While the S&P 500 is up 16.4% since March 2025, Manitowoc (currently trading at $10.05 per share) has lagged behind, posting a return of 5.1%. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Manitowoc, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Manitowoc Will Underperform?

We're swiping left on Manitowoc for now. Here are three reasons you should be careful with MTW and a stock we'd rather own.

1. Backlog Declines as Orders Drop

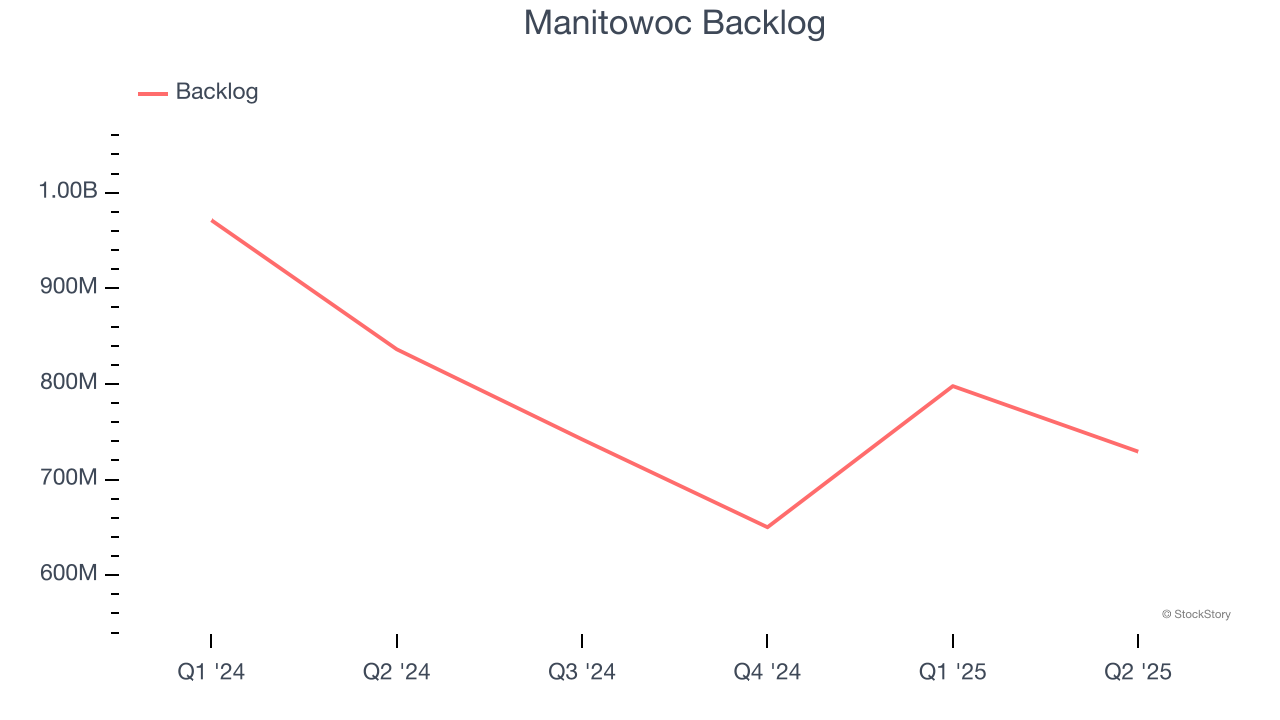

In addition to reported revenue, backlog is a useful data point for analyzing Construction Machinery companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Manitowoc’s future revenue streams.

Manitowoc’s backlog came in at $729.3 million in the latest quarter, and it averaged 15.3% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

2. EPS Trending Down

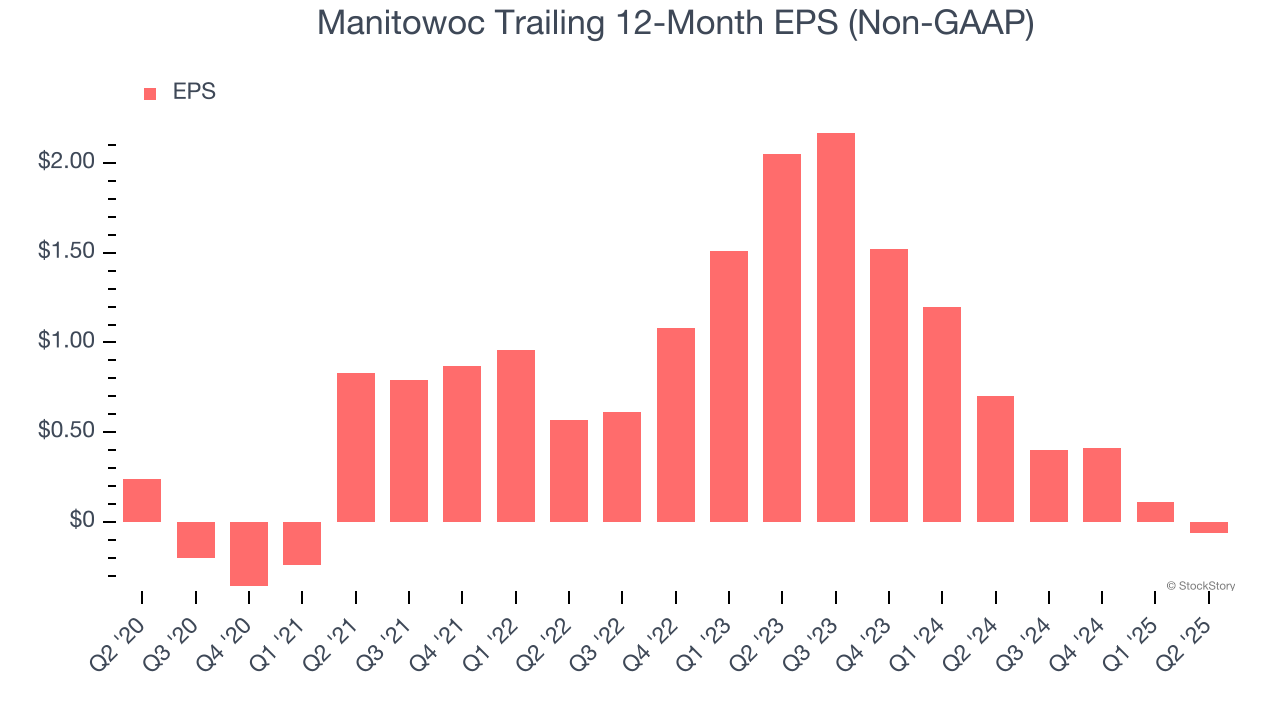

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Manitowoc, its EPS declined by 17.6% annually over the last five years while its revenue grew by 6.3%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Free Cash Flow Margin Dropping

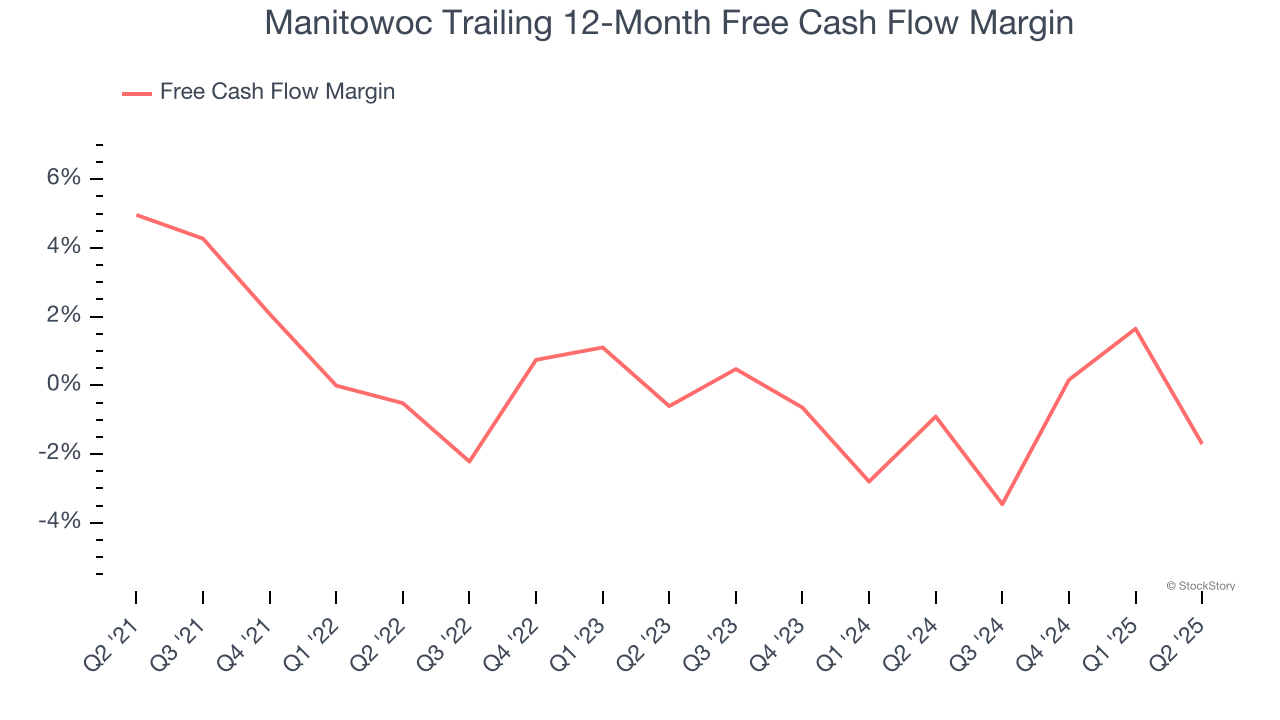

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Manitowoc’s margin dropped by 6.7 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Manitowoc’s free cash flow margin for the trailing 12 months was negative 1.7%.

Final Judgment

We see the value of companies helping their customers, but in the case of Manitowoc, we’re out. With its shares trailing the market in recent months, the stock trades at 20.6× forward P/E (or $10.05 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are superior stocks to buy right now. Let us point you toward the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.