Global airline Delta Air Lines (NYSE: DAL) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 2.1% year on year to $14.04 billion. The company expects next quarter’s revenue to be around $16.66 billion, close to analysts’ estimates. Its GAAP profit of $0.37 per share was 6.9% below analysts’ consensus estimates.

Is now the time to buy Delta Air Lines? Find out by accessing our full research report, it’s free.

Delta Air Lines (DAL) Q1 CY2025 Highlights:

- Revenue: $14.04 billion vs analyst estimates of $13.88 billion (2.1% year-on-year growth, 1.1% beat)

- EPS (GAAP): $0.37 vs analyst expectations of $0.40 (6.9% miss)

- Adjusted EBITDA: $1.18 billion vs analyst estimates of $1.30 billion (8.4% margin, 9.5% miss)

- Revenue Guidance for Q2 CY2025 is $16.66 billion at the midpoint, roughly in line with what analysts were expecting

- EPS (GAAP) guidance for Q2 CY2025 is $2 at the midpoint, missing analyst estimates by 12.1%

- Company said it can’t reaffirm its 2025 financial guidance

- Operating Margin: 4.1%, in line with the same quarter last year

- Free Cash Flow Margin: 8.6%, similar to the same quarter last year

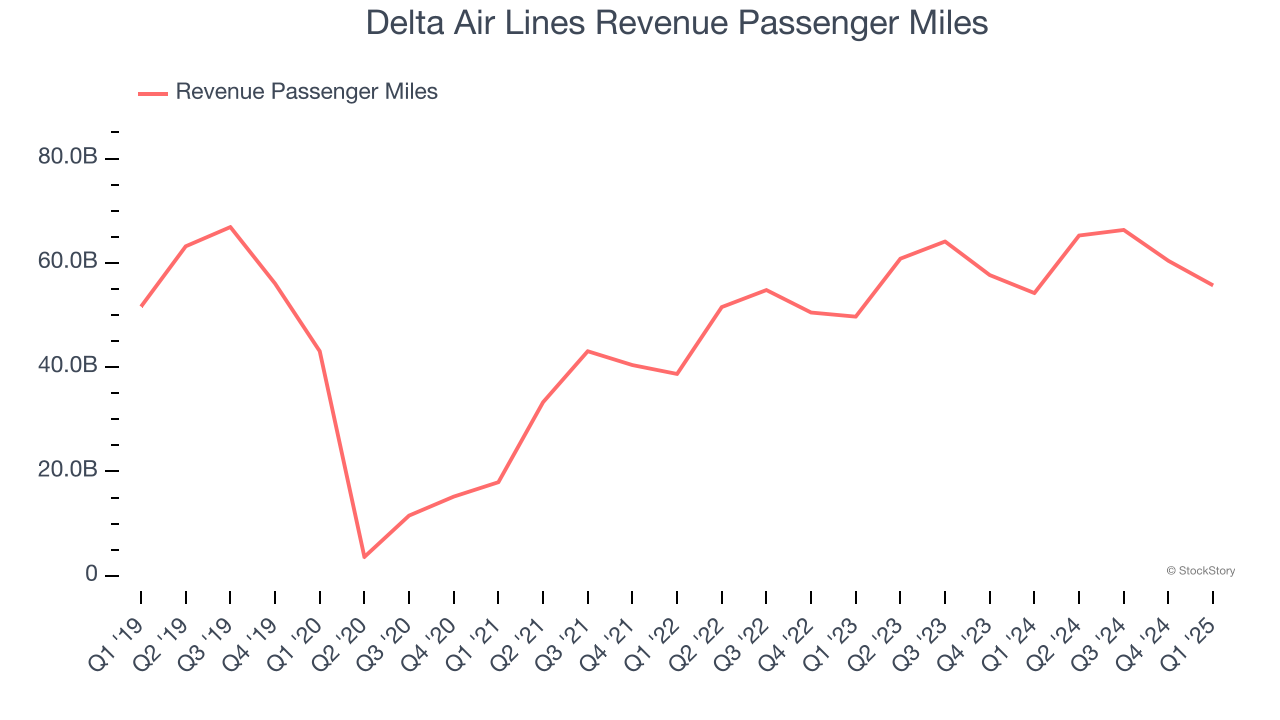

- Revenue Passenger Miles: 55.68 billion, up 1.47 billion year on year

- Market Capitalization: $23.02 billion

Company Overview

One of the ‘Big Four’ airlines in the US, Delta Air Lines (NYSE: DAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

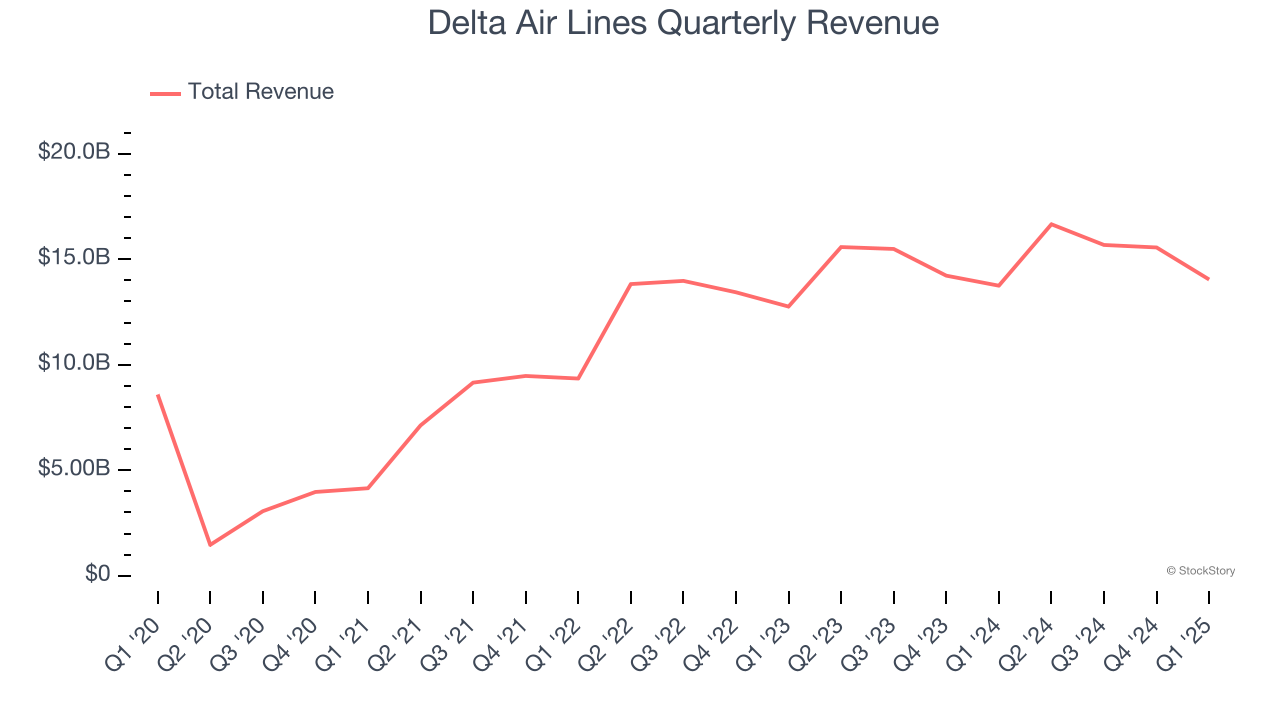

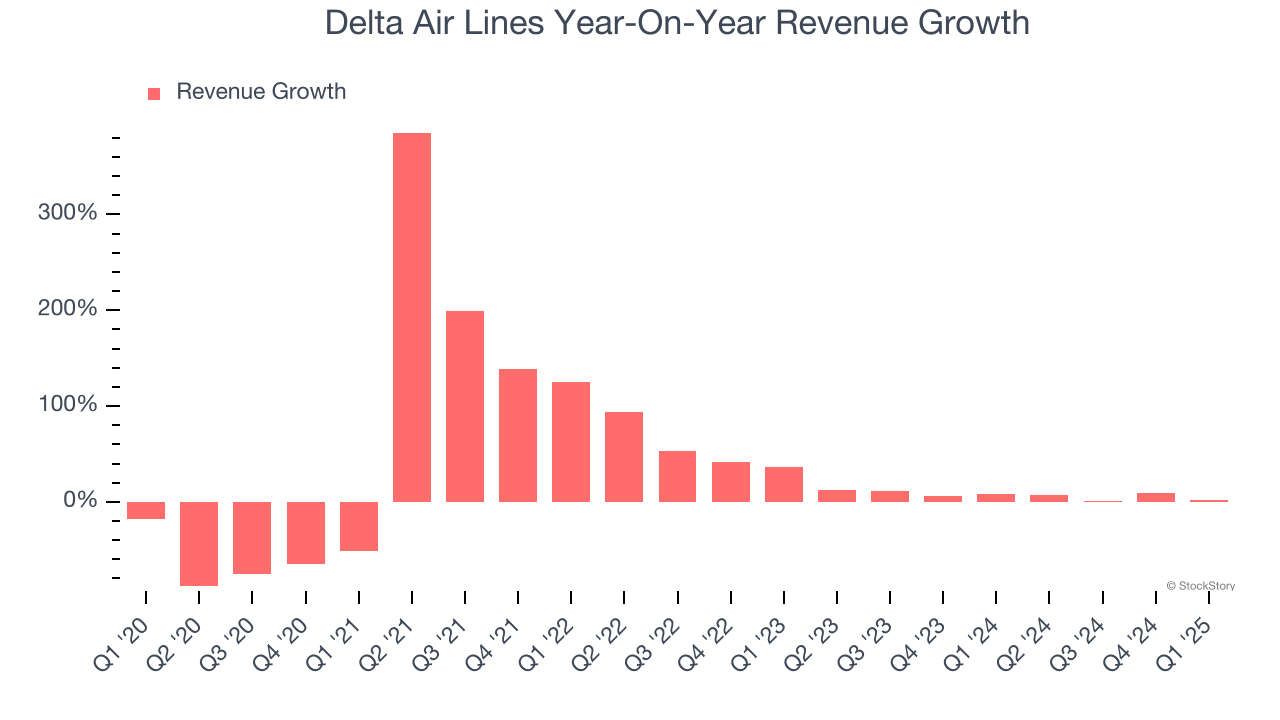

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Delta Air Lines grew its sales at a sluggish 6.5% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Delta Air Lines’s annualized revenue growth of 7.1% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

Delta Air Lines also discloses its number of revenue passenger miles, which reached 55.68 billion in the latest quarter. Over the last two years, Delta Air Lines’s revenue passenger miles averaged 9.6% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Delta Air Lines reported modest year-on-year revenue growth of 2.1% but beat Wall Street’s estimates by 1.1%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

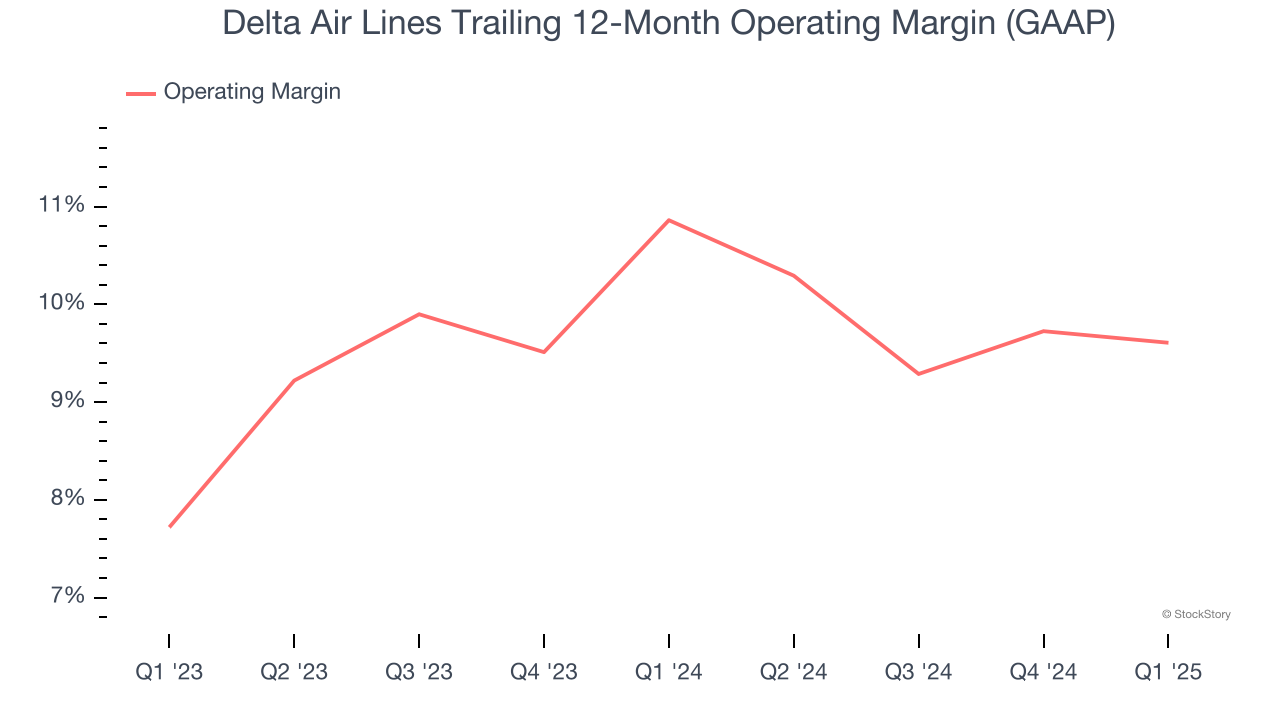

Delta Air Lines’s operating margin has been trending down over the last 12 months, but it still averaged 10.2% over the last two years, decent for a consumer discretionary business. This shows it generally does a decent job managing its expenses.

This quarter, Delta Air Lines generated an operating profit margin of 4.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Looking ahead, Wall Street expects Delta Air Lines to maintain its trailing 12-month operating margin of 9.6% in the coming year.

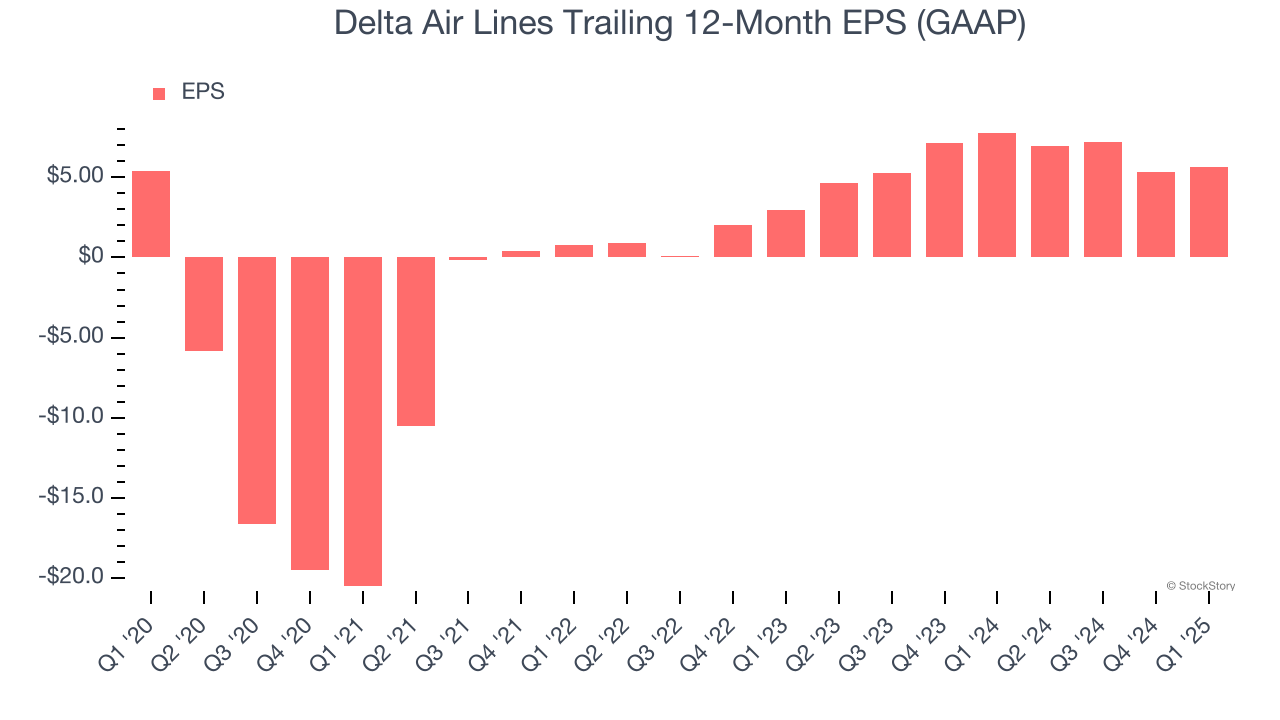

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Delta Air Lines’s flat EPS over the last five years was below its 6.5% annualized revenue growth. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q1, Delta Air Lines reported EPS at $0.37, up from $0.06 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Delta Air Lines’s full-year EPS of $5.64 to grow 12.9%.

Key Takeaways from Delta Air Lines’s Q1 Results

It was good to see Delta Air Lines narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed and EPS guidance for next quarter also fell short. The company said it can't reaffirm full-year 2025 guidance and commented that Trump's tariffs are hurting booking. Overall, this was a mixed quarter. The stock traded up 2.4% to $36.78 immediately following the results.

Is Delta Air Lines an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.