s stock price fell to $107.16. Shareholders have lost 13.4% of their capital, which is disappointing considering the S&P 500 has climbed by 3.8%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Kirby, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even with the cheaper entry price, we're swiping left on Kirby for now. Here are three reasons why we avoid KEX and a stock we'd rather own.

Why Is Kirby Not Exciting?

Transporting goods along all U.S. coasts, Kirby (NYSE: KEX) provides inland and coastal marine transportation services.

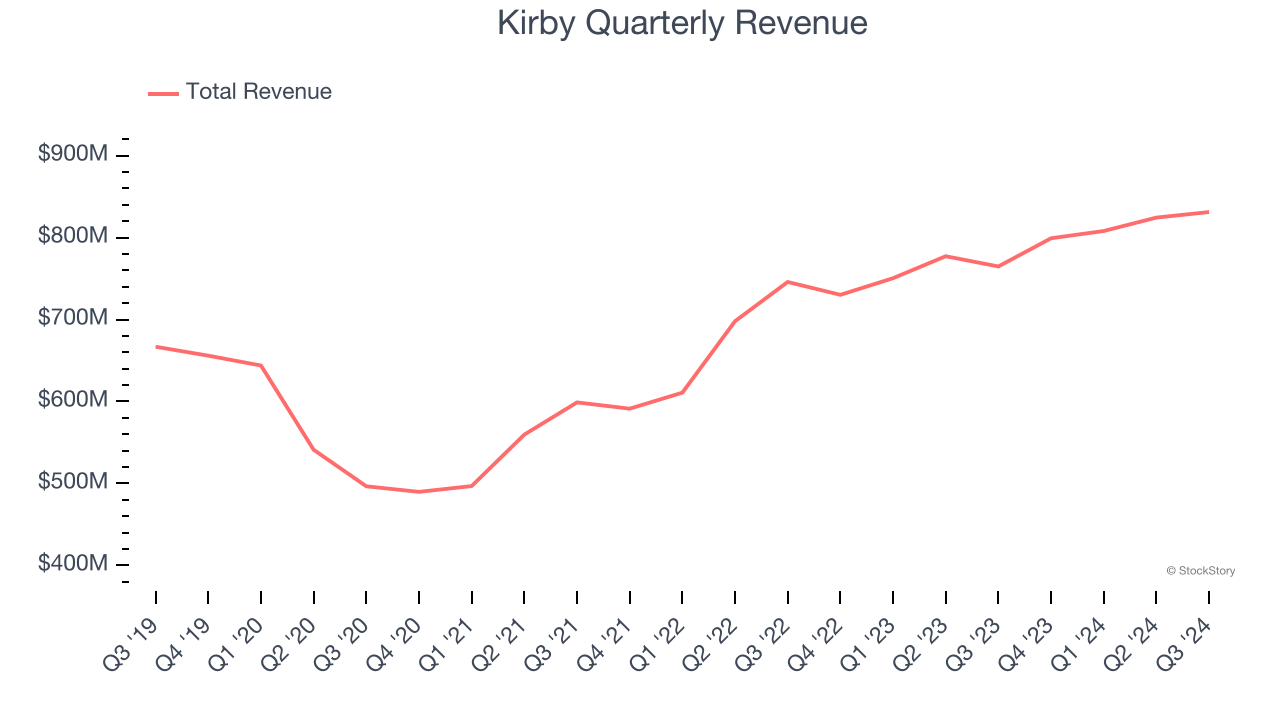

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Kirby’s 2.4% annualized revenue growth over the last five years was sluggish. This fell short of our benchmarks.

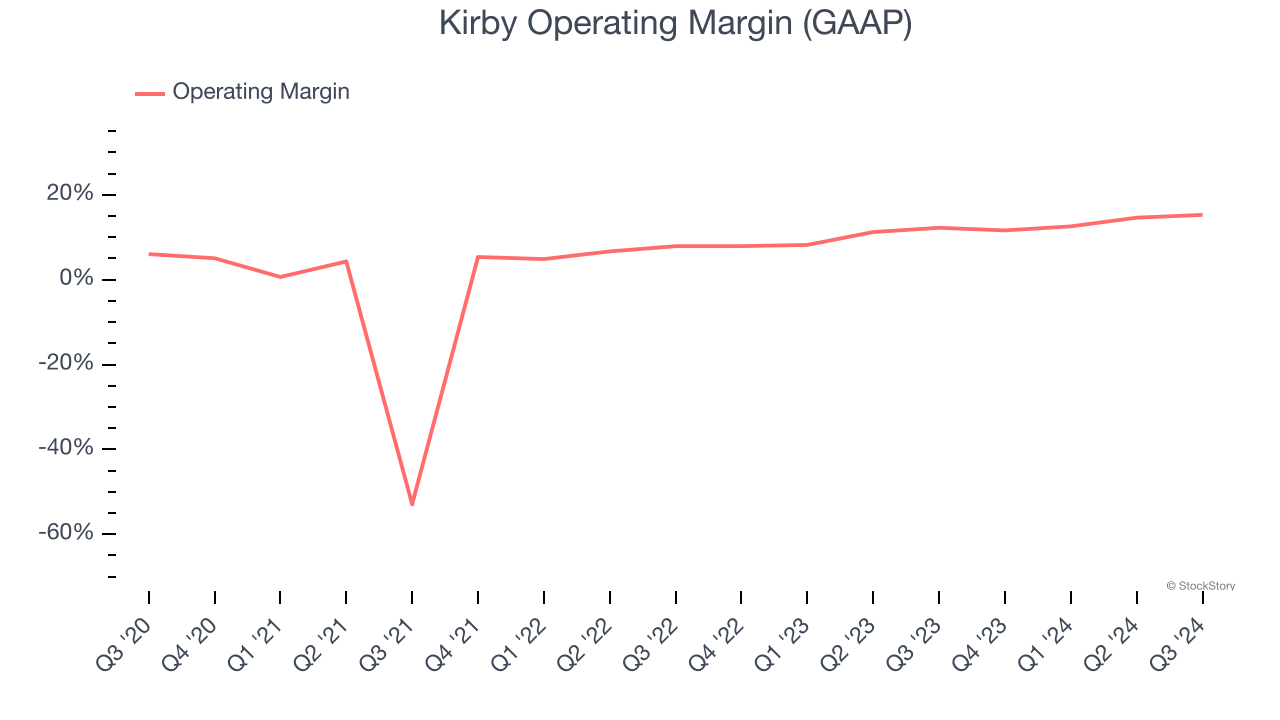

2. Weak Operating Margin Could Cause Trouble

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Kirby was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

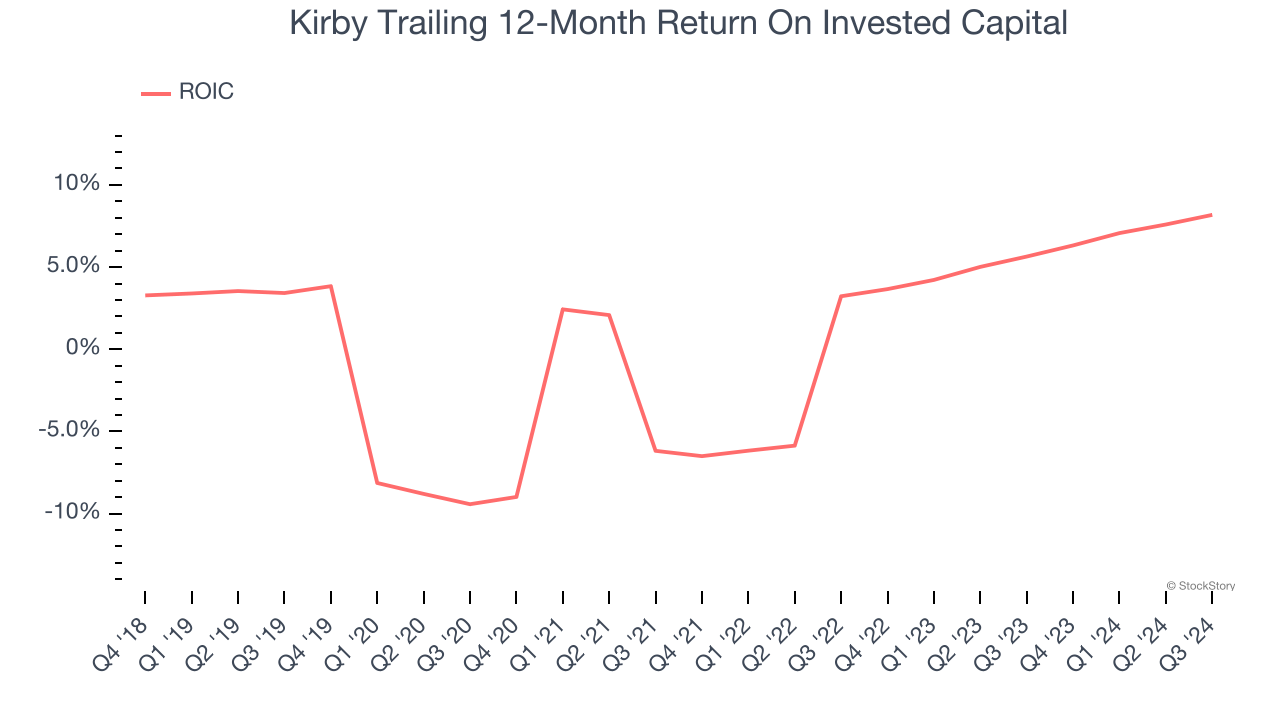

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Kirby historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.3%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

Final Judgment

Kirby isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 16.3× forward price-to-earnings (or $107.16 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. Let us point you toward CrowdStrike, the most entrenched endpoint security platform.

Stocks We Would Buy Instead of Kirby

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.