The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how engineered components and systems stocks fared in Q4, starting with Enpro (NYSE: NPO).

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 13 engineered components and systems stocks we track reported a satisfactory Q4. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 19.9% since the latest earnings results.

Enpro (NYSE: NPO)

Holding a Guinness World Record for creating the world's largest gasket, Enpro (NYSE: NPO) designs, manufactures, and sells products used for machinery in various industries.

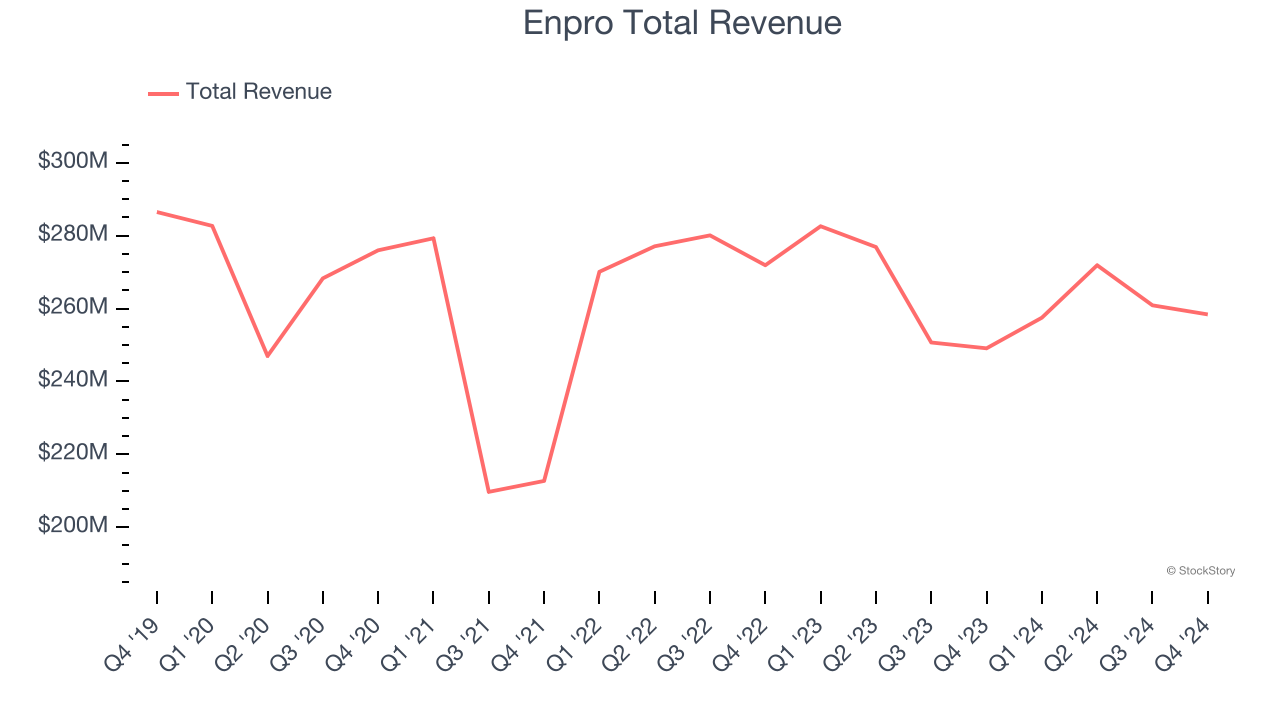

Enpro reported revenues of $258.4 million, up 3.7% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

"Our strong finish to 2024 was driven by excellent performance in Sealing Technologies and sequential improvement in sales and segment profitability at AST," said Eric Vaillancourt, President and Chief Executive Officer.

The stock is down 30.3% since reporting and currently trades at $136.27.

Is now the time to buy Enpro? Access our full analysis of the earnings results here, it’s free.

Best Q4: ESCO (NYSE: ESE)

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE: ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

ESCO reported revenues of $247 million, up 13.2% year on year, outperforming analysts’ expectations by 2.8%. The business had a stunning quarter with EPS guidance for next quarter exceeding analysts’ expectations.

ESCO pulled off the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 5.7% since reporting. It currently trades at $139.86.

Is now the time to buy ESCO? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Regal Rexnord (NYSE: RRX)

Headquartered in Milwaukee, Regal Rexnord (NYSE: RRX) provides power transmission and industrial automation products.

Regal Rexnord reported revenues of $1.46 billion, down 9.1% year on year, falling short of analysts’ expectations by 1.9%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations.

The stock is down 39.3% since the results and currently trades at $94.

Read our full analysis of Regal Rexnord’s results here.

Park-Ohio (NASDAQ: PKOH)

Based in Cleveland, Park-Ohio (NASDAQ: PKOH) provides supply chain management services, capital equipment, and manufactured components.

Park-Ohio reported revenues of $388.4 million, flat year on year. This result missed analysts’ expectations by 4.3%. Taking a step back, it was still a satisfactory quarter as it put up a solid beat of analysts’ EBITDA estimates.

The stock is down 19.8% since reporting and currently trades at $18.53.

Read our full, actionable report on Park-Ohio here, it’s free.

Applied Industrial (NYSE: AIT)

Formerly called The Ohio Ball Bearing Company, Applied Industrial (NYSE: AIT) distributes industrial products–everything from power tools to industrial valves–and services to a wide variety of industries.

Applied Industrial reported revenues of $1.07 billion, flat year on year. This number was in line with analysts’ expectations. It was a strong quarter as it also produced an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 18.5% since reporting and currently trades at $205.03.

Read our full, actionable report on Applied Industrial here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.