Workforce solutions provider ManpowerGroup (NYSE: MAN) reported Q1 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 7.1% year on year to $4.09 billion. Its GAAP profit of $0.12 per share was 76.4% below analysts’ consensus estimates.

Is now the time to buy ManpowerGroup? Find out by accessing our full research report, it’s free.

ManpowerGroup (MAN) Q1 CY2025 Highlights:

- Revenue: $4.09 billion vs analyst estimates of $3.97 billion (7.1% year-on-year decline, 2.9% beat)

- EPS (GAAP): $0.12 vs analyst expectations of $0.51 (76.4% miss)

- Adjusted EBITDA: $57 million vs analyst estimates of $73.16 million (1.4% margin, 22.1% miss)

- EPS (GAAP) guidance for Q2 CY2025 is $0.70 at the midpoint, missing analyst estimates by 31.1%

- Operating Margin: 0.7%, in line with the same quarter last year

- Free Cash Flow was -$166.9 million, down from $104.2 million in the same quarter last year

- Organic Revenue fell 2% year on year (-5.3% in the same quarter last year)

- Market Capitalization: $2.31 billion

Jonas Prising, ManpowerGroup Chair & CEO, said, "During the quarter, we saw good growth in Latin America and Asia Pacific while operating conditions remained challenging in Europe and North America. More recently, the demand outlook is less clear based on increased caution following trade policy developments. In this uncertain environment, we continue to compete well in the market and remain focused on what we can control, staying close to our clients and candidates and adjusting our cost base to market conditions as needed.

Company Overview

Founded during the post-World War II economic boom when businesses needed temporary workers, ManpowerGroup (NYSE: MAN) connects millions of people to employment opportunities through its global network of staffing, recruitment, and workforce management services.

Professional Staffing & HR Solutions

The Professional Staffing & HR Solutions subsector within Business Services is set to benefit from evolving workforce trends, including the rise of remote work and the gig economy. With companies casting a wider net to find talent due to remote work, the expertise of staffing and recruiting companies is even more valuable. For those who invest wisely, the use of predictive AI in recruitment and screening as well as automation in HR workflows can enhance efficiency and scalability. On the other hand, digitization means that talent discovery is less of a manual process, opening the door for tech-first platforms. Additionally, regulatory scrutiny around data privacy in HR is evolving and may require companies in this sector to change their go-to-market strategies over time.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $17.54 billion in revenue over the past 12 months, ManpowerGroup is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. For ManpowerGroup to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

