In Wednesday’s options trading, there were 1,168 unusually active options with Vol/OI (volume-to-open interest) ratios ranging from 1.35 to 138.69.

As I pondered what to write about today, my mind wandered to the iron condor strategy. Don’t ask me why? I’ve never written about or used an iron condor in an actual trade. I know someone who swears by them.

That got me thinking about income-generating strategies. I came across a Bankrate.com article about the five best strategies for doing so every month. The iron condor was one of the five.

From there, I thought, Christmas is coming. Why not use a single stock with unusually active options from yesterday’s trading to highlight these five strategies?

That led me to Lemonade (LMND), the New York-based insurtech that jumped 34% yesterday on strong quarterly earnings.

Truth be told, I haven’t followed Lemonade’s progress since the stock had its COVID moment in early 2021. Evidently, the AI-driven insurer is coming into its own.

Looking at the Q3 2025 shareholder letter, several key operating metrics jump out at me:

- Total customers increased by 24% to 2.87 million over last year.

- Premium per customer increased 4.9% to $403.

- Adjusted gross profit more than doubled to $80.9 million on $194.5 million in revenue.

- Its trailing 12-month gross loss ratio was 67%, down 10 percentage points from Q3 2024. This ratio indicates how much of the gross earned premiums it paid out in the trailing 12 months. Lower is better.

- Its net loss in the quarter was $38 million, 45% lower than a year ago, and 14% of its gross earned premiums. That’s down significantly from over 80% in Q3 2021.

Clearly, it’s getting closer to GAAP profitability. I’ll definitely keep a closer eye on LMND stock going forward.

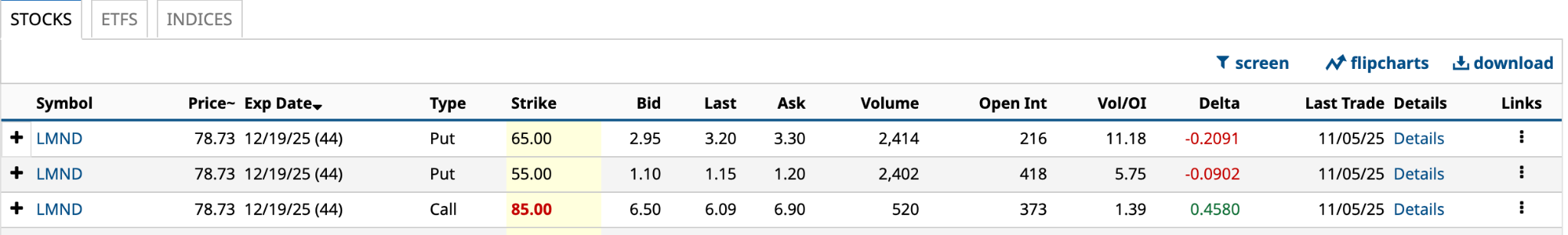

For this commentary, I’m treating Lemonade as if I’m bullish on its future. Yesterday, Lemonade had six unusually active options. These three expiring on Dec. 19 will be the foundation for these five income-generating ideas.

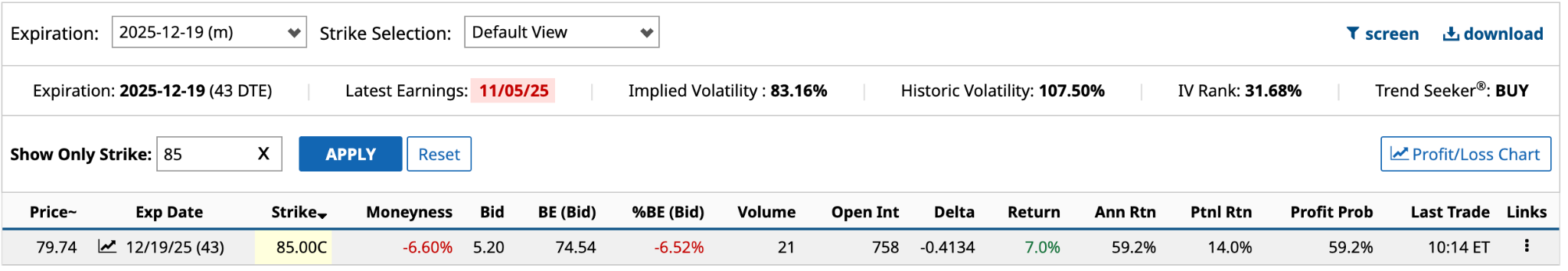

Covered Call

In this strategy, you own 100 shares of Lemonade and sell one call for premium income. With only the one call available, the $85 strike will have to do the trick. Here’s how the covered call looks today, early in trading. The premium income generated is $5.20.

With a bid price of $5.20 and a $79.74 share price, your annualized total return if the share price remains flat would be 59.2% [$5.20 bid / $85 strike - $5.20 bid * 365 days / 43 DTE]. The downside of this trade is that the expected move is $15.01 (18.82%) in either direction. It’s possible the 100 shares you own could be called away, and your profit would be capped.

With a bid price of $5.20 and a $79.74 share price, your annualized total return if the share price remains flat would be 59.2% [$5.20 bid / $85 strike - $5.20 bid * 365 days / 43 DTE]. The downside of this trade is that the expected move is $15.01 (18.82%) in either direction. It’s possible the 100 shares you own could be called away, and your profit would be capped.

So, if the share price is $85 at expiration on Dec. 19, your maximum profit would be $10.46 or 14% [$85 strike price + $5.20 bid price - $79.74 share price / $79.74 share price - $5.20 bid price]. The probability of the share price being over the $74.54 breakeven at expiration is 59.2%.

But remember, the expected move can go the other way. Assuming it did, your paper loss would be $981 [$15.01 expected move - $5.20 bid price] or 13.2%.

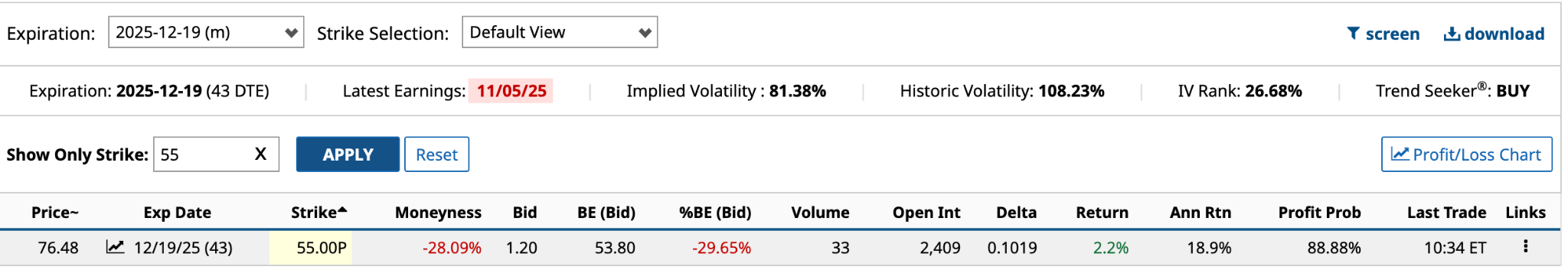

Selling Cash-Secured Puts

In this instance, you are generating income by selling cash-secured puts, which means you either have the cash in your account to buy the shares if assigned or the necessary margin to do so. If you’re bullish on Lemonade stock, it can be a good way to generate income while ultimately getting a better entry point to go long.

Yesterday, there were two unusually active puts expiring on Dec. 19 -- the $65 and $55 strikes. Here’s how the $55 put looks today.

The annualized return for the $55 strike is 18.9% [$1.20 bid price / $55 strike price * 365 / 43]. By comparison, the $65 strike’s annualized return is 40.4%, more than double.

