Poor Bitcoin! It's back at $25,000 this morning, giving up all its gains since 2020 but, much, much worse, Crypto-Lender, Celsius, told users Sunday night that it is pausing all withdrawals, swaps, and transfers between accounts due to “ extreme market conditions .” This is why crypto is BS – you can't count on the " bank " to give you your money … Celsius lends out customer deposits to other users to earn a return. The firm managed $11.8 billion in assets as of May 17, according to its website. It offers users annual percentage yields of up to 18.63% on cryptocurrency deposits. The company said it has 1.7 million users. Celsius raised $750 million in funding late last year from investors including Canadian pension fund Caisse de dépôt et placement du Québec. The short story is that a Dollar, with all of it's Government-backing and inherent deposit protections, is worth MORE than crytocurrencies – not thousands of times less. Until that balances out – be very wary of empty promises and unrealistic expectations in that space. On the whole, Cryptocurrencies are back to about $1Tn, half of where they peaked but still – try to buy a large quantity of Gold with Crypto and see how that goes. Gold and Silver, meanwhile, have also been disappointing meaning what? NOTHING is an inflation-hedge these days? Why is gold not over $2,000 an ounce with the cost of living 10% higher than it was last year, when gold was hovering around $1,800? The answer to that is what's also ailing Crypto as well as stocks and what's also holding up the Bond Market (which should be doing worse) and that's the price of the US Dollar relative to, well, everything, as it tests highs not seen since since 2002: The Dollar is up 15% since last year and, if not for that, inflation would be much, MUCH worse from the US perspective (it is much worse to the rest of the World) and Gold, priced in Euros (or pretty much any othe currency) is already breaking over it's 2020 highs . The S&P 500, priced in …

Poor Bitcoin!

Poor Bitcoin!

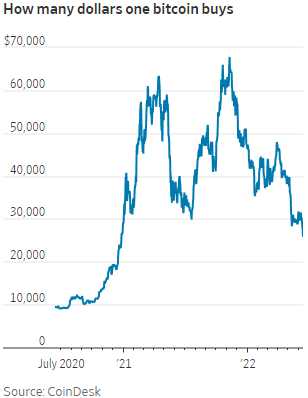

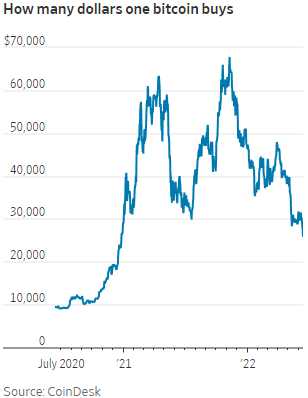

It's back at $25,000 this morning, giving up all its gains since 2020 but, much, much worse, Crypto-Lender, Celsius, told users Sunday night that it is pausing all withdrawals, swaps, and transfers between accounts due to “extreme market conditions.” This is why crypto is BS – you can't count on the "bank" to give you your money…

Celsius lends out customer deposits to other users to earn a return. The firm managed $11.8 billion in assets as of May 17, according to its website. It offers users annual percentage yields of up to 18.63% on cryptocurrency deposits. The company said it has 1.7 million users. Celsius raised $750 million in funding late last year from investors including Canadian pension fund Caisse de dépôt et placement du Québec.

The short story is that a Dollar, with all of it's Government-backing and inherent deposit protections, is worth MORE than crytocurrencies – not thousands of times less. Until that balances out – be very wary of empty promises and unrealistic expectations in that space. On the whole, Cryptocurrencies are back to about $1Tn, half of where they peaked but still – try to buy a large quantity of Gold with Crypto and see how that goes.

Gold and Silver, meanwhile, have also been disappointing meaning what? NOTHING is an inflation-hedge these days? Why is gold not over $2,000 an ounce with the cost of living 10% higher than it was last year, when gold was hovering around $1,800?

Gold and Silver, meanwhile, have also been disappointing meaning what? NOTHING is an inflation-hedge these days? Why is gold not over $2,000 an ounce with the cost of living 10% higher than it was last year, when gold was hovering around $1,800?

The answer to that is what's also ailing Crypto as well as stocks and what's also holding up the Bond Market (which should be doing worse) and that's the price of the US Dollar relative to, well, everything, as it tests highs not seen since since 2002:

The Dollar is up 15% since last year and, if not for that, inflation would be much, MUCH worse from the US perspective (it is much worse to the rest of the World) and Gold, priced in Euros (or pretty much any othe currency) is already breaking over it's 2020 highs.

The S&P 500, priced in…

Poor Bitcoin!

Poor Bitcoin!  Gold and Silver, meanwhile, have also been disappointing meaning what? NOTHING is an inflation-hedge these days? Why is gold not over $2,000 an ounce with the cost of living 10% higher than it was last year, when gold was hovering around $1,800?

Gold and Silver, meanwhile, have also been disappointing meaning what? NOTHING is an inflation-hedge these days? Why is gold not over $2,000 an ounce with the cost of living 10% higher than it was last year, when gold was hovering around $1,800?