- Kohl’s Board has overseen a fundamental transformation to accelerate growth and profitability

- Kohl’s Board is running a robust and intentional process to evaluate interest from multiple parties

- Macellum’s slate lacks the right skills and experience - six of ten nominees have never served on a public company board

- Macellum presents hollow agenda and has offered no value-enhancing ideas

- Kohl’s urges shareholders to VOTE FOR ALL 13 of the Company’s highly qualified Directors on the BLUE Proxy Card today

- For more information, investors can visit www.KohlsMomentum.com

Kohl’s Corporation (NYSE: KSS) (“Kohl’s” or the “Company”) today mailed a letter to shareholders detailing the steps the Board has taken to maximize shareholder value, including the robust and intentional process to evaluate potential bids. The letter also summarizes Macellum’s shifting narrative and short-term focus on a sale of the Company at any price.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220331005422/en/

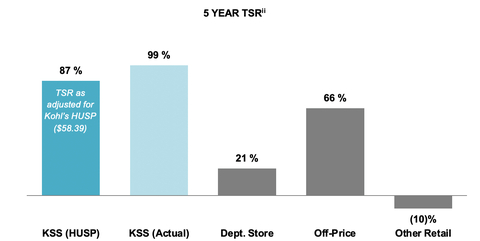

Kohl’s recent performance relative to peers can be objectively assessed using the hypothetical undisturbed share price (HUSP), which adjusts for stock price increases associated with media coverage of expressions of interest to buy the Company. This methodology assumes that from the unaffected date, Kohl’s stock price would have likely traded in-line with its direct department store peers. (Graphic: Business Wire)

The full text of the letter to shareholders follows.

***

PROTECT THE VALUE OF YOUR INVESTMENT IN KOHL’S – REJECT MACELLUM’S EMPTY AGENDA AND VOTE THE BLUE PROXY CARD TODAY FOR ALL OF KOHL’S HIGHLY QUALIFIED DIRECTOR NOMINEES

Dear Fellow Shareholder,

Your Board has the skills necessary to oversee Kohl’s strategy while exploring any potential value-maximizing opportunities. Comprised of 13 independent directors and our CEO,1 your Board has industry-leading experience in areas critical to our growth, including retail, e-commerce, and technology, as well as robust financial and M&A expertise. Your Board is fully engaged and will continue to take action to maximize value for all shareholders.

The Kohl’s Board is taking the right steps to maximize shareholder value.

Overseeing the Company’s value creation strategy: Your Board, working closely with Kohl’s management team, has acted decisively to put the Company on a new trajectory for improved growth and accelerated profitability. Since announcing our new strategy in October 2020, Kohl’s has made substantial progress in transforming our business, achieving record earnings per share in 2021. Total shareholder returns (“TSR”) have been 146% from October 19, 2020 through January 21, 2022, significantly outperforming the SPDR S&P Retail ETF and the S&P 500. TSR over a 5-year period has far exceeded the median of our peers, as shown in the chart below.

Running a robust and intentional process: We are committed to testing and measuring our strategy against alternatives. In January, the Board and its Finance Committee, comprised solely of independent directors including a designee from Macellum Advisors GP, LLC (“Macellum”), directed Goldman Sachs to engage with bidders who submitted indications of interest in Kohl's that were non-binding and without committed financing. This process continues and involves further engagement with select bidders who submitted indications of interest in Kohl’s, including assisting with further due diligence that may create opportunities to refine and improve proposals.

Refreshing the Board with the right skills and experience: As Kohl’s strategy has evolved, the Board has proactively added the right capabilities and skill sets to accelerate Kohl’s transformation into the most trusted retailer of choice for the Active and Casual lifestyle. The Board has added six new independent directors in three years, including the three directors who joined Kohl’s Board last year as part of the Company’s settlement with Macellum, the hedge fund now seeking to take control of Kohl’s. Our directors bring highly relevant experience from top roles at leading retail companies such as lululemon, Walmart, Burlington, and Kroger, as well as deep experience in M&A, technology and operations.

Macellum’s Campaign: An Empty Agenda

Macellum is attempting to take control of your Board with an inexperienced, unqualified slate. Six of ten nominees have never served on a public company board, and none have served on a retail company board of comparable size to Kohl’s. In addition, Macellum is promoting an ever-changing narrative, misinformed claims, and value-destructive proposals, all of which reveal a reckless and short-term approach that is not in the interest of driving long-term, sustainable value.

Macellum has offered virtually no new ideas; the few ideas they have presented are short-term focused and likely to destroy significant value: Macellum has presented no value-enhancing proposals. The sale leasebacks that they are demanding are an inefficient source of financing that would negatively impact margins by adding unnecessary rent expenses in perpetuity and risk Kohl’s investment-grade rating. While Kohl’s utilized sale leaseback transactions in May 2020 under unique circumstances, they are typically an inefficient means of accessing capital. A large sale leaseback would also potentially limit Kohl’s flexibility to explore all avenues to create value for shareholders. Notably, Macellum also previously urged Big Lots to pursue sale leasebacks, arguing that they would create significant value. Big Lots then engaged in a sale leaseback transaction in April 2020. Big Lots subsequently saw a meaningful decline in operating margin, and Bloomberg reported in August 2020 that the sale leaseback was a factor in thwarting a buyout offer from Apollo Global Management.

Macellum’s campaign is riddled with contradictions: Macellum has repeatedly contradicted itself in its public attacks on Kohl’s. Examples include:

- Macellum criticized Kohl’s Board for rejecting a $64 offer while claiming the Company was worth “at least $100 per share.”

- Macellum called Kohl’s shareholder rights plan an entrenchment mechanism while publicly acknowledging it is a “stop, look, and listen device.”

- Macellum praised the omnichannel approach as the future of the industry only months before calling on Kohl’s to spin-off its e-commerce business.

Macellum appears to be advocating for a quick sale of Kohl’s at any price: Macellum’s push for a hasty sale at any price reveals a short-term approach that is not in the best interest of Kohl’s shareholders. Macellum has repeatedly criticized Kohl’s for rejecting an offer to acquire the Company at $64 per share, a price that is well below the value that Macellum itself publicly declared. Their focus on short-term value is further evidenced in the selling of stock in the low $60s over the last month.

Macellum continues to make false and disruptive statements about the Board’s engagement with bidders: Macellum’s reckless and baseless commentary on your Board’s M&A process is particularly concerning. Macellum is not a party to the process, yet they continue to make false statements that have the potential to distract bidders.

Macellum’s criticisms of Kohl’s are ill-informed: Macellum has called 2021 a “lost year” for Kohl’s, despite the Company achieving record EPS. Additionally, Macellum seeks to mislead investors by focusing on Kohl’s stock performance on the day of its recent investor day that corresponded with a global market decline driven by heightened concerns of war in Ukraine and a surge in global oil prices—another example of Macellum opportunistically promoting an empty narrative. Regarding our go-forward strategy as articulated in our Q4 earnings and investor day, we have received positive feedback from shareholders and analysts, and the average analyst estimate for Kohl’s 2022 EPS has increased by 10% since those two events.

Macellum “day traded” Kohl’s options, netting tens of millions in profits: As the graph below shows, Macellum bought call options representing 2.5 million shares of Kohl’s common stock in the two weeks before Acacia's unsolicited expression of interest was publicly reported. In the following trading days, Macellum sold most of these options, all while stating that Kohl’s was worth “at least $100 per share.”

