Qnity (Q) has just started trading on the New York Stock Exchange, generating excitement among investors as a new pure-play semiconductor company. The newly independent spin-out from DuPont de Nemours (DD) brings with it over 10,000 employees in more than 80 countries, a management team that was assembled for the purpose of this spin-out, and strong margins that should continue to improve as the business sharpens its focus on the semiconductor industry.

Investors are interested in the stock as it offers them an opportunity to back a pure-play in the artificial intelligence niche, which is expected to propel the semiconductor industry to $1 trillion in revenues by 2030. Management believes its renewed focus will help the company outperform peers and grow at a faster rate than the rest of the industry. Some of the leaders that the company inherits from DuPont include Chuck Xu, vice president of the ElectronicsCo division at DuPont, who will lead the new Interconnect Solutions division, and Sang Ho Kang, also currently a VP of the ElectronicsCo division, who will lead the new Semiconductor Technologies division.

In the absence of trading data, one can only look at the fundamentals of the business to get an idea of what the company is capable of. For those who don’t know, Qnity makes materials for lithography, the process of transferring a circuit onto a silicon wafer (the chip). It also helps in managing the heat dissipated by AI chips. These are just two examples of what the company does, but they show why the company has a crucial role in the development of future AI technology. As 3D packaging, chiplets, and advanced node manufacturing become more important, the company’s products have the right environment to thrive.

And let’s not forget the most important thing: Qnity is a U.S.-based materials supplier. This geopolitical angle is crucial at a time when China and the U.S. battle for supremacy through any means, including export bans.

About Qnity Stock

Qnity provides high-performance materials and integrated solutions across the semiconductor supply chain. The company was recently spun off from DuPont and now operates as a standalone semiconductor pure-play company. It is headquartered in Delaware.

Qnity stock is trading around the $100 mark, and with only a handful of days of trading so far, there isn’t any meaningful conclusion to make about its performance. The electronics segment of DuPont that was spun off as Qnity enjoyed EBITDA margins of over 25% as per Q1 2025. Sales of this segment recently touched the $1 billion mark and were expected to grow at 14%. These metrics should now improve as the new management starts carving out the company’s future. Once Qnity reports quarterly earnings early next year, the management’s plans as well as the company’s valuation will become clearer. For now, investors only have the management’s word of “outperforming its peers.”

Another interesting aspect to note is the dividend yield. DuPont currently has a dividend yield of 4.17%. This is a healthy yield, not to mention the company has been paying out dividends regularly since 1994. Will this also be the case with Qnity? We don’t know. But if it is, early investors will be rewarded as dividend hunters flock in for a rare dividend in the semiconductor industry.

The company is also holding a business update call on Nov. 6 after the market closes, which should give interesting insights to help early investors make an informed decision.

What Do Analysts Expect From Qnity Stock?

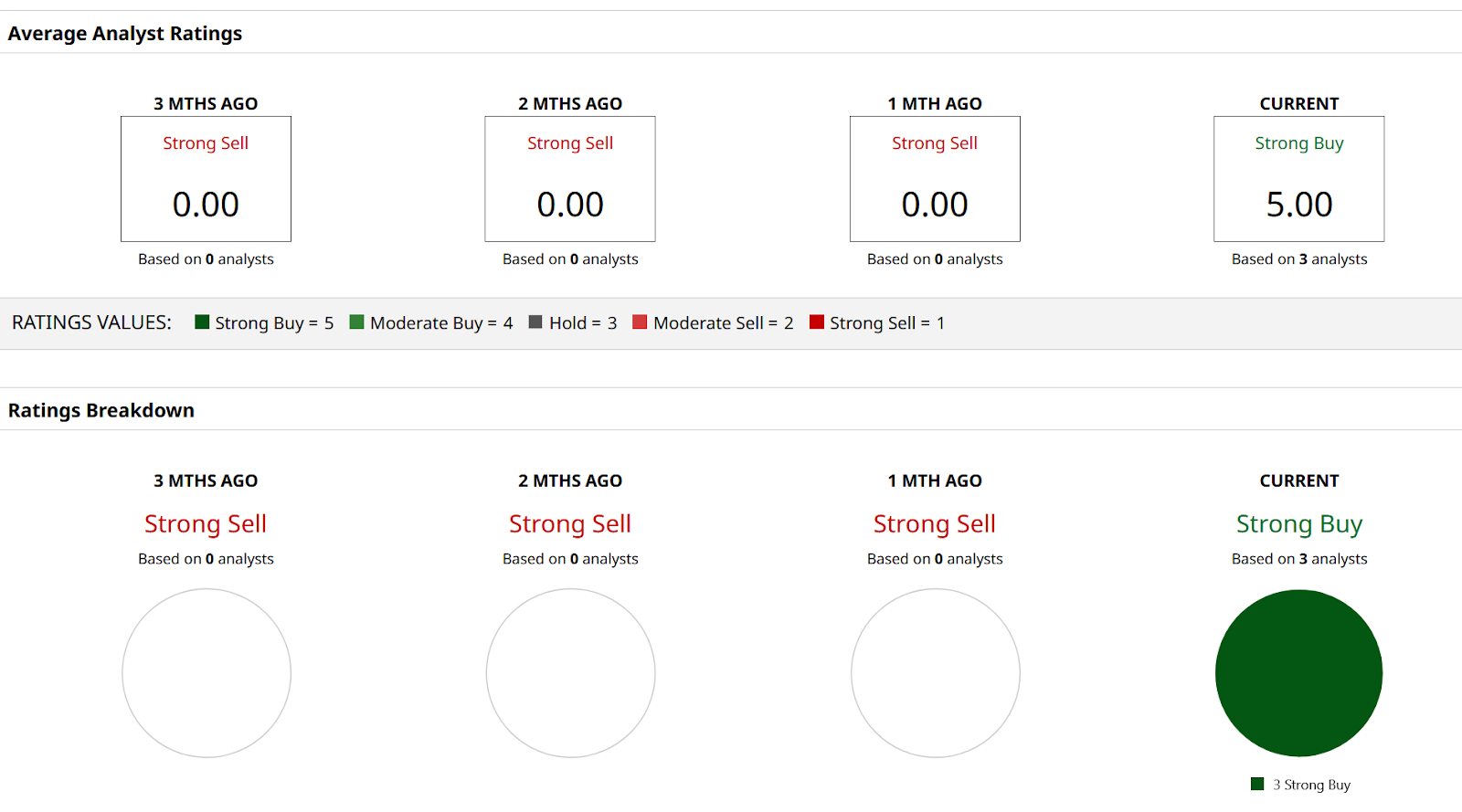

Qnity currently has 3 “Strong Buy” ratings only. Since the company operates in an industry that will be highly relevant over the next few decades, it is likely that analyst interest will increase. The stock has a target price of $110, offering 10% upside from here on.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?

- A $5.5 Billion Reason to Buy Cipher Mining Stock Here

- Tesla Faces Another Sales Hit in Europe. Should You Ditch TSLA Stock Now?