With a market cap of $42.5 billion, Teradyne, Inc. (TER) is a global provider of automated test systems and robotics products, serving customers across the United States, Asia Pacific, Europe, the Middle East, and Africa. Through its Semiconductor Test and Robotics segments, the company supports semiconductor manufacturing and industrial automation with advanced testing platforms, collaborative robots, and automation solutions.

Shares of the North Reading, Massachusetts-based company have surpassed the broader market over the past 52 weeks. TER stock has climbed 140.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.2%. In addition, shares of the company have soared 40.1% on a YTD basis, compared to SPX's marginal decline.

Looking closer, shares of the maker of wireless products, data storage, and equipment have outpaced the State Street Technology Select Sector SPDR ETF's (XLK) 15.8% return over the past 52 weeks.

Teradyne shares surged 13.4% following its Q4 2025 results on Feb. 2 as the company posted adjusted EPS of $1.80 and revenue of $1.08 billion, well above expectations. Results exceeded the high end of guidance, driven by strong AI-related demand in compute and memory, with Semiconductor Test revenue alone reaching $883 million and fueling 41% sequential growth from Q3. Investor enthusiasm was further boosted by upbeat Q1 2026 guidance calling for revenue of $1.15 billion - $1.25 billion and adjusted EPS of up to $2.25, alongside management’s outlook for continued AI-driven growth across all business segments.

For the fiscal year ending in December 2026, analysts expect Teradyne's adjusted EPS to increase 45.2% year-over-year to $5.75. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

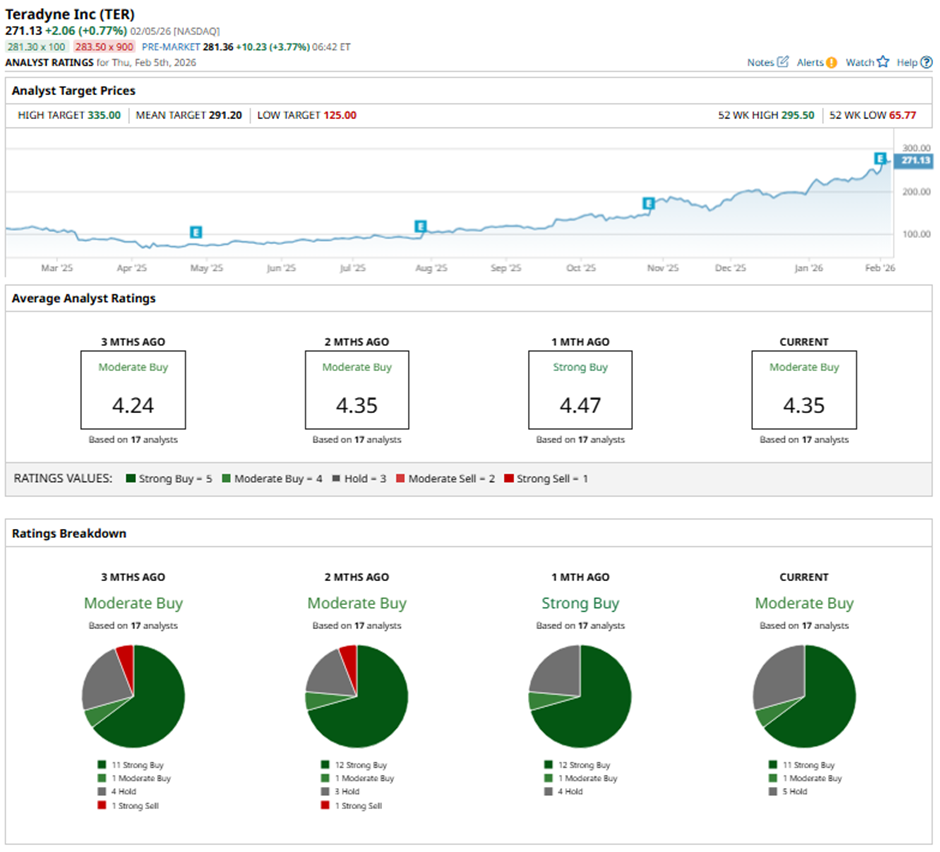

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buys,” one “Moderate Buy” rating, and five “Holds.”

On Feb. 5, Northland Securities analyst Gus Richard downgraded Teradyne to “Hold” and set a price target of $270.

The mean price target of $291.20 represents a 7.4% premium to TER’s current price levels. The Street-high price target of $335 implies a potential upside of 23.6% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart