Vocational education company Adtalem Global Education (NYSE: ATGE) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 12.4% year on year to $503.4 million. The company expects the full year’s revenue to be around $1.92 billion, close to analysts’ estimates. Its non-GAAP profit of $2.43 per share was 11.1% above analysts’ consensus estimates.

Is now the time to buy Adtalem? Find out by accessing our full research report, it’s free.

Adtalem (ATGE) Q4 CY2025 Highlights:

- Revenue: $503.4 million vs analyst estimates of $490.6 million (12.4% year-on-year growth, 2.6% beat)

- Adjusted EPS: $2.43 vs analyst estimates of $2.19 (11.1% beat)

- Adjusted EBITDA: $87.91 million vs analyst estimates of $138.3 million (17.5% margin, 36.5% miss)

- The company reconfirmed its revenue guidance for the full year of $1.92 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $7.90 at the midpoint, a 1.9% increase

- Operating Margin: 22.1%, in line with the same quarter last year

- Free Cash Flow was $15.12 million, up from -$29.7 million in the same quarter last year

- Market Capitalization: $4.02 billion

“As America’s largest healthcare educator, we are uniquely positioned to address the growing healthcare workforce gaps at scale. Our second quarter results – our tenth consecutive quarter of enrollment growth, which was up 6.3% to 97,000 students – demonstrate our ability to meet this challenge head on,” said Steve Beard, chairman and chief executive officer, Adtalem Global Education.

Company Overview

Formerly known as DeVry Education Group, Adtalem Global Education (NYSE: ATGE) is a global provider of workforce solutions and educational services.

Revenue Growth

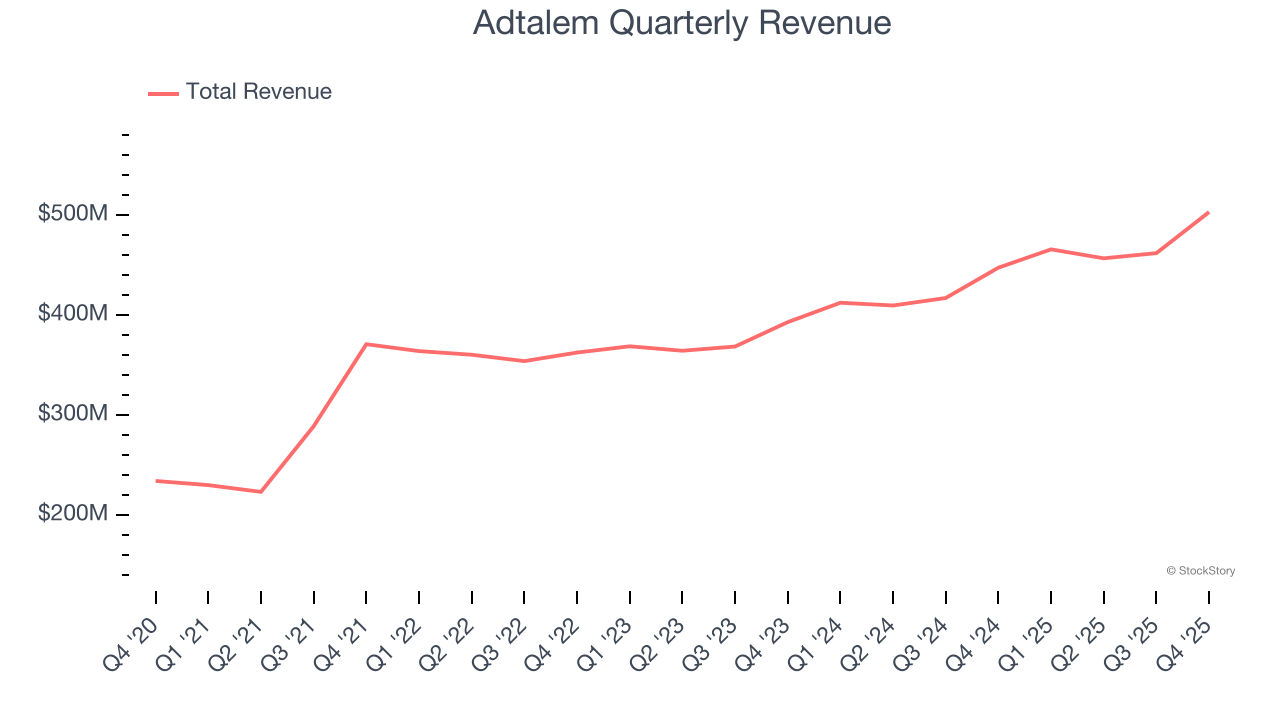

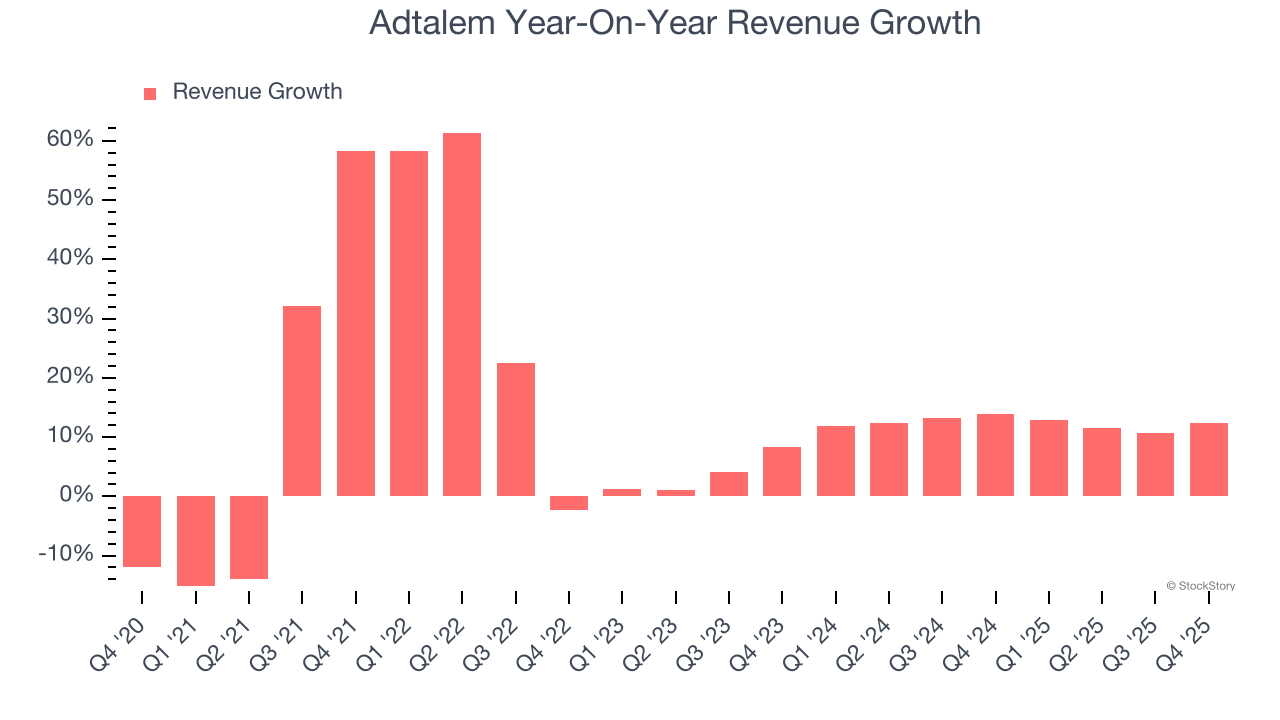

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Adtalem grew its sales at a 13.9% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Adtalem’s recent performance shows its demand has slowed as its annualized revenue growth of 12.4% over the last two years was below its five-year trend.

This quarter, Adtalem reported year-on-year revenue growth of 12.4%, and its $503.4 million of revenue exceeded Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

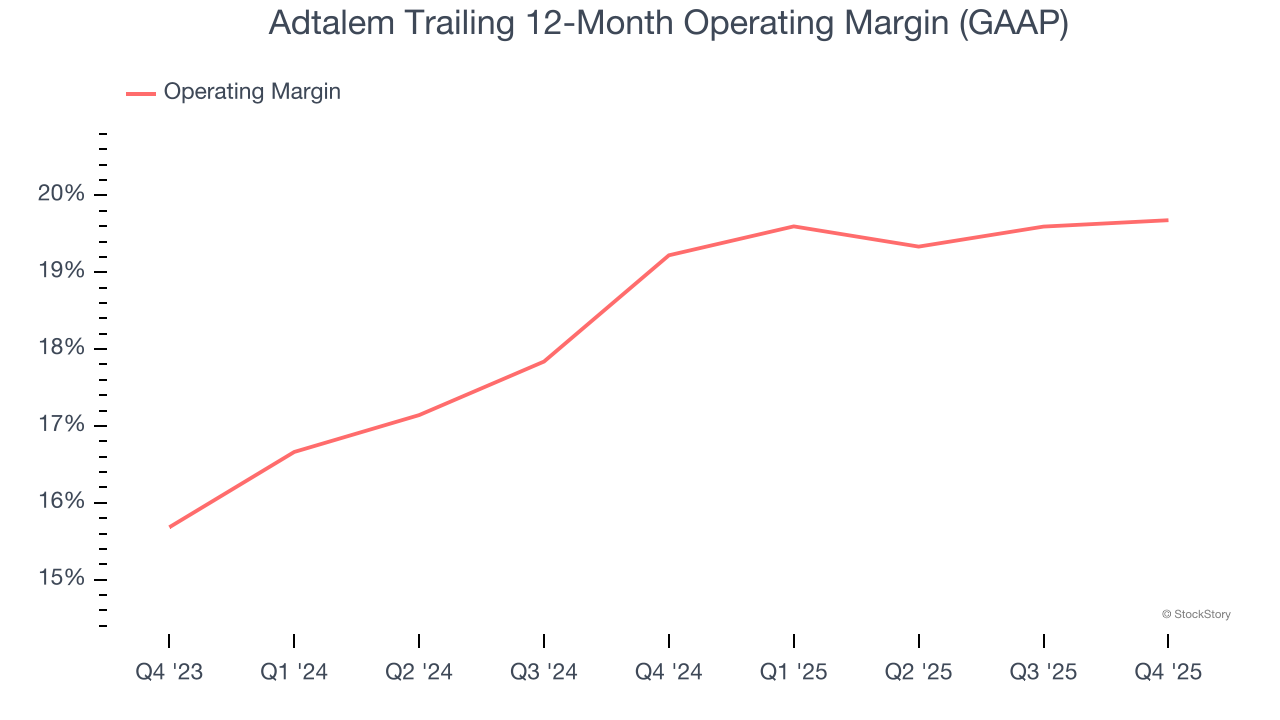

Adtalem’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 19.5% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Adtalem generated an operating margin profit margin of 22.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

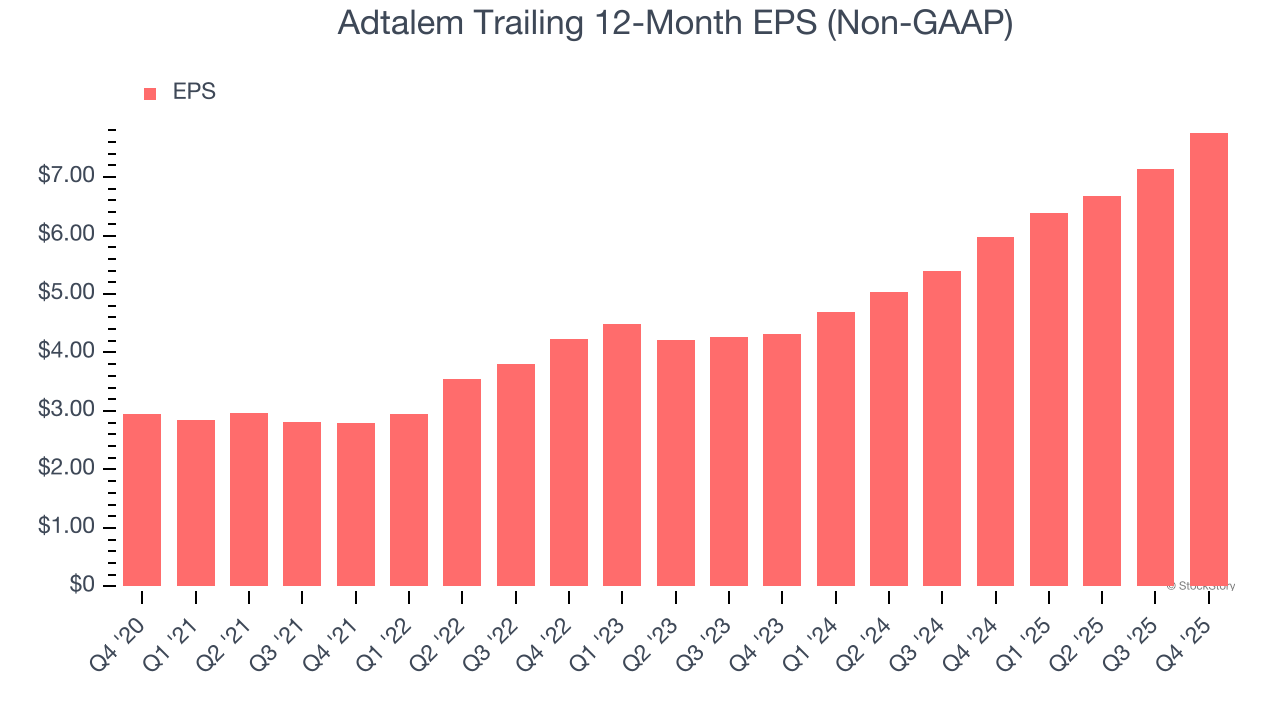

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Adtalem’s EPS grew at a weak 21.4% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 13.9% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Adtalem reported adjusted EPS of $2.43, up from $1.81 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Adtalem’s Q4 Results

It was good to see Adtalem beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, this was a weaker quarter. The stock traded up 3.1% to $119.54 immediately following the results.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).