Several of Macellum’s nominees are not truly independent given their close ties to the hedge fund’s founding partner, who is also on the slate: Four of Macellum’s nine nominees have close professional ties to Macellum’s Founding Partner Jonathan Duskin, who is also a nominee. Macellum evidently handpicked these nominees for their proximity to Mr. Duskin to amplify the hedge fund’s short-term agenda. In contrast, the Kohl’s Board is 100% independent with the sole exception of the CEO and benefits from the diverse perspectives of our directors who are acting in the best interest of all shareholders. Adding directors beholden to one particular shareholder would destroy this dynamic.

The choice is clear: Re-elect the Kohl’s Board, which has the right skills and expertise to drive our strategy forward while evaluating any value-creating opportunities, or elect Jonathan Duskin and his associates to destroy value in the strategic alternatives process or as operators.

Your Board is committed to protecting shareholders’ interests and taking proactive measures to maximize long-term value. Macellum’s contradictory and misinformed claims, short-term proposals, and unqualified director slate with close ties to the hedge fund, by contrast, make clear the stakes in this director election.

VOTE THE BLUE PROXY CARD TODAY FOR ALL OF KOHL’S HIGHLY QUALIFIED DIRECTOR NOMINEES

VISIT WWW.KOHLSMOMENTUM.COM FOR MORE INFORMATION

YOUR VOTE IS IMPORTANT!

Please refer to the enclosed BLUE proxy card for information on how to vote by telephone or by Internet, or simply sign and date the BLUE proxy card and return it in the postage-paid envelope provided.

If you have any questions, or need assistance in voting your shares, please call our proxy solicitor:

INNISFREE M&A INCORPORATED TOLL-FREE, at 1-877-687-1874 BANKS AND BROKERS MAY CALL COLLECT, at 1-212-750-5833

|

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” “plans,” or similar expressions to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Forward-looking statements relate to the date initially made, and Kohl’s undertakes no obligation to update them.

About Kohl's

Kohl’s (NYSE: KSS) is a leading omnichannel retailer. With more than 1,100 stores in 49 states and the online convenience of Kohls.com and the Kohl's App, Kohl's offers amazing national and exclusive brands at incredible savings for families nationwide. Kohl’s is uniquely positioned to deliver against its strategy and its vision to be the most trusted retailer of choice for the active and casual lifestyle. Kohl’s is committed to progress in its diversity and inclusion pledges, and the company's environmental, social and corporate governance (ESG) stewardship. For a list of store locations or to shop online, visit Kohls.com. For more information about Kohl’s impact in the community or how to join our winning team, visit Corporate.Kohls.com or follow @KohlsNews on Twitter.

1 |

13 directors are standing for reelection |

2 |

Thomson Eikon estimates as of March 22, 2022. Calculated as Kohl’s stock price prior to announcement of Acacia’s initial bid ($46.84) adjusted for the median performance of direct peers (M/JWN/DDS) between the unaffected date and March 22nd. TSR assumes dividends reinvested in Kohl’s stock. Direct peers include DDS, M, JWN; Off-price peers include BURL, TJX, ROST; Other retail peers include the other retailers in the Company's TSR Peer Group which represent a wide cross-section of retailers. |

3 |

CapitalIQ & IBES Estimates as of March 23 |

4 |

SEC filings (Macellum Proxy), Capital IQ, Bloomberg. Represents shares of Common Stock underlying European-style call options with 15-Jul-2022 expiration date and $40.00 strike price purchased/sold in the over-the-counter market. Estimated based on proceeds from sales minus cost for purchase. Cost of purchase estimated based on VWAP of the close price of the American style listed options with the same strike price ($40) and expiration date (15-Jul-2022) as the European OTC options bought by Macellum on the days of Macellum’s purchase; estimated sale price based on close price of the same listed options on the days of sale. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220331005422/en/

Contacts

Investor Relations:

Mark Rupe, (262) 703-1266, mark.rupe@kohls.com

Media:

Jen Johnson, (262) 703-5241, jen.johnson@kohls.com

Lex Suvanto, (646) 775-8337, lex.suvanto@edelman.com