Amazon (AMZN) has recently unveiled its Graviton5 CPU, and the moment feels less like a routine product debut and more like a decisive shift in the company’s long-term cloud strategy. For years, AWS has played the diplomat, balancing chips from Nvidia (NVDA), Intel Corporation (INTC), and Advanced Micro Devices (AMD) while quietly refining its own silicon expertise. Now, with Graviton powering a majority of new AWS CPU capacity for three consecutive years, Amazon is signaling a far more assertive future.

Graviton5 arrives with sharper data throughput, stronger memory management, elevated network performance, and a more rigorous security architecture—all crafted through a 3-nanometer design meant to maximize efficiency and stability. Major clients such as Adobe (ADBE), Airbnb (ABNB), SAP (SAP), and Snowflake (SNOW) are already relying on Graviton-powered systems, underscoring its growing credibility in high-demand workloads.

With Wall Street turning increasingly optimistic and Amazon intensifying its custom-chip ambitions, should investors buy the stock, sell, or simply stay on the sidelines?

About Amazon Stock

Amazon has grown from a small online bookseller into a global tech juggernaut, currently valued at a market capitalization of $2.45 trillion. Today, it leads U.S. e-commerce while powering much of the internet through AWS. The company spans online retail, cloud computing, streaming, smart devices, digital ads, healthcare, and fast-advancing AI services. Its reach extends from logistics to entertainment, reshaping how people shop, watch, work, and connect. With every new venture, Amazon continues to define the future of modern technology.

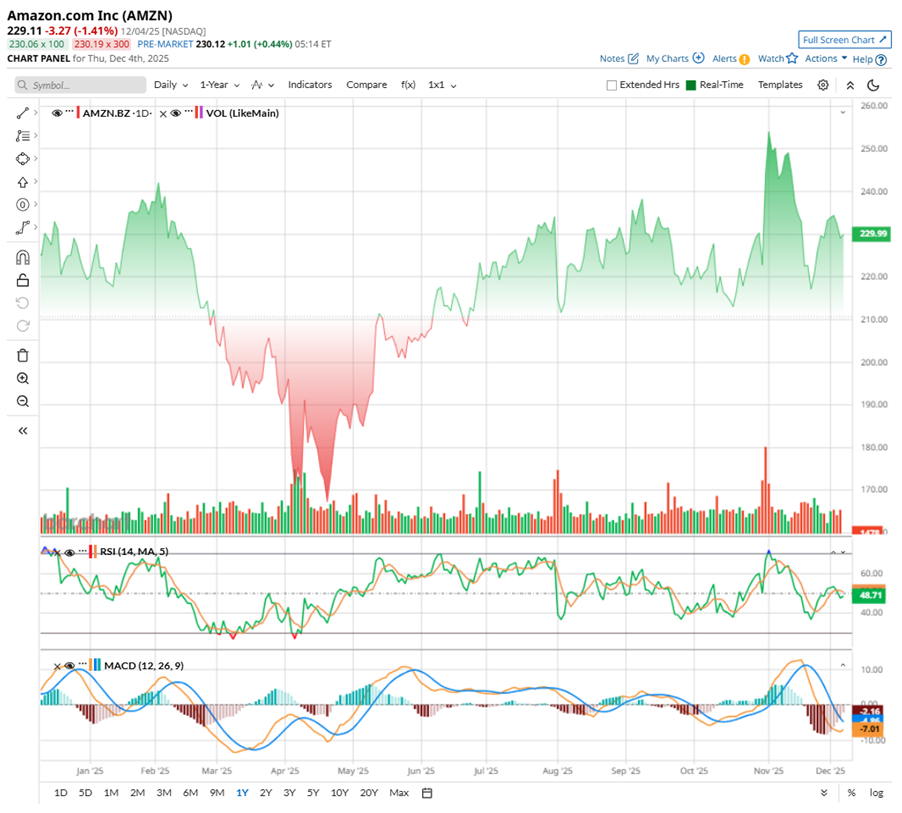

Amazon’s shares have been navigating a volatile path in 2025, reflecting both strong growth catalysts and broader market headwinds. Early in the year, concerns over slowing cloud momentum and rising marketplace costs weighed on sentiment, pushing the stock lower. A solid Q3 earnings beat sparked optimism last month, driving AMZN to a 52-week peak of $258.60. Yet a broader AI-driven sell-off pared most of those gains, leaving the stock up just 4.6% year-to-date (YTD), but down 8.2% over a month and roughly 11.2% below its highs.

Technically, the chart signals caution. The 14-day RSI sits at a neutral 48, indicating neither overbought nor oversold conditions. The MACD shows the yellow line crossing below the blue signal line, both trending downward, while the histogram remains negative, highlighting waning bullish momentum. In short, despite strong earnings and AI developments, Amazon’s recent rally struggles to sustain strength, suggesting the stock could face short-term volatility before charting a clear direction.

AMZN trades at 32.5 times forward adjusted earnings, making the stock feel unusually affordable for a company of its scale.

Amazon Jumps After a Stellar Q3 Report

Amazon’s stronger-than-expected Q3 report landed on Oct. 30, and the market reacted almost reflexively. AMZN stock vaulted nearly 14% across the subsequent two trading sessions, hitting a fresh YTD peak by Nov. 3. Net sales rose 134% year-over-year (YoY) to $180.2 billion, easily clearing both management’s forecasts and analyst expectations. EPS jumped 36.4% annually to $1.95, reinforcing the view that Amazon is regaining its operating muscle after years of heavy reinvestment.

And once again, AWS commanded the spotlight. Cloud revenue increased 9.4% YoY to $11.4 billion, with CEO Andy Jassy stressing that AWS is now accelerating at a pace “we haven’t seen since 2022,” suggesting cloud demand is re-intensifying rather than cooling.

Operationally, Amazon displayed impressive discipline. Operating cash flow climbed 16% to $130.7 billion over the trailing 12 months, while the company continued reinforcing its infrastructure, adding over 3.8 gigawatts of capacity to fuel both cloud services and its expanding AI ecosystem. Plus, retail efficiency also strengthened. Amazon is on track for its fastest Prime delivery speeds yet, expanding same-day grocery service to 2,300 communities and doubling rapid-delivery access in rural regions.

AI remains Amazon’s biggest focus. Trainium2, its custom AI chip, is fully booked and growing rapidly, up 150% quarter-over-quarter (QoQ). The launch of Project Rainier, built with nearly 500,000 Trainium2 chips to support Anthropic’s Claude models, shows how serious Amazon is about leading the AI race.

For fiscal Q4, management estimates revenue to be between $206 billion and $213 billion, and operating income is anticipated to land somewhere between $21 billion and $26 billion, keeping expectations firmly positive.

For fiscal 2025, Wall Street analysts tracking Amazon project its EPS to be $7.17, indicating a 29.7% YoY surge, before rising by another 9.3% annually to $7.84 in fiscal 2026.

What Graviton5 Means for Amazon

Graviton5 is not just another AWS chip—it is Amazon tightening its grip on the very infrastructure that powers the modern internet. Delivering around 25% higher compute performance than the previous generation, this fifth-generation CPU is already sliding into EC2 M9g instances, with heavier-duty versions slated for 2026. With every step, Amazon reduces its dependence on other chipmakers and leans deeper into its own custom silicon roadmap. In addition to improving customer performance, the shift strengthens Amazon’s long-term control over cloud economics, pricing, and efficiency.

The real advantage for Amazon is leverage. With a 192-core design, bigger cache, cleaner memory pathways, and major latency reductions, Graviton5 becomes a tool that quietly locks customers deeper into the AWS ecosystem. Faster apps, smoother scaling, and better cost efficiency mean fewer reasons for enterprises to explore other clouds. And when companies like SAP, Atlassian, Airbnb, and Siemens report 25% to 60% gains on real workloads, it becomes a proof point Amazon can weaponize in sales conversations—performance becomes the hook, and cost savings become the glue.

For Amazon, this strategy compounds. Every customer who shifts to Graviton-based instances strengthens AWS’ margins, reduces dependence on other players, and increases stickiness within its cloud empire. If these early performance boosts hold at scale, Graviton5 won’t just accelerate AWS, but it could make Amazon’s entire cloud business more profitable, predictable, and dangerously hard for competitors to match.

What Do Analysts Expect for AMZN Stock?

Analysts walked out of AWS re:Invent sounding almost unanimously invigorated, convinced that Amazon’s AI engine is shifting into a far more aggressive gear. Bank of America came away particularly upbeat, with Justin Post noting that AWS now feels more coordinated, more ambitious, and far more intertwined with Nvidia than before. His team pointed to Amazon’s rapid march toward Trainium4—chips that will tap Nvidia’s NVLink Fusion racks to bind AI components more tightly, boosting speed and efficiency. Post now sees AWS revenue climbing as high as 25%, signaling a renewed conviction in Amazon’s cloud trajectory.

JP Morgan’s Doug Anmuth echoed that confidence, arguing that Amazon is closing competitive gaps through stronger Trainium performance, a more robust Bedrock platform, and deep alliances with Anthropic and OpenAI. He sees AWS revenue rising 23% in Q4 and again in 2026, driven by Trainium3’s 4.4x compute leap, better PyTorch integration, and Amazon’s expanding AI estate—from AI Factories to the Nova 2 model suite.

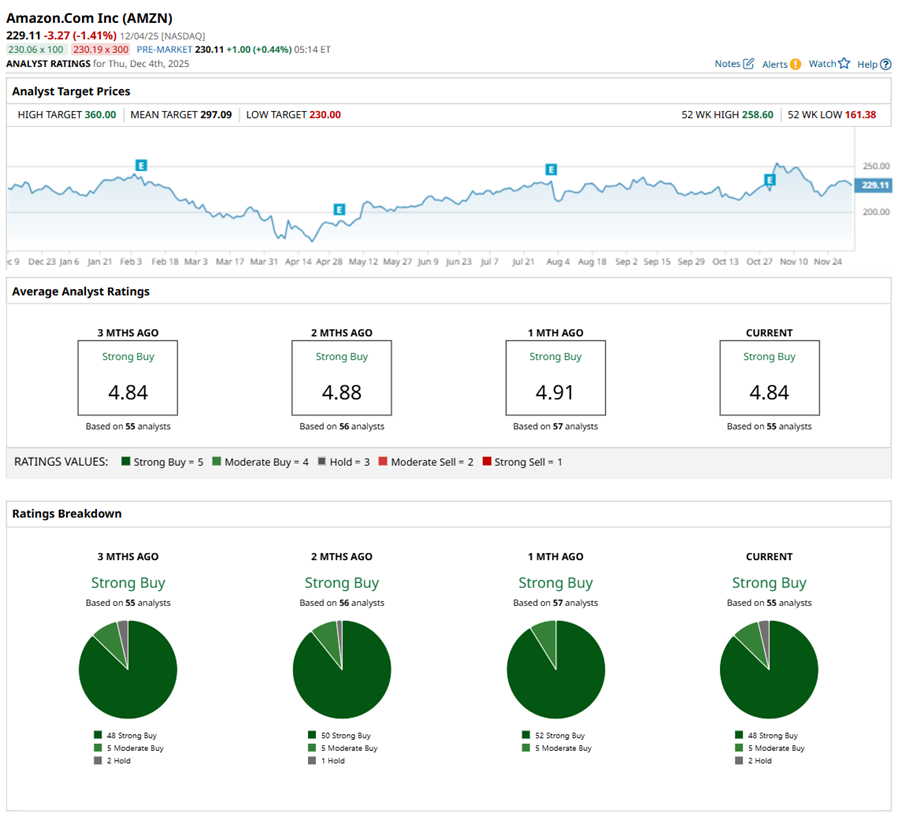

Analysts monitoring AMZN are bullish, with consensus leaning heavily toward a “Strong Buy.” Out of 55 analysts, 48 advise a “Strong Buy,” five recommend a “Moderate Buy,” and two are cautious with a “Hold” rating.

The average price target of $297.09 suggests a 29.7% upside potential from here. Meanwhile, Loop Capital’s Street-high target of $360 suggests AMZN stock could rise 57.2%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoFi Stock Breaks Below Key Moving Averages on $1.5B Offering. Should You Buy the Dip?

- Netflix Is Buying Warner Bros. Discovery. Should You Buy NFLX Stock?

- Amazon Just Released Its Graviton5 CPU. Should You Buy, Sell, or Hold AMZN Stock Here?

- Tesla, Netflix, and ON Semiconductor: 3 Unusually Active Cash-Secured Put Options to Sell Now