With a market cap of $50.3 billion, Valero Energy Corporation (VLO) is a global energy company that manufactures, markets, and sells petroleum-based and low-carbon transportation fuels and petrochemical products. Headquartered in San Antonio, Texas, it operates through Refining, Renewable Diesel, and Ethanol segments.

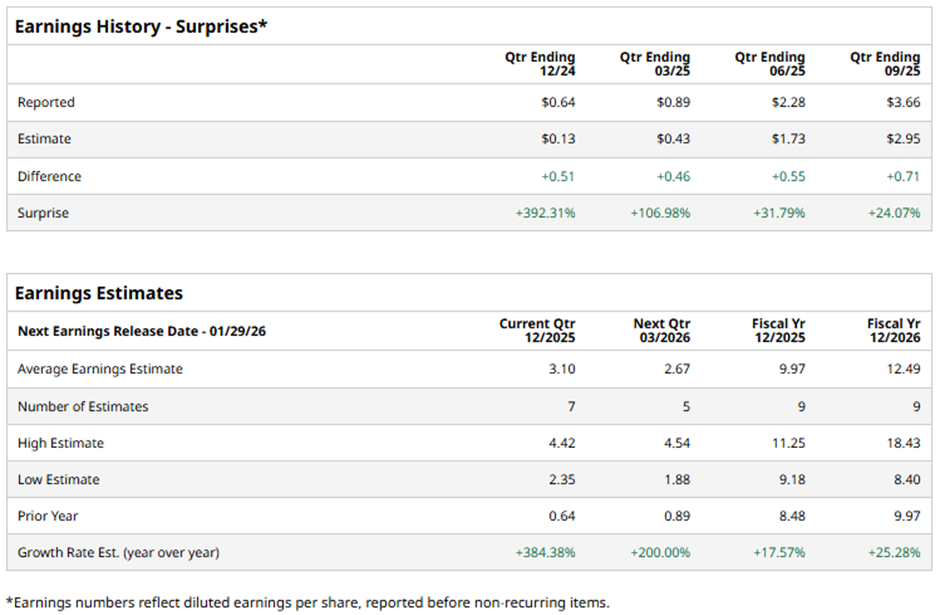

The San Antonio, Texas-based company is set to deliver its fiscal Q4 2025 results before the market opens on Thursday, Jan. 29. Ahead of this event, analysts forecast VLO to report an adjusted EPS of $3.10, a surge of 384.4% from $0.64 in the previous year's quarter. It has exceeded Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts predict Valero Energy to post adjusted EPS of $9.97, a 17.6% rise from $8.48 in fiscal 2024. Moreover, adjusted EPS is anticipated to increase 25.3% year-over-year to $12.49 in fiscal 2026.

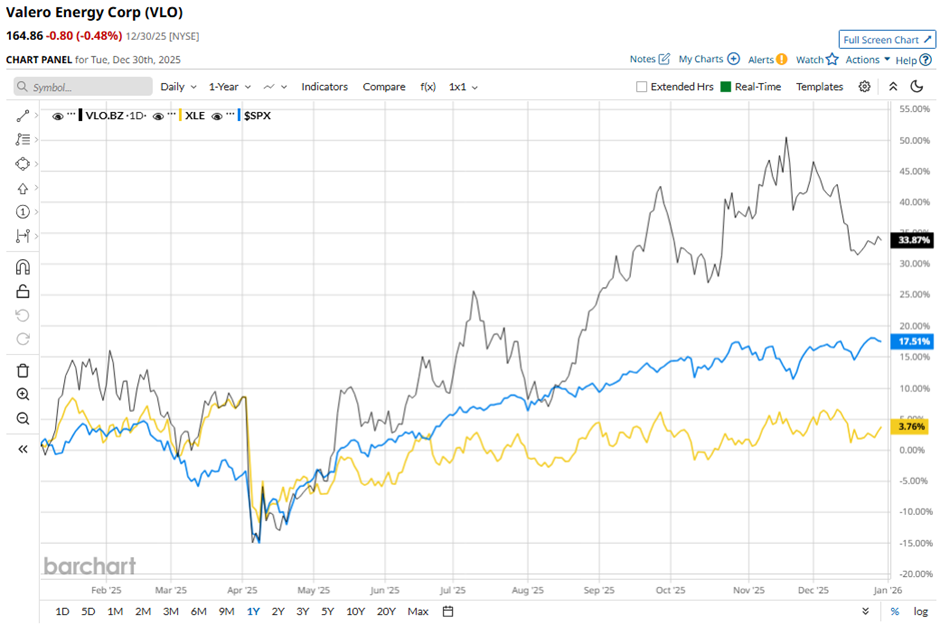

VLO stock has soared 37.9% over the past 52 weeks, outperforming the S&P 500 Index's ($SPX) 16.8% gain and the State Street Energy Select Sector SPDR ETF's (XLE) 6.4% rise over the same period.

Shares of VLO jumped nearly 7% on Oct. 23 after the company reported stronger-than-expected Q3 2025 adjusted EPS of $3.66. The company also beat revenue expectations with $32.17 billion and reported a major rebound in refining performance, including a 44% surge in refining margin per barrel to $13.14 and throughput utilization of 97%.

Analysts' consensus rating on VLO stock is moderately optimistic, with a "Moderate Buy" rating overall. Out of 20 analysts covering the stock, opinions include 12 "Strong Buys," one "Moderate Buy," and seven "Holds." The average analyst price target for Valero Energy is $186.72, suggesting a potential upside of 13.3% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart