Flash memory is becoming one of the most important pieces of the artificial intelligence (AI) puzzle. As data-hungry applications spread across data centers, smartphones, laptops, and edge devices, the demand for faster and denser storage is accelerating. Adding AI and IoT to the mix — both of which thrive on massive data ingestion — suddenly makes flash memory look more like critical infrastructure. In fact, the global 3D NAND flash memory market is projected to grow at a healthy 12.1% compound annual growth rate (CAGR) from 2026 to 2032, underscoring just how durable this demand cycle may be.

That backdrop sets the stage nicely for Sandisk Corporation (SNDK). The company specializes in NAND flash-based storage solutions designed for AI workloads across data centers, edge environments, and consumer devices. It is a sweet spot in the market, and investors have been rewarding it. After a strong finish to 2025, Sandisk stock has doubled so far in 2026 and is firmly landing on the market’s radar.

The rally is supported by tightening supply, rising 3D NAND pricing, and expectations that AI-driven demand won’t fade anytime soon. The imbalance could last longer than many expect, setting the stage for meaningful EBITDA margin expansion.

With pricing power improving and margins anticipated to expand, expectations are high heading into SanDisk’s fiscal Q2 earnings report, set to release on Thursday, Jan. 29. While management expects revenue between $2.55 billion and $2.65 billion and EPS between $3.00 and $3.40, analysts are aiming even higher.

Let’s take a closer look at SanDisk.

About Sandisk Stock

Milpitas, California-based Sandisk is a leading designer, developer, manufacturer, and marketer of NAND flash memory storage solutions. Its broad portfolio spans solid-state drives (SSDs), memory cards, and embedded storage products that serve consumer electronics, enterprise customers, and data centers worldwide. With a market capitalization of approximately $69.4 billion, SanDisk has built a comprehensive flash ecosystem that supports a seamless and resilient flow of data across modern digital infrastructure.

The company is benefiting from a powerful structural tailwind. Demand for high-performance memory has surged alongside the rapid expansion of AI, cloud computing, and big data analytics. Hyperscale customers increasingly rely on fast, energy-efficient storage to support AI workloads and large-scale server deployments, placing Sandisk at the center of this growth cycle.

The company was spun off from Western Digital (WDC) in February last year, a move designed to unlock the value of its flash memory business. Since the separation, the company has capitalized on tightening supply conditions across the global NAND market. Prices for advanced memory products rose sharply in 2025 and are expected to climb further this year as demand growth continues to outpace supply.

SanDisk’s vertically integrated model, spanning wafer fabrication to SSD assembly, boosts efficiency, innovation, and reliability for hyperscale clients. Its advanced TLC and QLC NAND enhance density and energy efficiency. Post-spinoff independence is driving higher R&D investment, positioning SanDisk for next-generation enterprise SSD growth and stronger pricing power in 2026.

Since its spinoff, SNDK has skyrocketed nearly 1,200%, leaving broader benchmarks like the S&P 500 Index ($SPX) far behind and forcing analysts to constantly recalibrate expectations. The momentum has not faded in 2026 either. In just the first few weeks of the new year, Sandisk’s shares are already up close to 100%, while the S&P 500 has managed a far more modest gain of about 1%. The gap highlights just how strongly investors are leaning into SanDisk’s role in the AI-driven data and storage cycle.

In fact, on Jan. 21, SNDK stock rose 10.6% and hit a high of $509.50, after multiple analysts raised their price targets on the stock.

From a technical standpoint, the trend remains firmly bullish. Trading volume has been picking up alongside the rally, signaling growing participation rather than a thin, speculative move. The 14-day RSI has pushed into overbought territory, reflecting strong upside momentum, even if short-term pauses would not be surprising.

Meanwhile, the MACD oscillator continues to flash green. The MACD line remains above the signal line and is trending higher, while the histogram has flipped decisively from December’s negative readings into positive territory, underscoring strengthening bullish momentum.

SNDK’s valuation tells a two-sided story. On the surface, it is not cheap. Priced at forward adjusted earnings of 43.38 and a price-to-sales ratio of 6.24, it sits above sector averages, reflecting lofty growth expectations baked into the stock. Still, a low forward PEG of 0.34 suggests that if AI-driven growth plays out as expected, today’s valuation may look reasonable, or even attractive over time.

Sandisk Rises After Q1 Earnings Report

Sandisk’s fiscal first-quarter 2026 report was released on Nov. 6, and investors clearly liked what they saw. Shares rose over the next four trading sessions as the numbers landed comfortably ahead of expectations. Revenue came in at $2.31 billion, up 22.6% year-over-year (YOY) and 21% sequentially, while adjusted EPS reached $1.22, beating Wall Street estimates on both fronts.

Additionally, profitability showed steady improvement. Gross margin climbed to 29.9% sequentially, and operating margin reached 10.6%, reflecting better pricing and operating leverage. Growth was broad-based. Data center revenue jumped 26% quarter-over-quarter (QOQ) to $269 million, supported by two hyperscalers already in qualification, with another hyperscaler and a top storage OEM lined up for calendar 2026. Engagements now span five major hyperscale customers. Edge revenue rose 26% sequentially to $1.4 billion, while consumer revenue increased 11% to $652 million, benefiting from improving demand and product refreshes.

Technology progress remains a key driver. BiCS8 accounted for 15% of total bits shipped in the quarter and is expected to represent the majority of bit production exiting fiscal 2026.

Financially, SanDisk crossed an important milestone earlier than planned, achieving a net cash positive position. Adjusted free cash flow surged to $448 million, with net cash at $91 million. Cash and equivalents totaled $1.4 billion, slightly above gross debt of $1.35 billion.

Looking ahead, management notes that NAND demand continues to exceed supply, prompting disciplined allocation to maximize long-term value. Investments in the technology roadmap and deeper partnerships in data center and edge markets remain priorities, while a refreshed consumer portfolio positions the company for seasonal strength.

There are still transition-related challenges, including leverage – debt-to-equity at 0.14 – and negative return on equity. However, structural tailwinds from AI-driven data growth remain intact.

With the next earnings report due this week, management is guiding for roughly $2.6 billion in revenue, a non-GAAP gross margin of 41% to 43%, and non-GAAP EPS between $3.00 and $3.40, setting the stage for another closely watched update.

Analysts tracking Sandisk are even more optimistic, expecting the company’s revenue to be around $2.68 billion. EPS for the quarter is estimated to be $2.94. Looking ahead, fiscal 2026 EPS is projected to grow 551.7% YOY to $11.60, followed by a 110.6% surge to $24.43 in fiscal 2027.

What Do Analysts Expect for Sandisk Stock?

On Jan. 20, Citigroup doubled down on SNDK, reaffirming a “Buy” rating while lifting the price target sharply from $280 to $490. The move reflects confidence in accelerating enterprise SSD demand and a supportive supply backdrop. As part of its 2026 outlook refresh for technology hardware, Citi highlighted resilient hyperscaler data center spending, noting that ongoing investments in storage, power, connectors, and fiber continue to create a favorable setup for SanDisk’s growth.

