Denver, Colorado-based Palantir Technologies Inc. (PLTR) builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations. It also provides software platforms that offer identification of hidden patterns and deployment of software in different environments for commercial purposes. With a market cap of $449.8 billion, Palantir’s operations span North America, the U.K., and internationally.

The tech giant has significantly outperformed the broader market over the past year. PLTR stock has soared 162.9% on a YTD basis and skyrocketed 342.5% over the past 52 weeks, notably outperforming the S&P 500 Index’s ($SPX) 17.2% gains on a YTD basis and 18.1% surge over the past year.

Narrowing the focus, Palantir has also outpaced the SPDR S&P Software & Services ETF’s (XSW) 4.7% gains on a YTD basis and 16.2% returns over the past year.

Palantir Technologies’ stock prices gained 7.9% in the trading session following the release of its expectations-crushing Q2 results on Aug. 4. The company has continued to observe a robust momentum and solid growth in the demand for its AI products and platforms. During the quarter, its U.S. commercial revenue grew 93% year-over-year to $306 million, while U.S. government revenues surged by 53% to $426 million. Overall, its topline grew 48% year-over-year, reaching $1 billion, 7% above the Street’s expectations. Meanwhile, its adjusted EPS soared 77.8% year-over-year to $0.16, beating the consensus estimates by a large margin.

For the full fiscal 2025, ending in December, analysts expect PLTR to deliver a 462.5% year-on-year growth in adjusted earnings to $0.45 per share. The company has a mixed earnings surprise history. While it has missed the Street’s bottom-line estimates twice over the past four quarters, it has matched or surpassed the projections on two other occasions.

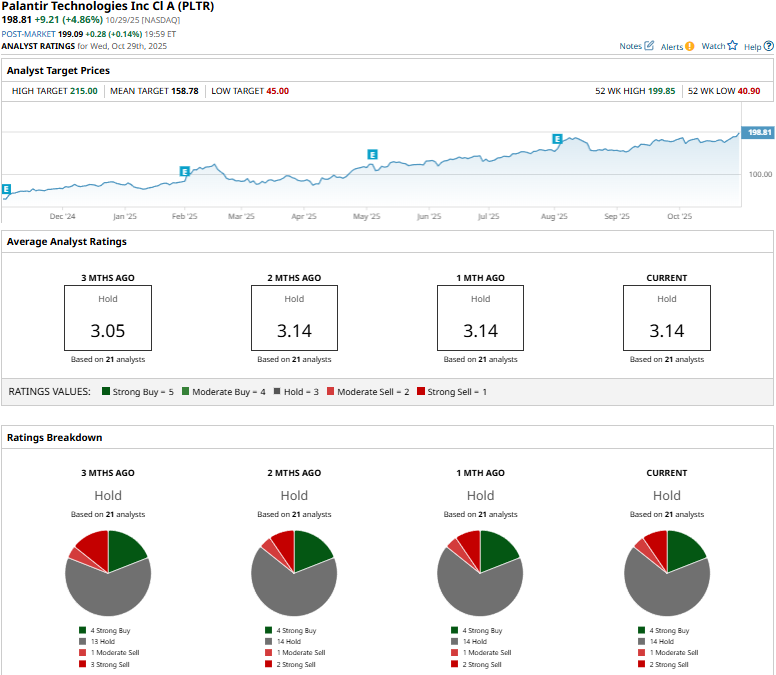

However, analysts remain cautious about the stock’s prospects. PLTR has a consensus “Hold” rating overall. Of the 21 analysts covering the stock, opinions include four “Strong Buys,” 14 “Holds,” one “Moderate Sell,” and two “Strong Sells.”

This configuration is marginally more optimistic than three months ago, when three analysts gave “Strong Sell” ratings.

On Oct. 28, Citigroup (C) analyst Tyler Radke maintained a “Neutral” rating on PLTR and raised the price target from $177 to $190.

As of writing, PLTR is trading above its mean price target of $158.78. While its street-high target of $215 suggests an 8.1% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart