With a market cap of $1.1 trillion, Berkshire Hathaway Inc. (BRK.B) is a diversified multinational conglomerate with operations spanning insurance, freight rail transportation, utilities, energy, manufacturing, and retail. The company engages in industries ranging from energy generation and industrial manufacturing to consumer goods, financial services, and retail operations.

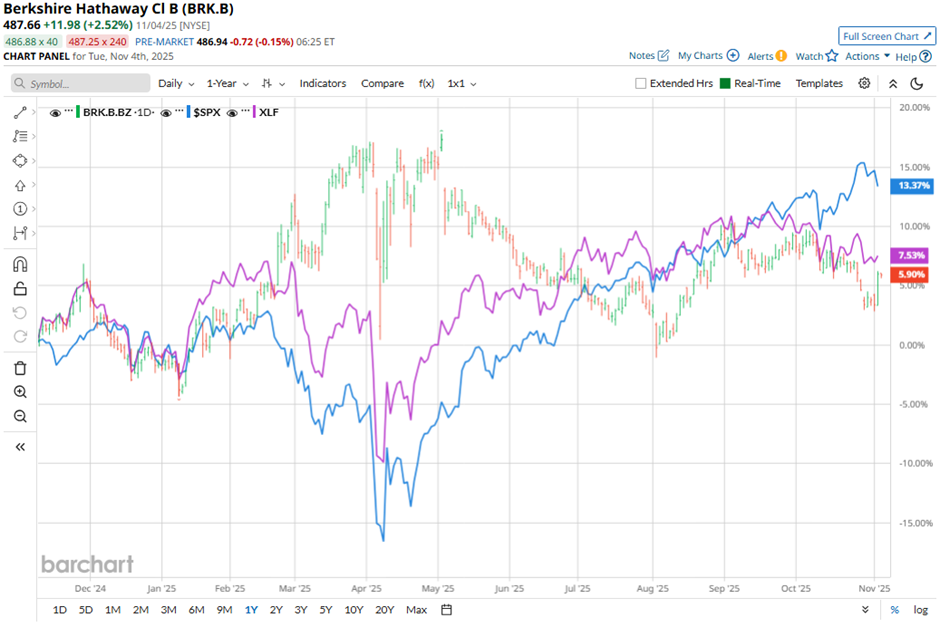

The Omaha, Nebraska-based company's shares have lagged behind the broader market over the past 52 weeks. BRK.B stock has risen 10.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 18.5%. Moreover, shares of the company are up 7.6% on a YTD basis, compared to SPX’s 15.1% gain.

In addition, shares of Berkshire Hathaway have also underperformed the Financial Select Sector SPDR Fund’s (XLF) 13.3% return over the past 52 weeks.

BRK.B released its Q3 2025 results on Nov. 1, reporting a 33.6% year-over-year jump in operating earnings to $13.49 billion, driven by strong performance in its insurance underwriting segment, which more than tripled earnings to $2.37 billion. Overall net earnings rose 17.3% year-over-year to $30.8 billion, while the company’s cash pile hit a record $381.67 billion amid no share buybacks.

For the current fiscal year, ending in December 2025, analysts expect Berkshire Hathaway’s EPS to drop 6% year-over-year to $20.68. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

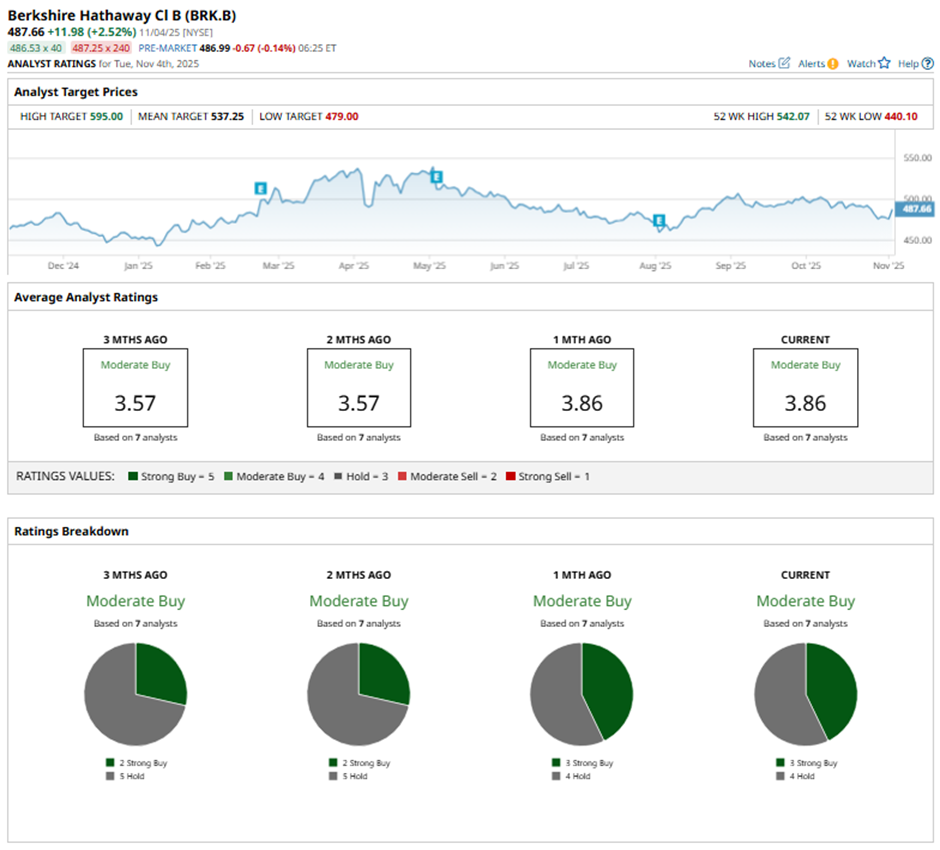

Among the seven analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on three “Strong Buy” ratings and four “Holds.”

This configuration is slightly more bullish than it was three months ago, when BRK.B had two “Strong Buys” in total.

On Nov. 3, UBS raised its price target on Berkshire Hathaway to $595 and maintained a “Buy” rating.

The mean price target of $537.25 represents a 10.2% premium to BRK.B’s current price levels. The Street-high price target of $595 suggests a 22% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart