Aircraft leasing company FTAI Aviation (NASDAQ: FTAI) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 52.4% year on year to $676.2 million. Its GAAP profit of $1.57 per share was 13.8% above analysts’ consensus estimates.

Is now the time to buy FTAI Aviation? Find out by accessing our full research report, it’s free.

FTAI Aviation (FTAI) Q2 CY2025 Highlights:

- Revenue: $676.2 million vs analyst estimates of $630.6 million (52.4% year-on-year growth, 7.2% beat)

- EPS (GAAP): $1.57 vs analyst estimates of $1.38 (13.8% beat)

- Adjusted EBITDA: $347.8 million vs analyst estimates of $288.2 million (51.4% margin, 20.7% beat)

- No forward guidance given

- Operating Margin: 31.1%, up from -36.7% in the same quarter last year

- Market Capitalization: $11.73 billion

“FTAI delivered an excellent quarter, generating over $400 million in positive Adjusted Free Cash Flow,” said Joe Adams, Chairman and CEO(1).

Company Overview

With a focus on the CFM56 engine that powers Boeing and Airbus’s planes, FTAI Aviation (NASDAQ: FTAI) sells, leases, maintains, and repairs aircraft engines.

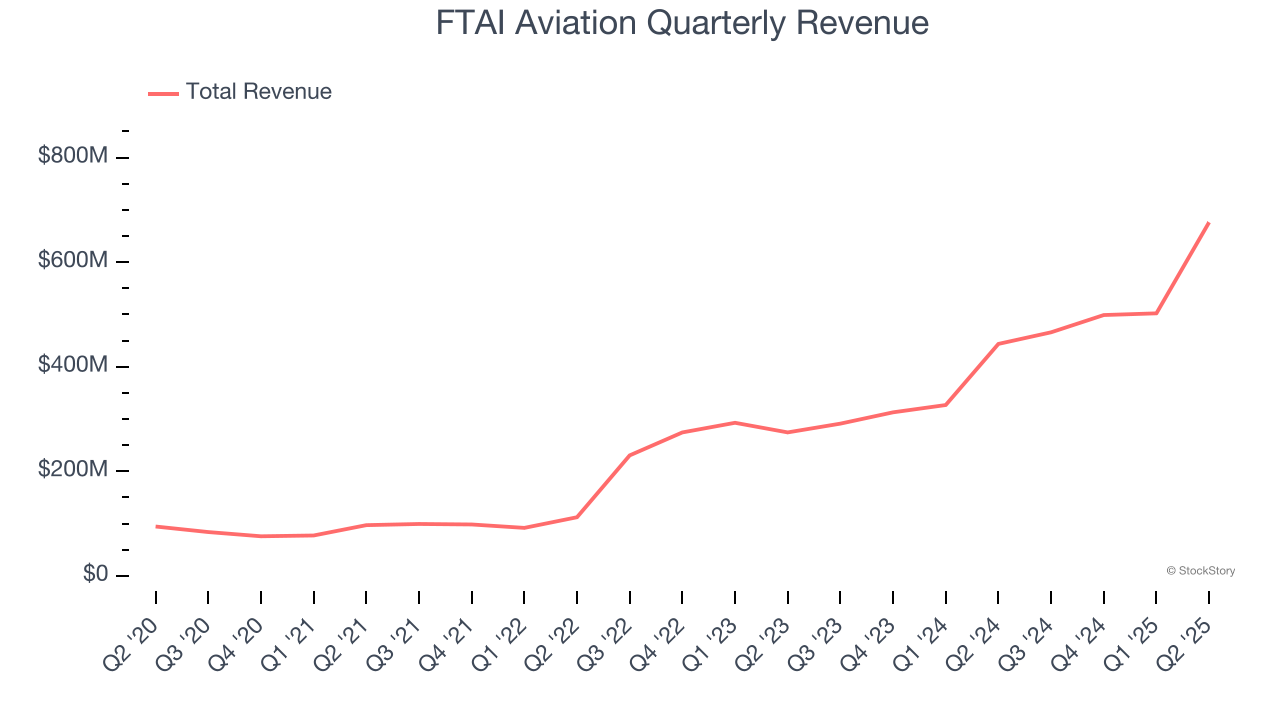

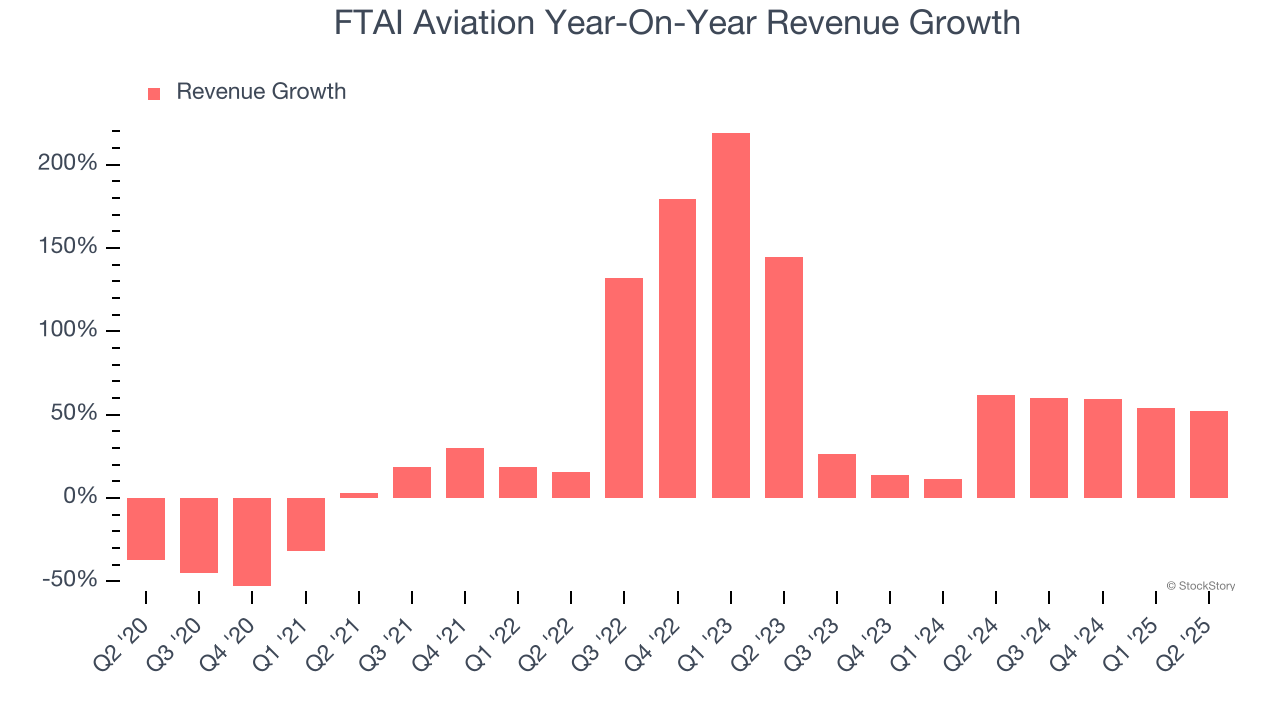

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, FTAI Aviation’s 32.7% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. FTAI Aviation’s annualized revenue growth of 41.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, FTAI Aviation reported magnificent year-on-year revenue growth of 52.4%, and its $676.2 million of revenue beat Wall Street’s estimates by 5.8%.

Looking ahead, sell-side analysts expect revenue to grow 22.3% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is admirable and suggests the market is forecasting success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

FTAI Aviation has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, FTAI Aviation’s operating margin rose by 37.4 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q2, FTAI Aviation generated an operating margin profit margin of 31.1%, up 67.8 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

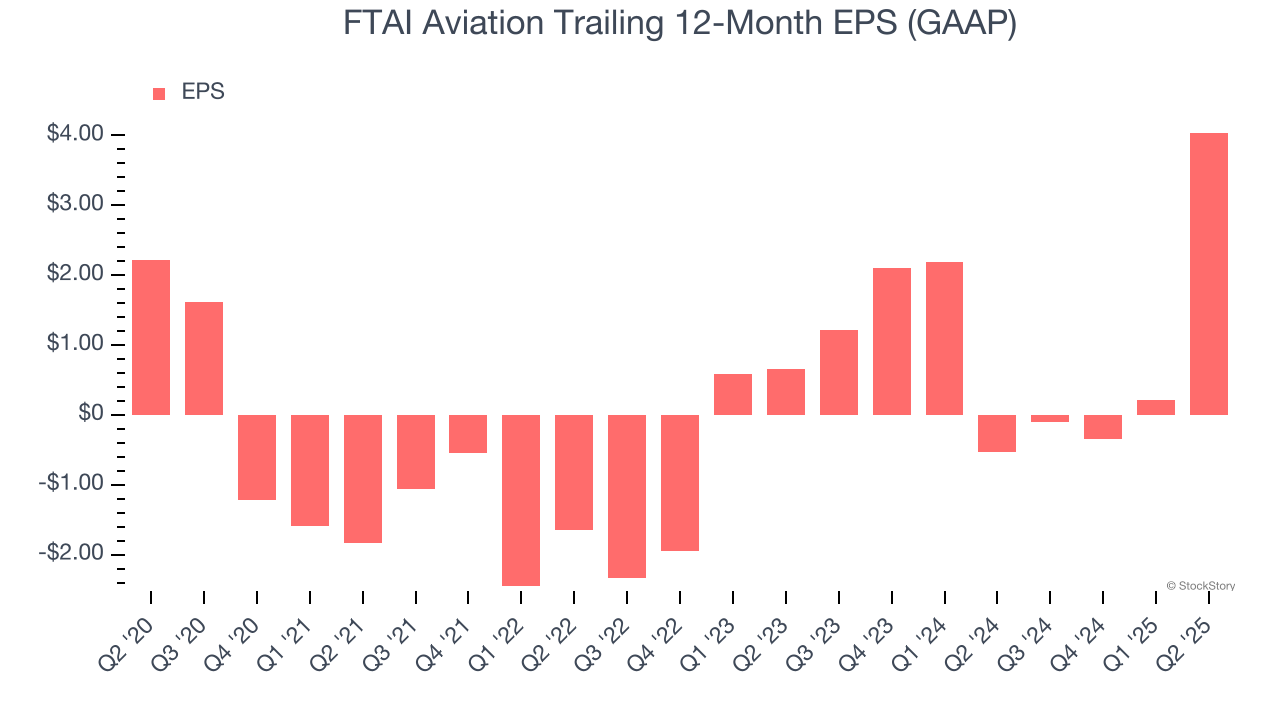

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

FTAI Aviation’s EPS grew at a remarkable 12.8% compounded annual growth rate over the last five years. Despite its operating margin improvement during that time, this performance was lower than its 32.7% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

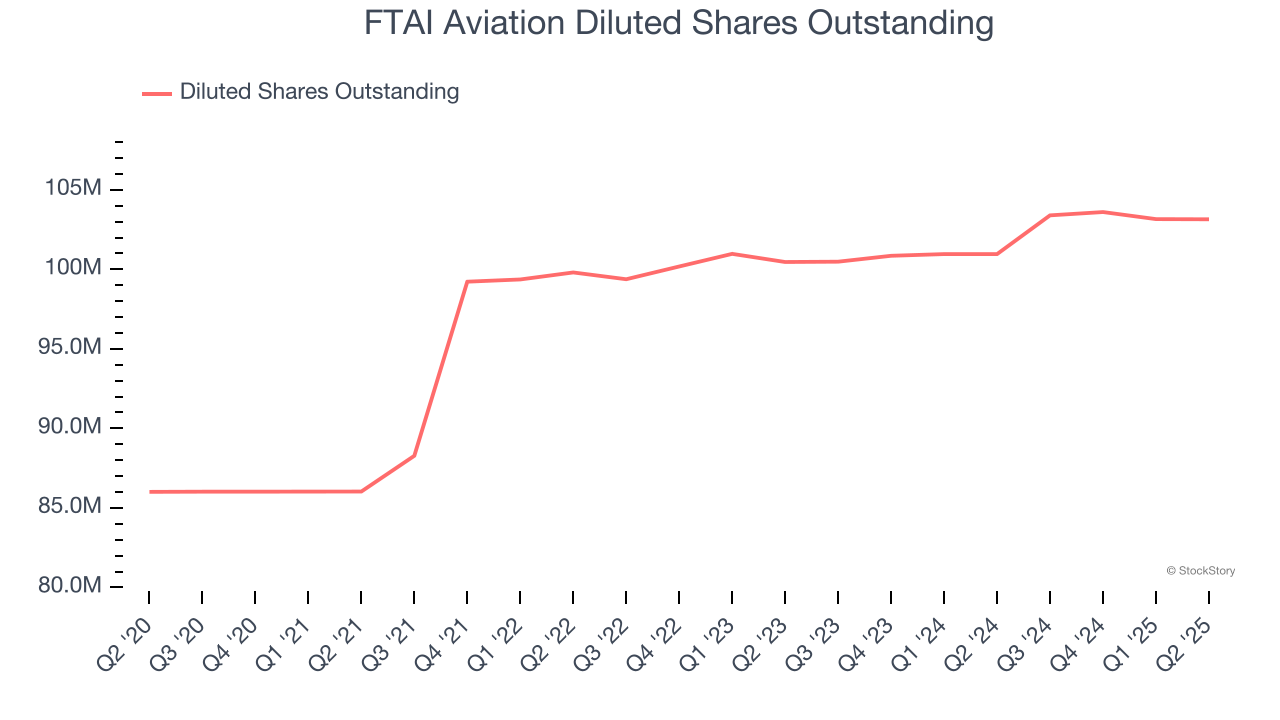

Diving into the nuances of FTAI Aviation’s earnings can give us a better understanding of its performance. A five-year view shows FTAI Aviation has diluted its shareholders, growing its share count by 19.9%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For FTAI Aviation, its two-year annual EPS growth of 149% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, FTAI Aviation reported EPS at $1.57, up from negative $2.26 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects FTAI Aviation’s full-year EPS of $4.04 to grow 33.7%.

Key Takeaways from FTAI Aviation’s Q2 Results

We were impressed that FTAI Aviation beat analysts’ revenue and EBITDA expectations this quarter. Management highlighted that the "Aerospace Products segment continued to perform, with 81% year-over-year growth in Adjusted EBITDA in Q2 2025 and an increase in market share to approximately 9% on an annualized basis, up from 5% last year. We remain confident in our ability to reach our long-term market share goal of 25%." Zooming out, we think this was a solid print. The stock traded up 7.7% to $122.93 immediately after reporting.

FTAI Aviation had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.