AAR has been on fire lately. In the past six months alone, the company’s stock price has rocketed 60.9%, reaching $115.46 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy AIR? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does AAR Spark Debate?

The first third-party MRO approved by the FAA for Safety Management System Requirements, AAR (NYSE: AIR) is a provider of aircraft maintenance services

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, AAR grew its sales at an impressive 10.8% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

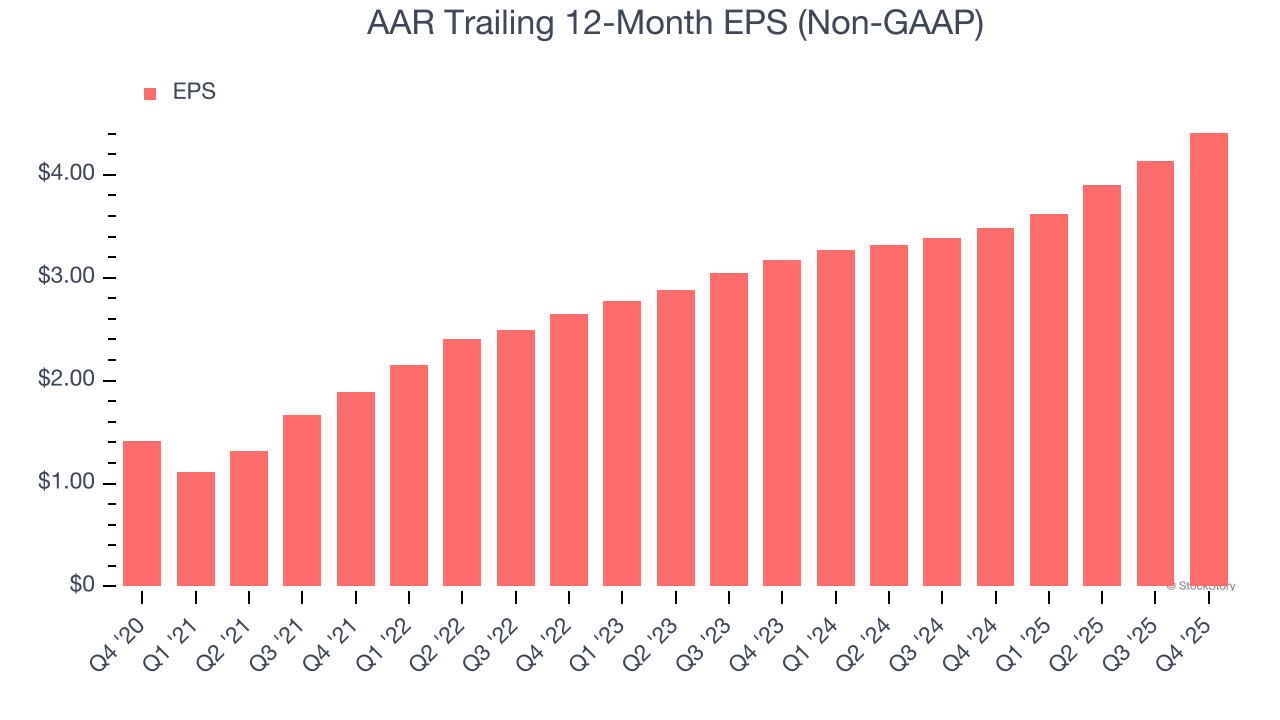

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

AAR’s EPS grew at an astounding 25.6% compounded annual growth rate over the last five years, higher than its 10.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Breakeven Free Cash Flow Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

AAR broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Final Judgment

AAR’s positive characteristics outweigh the negatives, and with the recent rally, the stock trades at 22.6× forward P/E (or $115.46 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than AAR

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.