Regional banking company First Financial Bancorp (NASDAQ: FFBC) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 6.5% year on year to $238.8 million. Its GAAP profit of $0.64 per share was 4% below analysts’ consensus estimates.

Is now the time to buy First Financial Bancorp? Find out by accessing our full research report, it’s free.

First Financial Bancorp (FFBC) Q4 CY2025 Highlights:

- Net Interest Income: $174 million vs analyst estimates of $170.8 million (12.7% year-on-year growth, 1.9% beat)

- Net Interest Margin: 4% vs analyst estimates of 4% (2.1 basis point beat)

- Revenue: $238.8 million vs analyst estimates of $246.4 million (6.5% year-on-year growth, 3.1% miss)

- Efficiency Ratio: 62.6% vs analyst estimates of 59.6% (300 basis point miss)

- EPS (GAAP): $0.64 vs analyst expectations of $0.67 (4% miss)

- Tangible Book Value per Share: $15.74 vs analyst estimates of $15.57 (9.8% year-on-year growth, 1.1% beat)

- Market Capitalization: $2.69 billion

Archie Brown, President and CEO, commented on the quarter, "I am very pleased with our record earnings performance for the fourth quarter. Adjusted(1) earnings per share were $0.80, leading to an adjusted(1) return on assets of 1.52%, an adjusted(1) return on tangible common equity ratio of 20.3%. The net interest margin, which declined slightly from the third quarter, has proven resilient as the reduction in funding costs negated most of the impact of short term rate reductions. Balance sheet trends were solid for the quarter with loan growth of 4% on an annualized basis and total average deposits increasing by approximately 7% on an annualized basis, excluding the impact from the Westfield acquisition.

Company Overview

Tracing its roots back to 1863 during the Civil War era, First Financial Bancorp (NASDAQ: FFBC) is a bank holding company that provides commercial banking, lending, deposit services, and wealth management to individuals and businesses.

Sales Growth

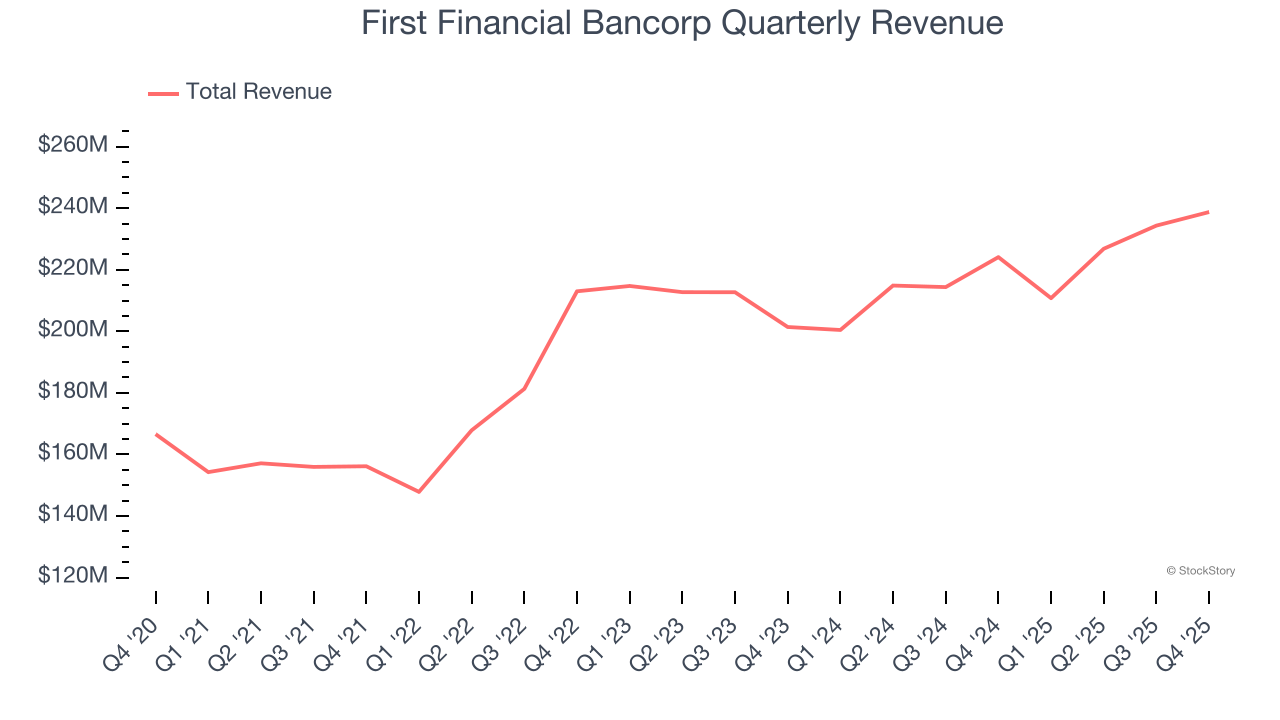

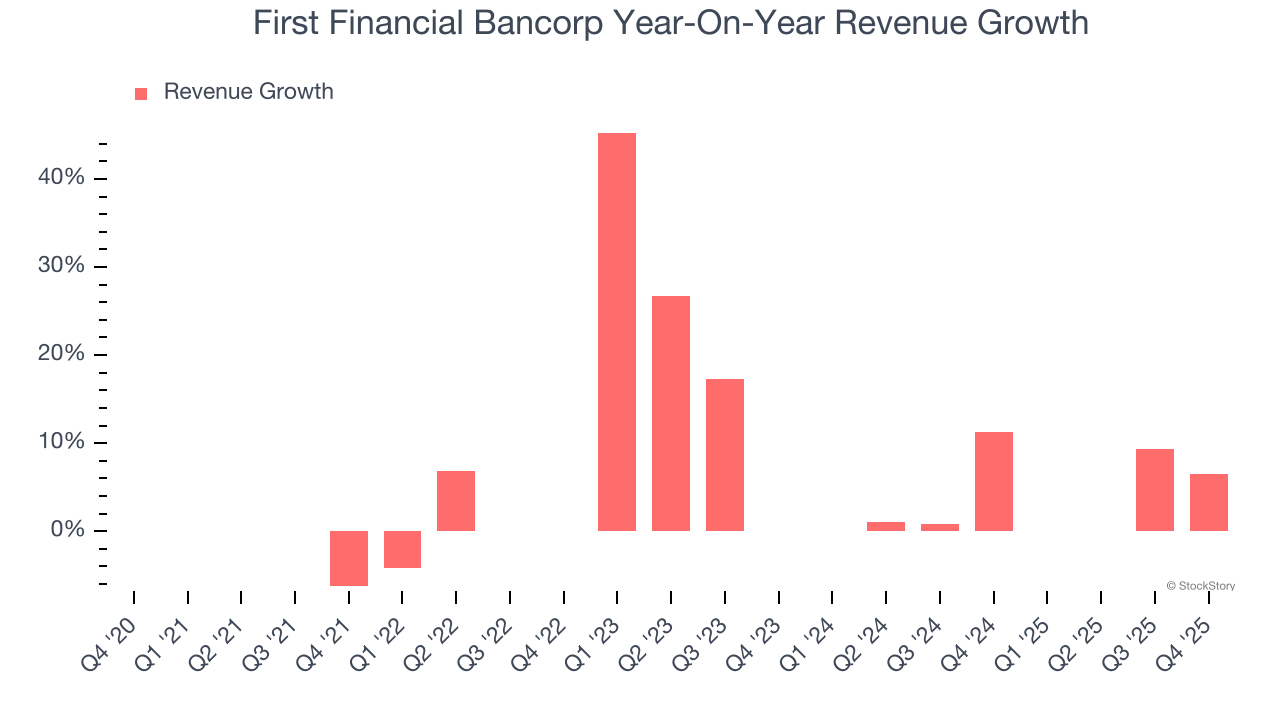

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions. Unfortunately, First Financial Bancorp’s 7.6% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the banking sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. First Financial Bancorp’s recent performance shows its demand has slowed as its annualized revenue growth of 4% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, First Financial Bancorp’s revenue grew by 6.5% year on year to $238.8 million, missing Wall Street’s estimates.

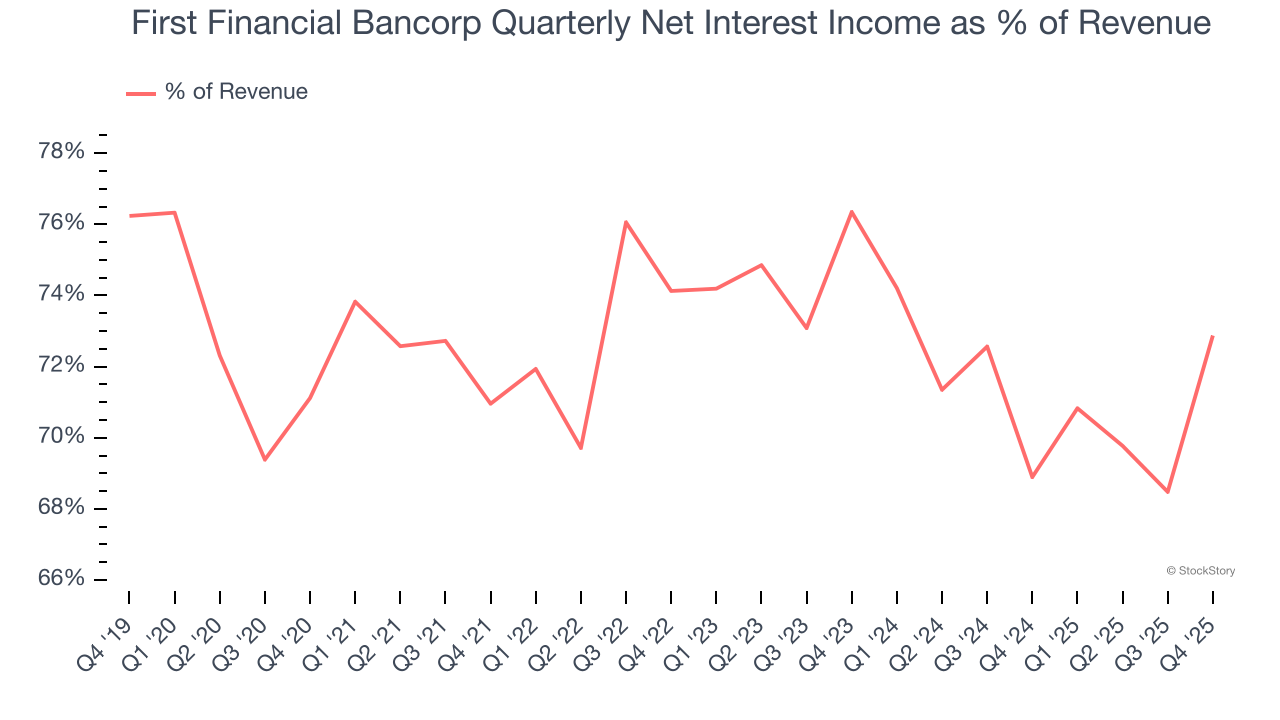

Net interest income made up 72.5% of the company’s total revenue during the last five years, meaning lending operations are First Financial Bancorp’s largest source of revenue.

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Tangible Book Value Per Share (TBVPS)

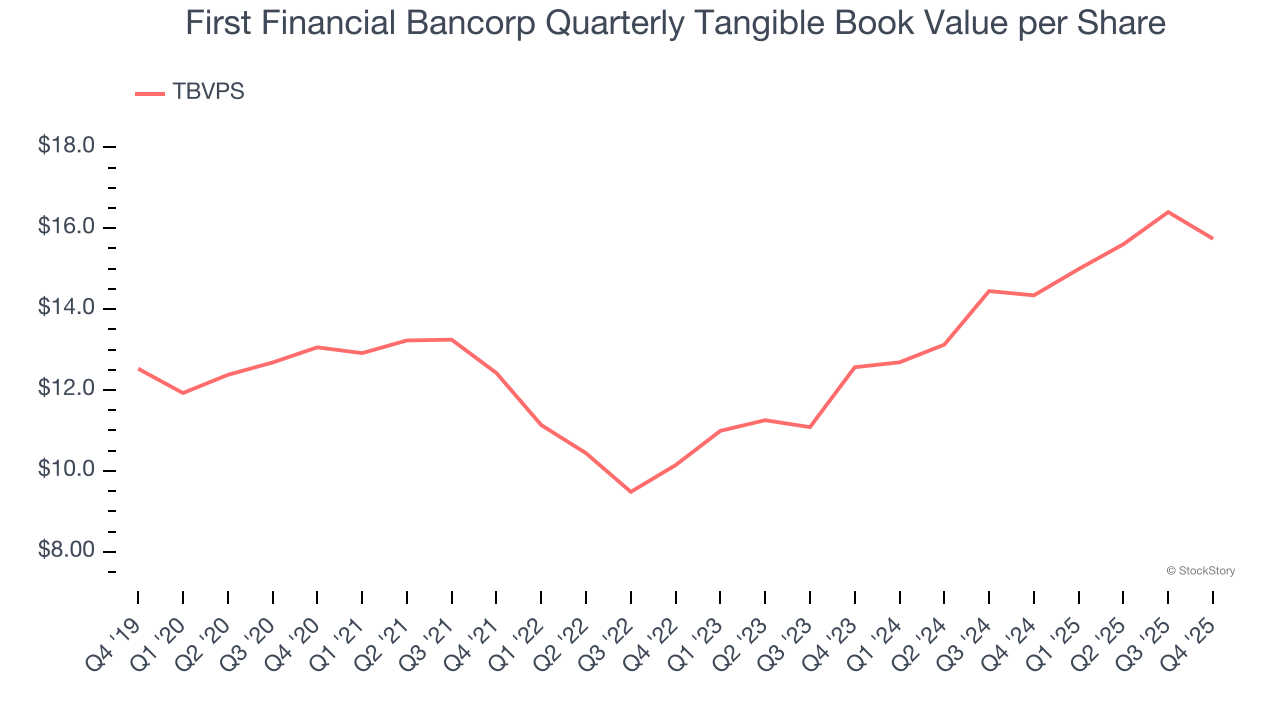

Banks are balance sheet-driven businesses because they generate earnings primarily through borrowing and lending. They’re also valued based on their balance sheet strength and ability to compound book value (another name for shareholders’ equity) over time.

Because of this, tangible book value per share (TBVPS) emerges as the critical performance benchmark. By excluding intangible assets with uncertain liquidation values, this metric captures real, liquid net worth per share. Other (and more commonly known) per-share metrics like EPS can sometimes be murky due to M&A or accounting rules allowing for loan losses to be spread out.

First Financial Bancorp’s TBVPS grew at a tepid 3.8% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 11.9% annually over the last two years from $12.56 to $15.74 per share.

Over the next 12 months, Consensus estimates call for First Financial Bancorp’s TBVPS to grow by 13.9% to $17.93, decent growth rate.

Key Takeaways from First Financial Bancorp’s Q4 Results

It was encouraging to see First Financial Bancorp beat analysts’ net interest income expectations this quarter. We were also happy its tangible book value per share narrowly outperformed Wall Street’s estimates. On the other hand, its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $27.20 immediately following the results.

Is First Financial Bancorp an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).