Meta Platforms (META) just announced nuclear power agreements with three providers, including Sam Altman-backed Oklo (OKLO). Soon after the announcement, shares of Oklo, a small modular reactor (SMR) developer, rose 8% as Meta aims to secure carbon-free electricity for its artificial intelligence infrastructure.

The deal validates Oklo’s business, which went public in 2024 through a SPAC merger. Altman co-founded Oklo and maintains a 4.3% stake in the company, valued at over $600 million today.

Meta's partnership bundle includes arrangements with Vistra (VST), TerraPower, and Oklo to power the Prometheus supercluster computing system under construction in New Albany, Ohio. The three projects collectively aim to deliver 6.6 gigawatts of power by 2035, exceeding New Hampshire's total electricity demand.

While Vistra will extend operations at existing nuclear facilities in Ohio and Pennsylvania, both TerraPower and Oklo represent developmental technologies not yet generating commercial power.

Oklo's advanced nuclear technology campus in Pike County, Ohio, is expected to come online as early as 2030. This will be the nearest-term new nuclear project in Meta's portfolio. The timeline advantage proves crucial as hyperscalers scramble for reliable baseload power that solar and wind alone cannot provide.

The announcement follows similar nuclear commitments from Amazon (AMZN) and Alphabet (GOOG) (GOOGL), which suggests data center operators are betting on nuclear as a scalable solution for powering energy-intensive AI training and inference workloads without carbon emissions.

The question for investors is whether Oklo can execute the development and licensing milestones needed to deliver on these commitments.

Is OKLO Stock a Good Buy Right Now?

Oklo represents one of the most aggressive execution plays in advanced nuclear energy, transitioning from theoretical reactor development to actual construction and fuel production. It has strategically leveraged Department of Energy authorization pathways that bypass the Nuclear Regulatory Commission's licensing bottlenecks.

In the past 12 months, OKLO stock has surged over 300% as investors are bullish on its multipronged approach spanning power generation, fuel recycling, and medical isotope production. Notably, while the nuclear energy company invests heavily in capital expenditures, it will remain unprofitable over the coming years.

Oklo has achieved a transformative milestone by securing three awards under the DOE's Reactor Pilot Program. The awards enable construction of the Aurora powerhouse at Idaho National Laboratory, the Pluto plutonium fuel test reactor, and Atomic Alchemy's radioisotope production facility.

This DOE authorization pathway allows Oklo to build facilities while regulatory reviews proceed simultaneously, rather than completing extensive licensing work before breaking ground. The Aurora-INL project commenced excavation in late 2025 and targets initial operations in the 2027-2028 timeframe before transitioning to full NRC commercial licensing.

Oklo's fuel strategy addresses a key industry constraint through unprecedented diversification. The company secured access to five tons of fuel recovered from the Experimental Breeder Reactor-II for its first powerhouse.

Importantly, recent federal policy shifts make up to 34 metric tons of surplus weapons-grade plutonium available as bridge fuel. Oklo estimates it could produce approximately 180 metric tons of reactor fuel, which would support 10 to 20 plants.

This plutonium-based fuel requires no uranium enrichment and accelerates the time to market while the company develops long-term supplies through its Tennessee Advanced Fuel Center recycling facility.

Oklo ended Q3 with $1.2 billion in cash and marketable securities, following a $540 million equity raise. This liquidity provides Oklo with the runway to deploy capital aggressively. Its operating losses in Q3 stood at $36.3 million, which includes $9.1 million in stock-based compensation.

Management expects full-year cash used in operating activities to be between $65 million and $80 million, though capital expenditures are ramping up as construction progresses across multiple facilities.

What Is the OKLO Stock Price Target?

Strategic partnerships validate Oklo's technical approach. Siemens Energy signed a binding contract to design and manufacture the power conversion system for Aurora-INL, representing a major long-lead procurement item.

The collaboration with Battelle Energy Alliance enables fast neutron irradiation testing capabilities absent from U.S. infrastructure for decades. The partnership will generate performance data to optimize future fuel designs and reduce costs through iterative learning.

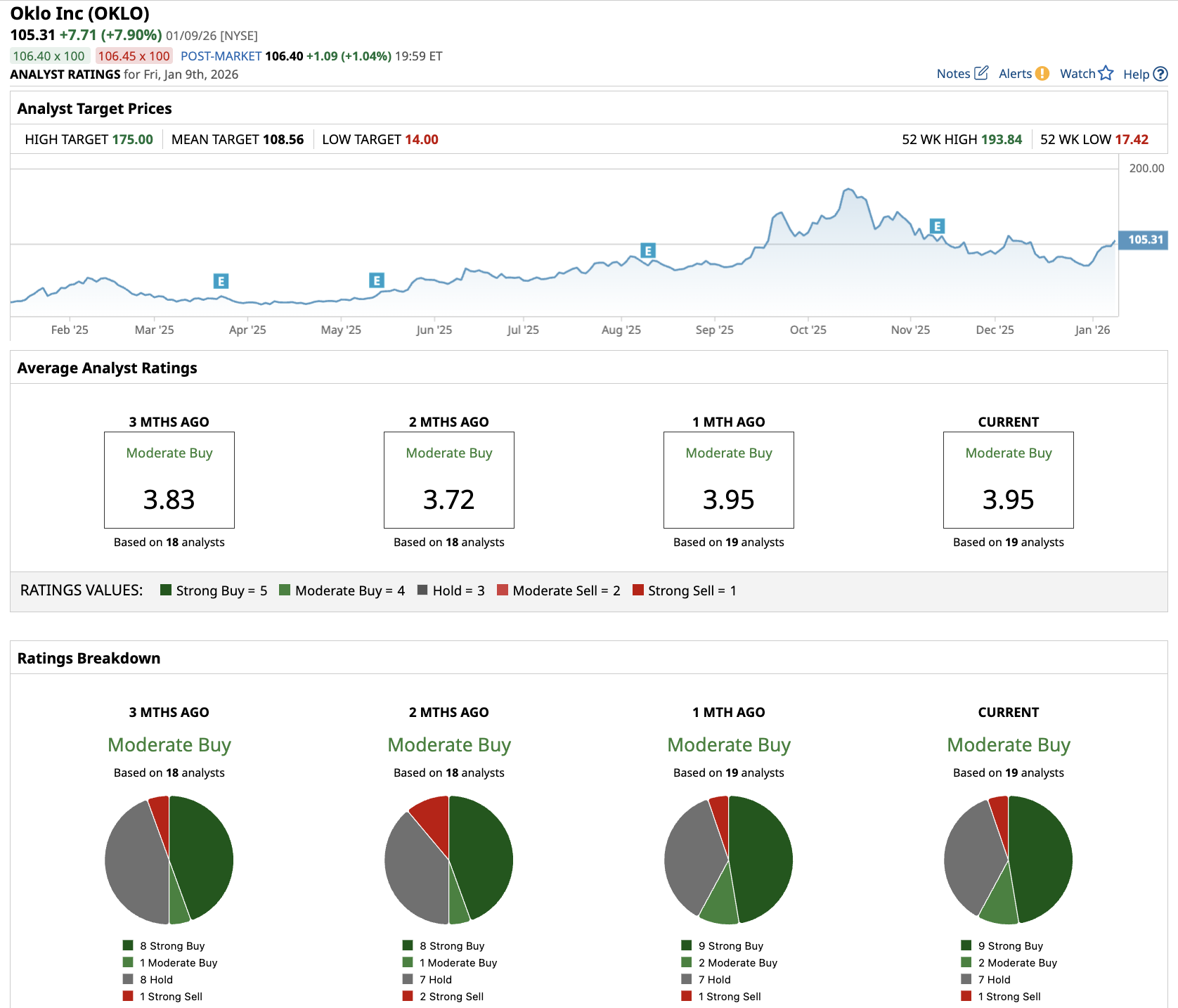

Out of the 19 analysts covering OKLO stock, nine recommend “Strong Buy,” two recommend “Moderate Buy,” seven recommend “Hold,” and one recommends “Strong Sell.” The average OKLO stock price target is $108.56, which is just slightly above the current price of $105.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart