Santa Clara-based best-in-class computer networking company Arista Networks (NASDAQ: ANET) supplies multilayer network switches delivering software-defined networking (SDN) solutions to data centers and information technology customers. It’s switches are used for cloud and high-performance computing as well high-frequency trading in the financial services sector. Arista derives most of its revenues from the hardware infrastructure it delivers to data centers and networks consistently taking market share from legacy players like Cisco (NASDAQ: CSCO) and Juniper Networks (NASDAQ: JNPR). Arista uses the same software version, a single solution for diverse use cases, across all its network switches and routers to improve reliability and cut down on upgrade, patch, and maintenance costs. The Company introduced next-gen cloud routing platform innovations and Unified Cloud Fabric to simplify routing for enterprise, mobile, and cloud operators while driving down operational costs and complexity. Its $1 million logos have doubled in the past three years and attained a market share leader in the 100, 200, and 400-gig ports segment.

Santa Clara-based best-in-class computer networking company Arista Networks (NASDAQ: ANET) supplies multilayer network switches delivering software-defined networking (SDN) solutions to data centers and information technology customers. It’s switches are used for cloud and high-performance computing as well high-frequency trading in the financial services sector. Arista derives most of its revenues from the hardware infrastructure it delivers to data centers and networks consistently taking market share from legacy players like Cisco (NASDAQ: CSCO) and Juniper Networks (NASDAQ: JNPR). Arista uses the same software version, a single solution for diverse use cases, across all its network switches and routers to improve reliability and cut down on upgrade, patch, and maintenance costs. The Company introduced next-gen cloud routing platform innovations and Unified Cloud Fabric to simplify routing for enterprise, mobile, and cloud operators while driving down operational costs and complexity. Its $1 million logos have doubled in the past three years and attained a market share leader in the 100, 200, and 400-gig ports segment. More Agile and Scalable

Its platform is widely considered more agile and better suited to its behemoth cloud customers like Microsoft (NASDAQ: MSFT), NetSuite, Oracle (NASDAQ: ORCL), Google Cloud (NASDAQ: GOOGL), Amazon Web Services (NASDAQ: AMZN), IBM (NYSE: IBM), and Meta Platforms (NASDAQ: META). It uses automated diagnostics to spot small problems before they get big enough to cause network outages. Outside of technology, some of its more recognizable clients include Live Nation (NYSE: LYV) and Citigroup (NYSE: C). The Company is practically recession-proof as evidenced by hitting record revenues in the heart of a bear market amid high inflation and rising interest rates and strong U.S. dollar. While Arista derives most of its revenues in the U.S., it also sells abroad to the U.K., India, Canada, Australia and Germany.

