Electronics distributor Richardson Electronics (NASDAQ: RELL) missed Wall Street’s revenue expectations in Q1 CY2025 as sales rose 2.7% year on year to $53.8 million. Its non-GAAP profit of $0.11 per share was 37.5% above analysts’ consensus estimates.

Is now the time to buy Richardson Electronics? Find out by accessing our full research report, it’s free.

Richardson Electronics (RELL) Q1 CY2025 Highlights:

- Revenue: $53.8 million vs analyst estimates of $54.75 million (2.7% year-on-year growth, 1.7% miss)

- Adjusted EPS: $0.11 vs analyst estimates of $0.08 (37.5% beat)

- Adjusted EBITDA: $2.81 million vs analyst estimates of $2.5 million (5.2% margin, relatively in line)

- Operating Margin: -5.1%, down from 1.9% in the same quarter last year

- Free Cash Flow was $4.05 million, up from -$2.93 million in the same quarter last year

- Backlog: $134.1 million at quarter end

- Market Capitalization: $131.7 million

“During the third quarter, we experienced significant year-over-year growth across key segments. Semiconductor wafer fab sales surged by 139%, while Canvys sales increased 39.5%. We achieved positive operating cash flow for the fourth consecutive quarter and ended the quarter with no debt and $36.7 million in cash and equivalents. While our cash position was bolstered by $8.2 million from the Healthcare assets sale in Q3 FY2025, the Company also generated cash from its ongoing business. We believe our strong balance sheet is an important competitive advantage with our customers and supports our long-term strategies to pursue high ROI business opportunities,” said Edward J. Richardson, Chairman, CEO, and President.

Company Overview

Founded in 1947, Richardson Electronics (NASDAQ: RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

Sales Growth

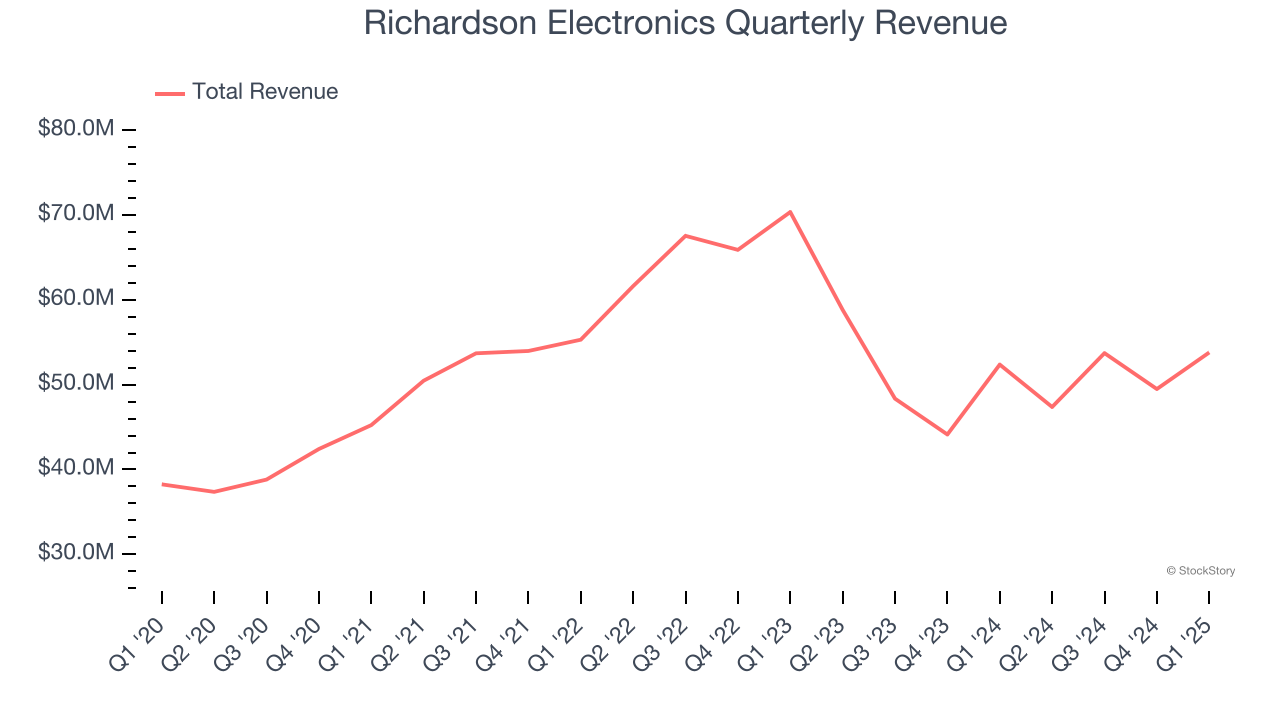

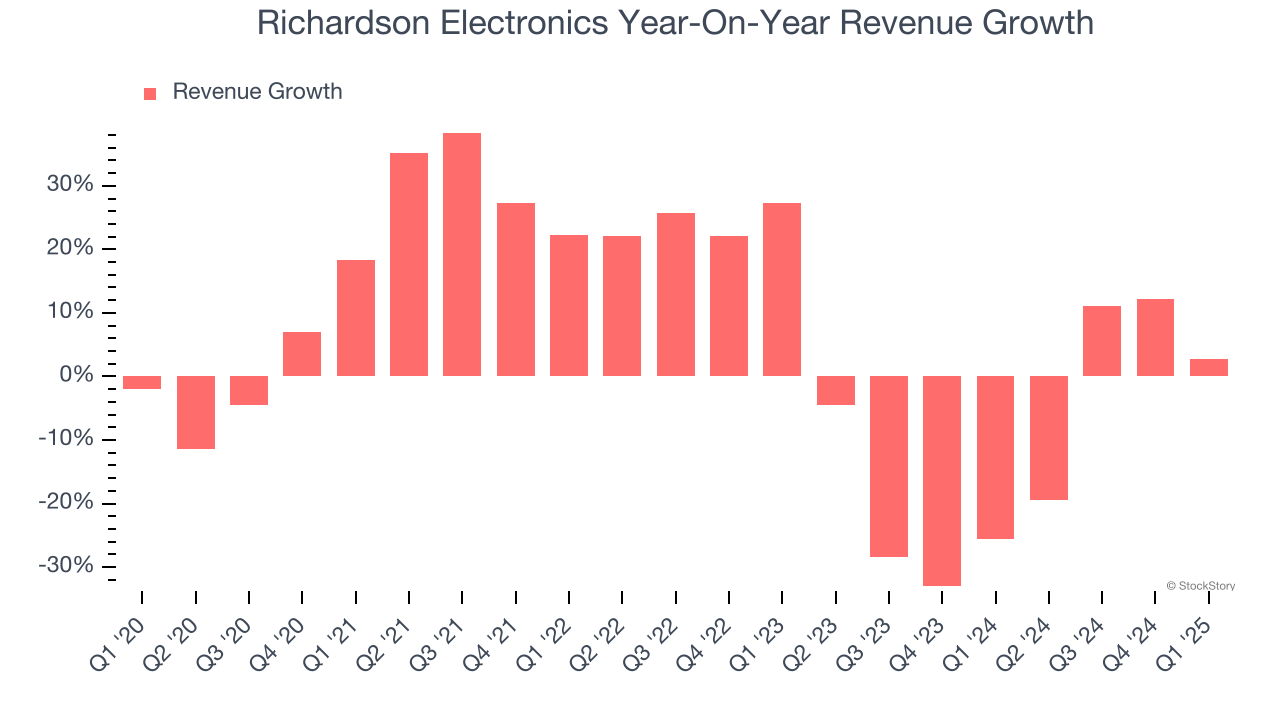

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Richardson Electronics’s sales grew at a tepid 4.9% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Richardson Electronics’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 12.3% annually. Richardson Electronics isn’t alone in its struggles as the Specialty Equipment Distributors industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Richardson Electronics’s revenue grew by 2.7% year on year to $53.8 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 14.1% over the next 12 months, an improvement versus the last two years. This projection is healthy and suggests its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