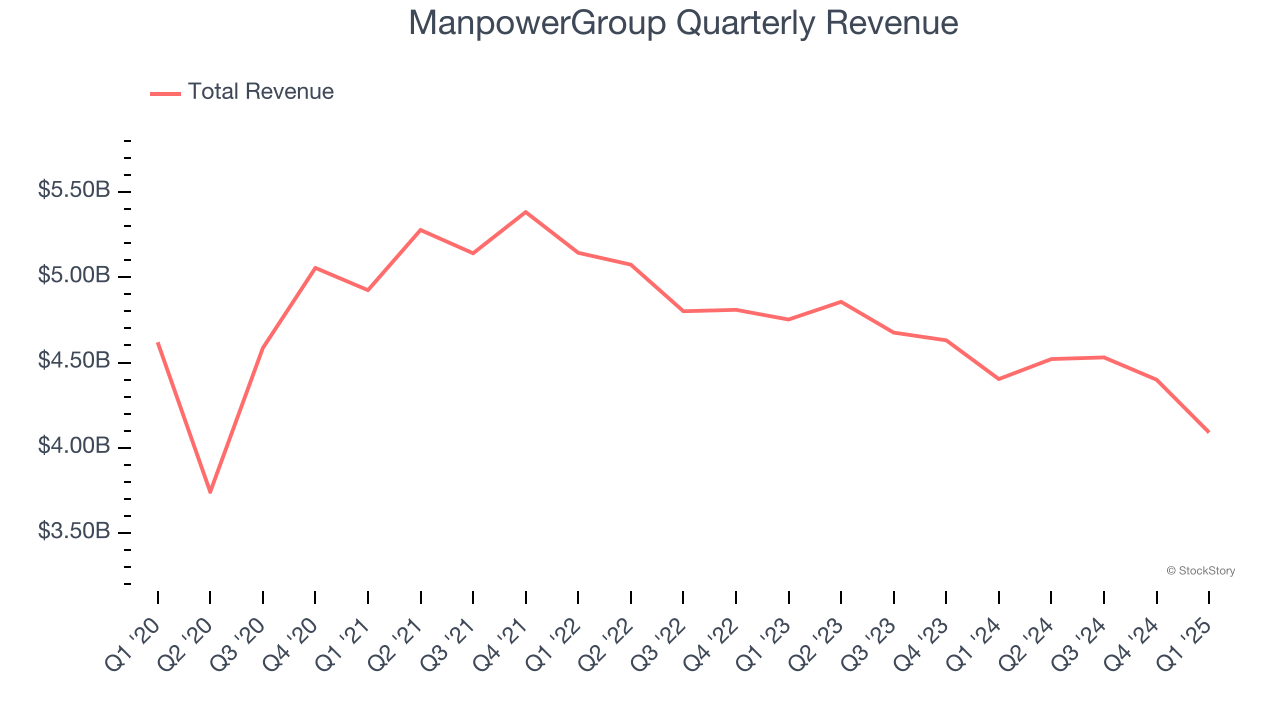

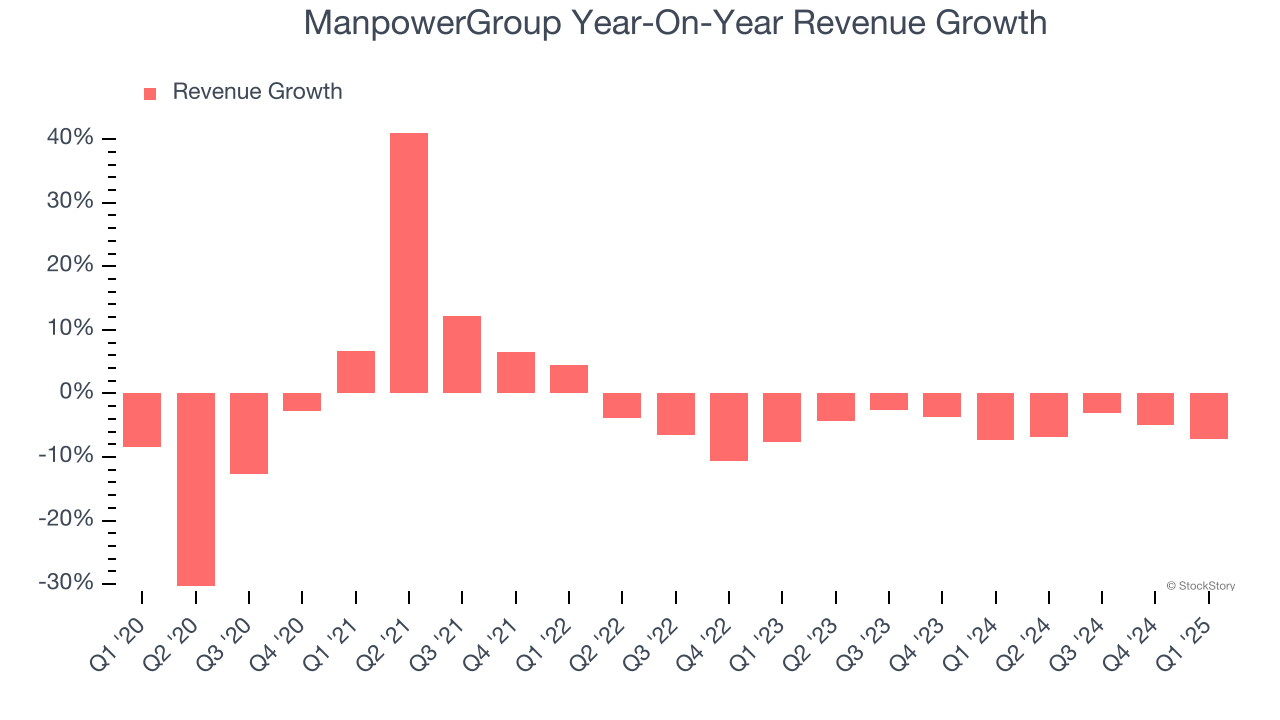

As you can see below, ManpowerGroup’s demand was weak over the last five years. Its sales fell by 3% annually, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. ManpowerGroup’s recent performance shows its demand remained suppressed as its revenue has declined by 5% annually over the last two years.

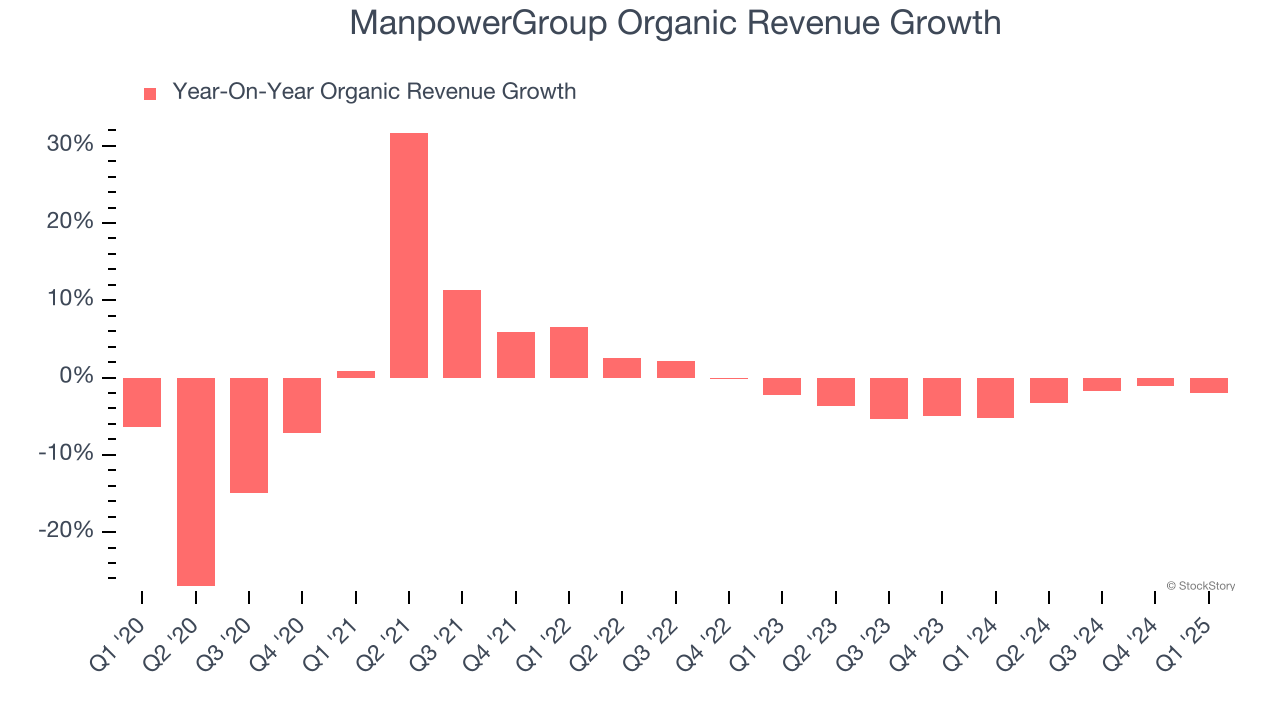

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, ManpowerGroup’s organic revenue averaged 3.4% year-on-year declines. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, ManpowerGroup’s revenue fell by 7.1% year on year to $4.09 billion but beat Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to decline by 3% over the next 12 months. Although this projection is better than its two-year trend, it's tough to feel optimistic about a company facing demand difficulties.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

