Medical technology company Integer Holdings (NYSE: ITGR) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 5% year on year to $472.1 million. The company expects the full year’s revenue to be around $1.85 billion, close to analysts’ estimates. Its non-GAAP profit of $1.76 per share was 3.6% above analysts’ consensus estimates.

Is now the time to buy Integer Holdings? Find out by accessing our full research report, it’s free.

Integer Holdings (ITGR) Q4 CY2025 Highlights:

- Revenue: $472.1 million vs analyst estimates of $462.7 million (5% year-on-year growth, 2% beat)

- Adjusted EPS: $1.76 vs analyst estimates of $1.70 (3.6% beat)

- Adjusted EBITDA: $91.6 million vs analyst estimates of $104.2 million (19.4% margin, 12.1% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $6.54 at the midpoint, beating analyst estimates by 3.8%

- EBITDA guidance for the upcoming financial year 2026 is $402.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 11.8%, in line with the same quarter last year

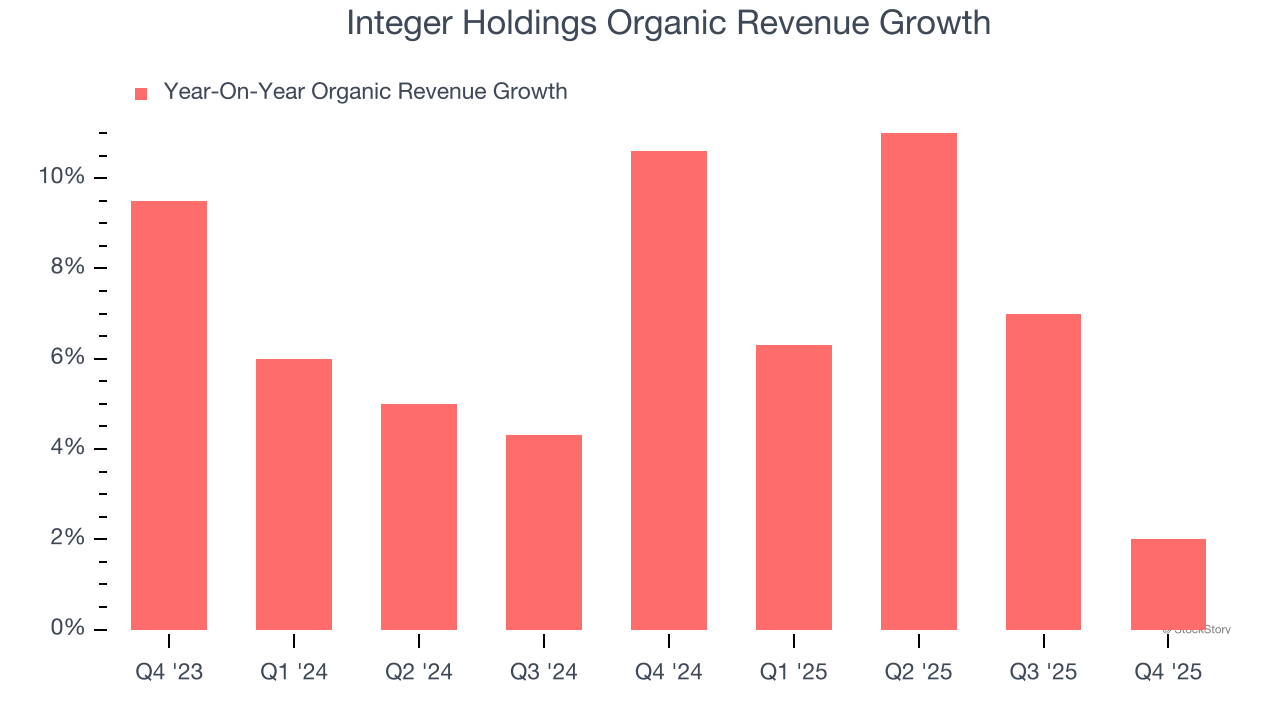

- Organic Revenue rose 2% year on year (beat)

- Market Capitalization: $3.03 billion

“Integer delivered strong performance in 2025, achieving 8% sales growth, 13% adjusted operating income growth, and a 21% increase in adjusted EPS. We have tightened the 2026 outlook range around the midpoint of our preliminary outlook provided last October and continue to expect solid underlying growth to be partially offset by select new product headwinds,” said Payman Khales, Integer’s president and CEO.

