Nvidia (NVDA) shares inched down on Wednesday following reports that Beijing has ordered its customs agents to block H200 artificial intelligence (AI) chips from entering the country.

This effective ban on NVDA’s advanced accelerator reinforces that China is pushing its tech firms to rely more on domestic alternatives amid its ongoing rivalry with the U.S.

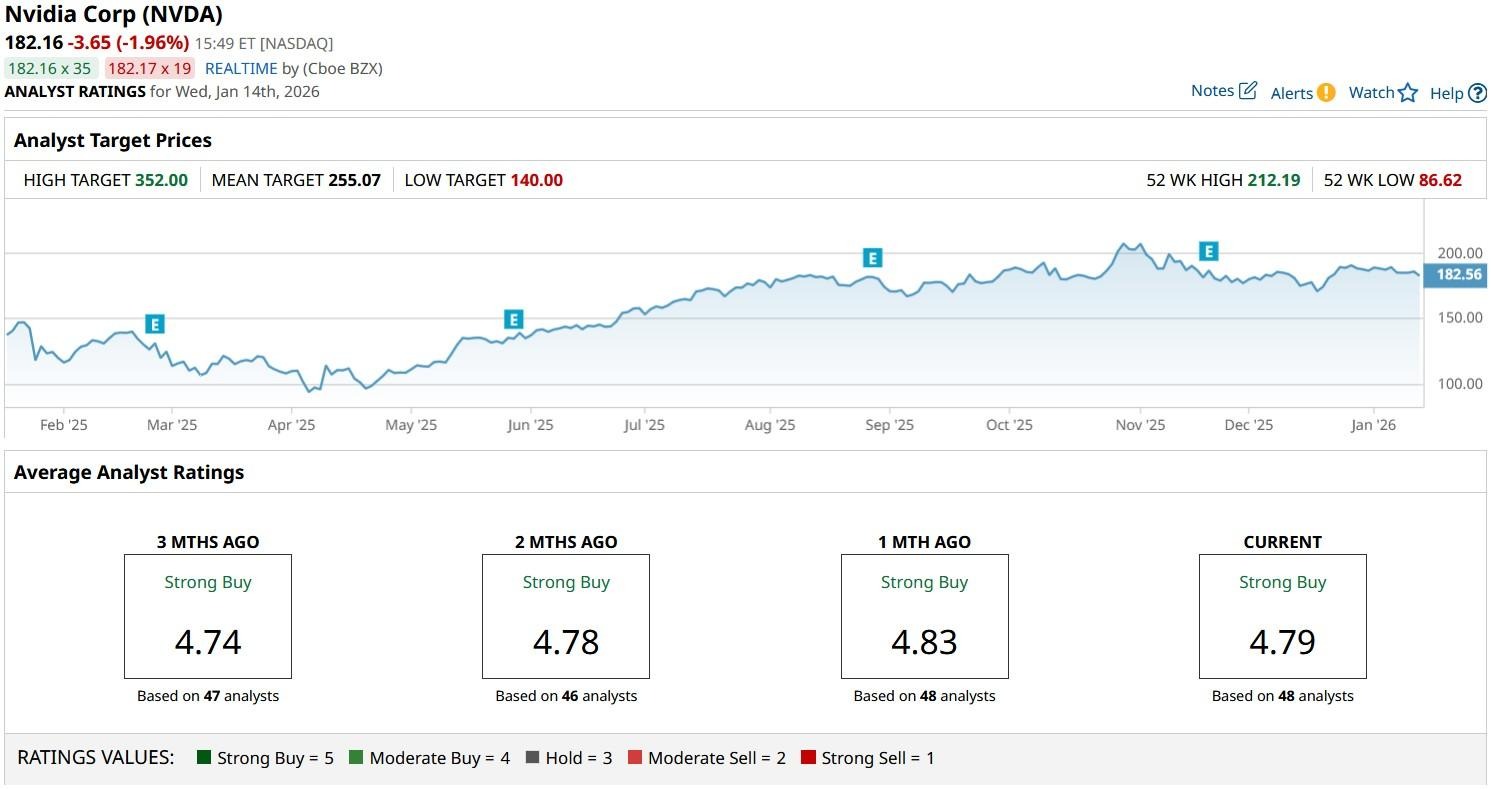

Despite Wednesday’s decline, Nvidia stock remains up more than 115% versus its 52-week low.

Does the China News Matter for Nvidia Stock?

While Nvidia management had largely excluded China business from its Q4 outlook in November, reports of a ban on H200 imports are still significant for the semiconductor behemoth.

Why? Because it may eliminate a growth catalyst that investors and analysts alike were starting to price back in after President Donald Trump unexpectedly signaled that his administration will allow H200 exports to China.

That surprisingly pleasant policy change, they hoped, would add at least $30 billion to the giant’s top line in 2026.

But now that Beijing has reportedly banned H200 chips from entering the country, estimates may come down again, potentially dragging NVDA stock lower in the months ahead.

Wells Fargo Sees Massive Upside in NVDA Shares

Wells Fargo’s senior analyst Aaron Raker recommends that long-term investors grow their exposure to Nvidia shares on the recent pullback.

According to him, the firm remains a leader in gaming, data center, high performance computing, and emerging AI opportunities, which will drive its stock higher from here in 2026.

Raker’s “Overweight” rating comes with a price target of $265, indicating potential upside of another 47% from here.

Historically (over the past five years), NVDA has rallied more than 7.0% on average in February. This seasonal trend makes it even more attractive to own in the near term.

Wall Street Remains Bullish on Nvidia

What’s also worth mentioning is that Wells Fargo is not the only Wall Street firm recommending sticking with Nvidia stock in 2026.

The consensus rating on NVDA shares also currently sits at “Strong Buy” with the mean target of about $255 indicating potential upside roughly 35% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart