As 2025 draws to a close and investors look toward 2026, the AI infrastructure market is on a steep growth curve that shows no sign of flattening out. Industry forecasts peg global AI infrastructure spending at roughly $394 billion by 2030, expanding at a compound annual growth rate near 19.4% as hyperscalers and enterprises race to deploy ever more powerful chips. That kind of sustained buildout creates structural demand not just for the chips themselves, but for every link in the supply chain that keeps them working reliably at scale.

Teradyne (TER) sits squarely in that chain, supplying the semiconductor test equipment needed to validate complex AI accelerators before they ship. Stifel recently upgraded shares to “Buy,” arguing that Teradyne is set to benefit from growing AI test revenue in 2026 as next‑gen devices push test intensity higher. The question now is whether this “picks and shovels” name still has room to run, or if the Street has already priced in the opportunity. Let’s find out.

Teradyne’s Financial Snapshot

Teradyne is a Massachusetts‑based provider of semiconductor test equipment and industrial robots. Price performance has been strong, with the stock up 57% YTD and 69% over the past 52 weeks.

At a roughly $30.5 billion market cap, shares trade at 60.9x trailing earnings versus a sector median 23.91x, and 1.98x PEG versus 1.7x. Crucially, these metrics leave little room for disappointment, so sustaining upside in 2025 and 2026 becomes important.

Strategic AI Ecosystem Partnership

Teradyne’s growth story in 2026 is being shaped by where it sits in the AI manufacturing ecosystem. The company has become deeply embedded in advanced chip production, earning recognition from Taiwan Semiconductor Manufacturing Company’s (TSM) Open Innovation Platform for its work on 3D‑fabric and advanced‑node testing.

Another potential catalyst sits in the GPU and accelerator supply chain. UBS analysts now flag Teradyne as a serious contender to become a second‑source test supplier for Nvidia’s (NVDA) next‑generation Blackwell chips as Nvidia works to diversify its test and manufacturing footprint. Even a modest allocation of Blackwell‑related test volumes could move the needle because these AI accelerators are more complex and take longer to test than prior generations.

Analyst Confidence Behind TER

Wall Street’s expectations line up neatly with the idea that Teradyne is gearing up for a stronger AI‑driven test cycle. For the current quarter, the average EPS estimate sits at $1.36 versus $0.95 in the same period a year ago, implying projected EPS growth of 43.16% year over year.

For the full fiscal year, the consensus calls for EPS of $3.51 compared with $3.22 in the prior year. Those numbers suggest analysts see 2025 as a transition year.

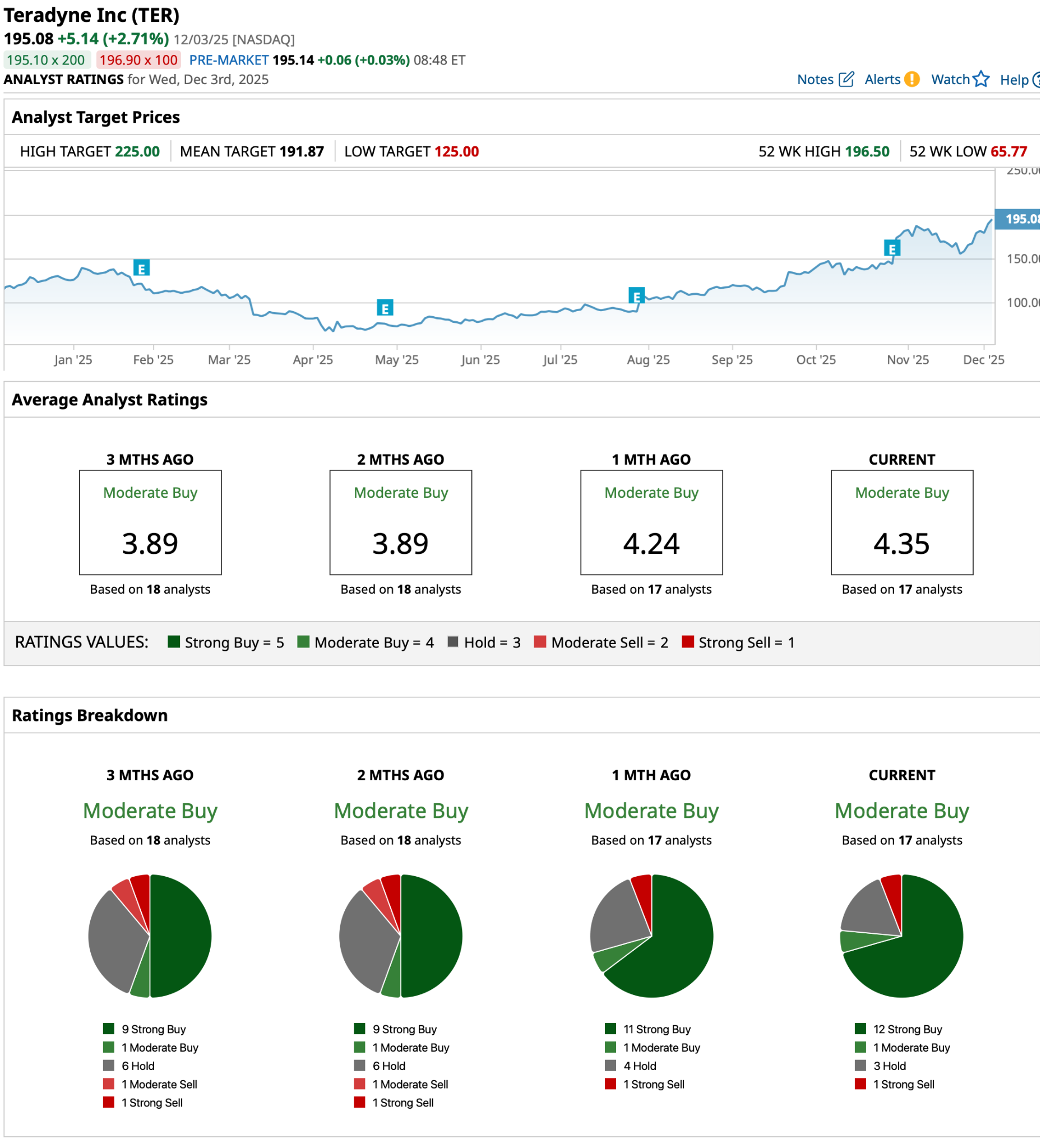

That near‑term setup feeds directly into how the Street is rating the stock. The general consensus for TER among 17 analysts is a “Moderate Buy” rating. Its average price target is $191.87, which implies downside of roughly 4% from current prices. Such a setup indicates that the stock has already run ahead of the existing target, and there is room for targets to be revised higher.

Conclusion

Teradyne looks like a classic “picks and shovels” AI name where the story and the numbers are finally starting to rhyme.

With test revenue tied to advanced chips, a growing robotics ecosystem, and upbeat earnings estimates, the setup into 2026 leans more bullish than not. Shares have already run hard, so near term, they may chop around current levels. However, over the next 12-18 months, the bias still appears tilted higher if AI test intensity keeps building and management continues to execute.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Archer Aviation Just Signed on a New Aerospace Partner. Should You Buy ACHR Stock Here?

- Stifel Says This 1 ‘Picks and Shovels’ AI Stock Is a Buy for Massive Growth in 2026

- As Trump Looks to Boost Robotics, This 1 Lesser-Known Stock Is a Strong Buy

- With Fears Swirling, IBM Says There Is No AI Bubble. Does That Make IBM Stock a Buy Here?