Company Overview

With its name reflecting the mathematical term for "whole" or "complete," Integer Holdings (NYSE: ITGR) is a medical device outsource manufacturer that produces components and systems for cardiac, vascular, neurological, and other medical applications.

Revenue Growth

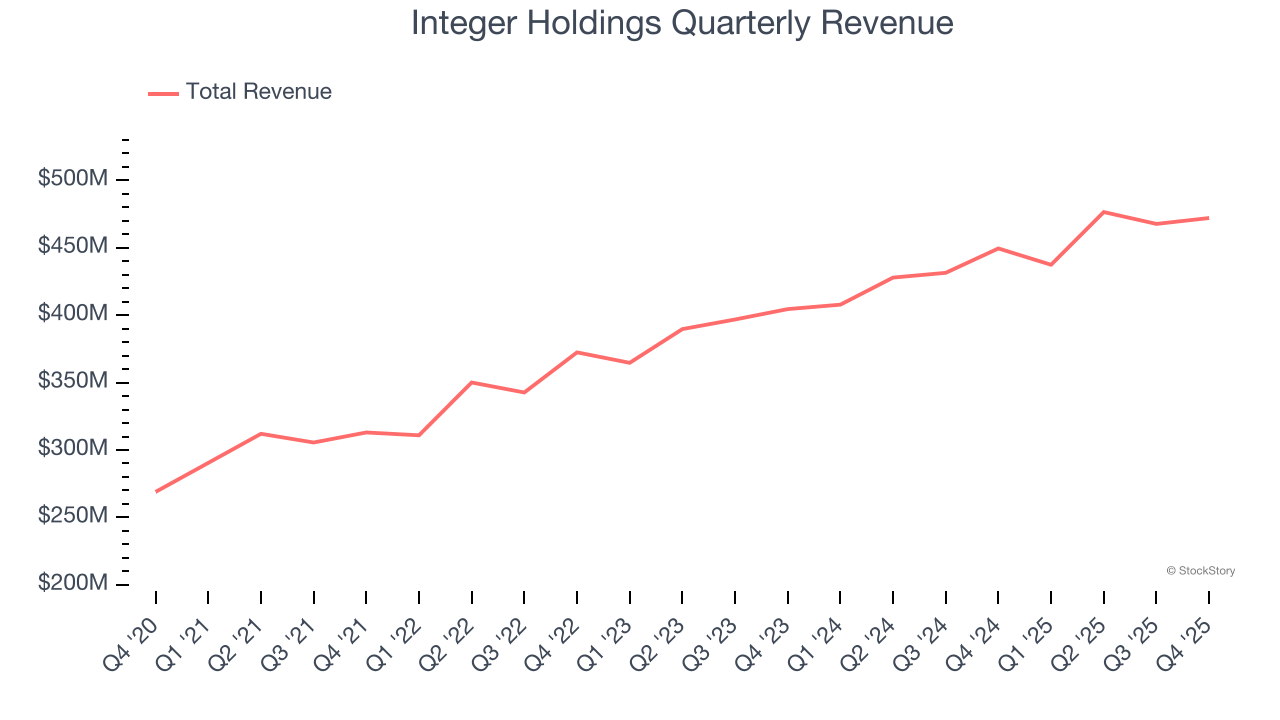

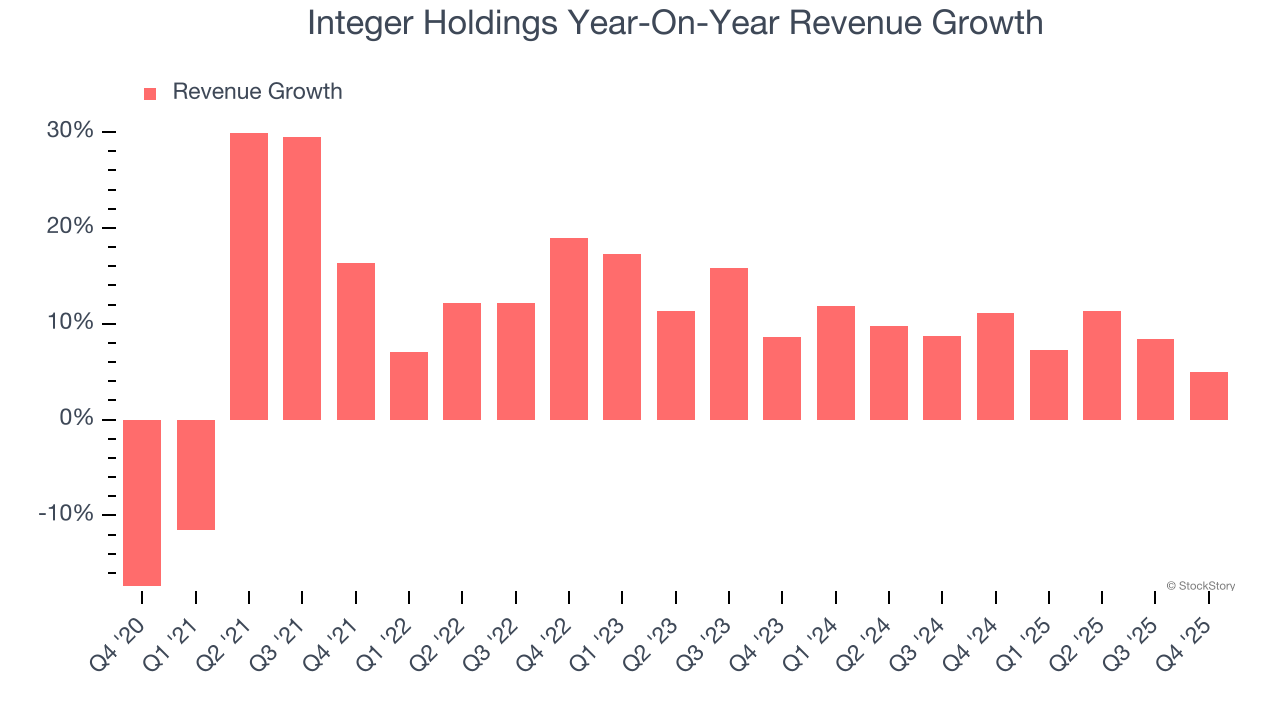

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Integer Holdings grew its sales at a decent 11.5% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Integer Holdings’s annualized revenue growth of 9.2% over the last two years is below its five-year trend, but we still think the results were respectable.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Integer Holdings’s organic revenue averaged 6.5% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Integer Holdings reported year-on-year revenue growth of 5%, and its $472.1 million of revenue exceeded Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

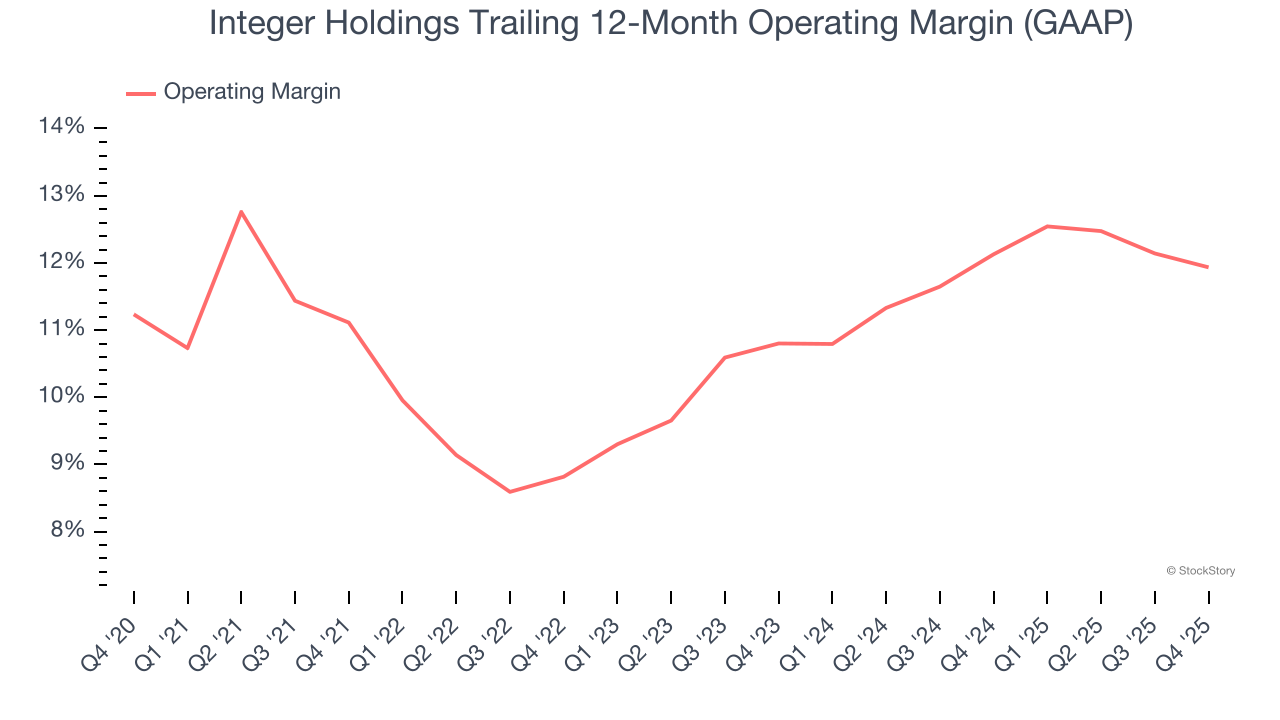

Operating Margin

Integer Holdings’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 11.1% over the last five years. This profitability was higher than the broader healthcare sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, Integer Holdings’s operating margin of 11.9% for the trailing 12 months may be around the same as five years ago, but it has increased by 1.1 percentage points over the last two years.

This quarter, Integer Holdings generated an operating margin profit margin of 11.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

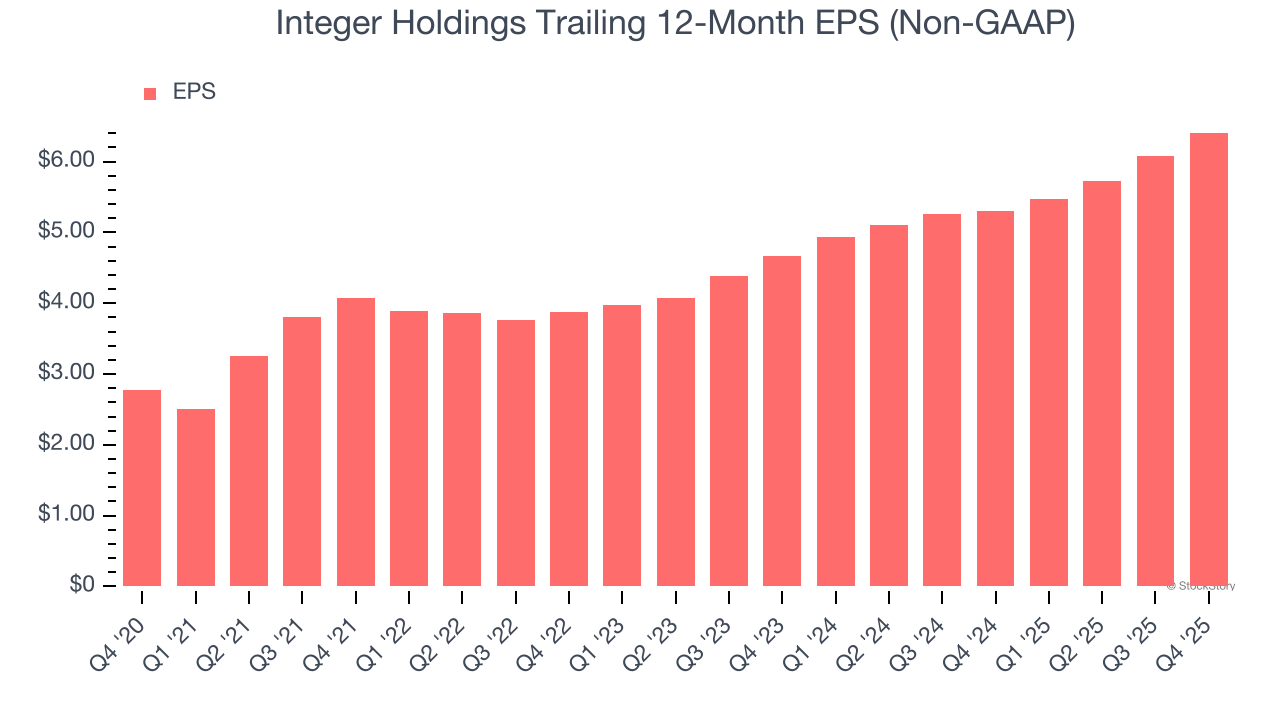

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Integer Holdings’s EPS grew at an astounding 18.2% compounded annual growth rate over the last five years, higher than its 11.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Integer Holdings reported adjusted EPS of $1.76, up from $1.43 in the same quarter last year. This print beat analysts’ estimates by 3.6%. Over the next 12 months, Wall Street expects Integer Holdings’s full-year EPS of $6.41 to shrink by 2.2%.

Key Takeaways from Integer Holdings’s Q4 Results

We enjoyed seeing Integer Holdings beat analysts’ full-year EPS guidance expectations this quarter. We were also glad its organic revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 8.3% to $93.68 immediately following the results.

Integer Holdings had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).