As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer internet industry, including Alphabet (NASDAQ: GOOGL) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 48 consumer internet stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was in line.

While some consumer internet stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.9% since the latest earnings results.

Alphabet (NASDAQ: GOOGL)

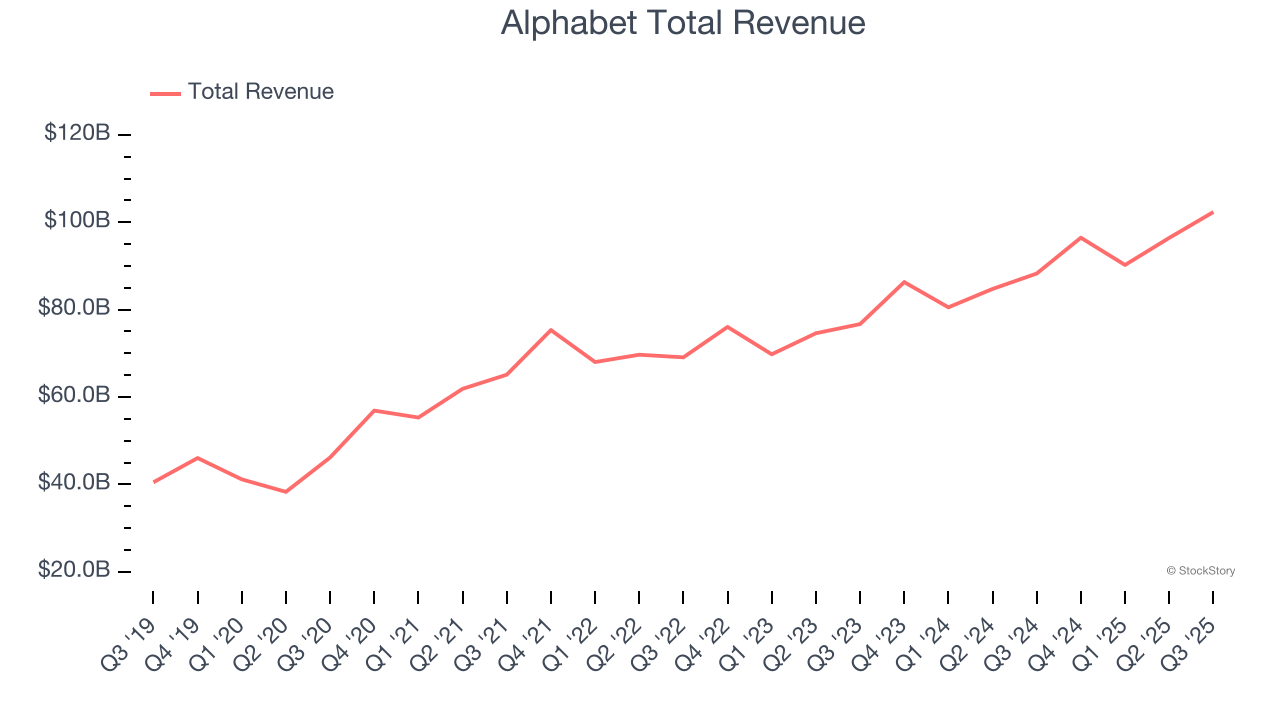

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ: GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

Alphabet reported revenues of $102.3 billion, up 15.9% year on year. This print exceeded analysts’ expectations by 2.4%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

Interestingly, the stock is up 19.5% since reporting and currently trades at $329.55.

Best Q3: EverQuote (NASDAQ: EVER)

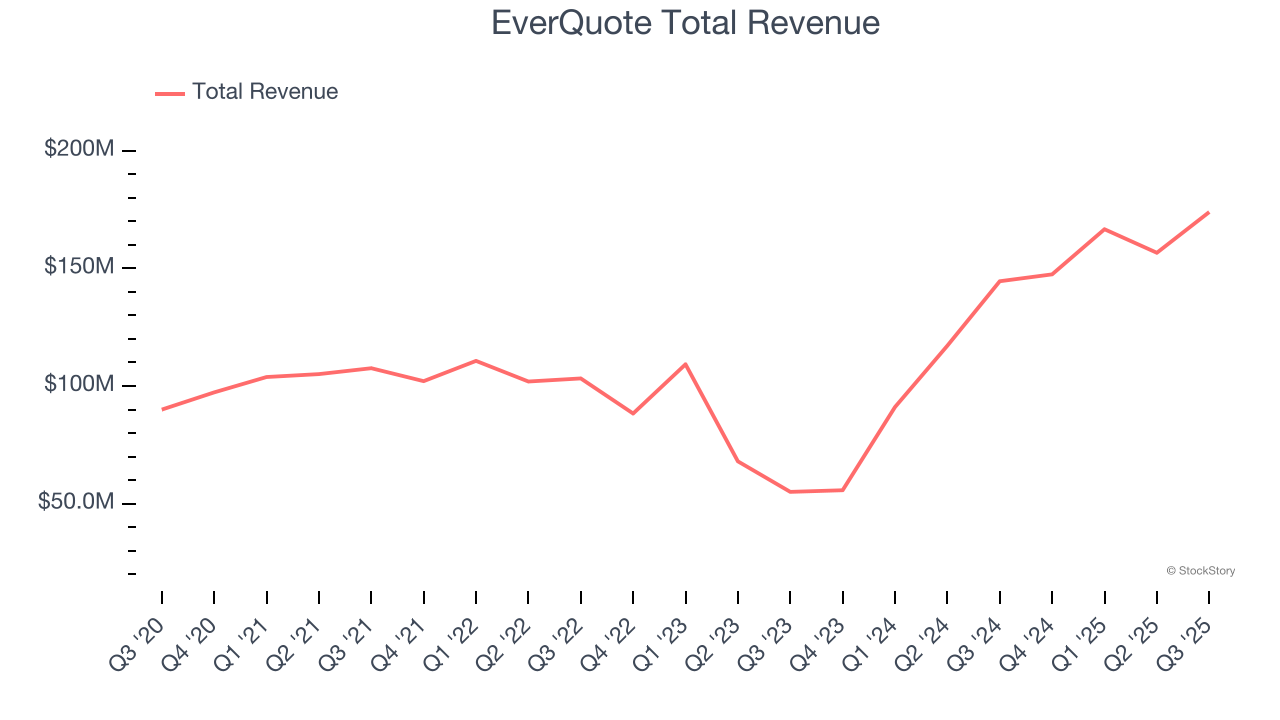

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $173.9 million, up 20.3% year on year, outperforming analysts’ expectations by 4.3%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 10.5% since reporting. It currently trades at $24.76.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Skillz (NYSE: SKLZ)

Taking a new twist at video gaming, Skillz (NYSE: SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $27.37 million, up 11.4% year on year, falling short of analysts’ expectations by 5.8%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue and EBITDA estimates.

Skillz delivered the weakest performance against analyst estimates in the group. The company reported 155,000 monthly active users, up 28.1% year on year. As expected, the stock is down 30.8% since the results and currently trades at $4.40.

Read our full analysis of Skillz’s results here.

Instacart (NASDAQ: CART)

Powering more than one billion grocery orders since its founding, Instacart (NASDAQ: CART) is an online grocery shopping and delivery platform that partners with retailers to help customers shop from local stores through its app or website.

Instacart reported revenues of $939 million, up 10.2% year on year. This number surpassed analysts’ expectations by 0.5%. It was a strong quarter as it also produced a solid beat of analysts’ EBITDA estimates and a narrow beat of analysts’ revenue estimates.

The stock is up 8.8% since reporting and currently trades at $40.

Read our full, actionable report on Instacart here, it’s free.

Lyft (NASDAQ: LYFT)

Founded by Logan Green and John Zimmer as a long-distance intercity carpooling company Zimride, Lyft (NASDAQ: LYFT) operates a ridesharing network in the US and Canada.

Lyft reported revenues of $1.69 billion, up 10.7% year on year. This result came in 1.2% below analysts' expectations. Overall, it was a slower quarter as it also recorded a slight miss of analysts’ revenue estimates and a slight miss of analysts’ EBITDA estimates.

The company reported 28.7 million users, up 17.6% year on year. The stock is down 8.3% since reporting and currently trades at $18.43.

Read our full, actionable report on Lyft here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.