The annualized return for the $55 strike is 18.9% [$1.20 bid price / $55 strike price * 365 / 43]. By comparison, the $65 strike’s annualized return is 40.4%, more than double.

While it’s tempting to go with the higher return, remember that the expected move is $15.01. If that were to come to fruition, you would have to buy 100 shares at $6,500 when you could buy them on the open market for $6,147.

The $55 strike offers a greater margin of safety while still acknowledging that buying 100 shares for $5,380 is a better proposition overall if you’re bullish.

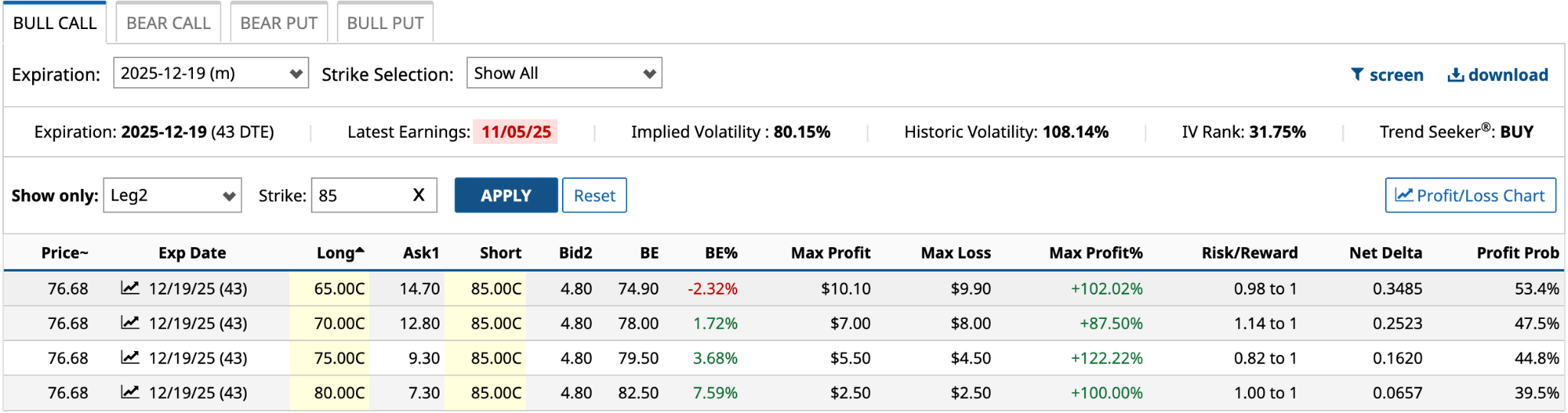

Bull Call Spread

Because I’m bullish, the bear call spread income-generating strategy doesn’t make sense in this instance. It is the bearish version of the bull call spread. A bull call spread involves buying a call option at one strike price and then selling another call at a higher strike price. They both have the same expiration date.

Since there was only the $85 call yesterday, I’ll build the bull call spread around it. With the $85 call long, in today’s trading, I get one short call with a $90 strike price. With the $85 call short, I get four long.

The key here is that the share price at expiration is above the breakeven. It is calculated as the lower strike plus the net debit or maximum loss. The highest profit probability of the four is the $65 long call at 53.4%. Given the risk/reward ratios are all about the same, I’d go with that one. However, if you don’t want such a high outlay per contract, the $75 strike could also be attractive because it’s middle-of-the-road.

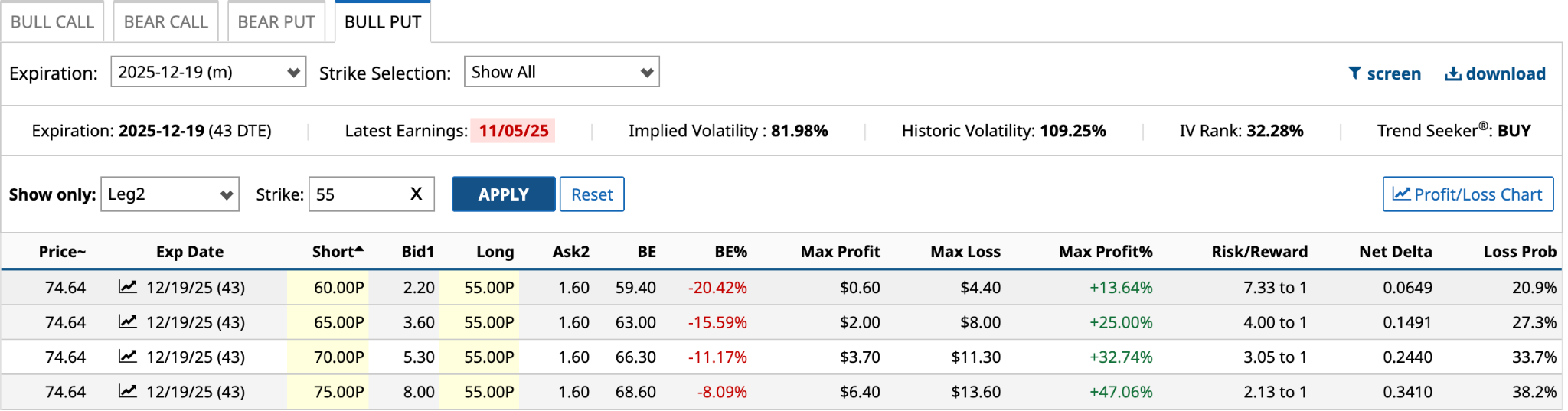

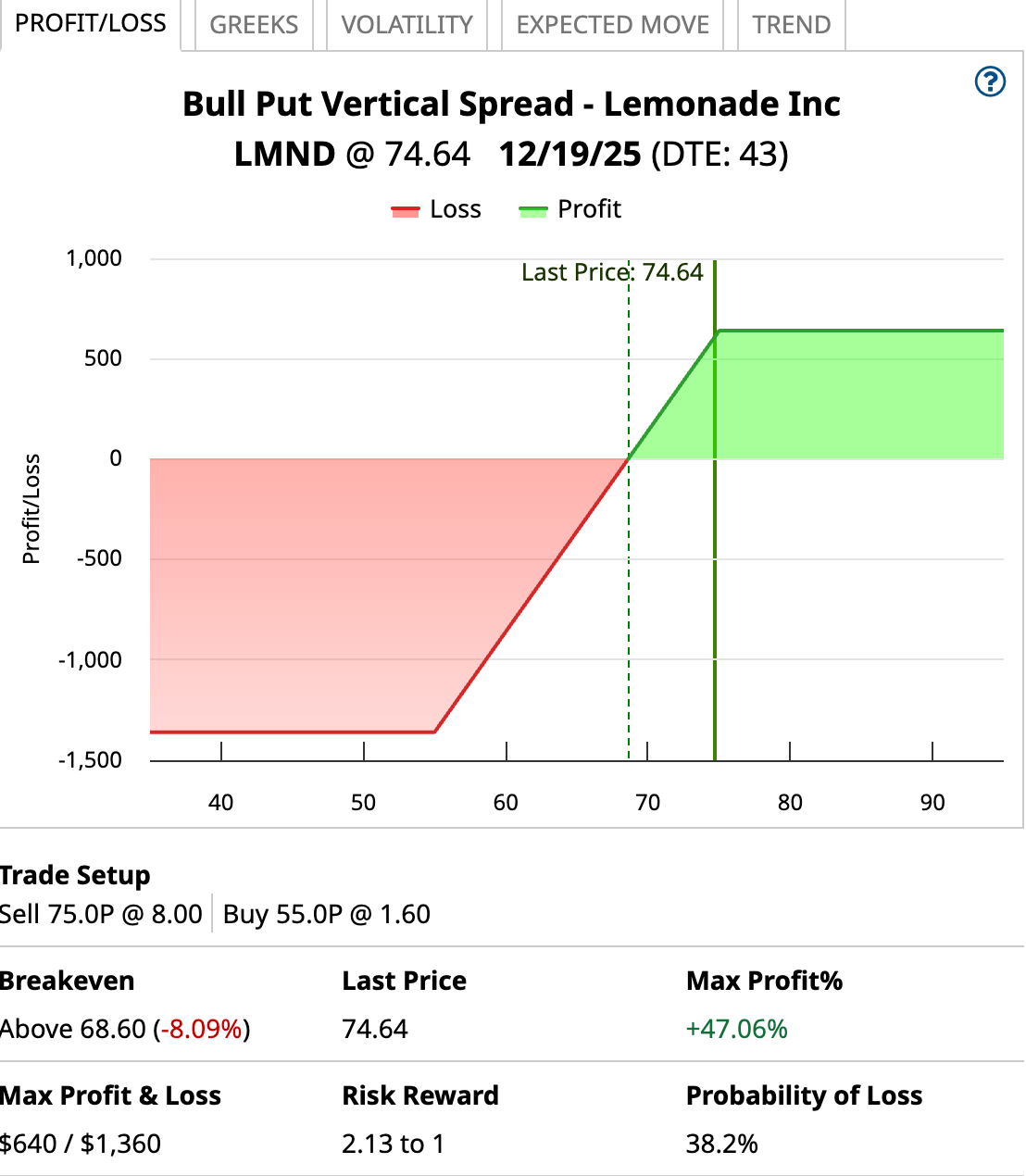

Bull Put Spread

The bull put spread is also bullish. Only in this instance, you’re selling a put option and buying a put option at a lower strike price. They both have the same expiration. Given yesterday’s two puts were $65 and $55, we’ll use both of them in combination.

Again, it’s important to remember that I’m bullish on Lemonade’s share price in the future. Therefore, a higher breakeven of $68.60 compared to the lower-priced strikes -- the share price at expiration should be higher than $68.60 -- should not be a problem.

Further, with an expected move of $15.01, hitting $75 in 43 days for a maximum profit of $640 feels realistic given its momentum. Plus, Barchart’s Technical Opinion is a strong buy right now, suggesting it should move higher in the near term.

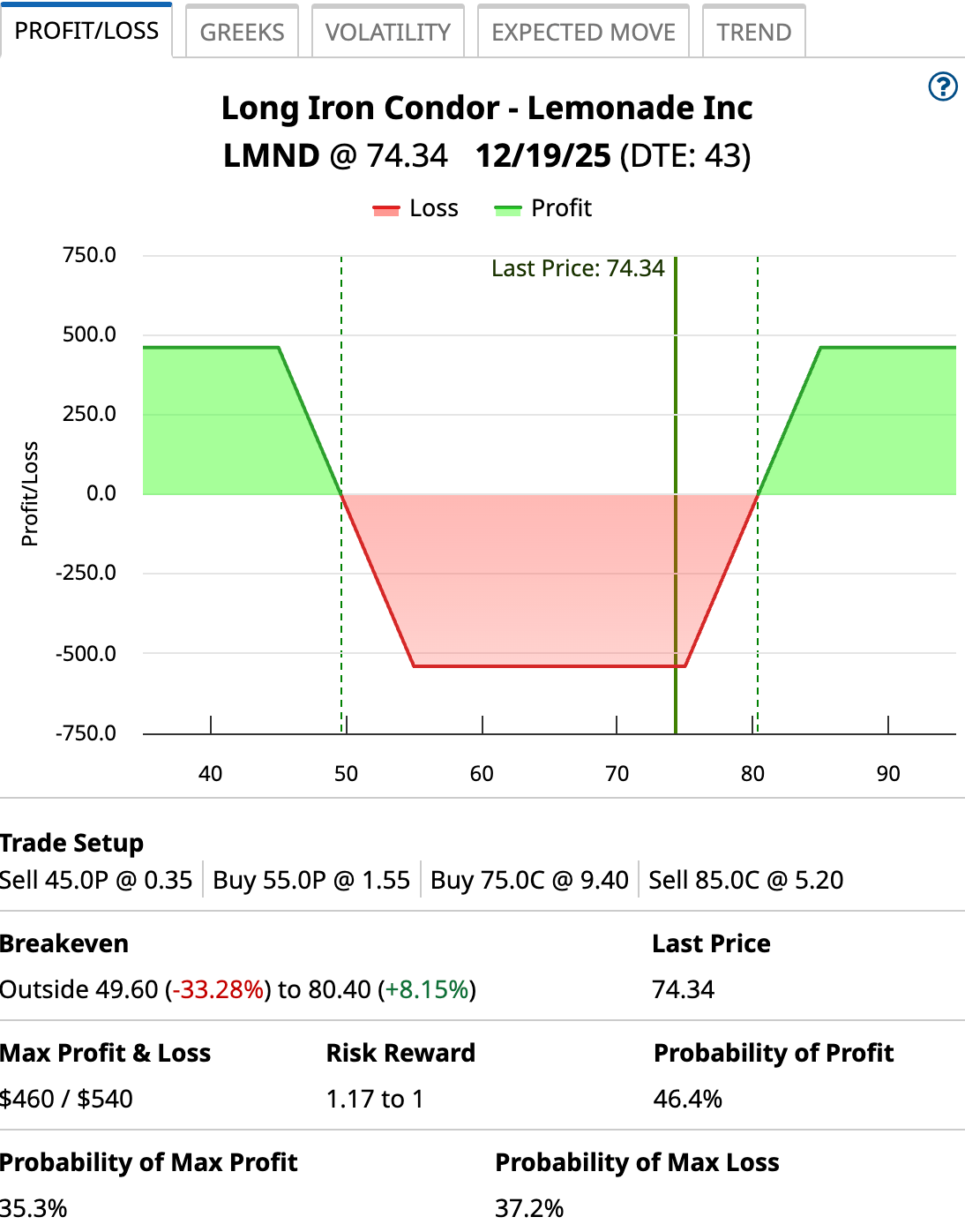

Iron Condor

Finally, I get to try my hand at an iron condor. Before I get into the specifics of what it is, there is both a short and a long iron condor. The former expects the share price to remain in a tight range with low volatility, while the latter expects volatility to increase.

Given I’ve been hinting that the expected move higher is possible, the short iron condor isn’t a consideration in this situation.

The long iron condor involves selling a put option, buying a put option, buying a call option, and selling a call option, all at consecutively higher strike prices. It combines a bear put spread and a bull call spread.

After looking at the $55 put, $65 put, and $85 call in the first, second, third and even fourth legs, I’m going with the $85 call in the fourth leg as follows:

We’ve got a short $45 put, a long $55 put, a long $75 call, and the $85 short call. So, you’re generating income from the short $45 put and short $85 call.

The net debit and maximum loss are $540 [long $55 put ask price $1.55 + long $75 call ask price $9.40 - short $45 put bid price $0.35 - short $85 call bid price $5.20]. The maximum profit is $460 [$85 call - $75 call - $5.40 net debit].

I chose the $85 call in the fourth leg because it’s not too expensive, the probability of profit is decent, and the likelihood of the share price being above the breakeven price of $80.40 is good. It’s unlikely that the downside will come into play over the next six weeks.

As most options sites will tell you, the iron condor takes time to get comfortable with. I’ll definitely be going to school over the next few weeks to be in this camp in the future.

Good luck.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Lemonade Options Showing Unusual Activity—Potential for Holiday Income?

- CAT Stock May Not Have 9 Lives. Here’s My Favorite Way to Trade Caterpillar with Options Here.

- Dutch Bros Beat Earnings But the Real Story Behind BROS Stock is the Hidden Arbitrage Trade

- Walmart Earnings: Bull Put Spread Trade