With a market cap of $48 billion, Target Corporation (TGT) is a U.S.-based general merchandise retailer offering a wide range of products, including apparel, beauty, food and beverages, electronics, home goods, and household essentials. It sells its merchandise through physical stores and digital platforms such as Target.com, along with exclusive design partnerships and in-store experiences.

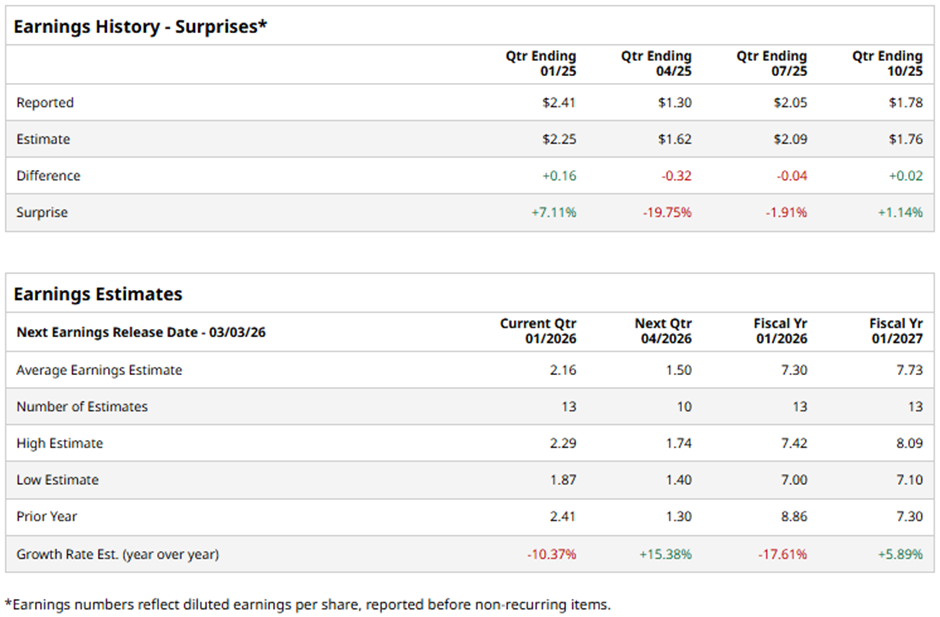

The Minneapolis, Minnesota-based company is expected to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts predict TGT to report an adjusted EPS of $2.16, down 10.4% from $2.41 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2025, analysts forecast the retailer to post an adjusted EPS of $7.30, a decrease of 17.6% from $8.86 in fiscal 2024. However, adjusted EPS is expected to rebound, rising 5.9% year over year to $7.30 in fiscal 2026.

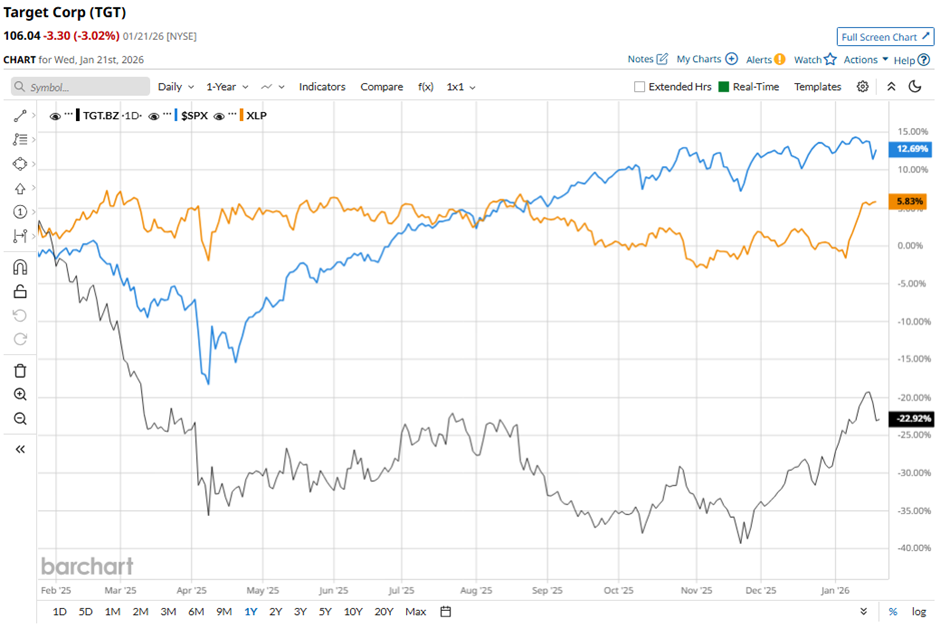

Shares of Target have declined 22.8% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 13.7% rise and the State Street Consumer Staples Select Sector SPDR ETF’s (XLP) 6.2% gain over the same period.

Despite beating expectations with Q3 2025 adjusted EPS of $1.78, Target’s shares fell 2.8% on Nov. 19. Quarterly revenue of $25.27 billion missed Wall Street forecasts, and comparable sales fell 2.7%, with ongoing softness in discretionary categories offsetting gains in Food & Beverage and digital sales. Sentiment was further pressured by lower EPS of $1.51, an 18.9% drop in operating income, and guidance calling for a low-single-digit sales decline in Q4 2025 and full-year adjusted EPS of $7 - $8.

Analysts' consensus view on TGT stock is cautious, with a "Hold" rating overall. Among 37 analysts covering the stock, eight recommend "Strong Buy," three have a "Moderate Buy," 20 suggest "Hold," one "Moderate Sell," and five advise "Strong Sell." As of writing, it is trading above the average analyst price target of $102.68.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart