One of the cornerstone trading strategies employed in the POWR Options program is a pairs trade. This involves taking a bullish stance on a stock you expect to outperform and a bearish position on a similar stock that is expected to be an underperformer. The pairs trade was first used by Alfred Jones in the early 1950s. His classic example was buying GM and shorting Ford. It has come a long way since then.

Instead of buying the stock you expect to outperform, POWR Options buys a bullish call option. Similarly, instead of shorting the stock that you feel is going to underperform, one would buy a bearish put option. This use of options in place of stock is much more affordable at trade inception, as we will see later. It also defines the risk to the overall combined premium paid.

A quick walk through a recently closed out trade in the Technology sector may help shed some light on the process.

Ratings

HP Inc was a B (Buy) Rated stock in the POWR Ratings while Western Digital had a D (Sell) Rating. HP Inc. was ranked 16 out of 36 in the Technology-Hardware Industry while Western Digital came in at the low end with a ranking of 33 out of 36 in the same industry.

Comparative Performance

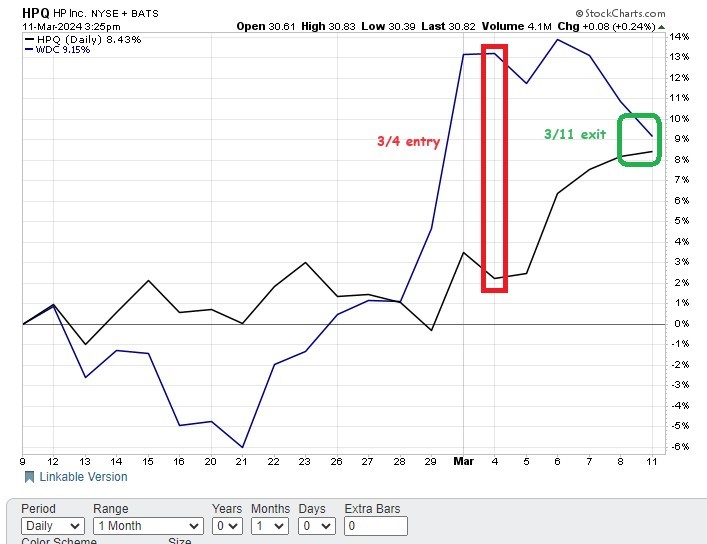

HP Inc (HPQ) and Western Digital (WDC) were fairly highly correlated over the prior two years until the beginning of 2024. Since the beginning of the year, however, much lower rated WDC has far outpaced the higher rated HPQ with a gain of over 25% compared to a loss of nearly 5% for HPQ so far this year.

Valuation

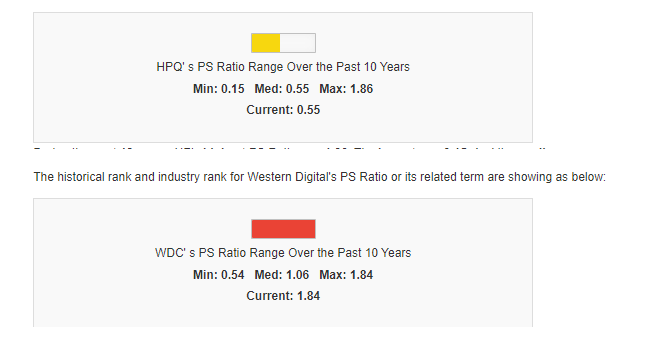

HP Inc (HPQ) had a Price to Sales (P/S) ratio of 0.55x which was right at the median for the past decade.

Western Digital (WDC) was trading at the highest Price/Sales (P/S) ratio in the past decade at over 1.8x. That was more than triple the valuation of HPQ on a P/S basis.

All this sets up ideally for a POWR Pairs trade. Buying bullish calls on HPQ and bearish puts on WDC. The expectation was for the comparative performance spread to revert. The much higher rated and attractively valued HP Inc. starting to outperform the much lower rated and less attractively valued Western Digital.

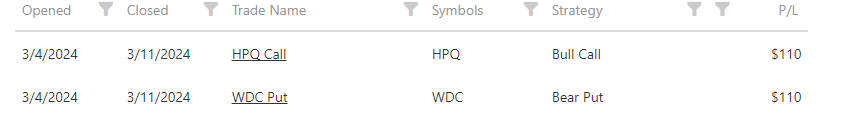

POWR Options entered into HPQ 7/19 $28 calls @ $2.50 per contract and the WDC 7/19 $62.50 puts @ $4.50 per contract on March 4. Total cost $700 per pair. Compare that to buying 100 shares of HPQ at $29 and shorting 100 shares of WDC at $65. Cost of that pairs trade would be $4700-and that is being fully margined($1450 for buying 100 HPQ and $3250 for shorting 100 WDC ).

Fast forward a week later and the comparative performance had reverted substantially.

HPQ gained almost 5% while WDC dropped by 4% since March 4. The comparative performance spread narrowed as shown in the chart below.

This reversion led to a quick close out of the pairs trade. Exited the combined trade a week later on March 11 for a $110 profit on the calls and an identical $110 profit on the puts for a total gain of $220. Made money on both the long calls and the long puts.

Nice percentage gain of 31.42% ($220/$700) on the pairs trade in just 7 days. Not bad for a fairly neutral position at trade inception. The gain on using the stock instead of the options would have been about $186 on HPQ and $290 on WDC. Total gain would be $476, but only about 10% given the much higher initial cost of using the stock. The use of options instead of stock meant that you could have tripled the percentage gain.

Not every POWR Pairs trade works out this well-or this quickly. Trading is all about probability and not certainty.

But the POWR Pairs performance is definitely positive over the nearly 2 ½ years since POWR Options first launched.

POWR Options

What To Do Next?

If you're looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

HPQ shares . Year-to-date, HPQ has gained 2.28%, versus a 8.72% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

The post How To Combine The Power Of Options And The POWR Ratings To Produce A POWR Pair Trade appeared first on StockNews.com