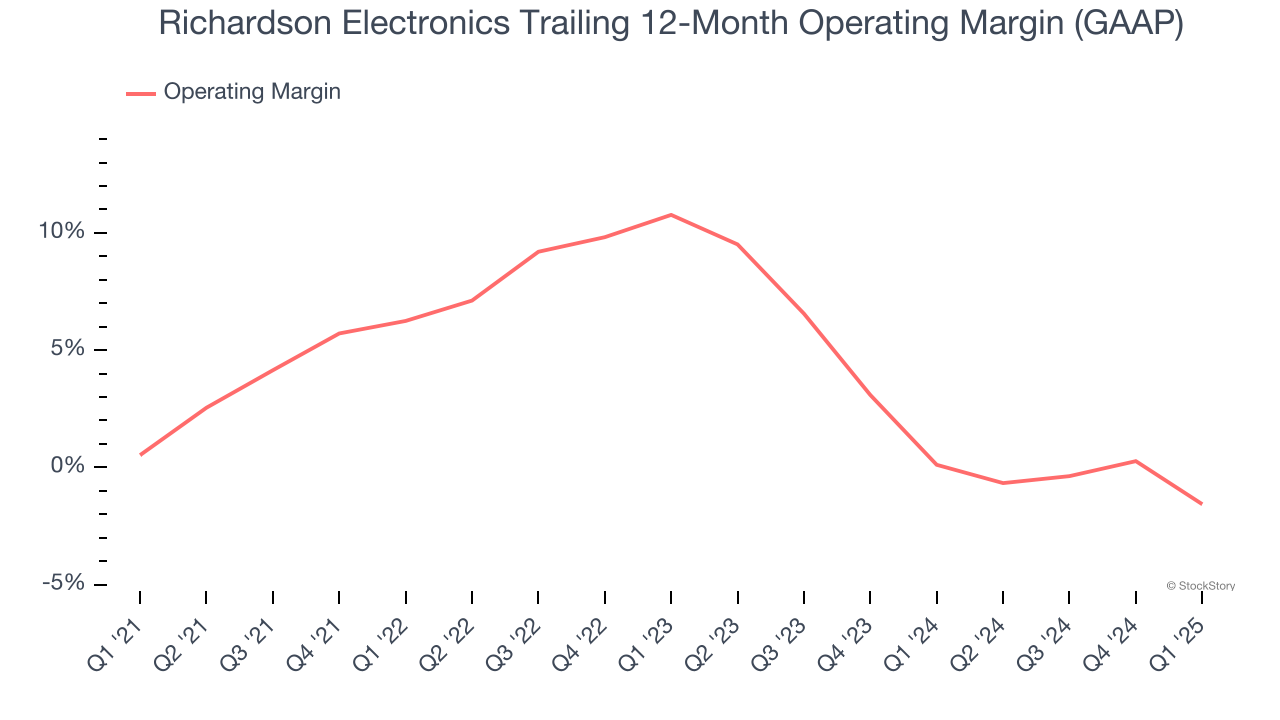

Richardson Electronics was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.8% was weak for an industrials business.

Analyzing the trend in its profitability, Richardson Electronics’s operating margin decreased by 2.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Richardson Electronics’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q1, Richardson Electronics generated an operating profit margin of negative 5.1%, down 7 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

Earnings Per Share

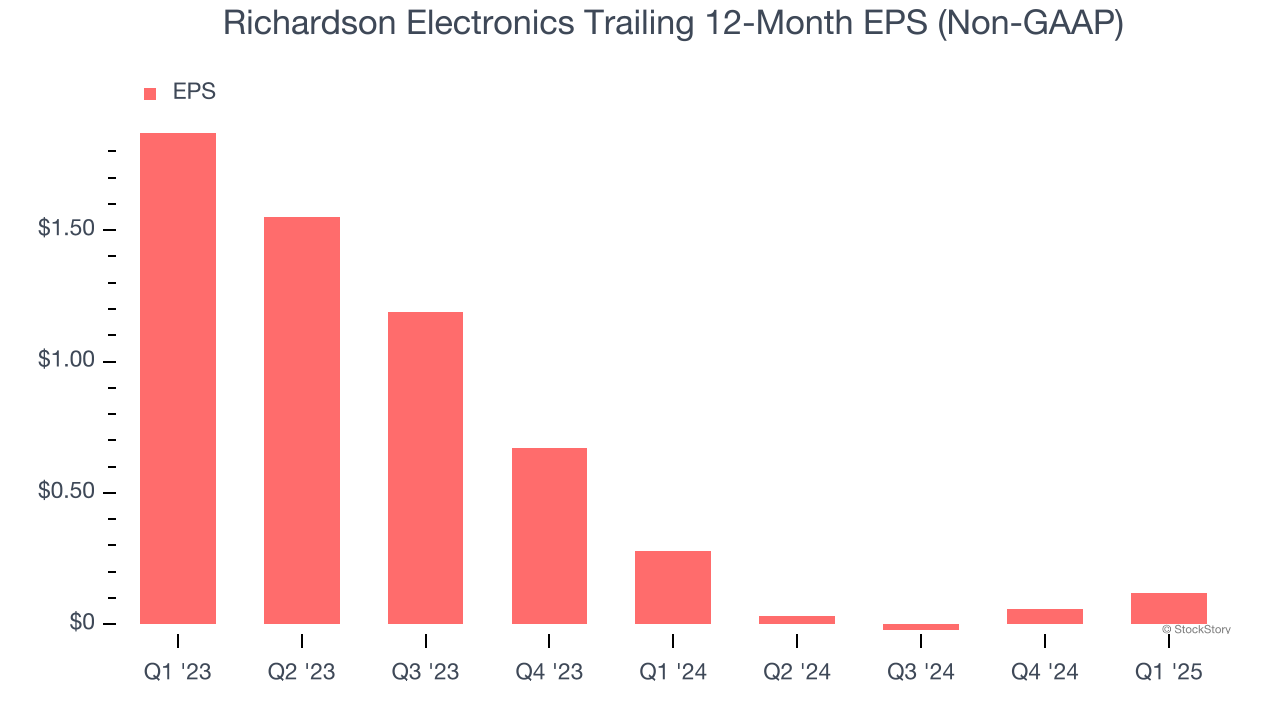

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Richardson Electronics, its EPS declined by more than its revenue over the last two years, dropping 74.7%. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Diving into the nuances of Richardson Electronics’s earnings can give us a better understanding of its performance. Richardson Electronics’s operating margin has declined by 15.9 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Richardson Electronics reported EPS at $0.11, up from $0.05 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Richardson Electronics’s full-year EPS of $0.12 to grow 483%.

Key Takeaways from Richardson Electronics’s Q1 Results

We were impressed by how significantly Richardson Electronics blew past analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 4.7% to $10.24 immediately following the results.

Sure, Richardson Electronics had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.