Here’s What the Chart Says

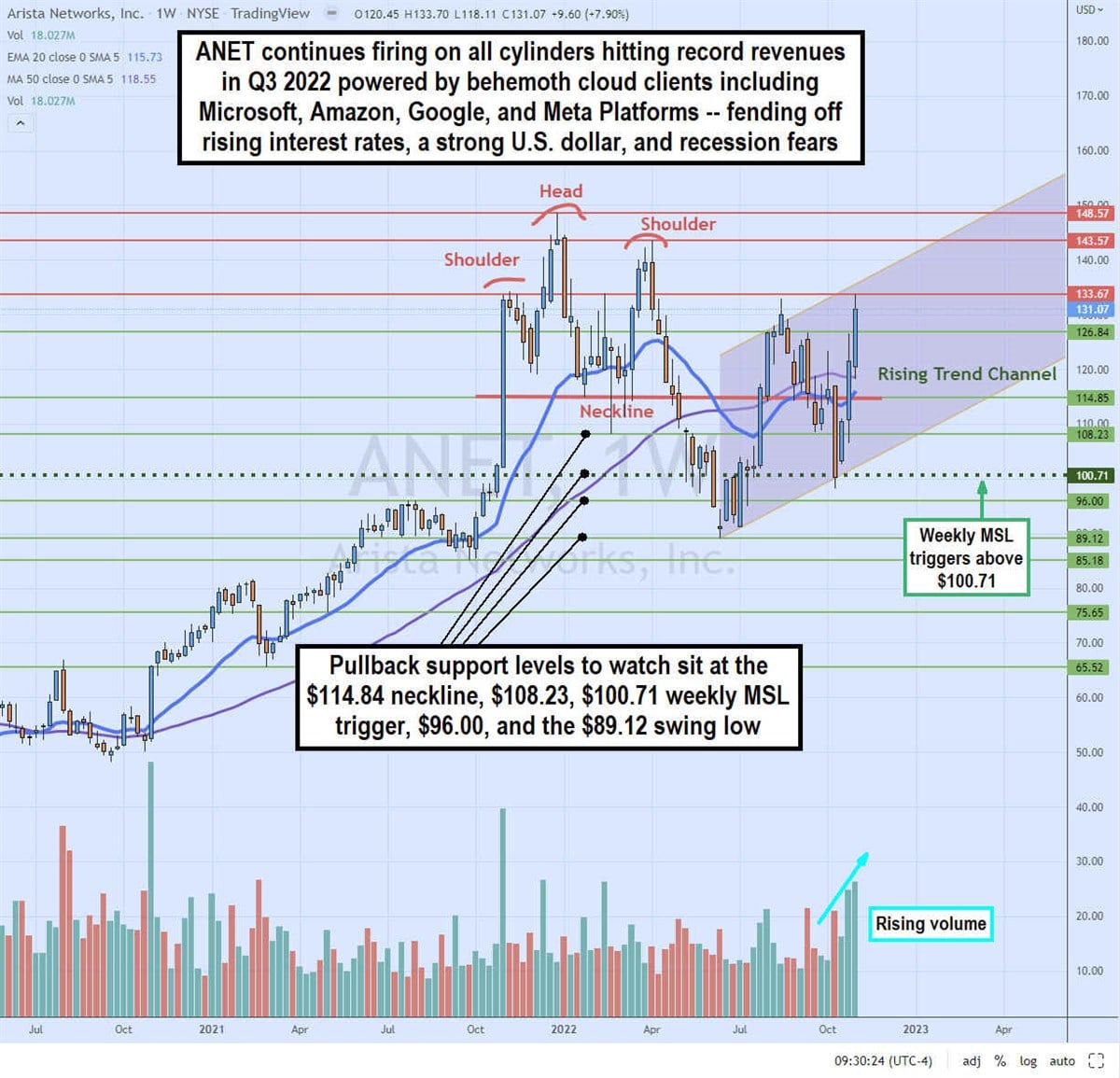

The ANET weekly chart illustrates the head-and-shoulders (H&S) reversal pattern in the first quarter of 2022 as it made its second shoulder peak at $143.57 in March and triggered the breakdown of the neckline level of $114.85 in April. Shares sold off falling to a swing low of $89.12 by June before staging a rally upon breaking through the weekly market structure low buy trigger at $100.71 by late July. This also set the stage for a rising trend channel after peaking near the $133.67 level which was the first shoulder peak price in the previous H&S pattern. Shares oscillated back down to retest the lower envelope of the rising trend channel and bounced back up through the weekly MSL trigger at $100.71 into its Q3 2022 earnings. The blowout earnings report propelled shares back up to retest the $133.67 first shoulder peak resistance again on rising volume. ANET shares will either squeeze through the shoulder resistance to retest the second shoulder peak at $143.57 and head peak at $148.57 or fall back down towards the lower range of the rising channel before attempting another breakout. Key pullback levels to monitor sit at the $114.84 neckline, $100.71 weekly MSL trigger, $96.00 support, and the $89.12 swing low.

Still Breaking Records

On Oct. 21, 2022, Arista released its fiscal third-quarter earnings report for the quarter ending September 2022. The Company saw earnings-per-share (EPS) of $1.25, excluding non-recurring items, versus consensus analyst estimates of $1.05, beating by $0.20. Revenues rose 57.2% year-over-year (YoY) to $1.18 billion beating analyst estimates for $1.06 billion. Non-GAAP gross margins have been falling for three consecutive quarters at 61.2%, falling from 61.9% in previous quarter and 64.9% in Q3 2021. Arista Networks CEO Jayshree Ullal commented, “Arista continues to outpace our networking peers with record revenue in Q3 2022. Clearly, we are entering the next phase of Arista’s evolution in products, customer intimacy and new market expansion.”

More Good Times Ahead

Arista Networks raised its Q4 2022 revenue guidance to come in between $1.175 billion to $1.200 billion versus $1.09 billion consensus analyst estimates. Non-GAAP gross margins are expected between 60% to 62% and non-GAAP operating margin of approximately 40%.

Analysts Are Late to the Party

After its Investor Day, several analysts upgraded their ratings and price targets. Piper Sandler admits being slightly late to the party but upgraded ANET shares to Overweight from Neutral and a $164 price target from $126, as Investors Day solidly projected 2023 potential for more than 25% growth, sustained cloud customer demand and a renewed push to gain market share of enterprise customers. Analyst James Fish noted, "Core to our thesis is the flush of backlog that is causation for >25% 2023 growth, high-quality and resilient customer base (including hyperscalers) in a challenging macro-environment, enterprise share gains, launch of new solutions (including SD-WAN & network-as-a-service (NaaS)), 400G/800G cycle in which Arista maintains top share, margin raise from best-in-class team, and positive risk-reward heading into 2023.” Bank of America also raised its rating to a Buy from Underperform with a price target of $150 from $105.