American Express, Capital One and Discover Rank Highest in a Tie

In one of the clearest signs yet that businesses in America are ready to get back to normal, airline rewards once again have become one of the top drivers of small business credit card customer satisfaction. According to the J.D. Power 2021 U.S. Small Business Credit Card Satisfaction Study,℠ released today, small business customer satisfaction is surging, driven by a combination of improved overall economic outlook, competitive interest rates and satisfaction with rewards programs—with a particular focus on airline rewards.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211123005334/en/

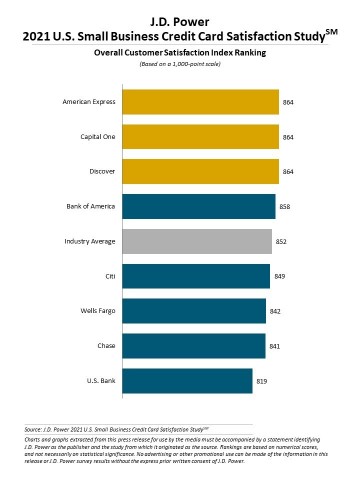

J.D. Power 2021 U.S. Small Business Credit Card Satisfaction Study (Graphic: Business Wire)

"The strongest drivers of small business customer satisfaction with credit cards is a strong alignment between specific business needs and individual card benefit," said John Cabell, director of wealth and lending intelligence at J.D. Power. "We saw the dark side of that phenomenon during the height of the pandemic when many customers were more frustrated with fees and credit limits and not able to take advantage of card benefits. Now, as the outlook is starting to improve for many small businesses, airline cards—as well as retail cards and bank brand cards—are starting to play a major role in the customer rewards satisfaction equation.”

Following are some key findings of the 2021 study:

- Overall customer satisfaction roars back from pandemic lows: Overall satisfaction among small business credit card customers is 852 (on a 1,000-point scale), which is 12 points higher than the level observed in 2020. Small business customers—32% of whom say they are financially better off than they were a year ago—view their credit card issuers more positively based on their response to COVID-19.

- Airline card rewards in the spotlight: Small business credit card customer satisfaction scores rise across nearly every attribute in the 2021 study, with the largest gains coming from credit card terms, including fees and interest rates, benefits and services and rewards programs. Among the various rewards programs profiled, the largest single driver of customer satisfaction is airline rewards, which sees a 16-point increase in customer satisfaction this year.

- Issuer involvement with PPP a double-edged sword: Overall satisfaction among small businesses that applied for relief under the Paycheck Protection Program (PPP) with their card issuer—and received it—averages 871, which is 19 points higher than the industry average. However, among small businesses that applied for the PPP and were denied, overall satisfaction scores fall more than 100 points to 774 and cardholders amass more revolving debt.

- Proactive cardholder support drives smarter card usage: When card issuers proactively provide the technology and resources that small businesses need, such as customized reporting, account management support and guidance on rewards and benefits, customers perceive more value from their cards by paying their balance every month, redeeming rewards and using benefits available to them.

Study Ranking

American Express, Capital One and Discover rank highest in customer satisfaction in a three-way tie, each with a score of 864.

The 2021 U.S. Small Business Credit Card Satisfaction Study, now in its third year, measures customer satisfaction with the largest small business credit card issuers in the U.S. by examining six factors (in alphabetical order): benefits and services; channel activities; credit card management; credit card terms; key moments; and rewards. The study includes responses from 3,101 small business credit card customers whose businesses have an approximate annual revenue between $10,000 and $10 million. The study was fielded in July-September 2021.

For more information about the U.S. Small Business Credit Card Satisfaction Study, visit https://www.jdpower.com/business/resource/us-small-business-credit-card-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021160.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20211123005334/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com