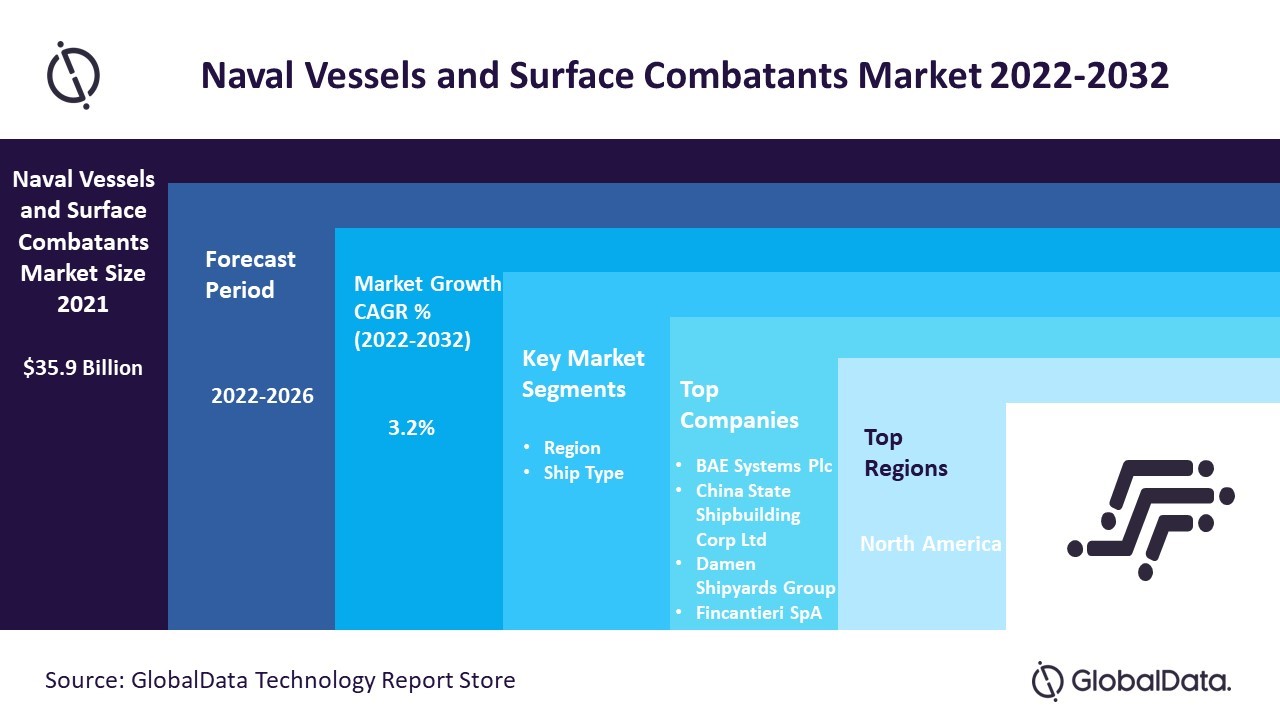

The latest market publication titled Naval Vessels and Surface Combatants Market Size, Share and Trend Analysis by Ship Type, Region, and Segment Forecast, 2021-2032 has been added to the report store by GlobalData Plc. The report projects the naval vessels and surface combatants market size was valued at US$35.9 billion in 2021. Factors such as rising investments in naval vessels due to maritime security threats coupled with territorial disputes and naval power projections will promote market growth. Furthermore, the development of unmanned surface vessels (USV) and the adoption of electromagnetic aircraft launch system (EMALS) technology will be another factor driving the market.

Read the Report Sample for More Market Dynamics

The increased focus on indigenous development of naval vessels and modularity in naval vessels to reduce lifecycle costs are some of the most prominent naval vessels and surface combatants market trends likely to influence the market growth positively. However, dependence on import regulations for critical sub-systems and program delays cause cost overruns and diminish operational capability are some of the main factors likely to limit the market’s growth throughout the forecast period. Furthermore, the dependence on import regulations for critical sub-systems and program delays might cause cost overruns and diminish operational capability. This might further lead to a market growth decline in the forthcoming years.

View Report Outlook Sample PDF for Further Insights on the market

Naval Vessels and Surface Combatants Market Segment Highlights

By Ship type

- Frigate: The frigate ship type segment held the largest market share in 2021. The segment will continue to account for the highest growth throughout the forecast period. A frigate is one of the several types of warships with a weight of more than 2,000 tons, and smaller than a destroyer, designed for protecting other warships and anti-submarine operations. They are engaged in attacks against airborne, surface, subsurface, and short targets.

- Aircraft Carrier

- Amphibious Ship

- Auxiliary Vessel

- Corvette

- Destroyer

- Light Combat Vessel

Regional Opportunities

- North America: The global naval vessels and surface combatants’ market is expected to be led by North America, with the highest revenue in 2021. The region’s spending is projected to be dominated by the US over the forecast period. With the hike in the US defense budget, the North American region is expected to offer significant opportunities for shipbuilders and sub-system vendors across the globe. Asia-Pacific will follow North America due to ongoing naval modernization initiatives for procurement of new naval platforms for replacing the aging vessel.

- Asia Pacific

- Europe

- Middle East & Africa

- Central & South America

For Segment-wise Insights and Regional Opportunities, Grab Report Copy

Naval Vessels and Surface Combatants Market Vendor Landscape

The companies in the naval vessels and surface combatants market growth are launching innovative solutions and products for strengthening their market positions. The naval vessels and surface combatants market players are also engaging in strategic partnerships for boosting the market growth.

Top Market Players:

- BAE Systems Plc: The company offers key products including advanced electronics, cybersecurity and intelligence, information technology solutions, and support services. In July 2022, BAE Systems Plc announced a technical collaboration with GE Aviation to explore next-generation adaptive power systems for combating air application.

- China State Shipbuilding Corp Ltd: The company is a manufacturer of shipboard equipment and a provider of shipbuilding services covering naval & civil, ship-repair, marine design, and research activities. In December 2021, the company announced the launch of two Type 054 frigates and one Type 071E LPD for the People’s Liberation Army Navy (PLAN or Chinese Navy).

- Damen Shipyards Group: The company is engaged in the ship building and repair yards. In May 2022, the company announced the collaboration between Damen Technical (DTC) and Cantiere Navale Vittoria (CNV) to build new flagship, a Damen Stan Patrol 6009, for the Italian Guardia di Finanza.

More Players Covered in this Report are:

- Fincantieri SpA

- Huntington Ingalls Industries Inc

- Lockheed Martin Corp

- Mitsubishi Heavy Industries Ltd

- Naval Group

- ThyssenKrupp AG

- United Shipbuilding Corp

Want to know Vendor-specific Offerings, Download Sample Now!

About GlobalData

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. As a leading information services company, thousands of clients rely on GlobalData for trusted, timely, and actionable intelligence. Our mission is to help our clientele ranging from professionals within corporations, financial institutions, professional services, and government agencies to decode the future and profit from faster, more informed decisions. Continuously enriching 50+ terabytes of unique data and leveraging the collective expertise of over 2,000 in-house industry analysts, data scientists, and journalists, as well as a global community of industry professionals, we aim to provide decision-makers with timely, actionable insights.

Media Contacts

Mark Jephcott

Head of PR EMEA

mark.jephcott@globaldata.com

cc: pr@globaldata.com

+44 (0)207 936 6400