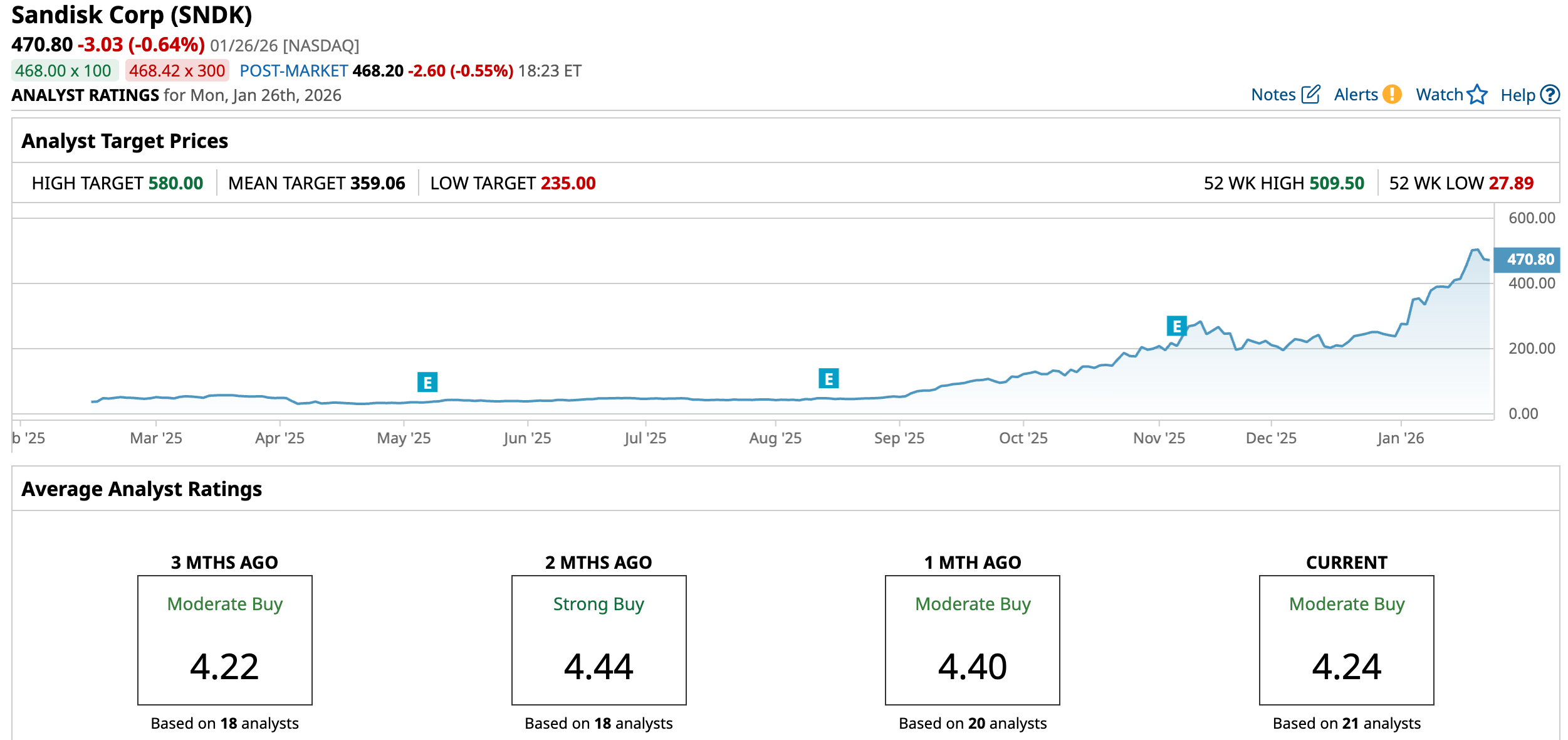

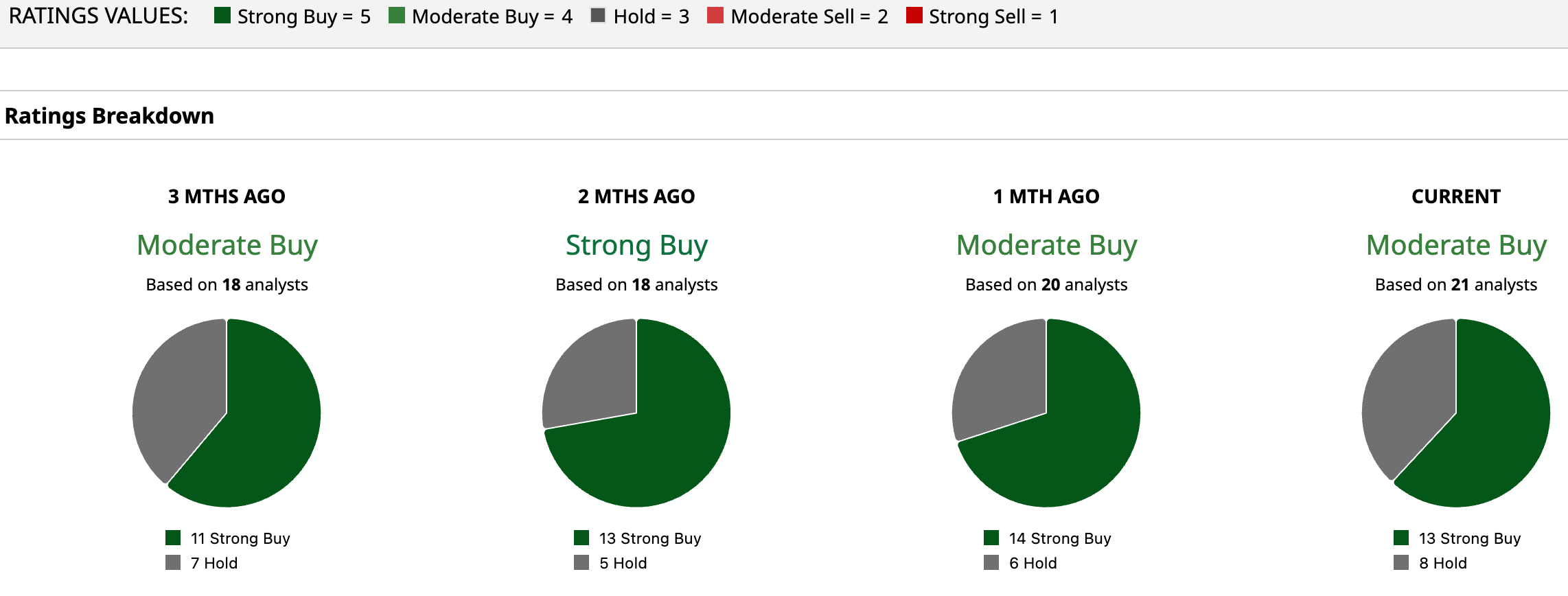

Overall, analysts have a positive outlook on SNDK, giving a consensus “Moderate Buy” rating. Of the 21 analysts rating the stock, a majority of 13 analysts rate it a “Strong Buy,” and eight analysts are playing it safe with a “Hold” rating.

SNDK stock currently trades above its consensus price target of $359.06. But the Street-high target of $580 suggests the stock could rally as much as 23.2%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why the Charts Say It’s Still Too Soon to Buy This Beaten-Down Mega-Cap Stock

- As Trump Drops Tariff Threats on Greenland, Should You Buy This 1 Hot Rare Earths Stock?

- As Tesla’s Austin Robotaxi Launch Draws Scrutiny, Consider Buying These 2 Robotaxi Stocks Instead

- Why 1 Analyst Just Slashed Their Price Target on Oracle Stock by More than 30%