Oil prices surged as the U.S. military forces captured and extradited Venezuelan President Nicolás Maduro. As per the words of U.S. President Donald Trump, the Venezuelan oil sector would see an influx of U.S. oil companies and spending of “billions of dollars.”

This is highly significant, although it requires considerable time and investment, given that the country holds roughly 17% of the world’s proven crude reserves. However, the reserves have also been reportedly mismanaged for years, resulting in aging infrastructure and low production.

Trump also emphasized the country’s “badly broken” infrastructure, which should interest companies such as oilfield services giant Halliburton Company (HAL). This ambitious plan creates a direct pathway for the company to provide its technical expertise and breathe new life into Venezuela’s aging wells and pipeline.

As this opportunity became clear to investors, HAL stock gained 8% intraday on Jan. 5, but it gave up some of those gains the next day. Therefore, should you buy, hold, or sell HAL stock now? Let's take a closer look.

About Halliburton Stock

Halliburton Company, founded in 1919, is a leader in energy services worldwide, specializing in oilfield services. Its main headquarters sit in Houston, Texas. The company supports all stages of the oil and gas lifecycle, from drilling new wells and evaluating reservoirs to completing wells, boosting production, and maintaining pipelines.

Halliburton uses cutting-edge tools, such as digital systems and real-time data, to streamline operations and improve efficiency. Services include fracking, cementing wells, fluid management, and chemical treatments for onshore fields and deepwater sites. Operating in multiple countries, it partners with large energy firms to reduce costs and increase output through smart innovations such as remote pipeline inspections. The company has a market capitalization of $25.5 billion.

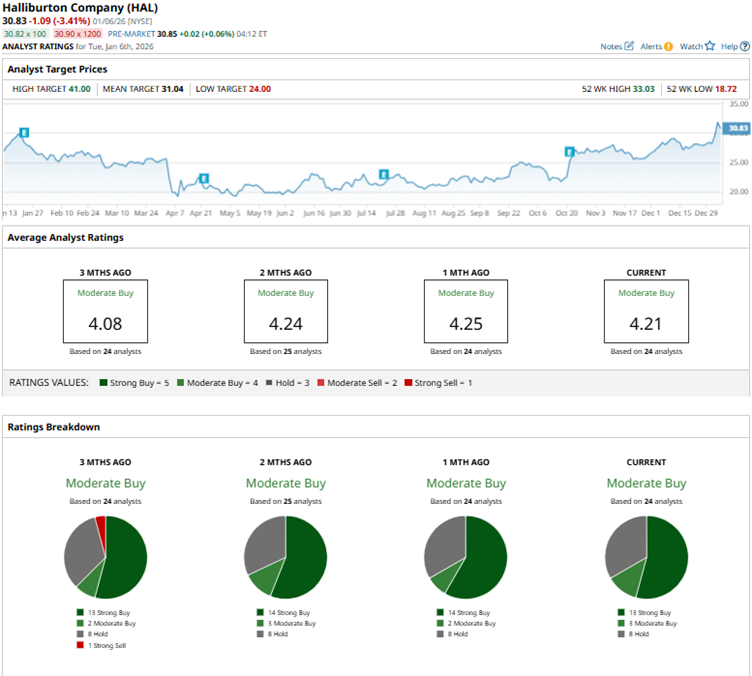

Last year, HAL stock benefited from optimism around oilfield services and rising energy demand. The stock has gained 17% over the past 52 weeks and 43% over the past six months. Following the news from Venezuela, HAL stock reached a 52-week high of $33.03 on Jan. 5 but is now down roughly 3% from that level. Over the past five days, Halliburton shares are up 12%.

HAL stock has a forward price-to-earnings ratio of 14 times.

Halliburton’s Third-Quarter Results Exceeded Estimates

On Oct. 21, Halliburton reported its third-quarter results for fiscal 2025. The company’s revenue declined modestly by 1.7% year-over-year (YOY) to $5.6 billion. However, this was higher than the $5.39 billion that Wall Street analysts had expected.

The company also took steps expected to deliver estimated quarterly savings of $100 million and to reset its 2026 capital budget. Adjusted net income per share for the quarter was $0.58, down 20% annually but surpassing the $0.50 per-share earnings that Street analysts had expected.

One day prior to the earnings release, Halliburton announced a strategic collaboration with VoltaGrid to deliver distributed power generation for data centers worldwide, with the initial deployment focused on the Middle East.

Wall Street analysts are not optimistic about Halliburton’s bottom-line growth trajectory. For Q4 of fiscal 2025, analysts expect the company to report a 23% YOY decline in its EPS to $0.54. For fiscal 2025, EPS is projected to be $2.26, down 24% YOY.

What Do Analysts Think About Halliburton Stock?

Analysts at Freedom Capital Markets downgraded HAL stock, citing a weak fundamental backdrop in the sector despite its strong rally, driven by geopolitical turmoil surrounding the U.S. and Venezuela.

On the other hand, last month, while maintaining an “Equal Weight” rating on HAL stock, Barclays analyst David Anderson raised the price target from $25 to $30. This indicates that while a measured view on HAL stock remains, analysts see improved prospects.

Analysts at Citi also raised the firm’s price target from $31 to $33, while maintaining a bullish “Buy” rating on the stock. Citi analysts also believe that the industry is at the “bottom of a two-year downcycle,” and the absence of negative estimate revisions could improve HAL stock’s performance this year.

Rothschild analysts initiated coverage of the stock with a “Buy” rating. Analysts believe that the oilfield services sector is approaching the bottom of its earnings cycle and expect the industry to recover as upstream investments pick up from next year. Rothschild also believes the company is well-positioned to capitalize on a global uptick in drilling and completion activity following a steep slowdown in North American activity.

Goldman Sachs analysts are also bullish about the stock’s prospects. Under the analysis of Neil Mehta, Goldman Sachs maintained a “Buy” rating on the stock, while raising the price target from $25 to $28.

Halliburton remains a sound favorite on Wall Street, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 24 analysts rating the stock, 12 analysts have a “Strong Buy,” three analysts suggest a “Moderate Buy,” and nine analysts play it safe with a “Hold” rating. The consensus price target of $31.70 represents marginal downside from current levels. However, the Street-high price target of $41 indicates that shares could climb as much as 28% from here.

Key Takeaways

While there are potential gains in Venezuela, unlocking them would require significant investment over the years. According to Francisco Monaldi, Director of the Latin American Energy Program at Rice University’s Baker Institute for Public Policy, the cost to reach Venezuela's 1970s peak of 3.5 million barrels per day (bpd) would be approximately $10 billion annually. However, Halliburton still has the potential to benefit from rising electricity demand from data centers. Moreover, analysts are overall moderately bullish on the company’s prospects. Therefore, HAL stock might be a buy for investors with a risk appetite.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Trump Just Sent Blackstone Stock Plunging Below Key Support Levels. How Should You Play BX Here?

- Morgan Stanley Is Bullish on Nvidia After CES 2026. Should You Buy NVDA Stock Here?

- Evercore Analysts Love UnitedHealth Stock for 2026. Should You Buy UNH Here?

- Is Chevron Stock a Buy, Sell, or Hold for January 2026?