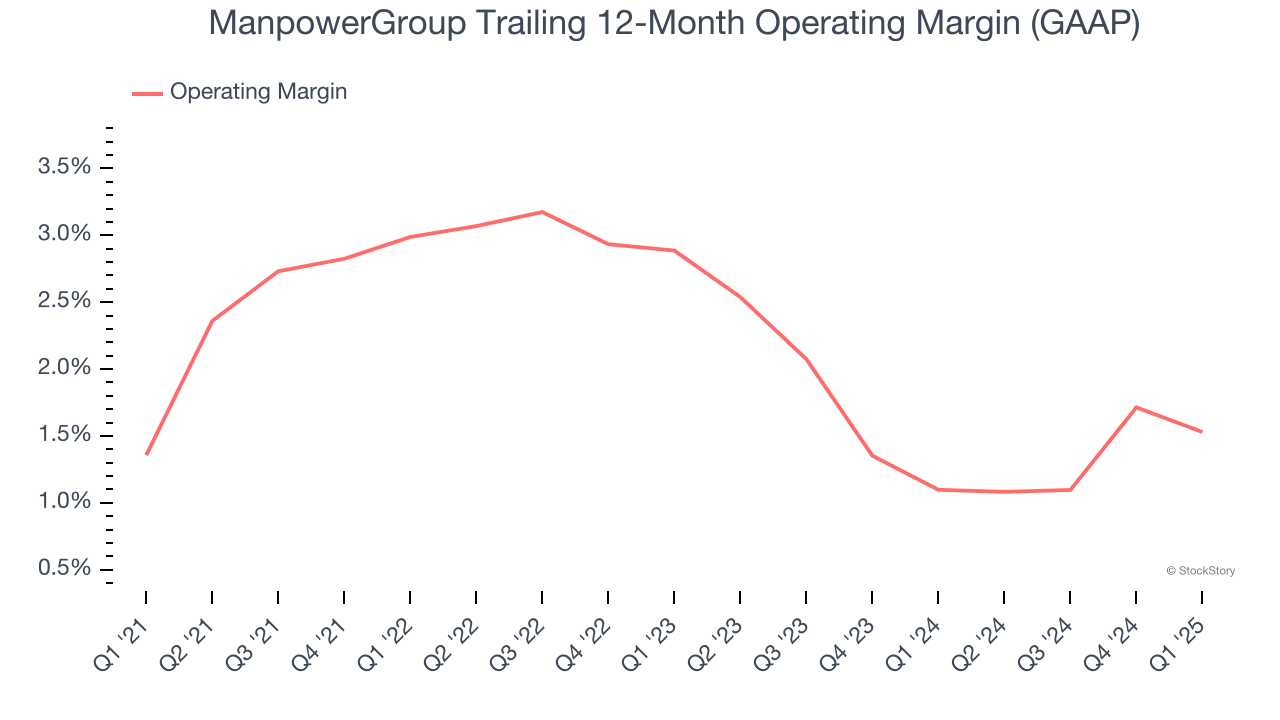

ManpowerGroup was profitable over the last five years but held back by its large cost base. Its average operating margin of 2% was weak for a business services business.

Looking at the trend in its profitability, ManpowerGroup’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, which doesn’t help its cause.

This quarter, ManpowerGroup’s breakeven margin was in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

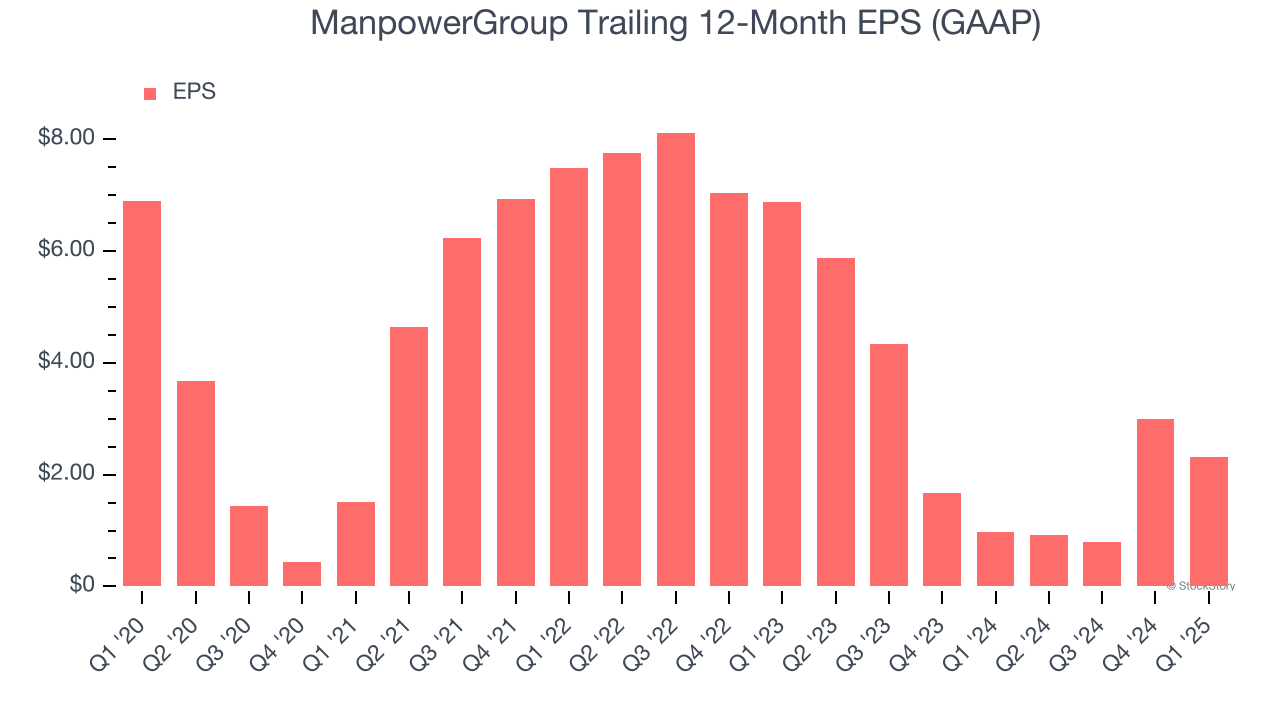

Sadly for ManpowerGroup, its EPS declined by 19.7% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q1, ManpowerGroup reported EPS at $0.12, down from $0.81 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects ManpowerGroup’s full-year EPS of $2.31 to grow 75.9%.

Key Takeaways from ManpowerGroup’s Q1 Results

We liked that ManpowerGroup beat analysts’ organic revenue expectations this quarter, leading to a revenue beat. On the other hand, both its EBITDA and EPS missed. Looking ahead, EPS guidance for next quarter missed significantly. Overall, this was a weaker quarter. The stock traded down 8.2% to $45.41 immediately after reporting.

ManpowerGroup underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.